Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Longer-term inflation expectations remain largely grounded, but a few Fed policymakers have taken note of a sharp rise in short-term inflation expectations .

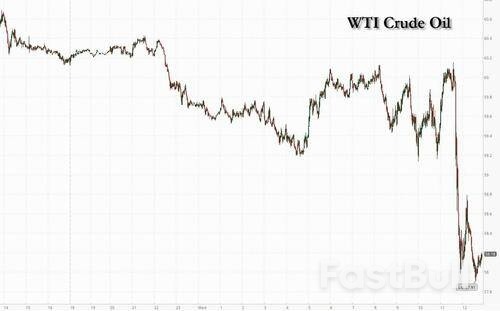

It had already been a miserable month for oil, which has suffered its worst monthly performance since 2021 and also is on pace for its month of April on record... and then it got even worse when shortly before noon ET, when Reuters reported, citing multiple sources, that Saudi Arabian officials are briefing allies and industry experts to say the kingdom is unwilling to prop up the oil market with further supply cuts and can handle a prolonged period of low prices.

This shift in Saudi policy could suggest a move toward producing more and expanding its market share, a major change after five years spent balancing the market through deep output as a leader of the OPEC+ group of oil producers. Those cuts had supported prices, in turn bolstering the oil export revenue that many oil producers rely on, but many OPEC+ members - most notably Kazakhstan - took advantage of the production restraint and blew away through their export quotas, infuriating other cartel members.

Sure enough, Reuters notes that Riyadh has been angered by Kazakhstan and Iraq producing above their OPEC+ targets. And after pushing members to adhere to those targets and to compensate for oversupply in recent months, a frustrated Riyadh is changing tack, OPEC+ sources said.

Saudi Arabia pushed for a larger-than-planned OPEC+ output hike in May, a decision that helped send oil prices below $60 a barrel to a 4-year low.

And now that Kazahkstan blew it for all cartel members, everyone will share the pain equally, as lower prices are bad news for producers that rely on oil exports to fund their economies. Although producers like Saudi have a very low cost of production, they need higher oil prices to pay for government spending. When oil prices fall, many large oil-producing countries come under pressure to cut their budgets.

And just to confirm that they are not bluffing, the Saudis appear to be briefing allies and experts that they are ready to do just that. The last time they did just that was in March 2020, just before covid shut down the global economy and briefly sent oil prices negative, sparking budget crises across all OPEC members.

Saudi officials in recent weeks have told allies and market participants the kingdom can live with the fall in prices by raising borrowing and cutting costs, the five sources said.

"The Saudis are ready for lower prices and may need to pull back on some major projects," one of the sources said. All sources declined to be named due to sensitivity of the issue.

The problem is that Saudi Arabia needs oil prices above $90 to balance its budget, higher than other large OPEC producers such as the United Arab Emirates, according to the International Monetary Fund (IMF). As a result, Riyadh may need to delay or cut back some projects due to the price drop, analysts have said.

OPEC+, which besides the Organization of the Petroleum Exporting Countries also includes allies such as Russia, may decide to speed up output hikes again in June, OPEC+ sources have said. OPEC+ is cutting output by over 5 million barrels or 5% of global supply, to which Saudi Arabia is contributing two-fifths.

Russia, the second largest exporter in OPEC+ behind Saudi Arabia, is aware of Riyadh's plans for faster output increases, said two of the five sources who are familiar with the Russian thinking and conversations with Riyadh. Even so, Russia would prefer the group stick to slower output increases.

Saudi Arabia and Russia, the de facto leaders of OPEC+, make the biggest contributions to OPEC+ cuts. Russia's budget balances at about $70 a barrel and the Kremlin's spending is on the rise due to the Russian war in Ukraine.

Russia may see a further fall in revenue as prices for its discounted, sanctioned oil could fall below $50 a barrel as a result of OPEC+ output rises, one of the two sources said.

Theories on the apparent change in Saudi strategy range from punishing OPEC+ members exceeding their quotas to a move to fight for market share after ceding ground to non-OPEC+ producers such as the United States and Guyana. Higher output may also be a fillip to U.S. President Donald Trump, who has called for OPEC to boost output to help keep U.S. gasoline prices down.

Trump is due to visit Saudi Arabia in May and could offer Riyadh an arms package and a nuclear agreement. OPEC+ decided to triple its planned output increase to 411,000 bpd.

That still leaves OPEC+ holding back more than 5 million bpd, curbs the group aims to unwind by the end of 2026.

"We would still call this a 'managed' unwind of cuts and not a fight for market share," UBS analyst Giovanni Staunovo said.

“This confirms the market’s fears that Saudi Arabia’s accelerated unwinds were not temporary, but a long-term strategy shift,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. It raises the question of whether “Saudi is going to repeat the 2020 playbook to dramatically increase production.”

For now the market is voting "yes", and the news sent WTI tumbling as much as 4%,or more than $2 to just under $58, the lowest price since early 2021 (and a level which was only briefly breached after Trump's Liberation Day sent oil to $55 before rebounding rapidly).

OPEC+ rocked the crude market in early April, with a surprise decision to increase supply in May by 411,000 barrels a day, the equivalent of three monthly tranches from a previous plan. Morgan Stanley has said it expects a “meaningful surplus” to develop over time, while JPMorgan Chase & Co. warned the cartel may accelerate planned production increases at a meeting next week.

Beyond OPEC+, non-cartel nations are also expected to add supplies, including drillers in Canada and Guyana, feeding concerns about a global glut.

At the same time, hopes are fading that there will be quick breakthroughs in US-led trade negotiations, weighing on the outlook for energy demand. The US economy contracted for the first time since 2022 in the first quarter as a result of a surge in pre-tariff imports and softer consumer spending. In China, factory activity slipped into the worst contraction since December 2023, revealing early damage from the trade war.

On the 101st day of Donald Trump’s second term as president came news that the US economy shrank during the first quarter. Perhaps it’s not surprising then that polling shows his support is contracting as well. Joshua Green explains how the two are connected. Plus: The Elon, Inc. podcast reviews Elon Musk’s 100 days in government.

Donald Trump rode back into office on expectations that he’d turbocharge the American economy. Polls showed voters were sick of inflation, nostalgic for the economy of Trump’s first term and willing to overlook doubts about his character and temperament because they liked his promise to bring down prices “on Day 1” and spark an economic “boom like no other.”

With the first 100 days of Trump’s term now in the books, however, many Americans are experiencing buyer’s remorse. Much of their dissatisfaction is rooted in frustration with what was supposed to be Trump’s great strength: managing the economy.

At a rally on Tuesday night in Michigan, Trump characteristically sought to paint a much rosier picture, declaring his early tenure “the most successful first 100 days of any administration in the history of our country.” But a flood of recent economic and polling data suggests Trump and Republicans face serious political jeopardy if they don’t turn things around soon.

To begin with, the Day 1 revival that Trump promised voters didn’t happen. Instead, they got a trade war that’s shaken the foundations of the global economy. Prices haven’t fallen, as Trump claimed they would. But equity markets have dropped sharply. So has the overall US economic outlook. And supply shortages could soon hit US retailers, because cargo shipments have plummeted in response to 145% tariffs on Chinese imports.

Instead of animal spirits fueling a “Trump boom,” as many forecasters had predicted, the president’s haphazard imposition of steep tariffs on enemies and allies alike has caused recession fears to rear up, as trade partners retaliate with levies of their own and businesses freeze investments and cut earnings outlooks. “America is a brand,” hedge fund magnate and Trump supporter Ken Griffin complained last week, and “we are eroding that brand.”

Voters are paying close attention to Trump’s actions and responding with historic levels of alarm. Consumer sentiment in the University of Michigan’s survey plunged after he announced his “Liberation Day” tariffs on April 2. The percentage of Americans who expect unemployment to rise is now higher than at any point since the Great Recession. Inflation expectations have skyrocketed too. The University of Michigan survey found that Americans now expect prices to rise at a 6.5% rate over the next year—almost triple the 2.4% the federal government reported in March, and the highest year-ahead expectation since 1981, according to the survey. Perhaps most problematic from a political standpoint, a growing number of Americans say they expect the financial pain to hit them personally. For the first time this century, a Gallup Poll found that a majority—53%—say their personal finances are getting worse.

The collapsing faith that Trump will improve economic conditions could spell serious trouble for him and Republicans. After all, polling in last fall’s presidential race showed that among voters who viewed the economy negatively, a staggering 69% backed Trump. With so many measures of economic sentiment cratering, what are those voters thinking now?

Yet this hasn’t triggered the kind of concern among Republicans that some political professionals think it should. “Trump’s numbers on the economy have been the bedrock of his support throughout his political career,” says Alex Conant, a Republican strategist and partner at Firehouse Strategies. “Now, for the first time we’re seeing erosion because of the tariffs. That’s a huge political problem if it continues—if we go into midterms with voters having lost trust in his ability to handle the economy, we’re going to lose in places that haven’t been competitive for a decade.”

Last weekend, Republicans and Trump fans gathered at parties across Washington that spun off from Saturday’s White House Correspondents’ Association dinner. Guests at the MAGA parties I attended mostly shrugged off concerns about Trump’s standing. Some expect his top legislative priority—a $4.5 trillion tax cut—to turn things around for him. Others, such as Rasmussen pollster Mark Mitchell, claim that polls showing Trump’s support eroding are merely a liberal “psyop.”

But there’s overwhelming evidence that Trump’s standing is indeed slipping significantly. The latest ABC News-Washington Post poll pegs his job approval rating at just 39%, the lowest of any president at the 100-day mark in 80 years. The Associated Press poll also has Trump deeply underwater, with a 39%-59% approval-disapproval disparity.

For Republicans who don’t buy the president’s claim that pollsters are afflicted with “Trump Derangement Syndrome,” there’s a deeper concern: his growing weakness among voter groups he’d only recently started to win over. Among Hispanics—the fastest-growing bloc of GOP support—a poll by the Pew Research Center shows Trump with an approval rating of just 27%, while 72% disapprove (down from 36% approve, 62% disapprove on Feb. 2). Among young men, who flocked to him last fall, Trump’s approval in the latest Harvard Kennedy School Institute of Politics poll sits at 34%, with 59% disapproving.

Much of the dissatisfaction is tied to Trump’s handling of the economy. In January, 62% of young men in the Harvard poll approved of his stewardship. Today, they’re losing faith. Only 19% believe the economy is headed in the right direction, and 66% of those in college expect to have a difficult time finding a job after graduation.

As Democrats learned the hard way, these critical voting groups are highly sensitive to economic pressures—from gas prices to grocery bills to mortgage rates—and can decisively swing an election. They shifted right during the high-inflation years of the Biden administration. Now, just 100 days into Trump’s second term, they’re delivering a clear warning: Unless economic conditions improve, they’re likely to swing back left.

The 100th day of the second Trump administration also marked about 100 days since Elon Musk transformed the US Digital Service into what he and Trump contend is a government cost-cutting initiative named after Musk’s favorite crypto coin. With the Trump news cycle more intense than ever and Musk the fastest-moving part of it, a new episode of the Elon, Inc. podcast attempts to make sense of the past three-and-a-half months. Host David Papadopoulos gathers Bloomberg Businessweek senior writer Max Chafkin, Bloomberg Elon Musk reporter Dana Hull and Bloomberg technology reporter Kurt Wagner to break down Musk’s activities as his days as a special government employee are wrapping up.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up