Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

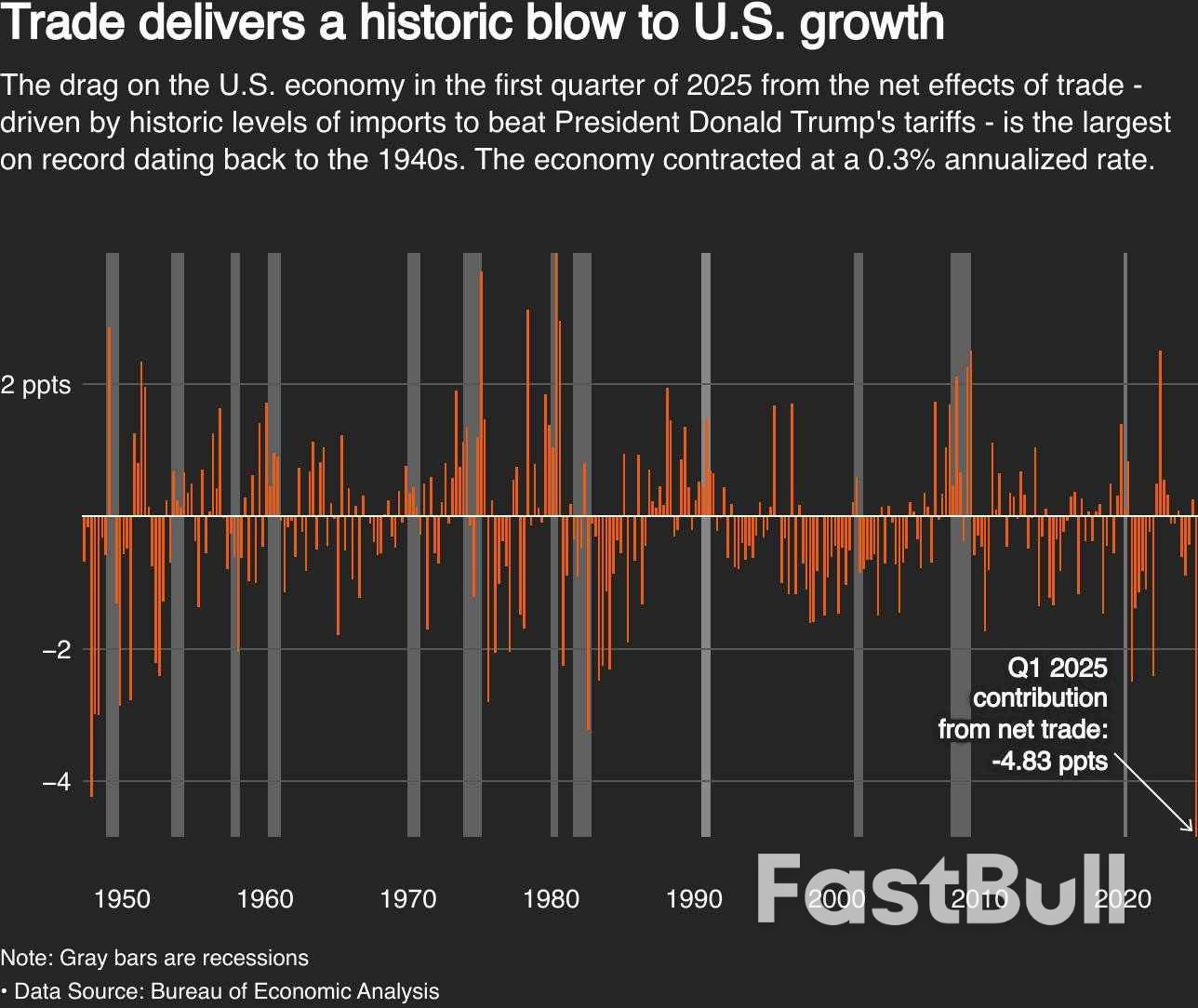

Federal Reserve policymakers won't take much signal from a decline in first-quarter U.S. GDP, but by June clearer signs of a faltering economy will move central bankers to resume cutting interest rates, ultimately by a full percentage point by the end of the year, traders bet on Wednesday.

Wall Street's main indexes dropped on Wednesday after data showed the economy contracted for the first time in three years in the first quarter, deepening concerns around the impact of U.S. tariffs and the global trade war.

Private payrolls growth also slowed more than expected in April, while the personal consumption expenditure index - the Federal Reserve's preferred inflation gauge - rose slightly more than expected in March on an annual basis.

Wednesday's reports join a series of data releases over the month that have pointed to an increasingly uncertain outlook for the U.S. economy, as the fallout from the Trump administration's steep tariffs and erratic trade policy take effect.

"Given the amount of damage that's been done to businesses (and) consumer confidence, we could just be getting started on seeing a continuation of these weaker numbers," said John Luke Tyner, portfolio manager at Aptus Capital Advisors.

U.S. consumer spending jumped last month as households rushed to buy motor vehicles to avoid higher prices and shortages due to tariffs.

Traders are now pricing in a full percentage point interest rate cut by the end of the year from the Fed.

Caterpillar (CAT.N), opens new tab declined marginally, after gaining premarket following its quarterly results.

At 10:03 a.m. ET, the Dow Jones Industrial Average (.DJI), opens new tab fell 699.90 points, or 1.73%, to 39,827.72, the S&P 500 (.SPX), opens new tab lost 113.47 points, or 2.04%, to 5,447.36 and the Nasdaq Composite (.IXIC), opens new tab lost 449.75 points, or 2.58%, to 17,011.57.

All S&P 500 sectors were in the red, with consumer discretionary (.SPLRCD), opens new tab and information technology (.SPLRCT), opens new tab shares down 3.6% and 2.3%, respectively.

The CBOE Volatility index (.VIX), opens new tab, seen as Wall Street's fear gauge, was up 3.53 points at 27.69, its highest in nearly a week.

"Magnificent Seven" members Meta Platforms (META.O), opens new tab and Microsoft (MSFT.O), opens new tab fell 2% and 3% ahead of their results, due after markets close, that investors are watching closely for clarity on the outlook for the tech sector and AI-focused investments.

Fanning concerns about a pullback in investments into AI, Super Micro Computer (SMCI.O), opens new tab cut its third-quarter forecasts due to delays in customer spending, while Snapchat parent Snap (SNAP.N), opens new tab said it would not provide a second-quarter financial forecast.

Their shares fell more than 16% each.

Wall Street's indexes recouped some ground this month after a sharp slump following the April 2 "Liberation Day" tariff announcements, but are set for monthly declines.

The S&P 500 is set to snap its best winning streak since November if losses hold through close.

Wednesday also marks 100 days since Trump took office. Erratic changes in trade policies and uncertainty have roiled markets over that period, offsetting initial optimism over the administration's business-friendly policies.

"If you were looking for a playbook on how to slow a healthy economy, (policy changes) seem like a good example," said Scott Helfstein, head of investment strategy at Global X.

Among other stocks, Norwegian Cruise Line Holdings (NCLH.N), opens new tab tumbled 10% after missing first-quarter earnings estimates.

Declining issues outnumbered advancers by a 7.61-to-1 ratio on the NYSE and by a 4.77-to-1 ratio on the Nasdaq.

The S&P 500 posted 2 new 52-week highs and 3 new lows while the Nasdaq Composite recorded 14 new highs and 57 new lows.

Reporting by Lisa Mattackal and Purvi Agarwal in Bengaluru; Editing by Devika Syamnath

The Federal Reserve’s preferred inflation gauge stalled in March for the first time in nearly a year and consumer spending was strong, a welcome reprieve before tariffs are expected to broadly drive up prices.

The personal consumption expenditures price index stagnated from February, according to Bureau of Economic Analysis data out Wednesday. Excluding food and energy, the so-called core PCE was also unchanged, the tamest in almost five years.

Inflation-adjusted consumer spending climbed 0.7% last month after an upward revision to the prior month, suggesting households spent aggressively to get ahead of new tariffs.

The data round out a quarter in which the US economy contracted for the first time since 2022 on a monumental pre-tariffs import surge and more moderate consumer spending. The report earlier Wednesday also showed core PCE inflation accelerated to a 3.5% pace in the first quarter — the most in a year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up