Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Governor Christopher Waller said on Friday that interest rate cuts could begin as soon as next month, aligning with US President Donald Trump’s plea. In an interview on CNBC’s

Federal Reserve Governor Christopher Waller said on Friday that interest rate cuts could begin as soon as next month, aligning with US President Donald Trump’s plea. In an interview on CNBC’s Squawk Box, Waller said policymakers should not wait for economic conditions to deteriorate before acting.

“I think we’re in the position that we could do this and as early as July,” Waller remarked, hinting at a potential rate cut at the July 29–30 Federal Open Market Committee (FOMC) meeting. “That would be my view, whether the committee would go along with it or not.”

Waller’s remarks follow Wednesday’s decision by the FOMC to hold its benchmark interest rate at a range of 4.25% to 4.5%, the fourth consecutive pause since the last cut in December 2024.

President Trump, who appointed Jerome Powell as Fed Chair and nominated Waller during his first term, has argued that higher rates are choking economic growth and driving up the cost of servicing the $36 trillion national debt.

He has called for at least a two percentage point reduction, even suggesting rates should fall 2.5 points below their current level. Powell has so far resisted those demands, but his grip may be loosening. Still, the Fed chair insists that the central bank should proceed cautiously.

Waller’s recent comments show there’s an internal push for at least a modest rate cut, which will be the first since Trump’s return to the White House.

“Why do we want to wait until we actually see a crash before we start cutting rates?” he asked. “I’m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting.”

Although Waller is a voting member of the FOMC, Wednesday’s rate decision was unanimous. According to the Fed’s “dot plot,” which outlines individual policymakers’ forecasts, seven of 19 officials expect no change in rates through the end of the year.

Yet, two anticipate a single cut, while 10 project two or more reductions in 2025. There could be a significant split within the central bank.

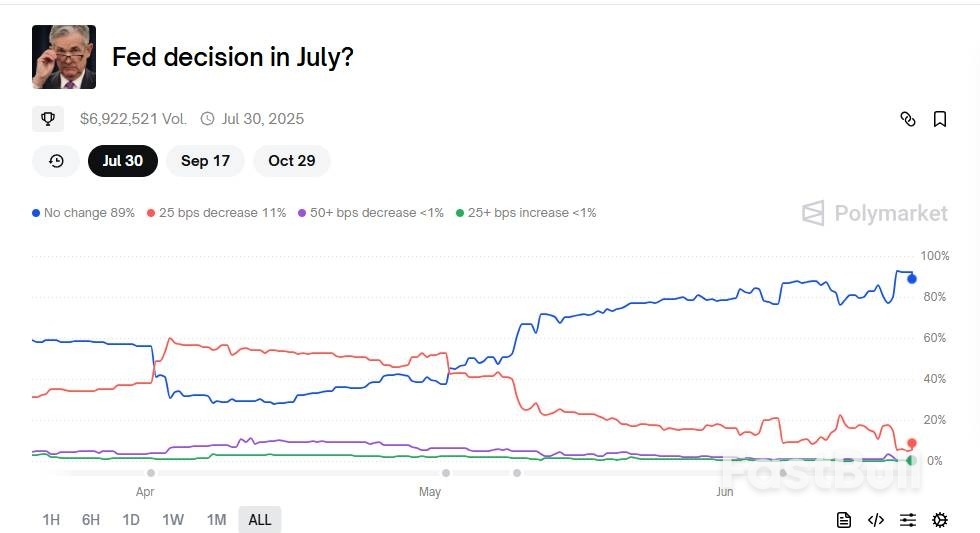

According to the prediction platform Polymarket, there is an 89% chance the Fed will keep rates unchanged in July, with only 10% betting on a 25 basis point cut.

Fed July decision prediction. Source: Polymarket

Fed July decision prediction. Source: PolymarketWaller admitted that although he prefers a rate cut, they should be gradual. “You’d want to start slow and bring them down, just to make sure that there’s no big surprises. But start the process,” he continued, “We’ve been on pause for six months to wait and see, and so far, the data has been fine.”

During a press conference on Wednesday, Powell claimed that new trade barriers are beginning to push up consumer prices. “We’re beginning to see some effects,” he reckoned. “Inflation is creeping up,” and recent data shows that “near-term measures of inflation expectations have moved up” across consumer and market surveys.

The Fed chair directly blamed Trump’s tariffs as the culprit, saying that survey respondents view them as the driver behind inflationary pressures.

Still, Waller pushed back on the idea that tariffs will cause lasting damage. He argued that their effect should be “a one-off level effect and not cause persistent inflation.”

“We believe we can stay in wait-and-see mode,” Powell told the press in his address. He mentioned that the inflation data has shown minimal pass-through so far because companies are still working through inventory stockpiled ahead of tariff implementation. Weak consumer demand has also limited pricing power, providing the Fed with some room to maneuver.

Federal Reserve Governor Christopher Waller indicated Friday that the central bank might lower interest rates as early as July, marking a significant shift in monetary policy.

"We could do this as early as July," Waller stated during a CNBC interview. The Federal Open Market Committee is scheduled to meet July 29-30 in Washington.

Waller explained that the Fed has room to reduce rates and then assess inflation trends, adding that the central bank could pause cuts if necessary.

His comments follow Wednesday’s decision by Fed policymakers to maintain current interest rates. Officials also projected two rate cuts before the end of 2025, according to their median forecast.

The committee appears divided on the timing of rate adjustments, with seven policymakers indicating they expect no cuts this year.

During the interview, Waller addressed concerns about tariffs and inflation, stating that the Fed hasn’t seen a "big tariff shock to inflation" yet. While acknowledging that inflation persistence from tariffs is a valid concern, he said he doesn’t see "second-round tariff inflation effects."

Waller described the current labor market as "OK but not strong like in 2022" and cautioned against waiting too long to implement rate cuts. "Don’t want to wait for cuts until job market tanks," he said.

The Fed governor also suggested that not all tariffs would be passed through to inflation, estimating that inflation might rise "three-tenths or half percent" as a result.

Iran said on Friday it would not discuss the future of its nuclear programme while under attack by Israel, as Europe tried to coax Tehran back into negotiations and the United States considers whether to get involved in the conflict.

A week into its campaign, Israel said it had struck dozens of military targets overnight, including missile production sites, a research body involved in nuclear weapons development in Tehran and military facilities in western and central Iran.

Iran fired missiles at the southern Israeli city of Beersheba early on Friday and Israeli media said initial reports pointed to missile impacts in Tel Aviv, the Negev and Haifa after further attacks hours later.

About 20 missiles were fired in the latest strikes, an Israeli military official said, and at least two people were hurt, according to the Israeli ambulance service.

Fars news agency quoted an Iranian military spokesman as saying the latest missile and drone attacks used long-range and ultra-heavy missiles that targeted military sites, defence industries and command and control centres.

In a sign of increasing concern about any strikes on energy facilities in Iran or elsewhere in the Gulf that could affect supplies, Qatar held crisis talks this week with energy majors, an industry source and a diplomat in the region told Reuters.

Doha was asking companies to raise governments' awareness of the risks to global gas supply in the U.S. and Europe, they said. QatarEnergy did not immediately respond to a request for comment.

The White House said on Thursday President Donald Trump would decide on U.S. involvement in the conflict in the next two weeks.

Iranian Foreign Minister Abbas Araqchi said there was no room for negotiations with the U.S. "until Israeli aggression stops". But he later arrived in Geneva for talks with European foreign ministers at which Europe hopes to establish a path back to diplomacy over Iran's nuclear programme.

Before the meeting with France, Britain, Germany and the European Union's foreign policy chief, two diplomats said Araqchi would be told the U.S. is still open to direct talks. But expectations for a breakthrough are low, diplomats say.

A senior Iranian official told Reuters Iran was ready to discuss limitations on uranium enrichment but that any proposal for zero enrichment - not being able to enrich uranium at all - would be rejected, "especially now under Israel's strikes".

Israel began attacking Iran last Friday, saying its longtime enemy was on the verge of developing nuclear weapons. Iran, which says its nuclear programme is only for peaceful purposes, retaliated with missile and drone strikes on Israel.

Israel is widely assumed to possess nuclear weapons. It neither confirms nor denies this.

Israeli air attacks have killed 639 people in Iran, according to the Human Rights Activists News Agency, a U.S.-based human rights organisation that tracks Iran. The dead include the military's top echelon and nuclear scientists.

In Israel, 24 civilians have been killed in Iranian missile attacks, according to authorities.

Israel's strikes on Iran's nuclear installations so far pose only limited risks of contamination, experts say. But they warn that any attack on the nuclear power station at Bushehr in Iran could cause a nuclear disaster.

Israel says it is determined to destroy Iran's nuclear capabilities but that it wants to avoid any nuclear disaster.

Before Friday's meeting in Geneva, Arqachi accused Israel of war crimes in an address to the U.N. Human Rights Council and said Israel's attacks had undermined plans for talks with U.S. officials on June 15 to craft a "very promising" agreement on Iran's nuclear programme.

Israel did not immediately respond to his remarks.

Geneva is where an initial accord was struck in 2013 to curb Iran's nuclear programme in return for sanctions being lifted. A comprehensive deal followed in 2015.

Trump pulled the U.S. out of the agreement in 2018. A new series of talks between Iran and the U.S. collapsed when Israel started attacking Iran's nuclear facilities and ballistic capabilities on June 12.

Trump has alternated between threatening Tehran and urging it to resume nuclear talks. His special envoy to the region, Steve Witkoff, has spoken to Araqchi several times since last week, sources say.

Western and regional officials say Israel is trying to shatter the government of Supreme Leader Ayatollah Ali Khamenei.

Katz said he had instructed the military to intensify attacks on "symbols of the regime" in the Iranian capital Tehran, aiming to destabilise it.

Iranian opposition groups think their time may be near, but activists involved in previous protests say they are unwilling to unleash mass unrest with their nation under attack, and Iranian authorities have cracked down hard on dissent.

Iranian state media reported rallies in several cities, describing them as rallies of "rage and victory,” and “solidarity and resistance.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up