Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve faces a tough balancing act between persistent inflation, slowing growth, and political pressure from Trump to cut rates—amid rising tensions over tariffs and economic uncertainty.

The largest U.S. lender, along with its peers has been ramping up its use of AI. Goldman Sachs is rolling out a generative AI assistant to its bankers, traders and asset managers, while Morgan Stanley developed a chatbot for its financial advisers with OpenAI.

JPMorgan's AI tools have supercharged the speed at which its bankers could provide research and investment advice to wealthy clients last month at a time when the U.S. tariff announcements erased trillions of dollars from the stock market.

"In the last few weeks, there have been several fluctuations in the market which are not in normal bite sizes, making it very complicated to think about all your clients and all the things required to do," Mary Erdoes said. The "powerful" AI tools helped advisors to quickly handle client requests by pulling data on their trading patterns and anticipating queries, she said.

In the days surrounding U.S. President Donald Trump's tariff announcement last month, U.S. stock markets set a new record for single-day trading volume, and posted some of the sharpest intraday swings of the past 50 years.

The volatility prompted individual investors to call their bankers seeking advice, Erdoes told Reuters.

"When you have a tool that pre-populates all the data and the movement in real time, while also remembering clients' old investment preferences and helps in tailoring a plan for them quickly, it also allows advisors to do much more," she added.

JPMorgan's so-called Coach AI tool used by private client advisers is quicker at locating content and research to drive conversations with clients.

"Our advisors are finding the right information up to 95% faster--which means they spend less time searching and more time engaging in meaningful conversations with clients," said Mike Urciuoli, chief information officer at JPMorgan asset and wealth management.

"It's a great example of how of AI isn't replacing human touch, it's enhancing it," Urciuoli added.

The app will help advisers expand their client rosters by 50% in the next three-to-five years by enabling them to take on more clients, with AI handling some of the other research-related work.

JPMorgan Asset & Wealth Management also saw a 20% year-over-year increase in gross sales between 2023-2024, with Gen AI-driven tools which has helped teams focus more effectively on high-impact client work, it said.

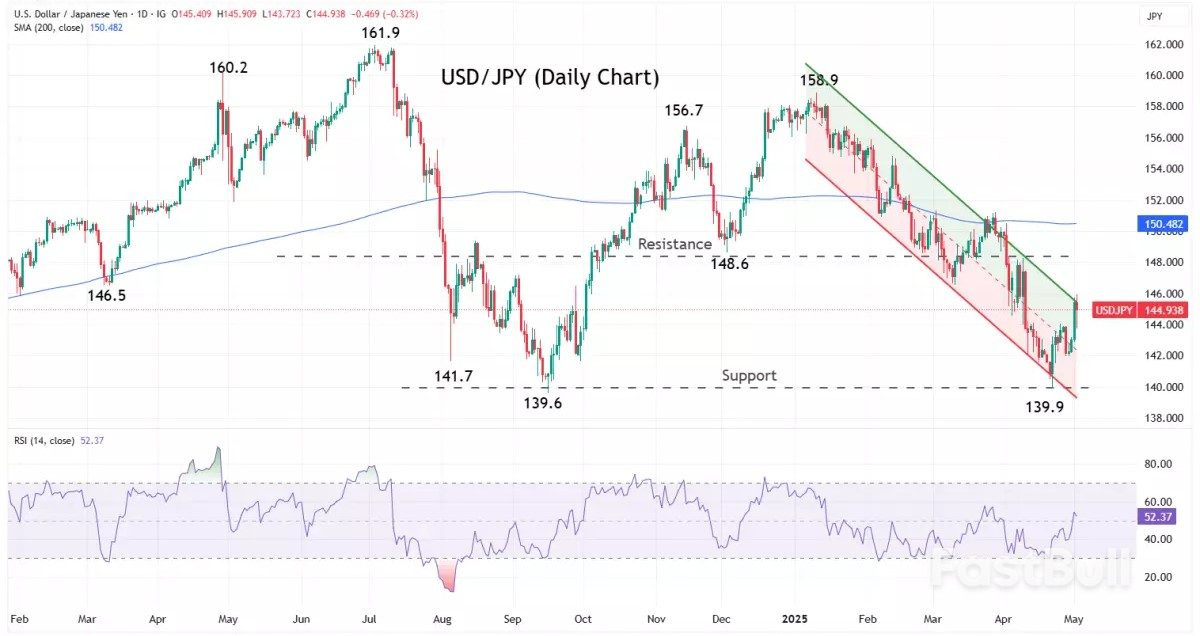

The U.S. dollar was mostly lower against major currencies, including the yen and the euro, on Monday as markets weighed continued uncertainty from President Donald Trump's policies and their impact on the economy.

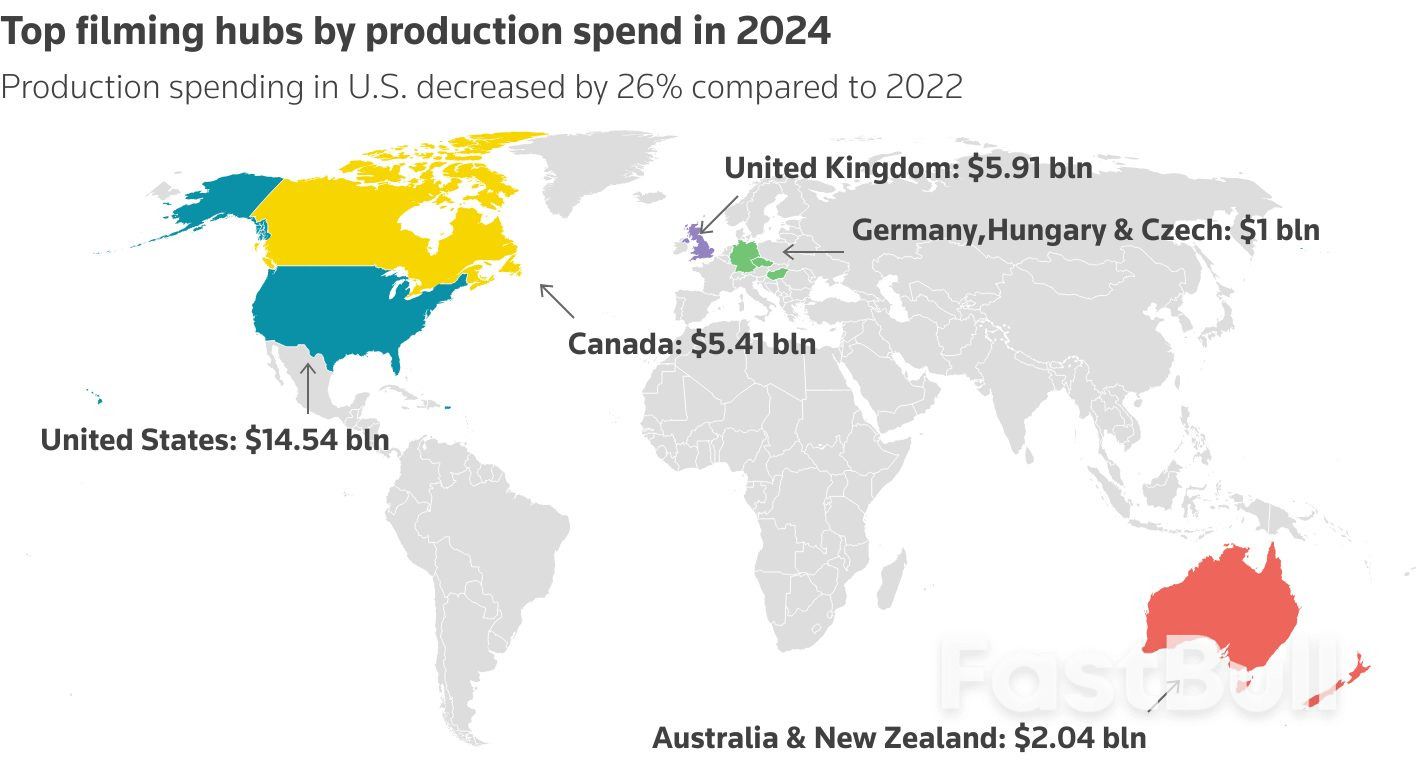

The greenback slid to a fresh record low against the Taiwan dollar to 28.8150 amid speculation that Taiwan was letting its currency appreciate as part of a trade deal with the U.S., or at least was unwilling to intervene to stop it rising alongside sharp inflows in capital.Trump doubled down on tariff-driven policies during an interview on Sunday, reiterating that the duties on U.S. imports would eventually make Americans rich. He announced on Sunday a new 100% tariff on films made outside the U.S.

Markets have been affected by the fact that Trump is not leaving his stance that tariffs are important, said Juan Perez, director of trading at Monex USA in Washington.

The dollar was down 0.79% against the Japanese yen at 143.805 . Against the Swiss franc , the dollar weakened 0.57% to 0.822.Trump said he would not attempt to remove Federal Reserve Chair Jerome Powell, but repeated calls for lower interest rates and called Powell a "stiff". The Fed meets on Wednesday and is widely expected to leave rates steady following a solid March payrolls report.Perez said the U.S. dollar was being hurt the most by chaos in the markets.

"I think we're returning today to...this very sour mood and descent and this idea that overall you may not necessarily rely on American markets the way you used to. And that's been seen across Treasuries."

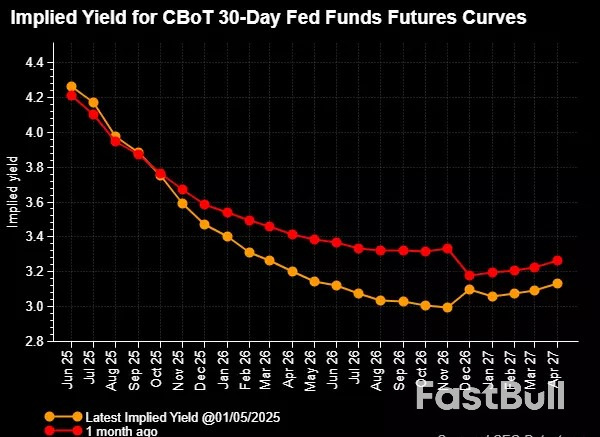

Markets now imply only a 37% chance of a Fed rate cut in June, down from 64% a month ago. Goldman Sachs and Barclays both shifted their cut calls to July from June.

The dollar trimmed its losses briefly against the yen after the Institute for Supply Management report for April showed a larger-than-expected pickup in growth in the U.S. services sector, which accounts for two-thirds of the American economy.

Chinese onshore markets were closed but the yuan traded offshore hit its highest in almost six months at 7.1831 per dollar as investors wagered Beijing might let its currency strengthen as part of trade talks with Washington. The yuan was last up 0.23% to 7.194 per dollar.

In Europe, the euro was up 0.27% at $1.133025 and the pound was up 0.28% at $1.33050.

The Bank of England will meet on Thursday and is widely expected to cut rates by a further 25 basis points to 4.25%. Central banks in Norway and Sweden also meet this week and are expected to keep rates steady.

Reporting by Chibuike Oguh in New York, Wayne Cole and Alun John. Editing by Sonali Paul, Mark Potter, Tomasz Janowski and Nia Williams

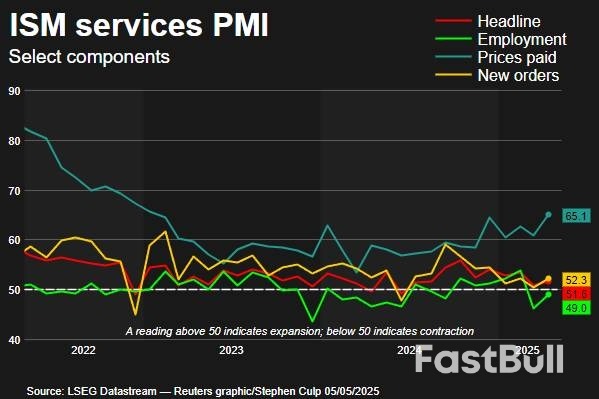

The Institute for Supply Management (ISM) survey on Monday showed services businesses were worried about the impact of President Donald Trump's tariffs on prices and deep federal spending cuts as his administration seeks to drastically shrink the government.

Trump's on-and-off again tariffs have heightened uncertainty over the once-resilient economy. Some real estate, rental and leasing firms in the ISM survey described the implementation of import duties as "maddeningly inconsistent."

Risks of a recession have risen. Trump on Sunday announced a 100% tariff on movies produced outside the United States.

"The negative impact on services activity and inflation from the tariffs and government spending cuts are very real and already beginning to materialize," said Scott Anderson, chief U.S. economist at BMO Capital Markets. "Without a hard pivot in U.S. tariffs and government spending cuts, we expect the ISM services readings to remain under downward pressure."

The ISM said its nonmanufacturing purchasing managers index (PMI) increased to 51.6 last month from 50.8 in March. Economists polled by Reuters had forecast the services PMI dipping to 50.2.

A PMI reading above 50 indicates growth in the services sector, which accounts for more than two-thirds of the economy. The ISM associates a PMI reading above 49 over time with growth in the overall economy.

Efforts by businesses and households to get ahead of the import duties likely accounted for some of the rise in the services PMI last month. The ISM survey's new orders measure increased to 52.3 from 50.4 in March.

Inventories also rose, with some businesses saying they had "purchased some products in advance of tariffs." Others attributed the rise to increased sales volumes.

"But overall, results are improving," said Steve Miller, chair of the ISM Services Business Survey Committee.

The survey added to solid job growth in April in offering assurance that the economy was not near a recession despite gross domestic product contracting in the first quarter, burdened by a massive inflow of imports as businesses sought to avoid higher prices from tariffs.

"The economy continued to expand at the start of second quarter, albeit at a slow pace," said Matthew Martin, a senior U.S. economist at Oxford Economics. "We expect the services side of the economy to fare better than the manufacturing sector this year but will be unable to avoid the impact of higher prices and weaker consumer spending as real disposable incomes decline."

Stocks on Wall Street were trading lower. The dollar slipped against a basket of currencies. U.S. Treasury yields rose.

Eleven industries including accommodation and food services, wholesale trade, mining and utilities reported growth. Among the six reporting a contraction were finance and insurance as well as public administration.

Businesses in the agriculture, forestry, fishing and hunting sector said "tariffs are negatively impacting small business customers," many of whom "source their products from China." Trump hiked tariffs on Chinese imports to 145%, sparking a trade war with Beijing.

Educational services companies worried about the White House's cuts to research funding, while their counterparts in the healthcare and social assistance sector reported they were "seeing some vendors increasing their prices," adding that "we are actively pushing back on those increases."

Providers of public administration services said "our business is in a state of crises with uncertainty caused by both the ongoing trade war and the threats to federal funding of programs."

The swirling uncertainty was seen encouraging the Federal Reserve to leave interest rates unchanged on Wednesday.

Suppliers' delivery performance worsened last month, suggesting supply chains were starting to get strained. The ISM survey's supplier deliveries index increased to 51.3 from 50.6 in the prior month. A reading above 50 indicates slower deliveries.

A lengthening in suppliers' delivery times is normally associated with a strong economy, which would be a positive contribution to the PMI. Delivery times are, however, likely getting longer because of the rush to beat tariffs.

Some businesses reported "steel conduit lead times have increased due to factories unable to keep up with demand."

With supply bottlenecks emerging, the survey's measure of prices paid for services inputs jumped to 65.1. That was the highest reading since January 2023 and followed 60.9 in March.

Seventeen services industries reported a rise in prices, with the exception of arts, entertainment and recreation.

Most economists anticipate the tariff hit to inflation and employment could become evident by summer in the so-called hard economic data. Services sector employment continued to decline, though the pace slowed. The survey's measure of services employment increased to 49.0 from 46.2 in March.

Companies attributed the rise to "backfilling many empty positions." Others noted hiring freezes "due to uncertainty of government grants."

"A stable labor market remains key for the economic outlook as the potential determining factor for sustaining consumers through whatever tariff-related disruptions are lurking in the months ahead," said Tim Quinlan, a senior economist at Wells Fargo. "The labor market is holding up, but for how long remains a key question for growth this year."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up