Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Several European companies have frozen hiring or cut jobs this year, citing difficult economic conditions exacerbated by U.S. tariffs.

Several European companies have frozen hiring or cut jobs this year, citing difficult economic conditions exacerbated by U.S. tariffs.

Here are some of the companies that announced layoffs:

* RENAULT: The French carmaker confirmed it is planning cost cuts but said it has no figures to report yet, on Saturday after a newsletter reported it would cut 3,000 jobs by year-end in support services at its headquarters in the Paris suburb of Boulogne-Billancourt and other locations worldwide.

* BOSCH: The German home appliance manufacturer will cut 13,000 jobs as it battles sluggish demand, high costs and pressure from rivals, it said on September 25.

* DAIMLER TRUCK: The truckmaker confirmed media reports on August 1 that it would cut 2,000 jobs across its plants in the U.S. and Mexico, on top of the previously announced 5,000 job cuts in Germany.

* STELLANTIS: The automaker expanded its voluntary redundancy scheme for Italy, bringing the total planned workforce reduction to almost 2,500 in 2025, it said on June 10.

* VOLKSWAGEN: The company’s CFO said on April 30 it had cut headcount in Germany by around 7,000 since starting cost savings in late 2023.

* VOLVO CARS: The Swedish carmaker will cut 3,000 mostly white-collar jobs as part of a wider restructuring, it said on May 26.

* COMMERZBANK: The German bank said on May 14 it had agreed with the works council on terms to cut around 3,900 jobs by 2028.

* LLOYDS: The British bank will consider the dismissal of around half of 3,000 staff to cut costs, a source familiar with the matter told Reuters on September 4.

* OMV: The Austrian oil and gas company plans to cut 2,000 positions, or a twelfth of its global workforce, the Kurier newspaper reported on September 4.

* STMICROELECTRONICS: The French-Italian chipmaker’s CEO said on June 4 he expected 5,000 staff to leave the company in the next three years, including 2,800 job cuts announced in 2025.

* BURBERRY: The British luxury brand will shed 1,700 jobs or around a fifth of its global workforce to cut costs, it said on May 14.

* LVMH: The Financial Times reported on May 1, citing an internal video, that the luxury group’s wine and spirits unit Moet Hennessy would cut its workforce by about 1,200 employees.

*JUST EAT TAKEAWAY: The food delivery company’s German unit Lieferando plans to cut 2,000 jobs from end-2025 to optimise the model of its delivery service, the company said on July 17.

* LUFTHANSA: The German airline group said on September 28 it would cut 4,000 administrative jobs by 2030.

* NOVO NORDISK: The Danish pharmaceutical company will cut 9,000 jobs globally, the company said on September 10.

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price ChartThe S&P 500 is back to its glorious self this year, overcoming some challenges a few months ago to rise 14% year to date. It's resilient, like the U.S. economy, driven by the largest of its 500 components.

There are a number of ways to invest in the S&P 500, and one of the most popular methods today is investing in an exchange-traded fund (ETF) that tracks it. The largest one is the Vanguard S&P 500 ETF (VOO 0.01%), which has $1.4 trillion in assets, but there are several others.

You might think it's a great time to buy in as the market rises, but it's not that simple.

The S&P 500 has been a wealth-building machine for decades. It gains on average more than 10% annually; Compounded over time, especially with consistent additions, that turns into a lot of money for investors.

As the market rises, investors can benefit from increasing stock prices. And when you invest in an ETF that tracks the S&P 500, it takes all of the guesswork out of investing.

It also gives you exposure to the best companies on the market today, and since it's a weighted index, it's heavily skewed toward artificial intelligence (AI). The largest companies in the U.S. by market cap are the largest companies in the index, and today, these are all AI companies. The Vanguard ETF's top holdings are Nvidia, Microsoft, Apple, and Amazon, and they collectively account for 25% of the total portfolio.

These stocks have incredible long-term tailwinds. Investing in an S&P 500 ETF gives you access to these opportunities while minimizing the risk of investing in only one company.

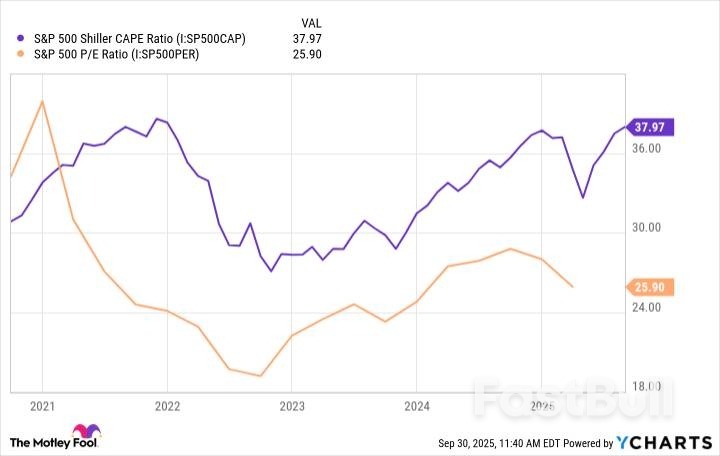

That being said, the best time to buy is on the dip, not at the top. The S&P 500 is breaking records all the time these days, and it's near its most expensive valuation. The average S&P price-to-earnings (P/E) ratio is almost 38, a five-year high. The cyclically adjusted P/E ratio, or CAPE ratio, which adjusts for inflation, is also near highs -- outside of a spike in 2021 right before the market crashed.

What does that mean for investors? Nothing concrete, but the nature of the market is that there are always going to be dips, corrections, and even crashes on the way to the top. The market has always recovered and gone on to bigger and better, but as the S&P 500 becomes more and more expensive, the potential for some kind of correction looks likely.

No one knows when there might be a dip, or worse. You can't time the market, and even though it's heading higher today, it could keep that up for a long time. It would be a shame to miss out on the growth because of fear of a correction. Keep in mind the potential for some near-term rebalancing as the market becomes even more expensive.

I would caution anyone who might need their funds in the near future to invest in safe, perhaps dividend-yielding stocks and keep some distance from anything that looks overpriced, including an S&P 500 ETF. But if you're in it for the long term, and you have the ability to weather downturns, it's always a good time to invest in the market, and an S&P 500 ETF is an excellent way to do that.

French Prime Minister Sébastien Lecornu abruptly resigned on Monday morning, just three weeks after his appointment, preempting what appeared to be an inevitable ousting. Lecornu was expected to unveil his policy agenda before the National Assembly on Tuesday, but both the Socialist Party and the National Rally had warned that without a drastic policy shift, they would trigger a no-confidence vote. French bonds and stocks slumped on the emerging political crisis.

President Emmanuel Macron's office issued a one-sentence statement, confirming that Macron had accepted the resignation of Lecornu. This comes amid turmoil over the composition of his cabinet, a coalition of centrists and conservatives.

Lecornu told reporters his resignation was primarily due to the inability to compromise across the political spectrum: "I was ready to compromise, but each political party wanted the other political party to adopt its entire program."

He told reporters in the courtyard of the Matignon Palace, the prime minister's headquarters, that he had spent weeks trying to forge a viable path forward with politicians, unions, and social partners from both political sides, but had achieved no breakthroughs.

Jean Garrigues, one of France's top political historians, told local media that Macron will likely be forced to dissolve the National Assembly once again.

"A fresh dissolution might lead to an increase of seats for the National Rally in the lower house, but it's unlikely that they'll get an outright majority," Garrigues stated in the interview.

UBS analyst Simon Penn provided clients with the three possible pathways for Macron to move forward:

He can try another technocrat type

He can call a general election

He can quit and call a full presidential election

The Bloomberg Economics team provided readers with the visualization.

Penn warned that France is entering a dangerous political environment:

French PM Lecornu has resigned less than a month after he was appointed (Sept. 9). On face value Lecornu looks to have quit before he was forced out. He was due to present his policy proposals to the National Assembly on Tuesday, but leaders of the Socialist and National Rally had already warned that unless there was a total change in direction they would call a vote of no confidence immediately after Lecornu stopped speaking.

Furthermore, the press and public reaction to the appointment of a near unchanged cabinet from the Bayrou administration has been somewhat scornful. President Macron has attempted three times to try for the same policies and failed three times. As the famous quote from Jean-Claude Juncker goes: "We all know what to do, but we don't know how to get re-elected once we have done it."

The latest failure puts French politics into very dangerous territory – more so than the markets seem to be pricing. The lessons of the UK in the 1970s are worth bearing in mind – a government in the early 70s attempting what today would be described as austerity; failing and being replaced by socialist policy, that today might be described as populist. It took mass strikes, power blackouts and an IMF bailout before UK voters were willing to accept the necessary medicine that came in the form of the 1979 Thatcher government.

Meanwhile, across other Wall Street desks this morning, analysts are desperately trying to make sense of the political turmoil and what comes next. Barclays analysts expect parliamentary elections, adding that a Macron resignation is "unlikely."

Political turmoil sent the CAC 40, the benchmark French stock market index, down 1.5% by early afternoon trading in Paris. French bonds also dropped.

More market commentary from UBS analyst Justinus Steinhors: "The Euro Stoxx 50 falls 80bp, retreating from highs. Yields jump on political turmoil: in France, PM Lecornu resigns after less than four weeks in office."

Alexandre Baradez, chief market analyst at IG in Paris, warned, "What's new this morning is the beginning of contagion from France to the rest of the European banking sector. The drop of the sector is 100% linked to France. Given that banks have outperformed the markets so much, all the elements are aligned for some profit-taking on these stocks."

Allianz CIO and Chief Economist Ludovic Subran told Bloomberg that it's not the time to panic.

Lecornu's resignation makes him the shortest-serving prime minister in the history of France's Fifth Republic, founded by Charles de Gaulle in 1958.

Mongolia, long reliant on mining, plans to build data centers powered by renewable energy as it prepares its first sovereign wealth fund aimed at channeling its mineral wealth to social welfare and infrastructure."We have a massive land with a very favorable climate for activities like [hosting] data centers," Temuulen Bayaraa, CEO of the sovereign fund, told CNBC on the sidelines of the Milken Institute Asia Summit in Singapore on Friday.

The landlocked East Asian nation is developing special economic zones dedicated for data centers, she added, referring to the Hunnu City that is envisioned as a smart, sustainable urban city.The Chinggis Khaan Sovereign Wealth Fund, established by law in April last year, has $1.4 billion in reserves and seeks to tap global demand for computing power and clean energy. Its investment strategy is still pending the government's review and final approval.

A host of Asian countries have accelerated efforts to develop data centers this year amid growing demand for cloud computing and artificial intelligence. Japan, Singapore and Malaysia have ramped up investments in building out their data center capacity.The recent explosion in AI workloads globally requires vast computing power, electrical power, cooling and networking infrastructure. Goldman Sachs expects global power demand from data centers to rise 50% by 2027 and by as much as 165% by 2030.

Aside from data centers, part of the fund's returns will also be used to build "mega-scaled" renewable energy power grids and projects, as part of the country's efforts to boost green energy exports to neighboring countries, Bayaraa said. Mongolia, sandwiched between Russia and China, has upgraded its ties with both superpowers to the level of "comprehensive strategic partnerships" in recent years.The plan comes as the Mongolian government pledged to boost the share of renewable energy, especially wind and solar power, in the country's electricity capacity to 30% by 2030, up from 18.3% in 2023.

The fund's investment strategies will also center on countering risks associated with price fluctuations in commodities, Bayaraa said, as the funds' sources are "very dependent on commodities." The Chinggis Fund is managed by Erdenes Mongol, a government-owned holding company that owns a share in the country's mining assets.The sparsely-populated country, with just about 3.5 million residents, has benefited from a boom in prices for its rich supplies of critical minerals, including coal, copper, uranium and rare-earth elements.

The Mongolian government has been under growing pressure to distribute its mineral wealth among its people and put an end to corruption in the sector. Anti-corruption protests in its capital, Ulaanbaatar, earlier this year forced Oyun-Erdene Luvsannamsrai to step down as prime minister."People didn't feel like mining contributed to the wealth, betterment of their livelihoods while eroding the natural resources. But now the sovereign wealth fund is positioned in a way to rebuild that trust," Bayaraa said.

The fund will play a central role in the country's development plan aimed at providing more transparency and equity in wealth distribution, she added, by pulling in mineral wealth to be "managed and disbursed in a ring-fenced manner to support people, their educational needs, financing, educational, healthcare and housing needs.""The critical work is to build a governance model [for the fund]," she added. Citizens will be able to access on an app details of the fund's sources, allocation and balance. "It's very targeted intervention for expanding middle class, pushing labor market participation," she said.

The fund's leader plans to hire members of the Mongolian diaspora with experience in the banking, investment, and wealth management industries to return home and help manage the fund."For the longest time, Mongolia has been attracting investment into Mongolia. For the first day, we are becoming an investor to contribute to the global agenda," Bayaraa said.

Before the tap of US economic indicators was turned off by the shutdown of the federal government that’s still in force, readings on American consumer spending continued to be resilient in the face of President Donald Trump’s steep tariff increases.

That this would have been the case in late summer 2025 was unexpected by many at the start of the year. Economists broadly had anticipated that jacking up levies on imports would stoke inflation, damage households’ purchasing power, and undermine spending.

“We in the economics profession need to look ourselves in the mirror,” Torsten Slok, chief economist at Apollo Global Management, wrote in a note to clients last week. “The consensus has been wrong since January. The forecast for the past nine months has been that the US economy would slow down. But the reality is that it has simply not happened.”

On of the last government-issued data prints before the Oct. 1 shutdown showed that consumer spending, after taking out inflation, climbed 0.4% in August — double the median forecast, even after the July base of comparison was revised higher. And that’s also despite a major slowdown in job growth.

So what gives? Some economists are concluding it’s the wealth effect. The S&P 500 Index has handed investors a 15%-plus total return so far this year, bonds are up and home values are higher compared with 2024. All in, Goldman Sachs economist Manuel Abecasis tallies that household net worth has increased to more than 800% of disposable (i.e. after-tax) income, near a record high.

As wealth has gone up, Americans’ savings rates have come down. At last look, in August, it was 4.6%, compared with an average of 5.4% last year and 5.6% the year before. “This suggests that wealth effects are driving spending,” Douglas Holtz-Eakin, president of the American Action Forum, an economic policy research group, wrote in a note last week.

The flip side of that, Holtz-Eakin cautions: “One of the real risks to the outlook is the pricing in equity markets.”

Anatole Kaletsky, chief economist and co-founder of Gavekal, goes further. If an economic downturn is avoided, this will “further entrench inflation,” making it more difficult for the Fed to lower rates — in turn putting pressure on the bond market. “The period of greatest danger for US financial markets lies ahead,” he wrote in a note last week.

Three possible rate cuts in Asia, Fed and ECB minutes, testimony by Lagarde in the European Union’s parliament and a speech by the Bank of England Governor Andrew Bailey may draw attention.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up