Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European stocks rose as traders awaited Powell’s speech on Fed rate cuts. ECB may ease next year amid lower inflation. Oil slipped, gold surged, bond yields steady; drone disruptions hit airports.

This article first appeared in Forum, The Edge Malaysia Weekly on September 22, 2025 - September 28, 2025

Artificial intelligence (AI) is revolutionising the field of surgery. AI-powered applications are now working alongside surgeons as indispensable partners, using vast datasets and advanced algorithms to provide real-time, life-saving insights. This technology isn’t just reshaping surgical procedures; it is actively enhancing and supercharging them for better patient outcomes worldwide. From pinpointing the perfect surgical plan before the first incision to predicting a patient’s recovery with stunning accuracy, AI is unlocking a new era of precision, safety and faster healing.

One example of AI is in the field of arthroplasty, with the invention of the ROSA (Robotic Surgical Assistant) knee system. It is a robotic arm-assisted technology that incorporates 3D modelling, real-time data and GPS-like tracking to enhance knee surgeries to be precise, down to each millimetre and personalised to each patient. This system is able to assist surgeons to do more precise surgery more objectively, leading to quicker recovery, reduced complications and morbidity compared with traditional methods. Though driven by AI, this system is not fully autonomous and is still dependent on the certified arthroplasty surgeon to make the final decisions.

Another pivotal innovation in this space is the da Vinci Surgical System. Operating from a console, the surgeon’s hand movements are translated into the ultra-fine motions of the robotic arms, essentially acting as a sophisticated extension of their own hands. It is the AI-powered visual overlays that make it revolutionary. Imagine an AI system highlighting the exact boundaries of a tumour or lighting up tiny, hard-to-spot blood vessels on a screen. This allows for less invasive procedures, which means smaller incisions, less blood loss, and a much faster return to daily life for the patient.

In addition, in the high-stakes world of neurosurgery, Brainlab AI software is a game-changer. It takes complex CT and MRI scans and turns them into an invaluable 3D road map of the brain. The software precisely delineates tumours and highlights critical nerves and blood vessels, allowing neurosurgeons to navigate the brain like never before. Early research is even showing that Convolutional Neural Network (CNN) models of AI can detect the recurrence of a tumour from scans alone, acting as an early warning system.

The impact of AI extends far beyond the moment of surgery. It is fundamentally changing how surgeons are trained and how patient risks are managed. What used to be an apprenticeship model through learning with a real patient, which has little to no room for mistakes, is now a thing of the past. Now, with AI-powered virtual reality (VR), trainees can practice complex cases in a safe, controlled digital environment. The AI provides instant, objective feedback, helping trainees hone their skills until they are perfect. It is like having a master surgeon looking over their shoulder at every moment, offering guidance and critique without the risk.

AI algorithms are also acting as powerful predictors. By analysing a patient’s medical history, these systems can forecast the risk of complications such as blood clots or infections before they happen. This early warning empowers doctors to take preventive action, transforming reactive medicine into proactive care.

This exciting wave of technology naturally brings up a question: will AI replace surgeons? The answer, according to medical experts, is a resounding no. The relationship is a synergistic one, where AI augments the surgeon’s abilities. It allows them to operate with intelligence, freeing them to focus on what truly matters.

The future of surgery isn’t a contest between human and machine but a collaboration. While AI provides unparalleled precision, in our view, it cannot replace the essential role of a surgeon:

● Clinical judgment and adaptability: AI is limited to its training data. A surgeon, with years of experience and intuition, can handle the unexpected — a sudden bleed or an anatomical anomaly — and make critical, life-or-death decisions on the spot.

● Empathy and Compassion: AI can’t provide the human connection crucial for patient care. It can’t offer reassurance, ethical guidance, or the empathy needed to help a patient and their family through a difficult journey.

● Ultimate Accountability: The final responsibility for a patient’s well-being rests with the surgeon. A surgeon’s judgment carries a moral and legal weight that no algorithm can bear.

This partnership, combining the surgeon’s wisdom with AI’s cutting-edge tools, delivers safer, more precise and personalised care for the ultimate benefit of the patient.

NATO on Tuesday condemned Russia for violating Estonian airspace last week and said it would use "all necessary military and non-military tools to defend ourselves" as it faced "a pattern of increasingly irresponsible behaviour" by Moscow.

Estonia said on Friday that three Russian MiG-31 fighter jets violated its airspace for 12 minutes before being escorted out by NATO Italian fighter jets - an incident Western officials say was likely designed to test NATO's readiness and resolve.

The incident occurred the week after some 20 Russian drones entered Polish airspace, prompting NATO jets to shoot down some of them.

"Russia bears full responsibility for these actions, which are escalatory, risk miscalculation and endanger lives. They must stop," the alliance's North Atlantic Council said in a statement.

"Russia should be in no doubt: NATO and Allies will employ, in accordance with international law, all necessary military and non-military tools to defend ourselves and deter all threats from all directions," the statement said.

"We will continue to respond in the manner, timing, and domain of our choosing."

Tuesday's meeting of the North Atlantic Council, made up of ambassadors from the alliance's 32 member countries, was called by Estonia under Article 4 of NATO's founding treaty.

The article states allies will "consult together whenever, in the opinion of any of them, the territorial integrity, political independence or security" of a member is threatened.

It is only the ninth time in NATO's 76-year history that the article has been invoked - and two of those occasions have come this month in response to the incidents over Poland and Estonia.

"Allies will not be deterred by these and other irresponsible acts by Russia from their enduring commitments to support Ukraine, whose security contributes to ours, in the exercise of its inherent right to self-defence against Russia’s brutal and unprovoked war of aggression," the NATO statement said.

Ever wondered what truly drives the crypto market, especially when prices dip? It’s often the unwavering spirit of everyday investors. Recent analysis reveals a fascinating trend: US Bitcoin retail demand remains remarkably strong, even in the face of market corrections.

Despite Bitcoin’s recent 4% dip, a significant indicator, the Coinbase BTC Premium Index, showed a notable increase from 0.043 on September 21 to 0.075 on September 22. This uptick, reported by Cointelegraph, suggests that while institutional players might be cautious, the average American investor is holding firm or even buying more. This consistent interest underscores the resilient Bitcoin retail demand.

What Does the Coinbase BTC Premium Index Reveal About Robust Bitcoin Retail Demand?

The Coinbase BTC Premium Index is a crucial metric that helps us gauge U.S. retail investor activity. It measures the price difference between Bitcoin on Coinbase’s USD trading pair and Binance’s USDT trading pair. A positive index value, like the one we’re seeing, typically signals strong buying pressure from U.S. retail investors.

Essentially, when the index is positive, it means that Bitcoin is trading at a premium on Coinbase compared to Binance. This premium indicates that U.S. buyers are willing to pay a little extra, reflecting robust demand within the U.S. market. For many analysts, a sustained positive index is an optimistic sign for Bitcoin’s immediate future. This trend confirms the ongoing strength of Bitcoin retail demand.

Why Are US Retail Investors Showing Such Remarkable Resilience?

The enduring strength in Bitcoin retail demand can be attributed to several factors:

Navigating Market Dips: A Strategic Opportunity for Bitcoin Retail Demand?

While sharp price declines can be unsettling, history shows that such dips often present strategic buying opportunities for savvy retail investors. The consistent positive movement of the Coinbase BTC Premium Index during a downturn suggests that U.S. retail investors are increasingly sophisticated in their approach.

Instead of capitulating, they are using these moments to strengthen their portfolios. This behavior underscores a maturing market where retail participants are less swayed by FUD (fear, uncertainty, doubt) and more focused on Bitcoin’s long-term potential. This strategic buying reinforces the robust Bitcoin retail demand.

What Does This Mean for You?

The persistent strength of US Bitcoin retail demand, even amidst market volatility, paints an optimistic picture for the cryptocurrency’s future. It highlights a growing conviction among everyday investors who see beyond short-term price swings and recognize Bitcoin’s foundational value. This remarkable resilience is a powerful testament to Bitcoin’s evolving role in the global financial landscape, suggesting a bright future powered by grassroots enthusiasm.

This is part of GIS’s series on the U.S.-EU trade deal. Part 2 will be available tomorrow.

Capitulation, surrender, submission and “a dark day for Europe.” These are just a few of the headlines appearing in European media and social networks immediately after United States President Donald Trump and European Commission President Ursula von der Leyen shook hands at the end of July to confirm a new trade agreement between the U.S. and the European Union. Together, the U.S. and the EU account for well over 40 percent of the global economy and are home to nearly 800 million of the world’s richest consumers and entrepreneurs (although this represents only a tenth of the planet’s population as a whole). So, there is indeed a lot at stake.But how is it possible that the articles by economists and commentators in the U.S. have begun pointing to the “unrealistic promises of the EU,” the “unfulfillable commitments of the agreement,” its “pro-inflationary effects” on American households and sometimes even its “advantages for the EU”? Are they talking about the same agreement?

Part of President Trump’s talent at salesmanship comes from his ability to create nicknames and exaggerated descriptions for things. He is so brilliant at this that even his opponents often accept his monikers.Accordingly, this is “the biggest deal ever” in his view. Is it? If it is intended to eclipse the Peace of Westphalia after the Thirty Years’ War, the results of the Congress of Vienna after the final defeat of Napoleon or the Treaty of Versailles ending World War I, then it certainly is not. The agreement is surprisingly weak and, actually, quite bad for everyone, but for reasons other than those being debated in Europe, which is full of defeatism and self-flagellation.

Let us discuss them in five points.

I. Those who will suffer most immediately and tangibly from the deal are American consumers. They import much more from Europe than Europeans from the U.S. It is because of this long-standing, alleged “rip off of America,” as Mr. Trump puts it, that the whole parade of new trade agreements between the U.S. and the rest of the world is taking place.

Approximately 70 percent of all exports from the EU to the U.S. will be subject to a 15 percent tariff, above the Trump administration’s baseline 10 percent rate. However, this surcharge will not be paid by Europeans, as President Trump claims, but primarily by consumers and businesses in the U.S. itself. A tariff is nothing more than an indirect tax.

We can think of it as a value-added tax (VAT) or a special form of excise tax expressed as a percentage. Everyone in the U.S. will now pay this import tax for goods from Europe, while the EU has committed to reducing the rate of this tax to zero for its consumers and entrepreneurs for the same range of goods imported from the U.S. Is this really a truly tragic defeat for consumers in the EU?

Characterizing this as a “debacle” sounds particularly hypocritical coming from those European politicians who praise President Trump while constantly proclaiming the need to focus on the interests of their own people. How would they view an agreement that was constructed in the opposite way? If President von der Leyen had brought in a 10 percentage-point increase in this levy for European consumers and a reduction to zero for U.S. consumers when buying European goods? Would these same people not be shouting the loudest? Would that not be an attack on the standard of living and wallets of ordinary folks? Yet this is exactly what President Trump has done to the American people.

President Trump would like lower interest rates even in the potentially inflationary environment he has helped create.

Expectations of inflation growth in the U.S. are now ubiquitous, ranging from 1 to 2 percentage points. We are just waiting to see the extent to which the tariffs gradually imposed on the whole world will be passed on to end prices (average tariffs will increase by 16-18 percentage points after agreements with 70 countries around the world have been concluded).

Of course, this may not be a one-to-one ratio, as a certain portion may be absorbed by the margins of manufacturers or retailers. We are familiar with this in the EU. Even VAT adjustments are not always reflected in prices on a one-to-one basis, but the principle is clear and indisputable.This is one of the reasons why the U.S. Federal Reserve is nervous and remains cautious about substantially lowering interest rates. It is clear that this annoys President Trump. He would like lower interest rates even in the potentially inflationary environment he has helped create with his reckless budgetary policy to reduce the cost of servicing the alarmingly growing U.S. debt.

It is not surprising, then, that President Trump’s support is falling, particularly on the issues of rising living costs and trade. Elliott Morris’s respected long-term surveys show that President Trump already has more opponents than supporters in 40 U.S. states when it comes to his trade policy. This, however, is not mentioned in Europe.From the EU’s point of view, it is commendable that when someone shoots themselves in their foot and aims at ours, we do not try to shoot ourselves. This is enlightened thinking at the level of the commission and some member states, which plenty of observers might not have expected. That the instinctively protectionist French were leading the charge against the deal should be a warning in itself.

II. Europe’s manufacturing sectors will also suffer indirectly. There is no doubt that Washington’s deglobalization policy is an attack aimed at the very heart of the EU’s economic model, an issue GIS has previously addressed. This is despite the general tariff being lower than previously announced and that some strategic products will now be traded bilaterally with zero tariffs (the aviation industry, some generic drugs, critical natural resources, etc.). The list is to be further expanded, even though the principle of specific higher tariffs for selected products compared to general tariffs, or even the adding of general and specific tariffs, has been dropped.

In the automotive industry, which is important for Europe, a general rate of 15 percent will apply, not the original 25 percent imposed only on cars (and certainly not the 25 percent specific duty plus 15 percent basic duty that was being discussed). Quite interestingly, according to the framework agreement reached in August, the U.S. and the EU “intend to accept and provide mutual recognition to each other’s standards” in the area of automobiles. The European bloc’s more demanding technical and safety standards were long viewed by the Americans as an unfair non-tariff barrier. As a result of this development, automotive manufacturers in Europe may soon face intensified competition from across the Atlantic.

Only steel, aluminum and copper imports remain subject to a special tariff of 50 percent. Fixed quotas on imports of both metals to the U.S. will be the subject of further difficult negotiations.What remains outside the focus of political and even some economic debate in Europe is that the strengthening of the euro and other European currencies against the dollar has already had roughly the same impact on industry that this basic tariff will have. Since January, the dollar has weakened by almost 15 percent against the euro. This has made European products in the U.S. less competitive even without tariffs.

While this significant weakening is at least a step in the right direction from the perspective of the Trump administration’s trade goals, it adds to inflationary pressures in the U.S. and to the Federal Reserve’s legitimate concerns about price stability. Stock markets being relatively calm is only comforting to some; equities can quickly swing in the opposite direction.Since January, the dollar has weakened by almost 15 percent against the euro. This has made European products in the U.S. less competitive even without tariffs.

III. President Trump himself, as well as his administration, are also likely to suffer in the long run. This is mainly because the agreement was accompanied by a series of bombastic promises from the EU that are either unenforceable or unfulfillable. The more astute American observers quickly noticed this. President von der Leyen was supposed to commit to the EU investing $600 billion in the U.S. over the next three years and importing $750 billion worth of energy resources over the same period. However, the commission does not have money of its own, and so these commitments are empty.

In hindsight, it seems that the commission simply added up the total volume of possible investments and commodity purchases (over which it has no control) being considered by private European companies until 2028, and accepted a megalomaniacal figure. And even if national governments did make these outlays, the commission does not have any control over their spending.

Moreover, this volume of energy imports is estimated to be about three times greater than all European energy purchases from the U.S. now, and is most likely unachievable in terms of capacity alone. It is therefore not surprising that President von der Leyen’s press release does not mention any specific amounts whatsoever. Only the U.S. side talks about them.The American side created the impression of victory and an excellent deal, while the European side gave the impression that it would be capable and willing to deliver. After all, the EU has long excelled in making unfulfillable long-term commitments and attaching grandiose price tags to them (the Lisbon Strategy, Juncker’s plan, Next Generation EU).

One wonders now whether this was not also the case at the June NATO summit in the Hague, with its grandiose commitments on arms spending.

Let us add that the economic logic of the so-called twin deficit clearly states that increased government borrowing and higher budget deficits increase the trade deficit, not the other way around. Similarly, if a country borrows by attracting foreign-financed investment on its soil, this also pushes the trade deficit higher, not lower. Lower trade deficits would, on the contrary, be helped by less indebtedness, whether public or private. This is the core inconsistency of President Trump’s economic policy.

But who cares? If the International Monetary Fund is already predicting a significant slowdown in U.S. economic growth in both the short and long term because of the president’s economic policy, these issues can be ignored. And when a messenger brings bad news, he can be removed. That is what President Trump did in August to Erika McEntarfer, head of the Bureau of Labor Statistics, after her office revised downward key data on the number of new jobs created in recent months.

IV. An important and fundamentally negative consequence of this agreement, as well as others that America is concluding with its partners this year, is the definitive dismantling of the international trade order that has been in place for almost 80 years. As early as 1947, the General Agreement on Tariffs and Trade (GATT) was signed by the original 23 signatories, followed much later by the institutionalized creation of the World Trade Organization (WTO) in 1995.

The basis of the entire system and its key principle, enshrined in the very first article of the GATT agreement, is the so-called general most-favored-nation treatment. To prevent permanent discrimination and distortions in trade, a simple rule applies: The best trade and customs conditions that one member country offers to another member of the club must automatically be offered to all other members. Because of this rule, and because today’s WTO agreement ultimately includes over 160 countries around the world, global tariffs were at a historic low at the beginning of Mr. Trump’s presidency.

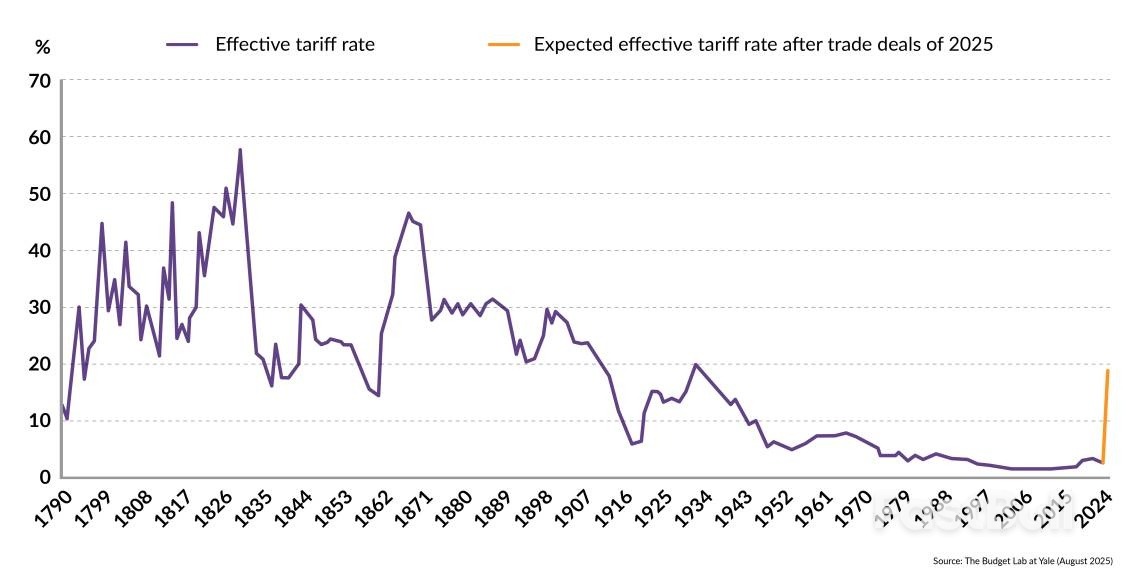

President Trump is dismantling this structure and, after decades of gradual trade liberalization, is recreating an archaic system of bilateral agreements that deliberately ignore the most-favored-nation principle. Likewise, he is dramatically increasing average tariffs on imports into the U.S., which are reaching levels last seen in the 1930s. That was a period of strong American trade isolationism following the adoption of the infamous Smoot-Hawley Tariff Act in 1930, which is now seen as a rather dark chapter in American economic history directly linked to the Great Depression.

Average tariff rates on imports into the U.S.

Following the implementation of the general most-favored-nation trade rules in the 1990s, tariffs on products imported into the U.S. fell to their lowest level ever. The Trump administration is returning to protectionism and increasing costs to Americans for imported goods. © GIS

Following the implementation of the general most-favored-nation trade rules in the 1990s, tariffs on products imported into the U.S. fell to their lowest level ever. The Trump administration is returning to protectionism and increasing costs to Americans for imported goods. © GIS

Of course, these moves violate international law and, according to legal experts, also U.S. law, but ultimately it will be up to international and U.S. courts to decide on the legality of these steps. By accepting the agreement with the U.S., however, the EU is unintentionally becoming part of this dismantling process.VAT will serve to illustrate the far-reaching consequences of this move. Imagine paying different VAT or excise duties on exactly the same product in one supermarket compared to another, or even different rates depending on whether you live in one city or another.

In such a system, everyone would naturally devote considerable effort to circumventing different prices, avoiding discriminatory rates – simply gaming the system to gain an advantage. Declaring a place of origin other than the actual one would be the least anyone would have to consider when looking at their competitors. All this unproductive activity was unnecessary in the relatively smooth world of multilateral trade agreements.

V. It is true that the U.S., as the erstwhile hegemon of (not only) the international trading system, can use its power to try to change this order of things, and it also has the power to push others to behave in a similar way.

But if the strongest economy does not abide by the agreements it has committed to, why should anyone else follow the rules? Each country then has an excuse not to respect any agreement when it suits them. Some will be troubled by compliance with the Paris Climate Agreement, others by the Treaty on the Non-Proliferation of Nuclear Weapons. There are countless examples. In this context, the statement by the U.S. president that the reconciliation between Armenia and Azerbaijan “restores trade between these countries” looks more like chutzpah.

It is indeed difficult, if not impossible, to say who has won or lost in the agreement between the U.S. and the EU. If one party is heading in the wrong direction and has dubious motives for its propositions, the deal will be rotten at its core. All this is true even though the agreement is still provisional, as it has to be approved by EU member states and may be subject to judicial reviews. To date, the U.S. Courts of Appeals have ruled that many of the Trump administration’s tariffs are illegal; the final verdict on this, however, will come from the Supreme Court. Much can therefore still change.

It is possible for the Europeans to minimize damage, avoid causing unnecessary harm, work on new trade links with the rest of the world, remove internal barriers to trade, hope that the new system of high tariffs will not last long and then focus on priority areas, not on marginal ones. A trade and production bloc such as the EU, which is highly exposed to the whims of its U.S. trading partner for security and military matters, cannot have a more noble nor a more practical ambition now.

With the U.S. government eight days from its 15th partial shutdown, opens new tab since 1981, Washington is in familiar territory with an important difference: President Donald Trump's administration has not widely shared its plans for what functions will cease and what will continue if Congress fails to act.

The Office of Management and Budget this year asked federal agencies to update their contingency plans for how they will operate if funding runs out when the fiscal year ends on September 30. In past shutdowns functions like air-traffic control and law enforcement have continued, while financial regulators have furloughed the vast majority of their staffs.

Those plans were often shared weeks in advance heading into past shutdowns. But as of Monday, the current versions have not been widely shared with Congress or the public and White House web page dedicated to those plans was blank.

The White House and OMB did not respond when asked if these plans will be publicly released or if shutdown plans differ from previous years.

“Shutdowns create tremendous amount of uncertainty for federal workers and local economies,” said Rachel Snyderman, managing director of economic policy at the Bipartisan Policy Center, adding these shutdown plans provide insight into who shows up to work with or without pay, and who is furloughed.

“There is no substitute for how the government would operate in a shutdown without the visibility that these plans provide,” said Snyderman, who served at OMB as a career staffer across several administrations.

The Republican-led House of Representatives passed a stopgap funding bill last week to extend funding through November 21, but it failed in the Senate where Republicans hold 53 of the 100 seats. Republicans blame Democrats for holding up the funding due to their opposition to the president whereas Democrats argue healthcare issues need to be addressed in this funding bill.

Both chambers are out all this week with the Senate not due to return to Washington until September 29.

These plans also inform Congress how the executive branch will follow the Antideficiency Act, an 1884 law that prevents the federal government from spending money without funding passed into law.

“With the threat of a possible government shutdown looming, the Trump Administration’s Office of Management and Budget must immediately release these updated contingency plans,” Senator Gary Peters of Michigan, the top Democrat on the Homeland Security and Government Affairs Committee that oversees shutdown operations, said in a statement.

“Without them, Congress and the public are completely in the dark about how the Administration would comply with the law while continuing to carry out critical national security functions,” he added.

Government shutdowns impact federal agencies funded through discretionary spending and mostly do not impact government functions with mandatory spending -- such as Social Security payments, Medicare health programs and interest payments on the nation's debt -- which collectively account for about three-quarters of the roughly $7 trillion federal budget.

Usually, a week away from a lapse of appropriations OMB starts notifying agencies on the prospects of a shutdown, legislative possibilities, and other pertinent updates.

The Trump administration has reworked the federal government by changing priorities, and oversaw departure of an estimated 300,000 federal employees this year through firings, layoffs, and buyouts, according to the Partnership for Public Service, a nonprofit that tracks federal workforce trends.

The OMB has also challenged federal funding powers, which the Constitution grants to Congress with the power of the purse. On Capitol Hill, funding negotiations between Republican and Democratic appropriators were shaken after the OMB leader Russ Vought in July argued publicly this funding process should be “less bipartisan.”

Agencies have some leeway to determine which categories of employees to furlough or not, like an exception allowed within the law for roles to continue if “necessary to protect life and property.”

“The parameters of what’s in bounds is pretty well settled, but I would not be surprised if there was an attempt to try to test those bounds as that would be consistent with what we’ve seen from this administration related to appropriations,” said Joe Carlile, a former high-level Democratic budget official.

Three Senate committee aides said they have been informed by some agencies in their jurisdiction that these contingency plans were submitted to OMB for approval and the logistics were similar to plans under previous administrations, while other agencies have not provided any updates.

The last government shutdown was during Trump's first term, spanning 34 days from the end of December 2018 into January 2019, and certain decisions by the Trump administration to spend money for the National Park Service and on food assistance programs at the Agriculture Department were found to have violated the law, according to the Government Accountability Office, a nonpartisan watchdog funded by Congress.

Sell-side strategists, who have rushed to upgrade their stock targets ever since the market rebounded from its early-year slide, keep underestimating the rally’s strength.

The record-setting advance has pushed the S&P 500 Index nearly 3% above the average year-end forecast among those tracked by Bloomberg, which currently stands at 6,486. Only in 2024 and 1999 have the calls lagged the market’s actual return so much around this time of the year.

The gap underscores what a vexing spell it has been for Wall Street soothsayers as equity prices have surged past worries about President Donald Trump’s trade war and signs of a cooling in the US economy.

Those factors have been overshadowed by surprisingly strong profit growth, enthusiasm for the Big Tech companies that are capitalizing on breakthroughs in artificial intelligence, and — more recently — the prospect of further interest-rate cuts from the Federal Reserve.

As a result, strategists at Goldman Sachs Group Inc., Deutsche Bank AG and other firms have been struggling to keep up, with many boosting their outlooks repeatedly since the S&P 500 staged a surprisingly strong recovery from the drop unleashed by Trump’s tariff rollout earlier this year.

“Analysts have a tendency to be conservative going into earning season, but they were particularly conservative this time, and I think the same goes for strategists,” said Wall Street veteran Ed Yardeni of eponymous firm Yardeni Research. “I’ve been a cheerleader for the resilience of the economy, and even I’ve been surprised that earnings — profit margins — haven’t really flinched in the face of Trump’s tariffs.”

Earnings growth estimates have been steadily advancing since July, giving equity investors yet another reason for optimism. Analysts now expect S&P 500 500 profits to grow 9.4% this year, up from 7.1% shortly after Labor Day, according to Bloomberg data.

Yardeni himself lifted his year-end expectations for the S&P 500 to 6,800 from 6,600 earlier this month and has acknowledged he’s had to revise his forecast this year more often then ever before. He also assigned a 25% probability that the US stock gauge could experience a “meltup” to 7,000 by 2025’s close — and sees the odds increasing if the Fed keeps reducing borrowing costs.

There are plenty of reasons that strategists have been hesitant to push their forecasts too far. The S&P 500 has already posted a 34% surge off of April’s lows, bringing its valuation multiple to the highest since January 2021. And it’s still far from clear how the tariffs will ultimately affect the growth and inflation outlook.

But the market’s steady advance has effectively revived some of the optimism that Wall Street forecasters had heading into this year, when they were predicting that S&P 500 would rise some 13%. After Trump’s chaotic trade-war upended the outlook, it had been knocked down by May to project just a 2% gain, the steepest drop since the start of the pandemic in 2020. In June, as equities extended the rebound, they were marking their estimates up again.

“What we have been surprised by is the unrelenting nature of the advance, without any material pullback at all,” said Julian Emanuel, chief equity and quantitative strategist at Evercore ISI. His year-end S&P 500 forecast stands at 6,250 after bumping, and he recently said he sees the benchmark climbing to 7,750 by the end of 2026. It closed just shy of 6,700 Monday.

The Fed’s decision last week to start cutting interest rates again after a nine-month pause has been the latest cause for optimism that the advance has some staying power.

There have been 16 instances in the past half century that the Fed has reduced borrowing costs while the S&P 500 was within 1% of a record high — as was the case last week, according to data from Barclays Plc. Each time, stocks were higher one year later.

Moreover, with the economy still growing — and the Fed showing a willingness to address the slowdown that’s started to pinch low-income householders and small companies — US stocks are experiencing “the best of both worlds,” according to Max Kettner, chief multi-asset strategist at HSBC Holdings Plc.

“This kind of policy setup is so rare and continues to argue for an aggressive risk-on stance,” he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up