Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European Union ministers are set to urge top U.S. trade officials on Monday to apply more of the July EU-US trade deal, such as by cutting U.S. tariffs on EU steel and removing them for EU goods such as wine and spirits.

European Union ministers are set to urge top U.S. trade officials on Monday to apply more of the July EU-US trade deal, such as by cutting U.S. tariffs on EU steel and removing them for EU goods such as wine and spirits.

U.S. Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer will meet EU ministers responsible for trade on their first trips to Brussels since taking office.

The EU ministers plan to discuss pressing trade issues, including Chinese rare earth and chip exports restrictions, and host Lutnick and Greer for 90 minutes over lunch.

Under the end-July deal, the United States set 15% tariffs on most EU goods, while the European Union agreed to remove many of its duties on U.S. imports.

That may only happen in March or April, given it requires approval from the European Parliament and EU governments, which EU diplomats say has exasperated Washington.

But while insisting the process is on course, the 27-nation bloc is also pointing to agreed items on which it wants to see progress, chief among them steel and aluminium.

The United States has a 50% tariff on the metals and since mid-August has applied this to the metal content in 407 "derivative" products such as motorcycles and refrigerators. More derivatives may be added next month.

EU diplomats say that such actions, along with the prospect of new tariffs on trucks, critical minerals, planes and wind turbines, threaten to hollow out the July accord.

"We're at a delicate moment," one EU diplomat said. "The U.S. is looking for reasons to criticise the EU as we are trying to get them to work on steel and other unresolved matters."

The bloc additionally wants a broader range of its products subject only to low pre-Trump duties. These could include wine and spirits, olives and pasta.

The EU is also ready to discuss areas of possible regulatory cooperation, such as covering cars, the bloc's proposed purchases of U.S. energy and joint efforts on economic security, particularly in response to Chinese export controls.

Singapore's biggest bank has withdrawn an application to start talks to buy as much as 49% of Alliance Bank Malaysia Bhd., replacing it with one to acquire up to 30% instead, people with knowledge of the matter said.

DBS Group Holdings Ltd. made the decision after failing to get approval from the Malaysian central bank for its initial request, which would've required a waiver because generally a company can only buy as much as 30% of a financial institution in the country, the people said.

The revised request should have a better chance of being approved by Bank Negara Malaysia, the people said, asking not to be identified because the information is private.

That would pave the way for DBS to engage with Alliance's largest shareholder, Vertical Theme Sdn., a Malaysian holding company backed by Singapore state investor Temasek Holdings Pte, the people said. Temasek has a 49% stake in Vertical Theme via Duxton Investment & Development Pte. It also holds about 28.3% of DBS.

Representatives for DBS and Vertical Theme declined to comment. A spokesperson for Alliance said the company wasn't aware of the matter, while the Malaysian central bank didn't immediately respond to a request for comment.

An Alliance deal would give DBS a footprint in Malaysia, where Singaporean rivals Oversea-Chinese Banking Corp. and United Overseas Bank Ltd. already have a presence. DBS is Southeast Asia's largest bank by total assets.

Alliance's shares have fallen 6% in Kuala Lumpur this year, while the city's main benchmark is down less than 2%. Alliance has a market capitalization of about 7.7 billion ringgit ($1.9 billion).

Key points:

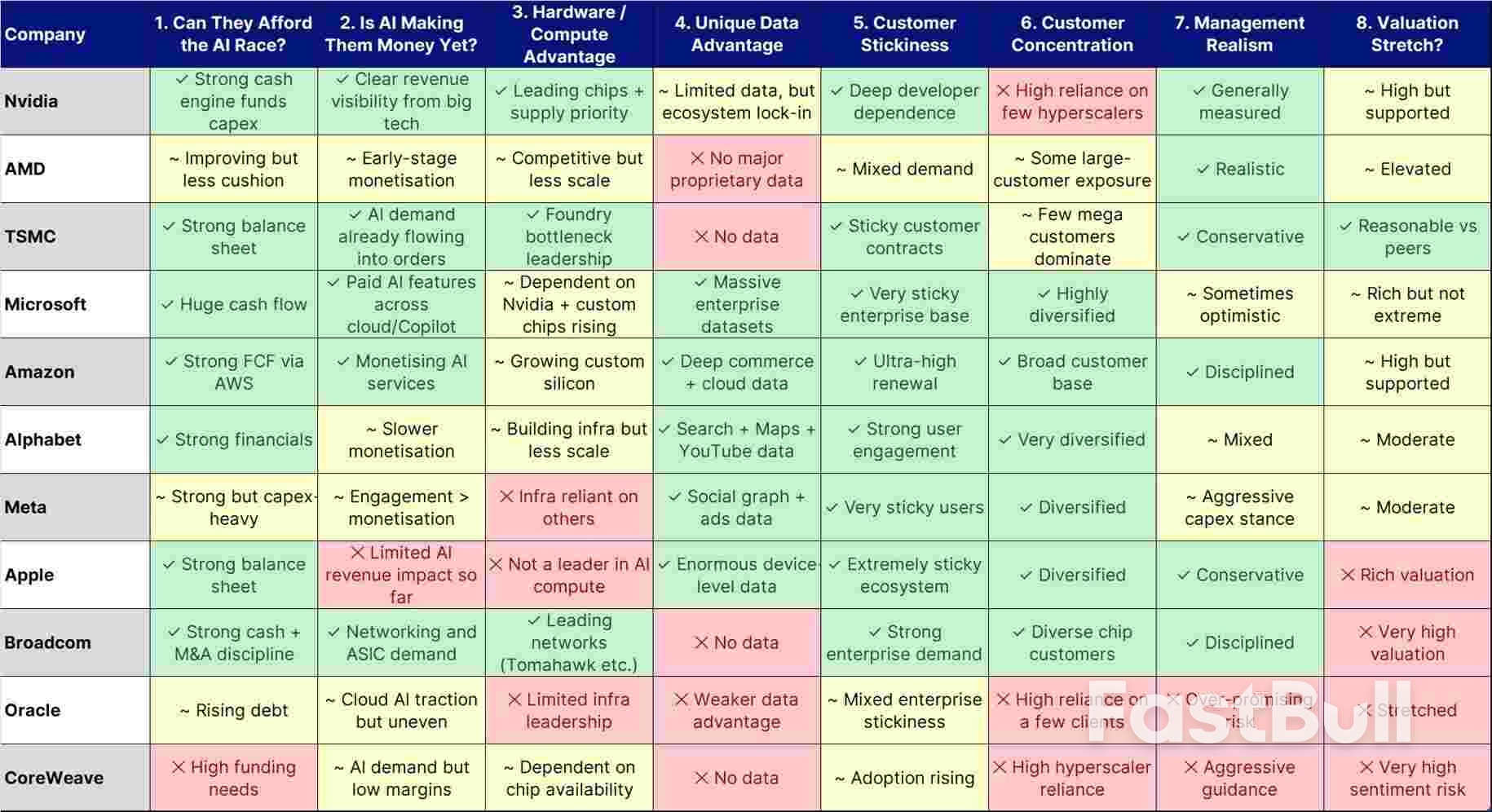

In our view, AI remains one of the most powerful forces reshaping markets, but the tone is changing. Strong earnings from leading chipmakers e.g., Nvidia's Q3 FY2026 revenue grew 62% YoY (Source: Nvidia Investor Relations) reassure investors that demand is real, yet the sharp swings in market reaction show that enthusiasm now sits alongside questions around sustainability, profitability, and execution.

The broad "everything goes up" phase of the AI trade is fading. What replaces it is a more nuanced market: one that rewards fundamentals over narratives.

Investors now face a key challenge of understanding which companies have the financial and operational strength to compete through cycles. That will potentially help them to separate the durable players from those caught up in the momentum.

Below is a simplified but strategically meaningful framework that could be used to decode the AI ecosystem.

1. Can the company afford the AI race?

Why it matters: AI is extremely capital-intensive. Companies investing in chips, power, and data centres need financial strength to survive both growth phases and volatility.

What to look for:

Risks: Heavy borrowing or negative cash flow may amplify volatility.

2. Is AI already adding to revenue?

Why it matters: Investors are becoming more selective; they want to see AI adding real business value, not just product demos.

What to look for:

Risks: Companies that invest ahead of monetisation may face margin pressure.

3. Does the company have infrastructure advantage?

Why it matters: AI needs chips, land, power, cooling, and network bandwidth. Access to scarce infrastructure is becoming a major competitive edge.

What to look for:

Risks: Delays due to power shortages or supply constraints.

4. Does the company control unique data?

Why it matters: As models get more similar, proprietary data becomes the true differentiator.

What to look for:

Risks: Companies relying on public data face weaker defensibility.

5. Are customers staying and using more?

Why it matters: Sticky customers create recurring revenue and lower the risk of AI investments not paying off.What to look for:

Risks: Churn or weak engagement can quickly erode the AI narrative.

6. How dependent is the company on a few large customers?

Why it matters: Many AI suppliers — especially in chips, cloud infrastructure, and data-centre services — rely heavily on a small number of hyperscalers. When 20–50% of revenue comes from one or two clients, even a slight pause in spending can create sudden earnings volatility.

What to look for:

Risks: Revenue may fall sharply if a major customer delays capex, shifts to an in-house solution, renegotiates pricing, or reduces reliance on the company's AI infrastructure.

7. Is management realistic about AI timelines?

Why it matters: Markets are punishing over-promising and rewarding measured execution.

What to look for:

Risks: Missed timelines or shifting goalposts raise credibility concerns.

8. Is the valuation pricing in too much perfection?

Why it matters: Elevated expectations increase volatility, especially in an environment where interest rates may stay higher for longer.

What to look for:

Risks: Stocks with perfection priced in can fall sharply on small disappointments.

Illustrative only. Not investment advice.Reasoning is simplified to help investors understand strengths and risks.

Source: Saxo

Source: SaxoWhile AI is clearly transforming industries and driving a multi-year investment cycle, in our opinion the next stage of this cycle may reward companies that balance ambition with financial strength, operational execution and diversified demand.

This 8-factor checklist gives investors a simple, structured framework to evaluate AI stocks, acknowledging both the potential upside and the meaningful risks.

Singapore's inflation rate climbed for a second straight month, year on year, with price growth in October hitting a near 1-year high and topping analysts' expectations.

After hitting a four-year low in August, consumer prices rose 1.2% — highest since August 2024 — compared with the average 0.9% estimated by economists polled by Reuters and the 0.7% rise in September.

Core inflation in the city-state — which strips out prices of accommodation and private transport — also rose to 1.2%, up from 0.4% and compared with the 0.7% expected in the Reuters poll.

On a month-on-month basis, the consumer price index was flat, with core inflation coming at 0.5% compared to the prior month.

Inflation data comes as Singapore on Friday sharply upgraded its economic growth forecast to 4% from 1.5%-2.5%, as it posted robust third-quarter GDP numbers.

The economy grew 4.2% in the third quarter from a year earlier, beating estimates and extending the second quarter's 4.7% expansion. Singapore's Ministry of Trade and Industry said that global economic conditions had turned out more resilient than expected, but warned that growth would likely cool in 2026 as U.S. tariffs weigh on global demand.

Singapore's exports to the U.S. are subject to a 10% baseline tariff, despite the country having a trade deficit with the U.S. and also a free trade agreement going back to 2004.

The country's economy is hugely dependent on trade, with World Bank data showing that Singapore has a trade-to-GDP ratio of over 320% in 2024.

In the third quarter, Singapore recorded a 3.3% fall in non-oil domestic exports, or NODX, year on year, dragged by weaker pharmaceutical and petrochemical exports.

In October though, NODX surged 22.2% compared to a year earlier, driven by exports of non-monetary gold and electronic products.

The Monetary Authority of Singapore has forecast inflation around 0.5% to 1% for 2025.

The MAS held monetary policy unchanged in its October meeting, saying that Singapore's economic growth had been stronger than expected.

South African police on Sunday confirmed they are investigating claims that Duduzile Zuma-Sambudla, daughter of former President Jacob Zuma, and two others conned 17 men into fighting for Russia in Ukraine.

Another of Zuma's daughters, Nkosazana Bongamini Zuma-Mncube, accused her stepsister of sending the men to Russia before they were ordered to the front lines.

"These men were lured to Russia under false pretenses and handed to a Russian mercenary group to fight in the Ukraine war without their knowledge or consent. Among these 17 men are eight of my family members," Zuma-Mncube said in a public statement.

Earlier this month, President Cyril Ramaphosa's office said it "received distress calls for assistance to return home from 17 South African men, ages 20 to 39, who are trapped in the war-torn Donbas."

Zuma-Sambudla, who is also a member of parliament for her father's uMkhonto weSizwe party (MK), did not immediately respond to the accusations.

She reportedly told the men they would train as bodyguards to work for the party.

On November 6, the South African Presidency said in a statement that the men were promised "lucrative employment contracts." Ramaphosa ordered an inquiry into how the men were recruited.

South African law prohibits citizens from fighting for foreign armies without government authorization.

Zuma-Mncube urged the government "to expedite all diplomatic efforts to secure the immediate and safe return of our citizens."

The latest police investigation comes as Zuma-Sambudla is already on trial for allegedly inciting violence during riots in 2021 that left more than 300 people dead.

The unrest broke out in July 2021 after her father was arrested for disobeying a court order to testify at a corruption inquiry, and it morphed into widespread looting.

Zuma-Sambudla has consistently voiced strong support for her father, former president Jacob Zuma [FILE: December 16, 2023]Image: Themba Hadebe/AP Photo/picture alliance

Zuma-Sambudla has consistently voiced strong support for her father, former president Jacob Zuma [FILE: December 16, 2023]Image: Themba Hadebe/AP Photo/picture allianceShe pleaded not guilty to the charge during a hearing in early November attended by Zuma.

He was South Africa's president from 2009 to 2018.

MK was a major disruptor in last year's national election, contributing to a sharp drop in support for the African National Congress, which Zuma once led.

The World Bank lifted Kenya's economic growth forecast for this year to almost 5% on Monday, citing a pick up in the construction sector in East Africa's largest economy.

Some of Kenya's main industries like construction suffered last year, partly as concerns mounted about the government's finances, but the trend has begun to reverse, the development lender said.

"Signs of recovery are emerging," a new report on Kenya's economy said, adding that the rebound in construction in the first half of 2025 had offset a slowdown in manufacturing.

The result is that the economy is now projected to grow by 4.9% this year, up from the World Bank's May forecast of 4.5%, and maintain that rate of growth over the next two years.

Risks to the outlook stem from international trade uncertainty, including the expiry of a U.S. trade deal with the region, and ongoing fiscal consolidation that could curb government spending, the report said.

Government officials say Kenya's economic expansion has also been negatively affected by a heavy public debt burden characterised by high annual repayments that have absorbed much of its revenue.

The government has turned to measures like loans securitised on a motorists' road maintenance levy on petrol prices to raise funds to pay road contractors who had abandoned sites last year due to lack of payment.

It is also in talks with the International Monetary Fund to secure a new financial support programme. Differences remain, however, including over whether the securitised borrowing should be classified as government debt or not.

Monday's World Bank report laid out a set of reforms the government should carry out to boost competition and support investment and economic growth.

Barriers to competition include the presence of more than 200 state owned firms that benefit from undue advantages, distorting competition, and restrictions on foreign investments, it said.

"There is significant room to make Kenya's regulatory framework less restrictive to competition," the lender said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up