Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ETF outflows surpass $428 million instigating sell pressure. BitMine acquires over 100,000 ETH during fluctuation. Ethereum's price below $4,000 reflects broader market effects.

Ethereum (ETH) fell below $4,000 due to substantial ETF outflows and whale activity. Notably, BlackRock's ETF saw $310.13M in outflows, increasing sell pressure, while BitMine added 104,336 ETH, signaling institutional confidence.

Ethereum dipped below the $4,000 mark on October 13, 2025, following notable institutional outflows primarily from BlackRock's ETF, amid wider crypto market volatility.

The event signifies Ethereum's vulnerability to ETF flows, affecting investor sentiment. Market response reflects broader technology sector dynamics.

Ethereum's recent descent was chiefly influenced by institutional behaviors, particularly BlackRock’s ETF outflow of $310 million in one day. Owning over 100,000 ETH, BitMine counteracted with significant accumulation. Influences trace back to heightened volatility within the market.

Negative net flows marked by Ethereum ETFs reached $428.5 million combined. BlackRock, as a key player, catalyzed sell pressure. Absent commentary from Ethereum's leadership, institutional moves dominated the discourse.

Bitcoin and major altcoins also mirrored Ethereum's decline. DeFi and NFT sectors revealed reduced activity, accentuating impacts on network demand. Analysts project technical rebounds yet stress prevailing market skepticism.

Analyzing historical precedents, ETH often recovers post correction. Major past sell-offs required stabilizing above technical support. Historical data indicates patterns of balance restoration following institutional actions.

Ethereum must navigate potential regulatory shifts affecting technological integration. Focus pivots on long-term trends in network utilization, indicating how the ecosystem might adjust amid financial and technological landscapes.

Over the past week, U.S.-China trade tensions escalated once more, heightening policy uncertainty and increasing market volatility.

On one side, China's Ministry of Commerce announced further restrictions on exports of rare earths, lithium batteries, and other critical materials, adding more companies to the “unreliable entities list” and expanding export controls to cover rare earth materials, key equipment, and lithium batteries. On the other side, the U.S. government threatened to impose an additional 100% tariff on Chinese goods and plans to restrict exports of critical software and aircraft components starting November 1.

Within just a few days, both sides acted swiftly and decisively, alternating between signaling willingness to negotiate and applying pressure. This made it difficult for traders to accurately price in the potential market impact of the U.S.-China standoff.

Global risk assets came under broad pressure, with the CN50 and Hang Seng Index (HK50) both falling nearly 5% on the day the tariffs were announced. Although investor sentiment in other Asia-Pacific markets, such as Japan and Australia, has since stabilized and partially recovered from the tariff-induced pullback, stocks in mainland China and Hong Kong remain mixed.

Chinese market participants are processing the news flow while closely monitoring several key questions: Will these tariffs and export restrictions actually be implemented? If so, what impact could they have on China's economy and capital markets? And which upcoming events or potential risks should investors pay attention to?

Compared with the tariffs announced by the U.S. in April, the latest round of U.S.-China frictions shows significant shifts.

First, the dispute has moved from traditional tariffs to export controls and technology restrictions, particularly in rare earths and high-tech sectors. China controls approximately 70%-80% of global rare earth mining and around 90% of refining and processing capacity. This round of restrictions targets not only raw material exports but also key equipment and processing technology.

While the U.S. can seek alternative supplies from countries like Brazil, India, and Australia, fully compensating for China's production gap would take significant time. A 2010 precedent—China's two-month rare earth export ban on Japan—took nearly five years for Japan to partially offset the supply shortfall, highlighting the strategic leverage inherent in rare earth controls.

Similarly, U.S. restrictions on exporting high-end chips to China make technological independence increasingly urgent. Accelerating domestic development of semiconductors and AI chips is not only a necessary step to mitigate supply risks but also strengthens China's bargaining position in tariff and trade negotiations.

Political factors have also added complexity to this round of talks. Ongoing U.S. government shutdown risks and the Supreme Court's pending ruling on IEEPA tariffs could reduce administrative efficiency and delay policy implementation, complicating negotiations further.

Even if the proposed 100% tariffs and export restrictions were fully implemented, the direct impact on China's macroeconomy may be less severe than some market expectations suggest.

From a trade perspective, while China's effective tariffs are already approaching 40%, diversification of export markets provides a buffer. In September 2025, China's exports to the U.S. fell 27% year-on-year, marking six consecutive months of decline, yet exports to ASEAN, the EU, and Japan rebounded significantly.

With trade increasingly shifting toward regional partners and emerging markets, China's external demand structure is gradually reshaping. Trade diversion, combined with potential policy offsets from Chinese authorities, should help mitigate the negative effects of U.S. tariffs.

At a deeper level, this round of friction is not just about tariff rates or export volumes; it is a contest over technological leadership, supply chain control, and global institutional influence.

Critical materials like rare earths hold strategic positions in global supply chains, giving China an irreplaceable advantage. Restricting exports may raise short-term downstream costs but simultaneously enhances China's leverage in negotiations.

In addition, U.S. software exports to China account for just 5.8% of total exports in 2024, limiting overall impact. Facing U.S. restrictions on high-end equipment and semiconductors, China's ongoing push for domestic substitutes and technological autonomy is gradually closing the gap while strengthening supply chain resilience.

Overall, short-term frictions may raise risk premiums, increase capital outflow pressures, and heighten expectations of RMB depreciation. Industries such as technology, semiconductors, electronics, and machinery—especially small and medium-sized enterprises—may bear the initial brunt, with some companies possibly accelerating shipments to avoid tariffs.

Nevertheless, China's relatively ample foreign exchange reserves, flexible exchange rate management, and solid fiscal tools should help stabilize market sentiment and ease short-term volatility.

Despite the continuous news flow, the likelihood of these tariffs being fully implemented remains low.

President Trump's well-known “TACO Strategy” involves escalating tariff threats and issuing vague statements to create a high-pressure negotiation environment, signaling to other economies that the U.S. is willing to endure short-term pain for long-term gains. China, meanwhile, seeks to condemn and retaliate while signaling to markets that it will not compromise. Their interactions have largely been a credibility game, where political signaling often outweighs immediate economic impact.

Domestic political uncertainty in the U.S. is the biggest obstacle to implementing these tariffs, with government shutdowns and compliance risks limiting practical execution. In contrast, China has more flexibility to respond with countermeasures, and this timing gap reduces the feasibility of fully implementing U.S. tariffs.

The APEC summit and planned U.S.-China presidential meetings remain on schedule, and the new tariffs proposed by the White House are not expected to take effect until November, leaving room and time for negotiations.

In the short term, discussions are likely to focus on quantifiable issues such as trade balance, tariff levels, export controls, and exchange rate fluctuations. The U.S. may push China to increase agricultural purchases and U.S. investments while pressing on issues like fentanyl; China could respond strategically by slowing the pace of foreign investment reforms.

Over a longer horizon, U.S.-China relations are likely to oscillate between temporary truce and ongoing negotiations. For the U.S., short-term pauses help ease domestic political and market pressures while retaining leverage for future action. For China, they stabilize external conditions, alleviate economic pressure, and provide breathing space for domestic reforms.

Breaking this cyclical deadlock ultimately depends on building verifiable mechanisms of trust. Setting concrete execution checkpoints to verify commitments, using temporary compromises to gain negotiation space, and gradually establishing reciprocal expectations could open new avenues for bilateral relations. This approach mirrors the framework of the 2019–2020 interim agreements and may again serve as a practical reference for current negotiations.

Overall, with temporary agreements becoming part of U.S.-China trade friction, such tensions are likely to represent a recurring feature of bilateral competition. Both sides use policy tools to signal positions and gain bargaining leverage, but the market impact ultimately hinges on the balance between “deterrence” and “executability.”

Market volatility is inevitable amid this strategic game. In the near term, key points to watch include the leaders' planned meeting in South Korea at the end of the month and the U.S. Supreme Court's IEEPA tariff ruling in early November. Both sides are sending negotiation signals; if tensions ease, risk sentiment could improve, and China-Hong Kong stocks, supported by technology and AI sectors, may show more stable gains.

In the face of short-term uncertainty, market participants may consider balancing defensive and opportunistic approaches.

Defensively, attention can be given to export-oriented companies, raw materials, and critical supply chain nodes to reduce short-term volatility risks. Maintaining adequate liquidity, managing exposure to firms heavily reliant on U.S. exports, and hedging systemic risks are also prudent. Close monitoring of foreign exchange and interest rate markets can help respond to potential RMB depreciation pressures.

On the opportunity side, investors may focus on growth prospects arising from technology upgrades, industrial substitution, and long-term structural reforms. High-quality targets in domestic substitution chains—such as semiconductor equipment, upstream materials, and core components for new energy—could benefit from both policy support and growing demand.

Learning how to read stock market charts and graphs helps investors identify trends, analyze price action, and make informed decisions.

Stock charts display how a stock’s price changes over time. Each chart type presents data differently, helping investors spot momentum, volatility, and turning points.

Connects closing prices across time, offering a clean view of overall direction. Ideal for beginners learning how to read charts in the stock market.

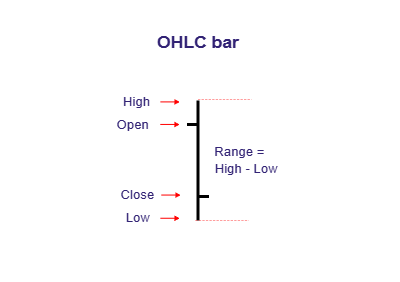

Shows open, high, low, and close for each period. The vertical bar reflects the full range, while left/right ticks mark open/close. Useful for gauging volatility and intraperiod sentiment.

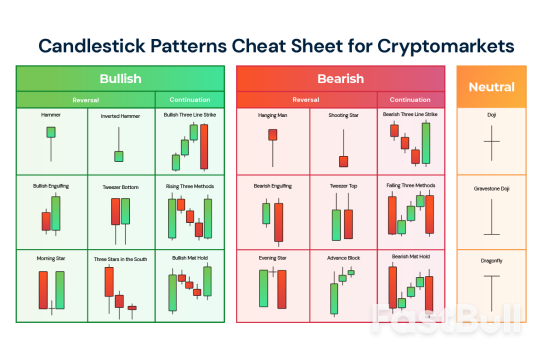

Visualizes the same OHLC data with colored bodies and wicks, revealing market psychology. Great for recognizing momentum, reversals, and continuation signals (how to read candle chart in stock market).

Ignores time and focuses on price movement only, filtering noise and highlighting breakouts and long-term trend structure.

Understanding key indicators is essential when learning how to read stock market charts and graphs. These indicators help investors evaluate trend strength, momentum, and potential reversals in the market.

The moving average smooths price data over a specific period, showing the average value of a stock’s price. It helps identify the overall trend direction — if prices stay above the MA, the market is bullish; below means bearish.

RSI measures price momentum on a scale of 0 to 100, helping identify overbought or oversold conditions. A reading above 70 often means overbought, while below 30 indicates oversold. When analyzing how to read a stock market chart, RSI offers insight into market psychology and timing.

The MACD indicator tracks the relationship between two exponential moving averages to show momentum shifts. When the MACD line crosses above the signal line, it’s a bullish signal; when below, it’s bearish.

Volume measures how many shares are traded during a given period. When price moves with rising volume, it confirms the strength of that move. This is critical in how to read charts in stock market analysis since it validates breakouts or reversals.

Bollinger Bands use a moving average with upper and lower bands based on standard deviations. When prices touch the upper band, assets may be overbought; when near the lower band, oversold. It’s a visual way to measure volatility and extremes in how to read candle chart in stock market analysis.

This tool helps identify potential support and resistance levels by dividing a major price move into key ratios (23.6%, 38.2%, 61.8%). Traders use it to predict pullbacks and continuation points.

Drawing trendlines helps visualize the market direction. Parallel trendlines form price channels that signal the boundaries of price movement. They’re often combined with indicators for confirmation.

Learning how to read stock market charts and graphs helps investors interpret price trends, market sentiment, and entry or exit signals. Whether you use a line chart, bar chart, or candlestick chart, understanding each format allows you to visualize the balance between buyers and sellers.

A line chart is the simplest way to view price movements over time. It connects the closing prices of each trading period with a continuous line, giving a clear picture of the overall trend.

Line charts are ideal for investors who want to see the “big picture” of a stock’s performance without short-term noise. When learning how to read a stock market chart, this is often the first step toward understanding broader trends.

A bar chart (also called an OHLC chart) shows more detail by including the open, high, low, and close prices within each period. Each vertical bar represents the trading range, while small ticks on either side show opening and closing prices.

When the close is higher than the open, it reflects bullish momentum; when it’s lower, bearish momentum. Bar charts are useful for seeing volatility and range strength — key for those studying how to read charts in stock market for active trading.

Candlestick charts are the most popular and powerful visualization for traders. Each “candle” represents one trading session and includes four data points: open, high, low, and close — similar to bar charts but more visual.

When learning how to read candle chart in stock market, focus on body size and wick length — long bodies show strong moves, while long wicks signal market indecision or reversals.

Common patterns include:

Reading charts isn’t just about recognizing shapes — it’s about context. Combine technical indicators with visual patterns to confirm trends and improve accuracy.

Understanding how to integrate these tools is the key to mastering how to read stock market charts and graphs effectively for real-world investing or trading decisions.

Chart patterns reveal market psychology. Shapes like triangles, double tops, and head-and-shoulders indicate trend continuation or reversal. Understanding them helps predict price behavior.

Beginners can start with simple patterns such as trendlines, support and resistance zones, or candlestick formations like hammers and dojis—they are easy to spot and reliable.

Long-term investors can review weekly or daily charts, while active traders may monitor hourly charts for faster signals and short-term trends.

Mastering how to read stock market charts and graphs helps investors spot opportunities, manage risk, and make smarter, data-driven trading decisions.

(Oct 16): The US dollar headed for a third straight daily loss against the euro while edging up versus the yen on Thursday, as concerns over US-China tensions and dovish remarks from Federal Reserve officials continued to weigh on sentiment.

Analysts say political headwinds have weighed on the yen but expect support to come from looming Fed rate cuts, the end of US quantitative tightening, and a potential rise in market volatility, which usually supports safe-haven assets.

US Treasury yields hovered near multi-week lows, with the benchmark 10-year just above 4%, pressuring the dollar as investors also weighed a prolonged US government shutdown.

The Fed’s Beige Book released Thursday offered little support to US rates, pointing to emerging signs of economic weakness, including rising layoffs and reduced spending among middle- and lower-income households. Fed Governor Stephen Miran said on Wednesday cutting rates is now more important.

The dollar index, which measures the greenback against six other currencies, was down 0.05% at 98.63, and was on track for a weekly decline of around 0.3%.

Investors were scrutinising China’s latest expansion of rare earth export controls, a move sharply criticised by senior US officials on Wednesday, who warned that it could disrupt global supply chains.

"The question for financial markets is whether China's proposed export controls on rare earths are merely part of a bargaining ploy to achieve greater concessions from the US," said Chris Turner, global head of markets at ING.

Amid the tit-for-tat action, US President Donald Trump still expects to meet Chinese President Xi Jinping in South Korea this month, US Treasury Secretary Scott Bessent said.

"An extension, rather than a grand bargain that settles all trade issues, is probably the most realistic second-best outcome compared to the alternative of escalation of retaliation," said Joseph Capurso, head of foreign exchange at Commonwealth Bank of Australia.

The Australian dollar was flat at US$0.6511 after data showed unemployment hit a near four-year high in September, adding to the case for interest rate cuts.

The Aussie, often considered a proxy for risk appetite, has been volatile this week due to the trade tension as traditional havens gained.

China's yuan firmed to a two-week high against the US dollar on Thursday after the central bank set its strongest daily midpoint in a year.

The euro touched a one-week high and was up 0.10% at US$1.1656 as traders braced for yet another episode in the French political drama, with Prime Minister Sebastien Lecornu likely to survive two no-confidence votes in parliament.

France's political crisis has barely affected euro zone sovereign bond markets as investors see no room for a selloff in French bonds without snap elections.

However, by shelving pension reform until after 2027, France’s prime minister has managed to defuse a sharp escalation in the crisis, though at the cost of complicating efforts to rein in public finances, analysts said.

The yen briefly firmed to a one-week high of 150.51 per dollar but was up 0.05% at 151.11. Japan's weakened Liberal Democratic Party is set to begin policy talks with the right-leaning Innovation Party on Thursday that could help Sanae Takaichi clinch a prime ministerial vote expected next week.

"Regardless of the outcome of the prime ministerial election, it is highly likely that the market will price in some expansionary fiscal policies," said Shinichiro Kadota, head of Japan forex and rates strategy at Barclays Tokyo.

"We remain long on the US dollar versus the yen given the risk of a further rally but with eyes on an eventual intervention risk or Bank of Japan hike if the move extends."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up