Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key Takeaways: Ethereum spot ETFs see $222 million net inflow. Net inflows boost market cap to $21.8 billion. Increased institutional involvement in cryptocurrencies.

Key Takeaways:

Ethereum spot ETFs attracted $222 million in net inflows on August 7, marking three consecutive days of gains. BlackRock's ETHA led with a $104 million contribution, highlighting increased institutional interest in Ethereum investments.

Ethereum spot ETFs experienced a $222 million net inflow on August 7, 2025, marking a third straight day of positive flows. BlackRock's and Grayscale's funds played a pivotal role, enhancing institutional participation.

BlackRock's ETF ETHA led with a single-day net inflow of $104 million, contributing to a total of $9.59 billion. Grayscale's Ethereum Mini Trust recorded a $34.61 million add, underscoring improved institutional engagement.

The elevated inflow reflects a growing institutional confidence in Ethereum's market potential, indicating sustained interest from traditional asset managers. The impact on Ethereum's liquidity pool appears notable.

The financial impact of these inflows strengthens Ethereum's market position. Institutional investments could tighten the Ethereum supply, affecting Layer 2 protocols, DeFi TVL, and staking pools.

Regulatory impacts are minimal currently, but ongoing institutional interest could prompt future decisions. The inflow underscores a broader trend of Ethereum's growing acceptance within financial markets.

The trajectory aligns with historical precedents, such as Bitcoin ETF launches. The Ethereum ETF inflow could result in long-term market appreciation, drawing attention to related ecosystems like DeFi and Layer 2 solutions.

The sustained ETF interest promises enhanced market liquidity and validation of Ethereum's role in financial markets. The positive trend may influence subsequent funding movements among crypto portfolios.

Wall Street may be worried about President Donald Trump politicizing government economic statistics, but not everyone agrees he was wrong to fire the BLS commissioner. “I probably would have fired the head of the Bureau of Labor Statistics too,” the billionaire hedge fund manager Ray Dalio wrote on X. He did not accuse her of rigging the jobs numbers to make Republicans look bad, as Trump did, but Dalio called the BLS process “obviously obsolete and error-prone.” The private sector, he said, could do the job better.

No, and no. The BLS is constantly modernizing its methods, and private companies cannot replace the BLS or any other US statistical agency.

Private companies are in the business of making a profit, and to do that they need to attract customers. Some customers are more profitable than others. As a result, a company’s data will tend to reflect the needs of its clients — it won’t capture the economy as whole.

That’s the job of government statistical agencies, whose surveys are designed to be representative. In fact, the private sector uses them to create economic statistics from its own data — and when the government uses private-sector data, which it does, it takes pains to put them in the context of the broader economy.

When I was at the US Federal Reserve, I worked with a team of economists and engineers on project using data from Fiserv, the financial services and technology firm. The goal was to transform its data on card transactions into a daily, geographically detailed report on retail sales. We used the spending shares by industry and geography in the Census Bureau’s economic census to reweight the company data and make them representative of the US. Even high-quality economic statistics from private companies need to be augmented by government statistics.

Private company data are not comprehensive. The BLS publishes statistics on employment, productivity and inflation. There is no existing private company with data that covers such a range. ADP, the private company that Dalio referenced, provides monthly estimates of private-sector payrolls in 10 industries. The BLS reports employment figures for more than 100 industries and multiple levels of government, as well as data on hours and wages. Among households, it estimates the unemployment rate, labor participation rate and other statistics with demographic detail.

Private-sector statistics like ADP’s — or Fiserv’s — are a useful complement, and government statistics increasingly use private-sector data. But the private sector cannot match the breadth of the government effort.

To be clear, this is the way it should be: Private companies are not in the business of creating public goods, which is what economic statistics from the government are. They are free to users, transparent in their methods, protective of the privacy of individuals and businesses, and dependable. Most private companies that create statistics charge users for access. (Some share their results publicly as a form of marketing.) Many private companies share only limited information about their methodology to deter competition.

And even when the private sector collects comprehensive and transparent data, there’s no guarantee that it will continue to do so. For many firms that create statistics, the effort is a sidebar to their main business. They could change their priorities or go out of business. Continuity is important in economic statistics, some of which are used in private-sector contracts, as the Consumer Price Index is used to set Social Security benefits.

If it’s not profitable, a private company will just stop producing statistics. Government statistical agencies work in the public interest.

Dalio is right that BLS should continue to innovate. But he is incorrect that it lacks a strategic vision on how to modernize. US statistical agencies have been modernizing their statistics since their founding. Countless researchers at statistical agencies have identified and implemented changes, including on how to use private company data to improve BLS data.

What the agencies need is more funding from the government and closer partnerships with the private sector. Instead, the administration has disbanded an advisory committee designed help make economic statistics timelier and more accurate. And it has proposed to cut the BLS’s budget, which has been flat for years, by 8%.

Instead of firing the commissioner, the president should be giving the agency a raise in the form of a bigger budget. The goal should be to restore public trust in government statistics, not undermine it.

Central European currencies were hanging on to gains from the previous session on Friday amid growing hopes for a breakthrough to end the war in Ukraine, while investors were looking ahead to an interest rate decision in Romania.The Kremlin said on Thursday that Vladimir Putin and Donald Trump will meet in the coming days, raising hopes of a potential peace deal in Ukraine and boosting central European assets.

On Friday, investors were looking ahead to an interest rate decision in Romania scheduled for 1200 GMT. Analysts expect the cost of credit to remain on hold at 6.50%, and the leuwas broadly steady versus the euro at 5.0749."The market will focus on comments regarding fiscal consolidation and the potential impact on inflation," ING said in a note.

Romania's government, which has hiked value-added tax and excise duties as of this month, needs to rein in the European Union's widest budget deficit if it is to keep its investment grade credit rating. But coalition partners are split over potentially unpopular spending cuts."Should the measures prove insufficient, we could see a return of pressure on the RON," ING said.

The Czech crownwas 0.14% firmer at 24.426 after having tightened up by 0.4% in the previous session. On Thursday the Czech National Bank left its main interest rate steady at 3.50% for a second straight meeting, saying inflation pressures did not allow further easing yet."The Czech crown... appreciated further yesterday after the Czech National Bank's (CNB's) fresh hawkish language," Commerzbank said in a note."(Governor Ales) Michl reiterated that all options remain open – but, we do not think that many market participants are anticipating rate hikes. Rather the time frame for unchanged interest rates will be prolonged."

The Hungarian forintfirmed 0.21% to 395.80.

"The Ukrainian-Russian headlines are clearly positive news for Hungary, which remains by far the most reliant on Russian energy imports among Central and Eastern European countries," ING said in a note.Trump has threatened new sanctions from Friday against Russia and countries that buy its exports unless Putin agrees to end the 3-1/2-year conflict.

The Polish zlotywas stable at 4.253.

CEE MARKETS SNAPSHOT AT 1034 CET | |||||

CURRENCIES | Latest trade | Previous close | Daily change | Change in 2025 | |

Czech crown | 24.4260 | 24.4590 | +0.14% | +3.21% | |

Hungary forint | 395.8000 | 396.6500 | +0.21% | +3.95% | |

Polish zloty | 4.2530 | 4.2535 | +0.01% | +0.56% | |

Romanian leu | 5.0749 | 5.0718 | -0.06% | -1.94% | |

Serbian dinar | 117.1200 | 117.1300 | +0.01% | -0.15% | |

Note: daily change calculated from 1800 CET | |||||

STOCKS | Latest | Previous close | Daily change | Change in 2025 | |

Prague | 2282.80 | 2287.3000 | -0.20% | +29.69% | |

Budapest | 103057.56 | 103272.78 | -0.21% | +29.92% | |

Warsaw | 2963.97 | 2985.33 | -0.72% | +35.22% | |

Bucharest | 21046.45 | 20814.90 | +1.11% | +25.87% | |

BONDS | Yield (bid) | Yield change | Spread vs Bund | Daily change in spread | |

Czech Rep 2-year | (CZ2YT=RR) | 3.5310 | -0.0010 | +159bps | -1bps |

Czech Rep 5-year | (CZ5YT=RR) | 3.8680 | 0.0120 | +162bps | +0bps |

Czech Rep 10-year | (CZ10YT=RR) | 4.3380 | 0.0190 | +169bps | +1bps |

Poland 2-year | (PL2YT=RR) | 4.2980 | -0.0370 | +236bps | -5bps |

Poland 5-year | (PL5YT=RR) | 4.8280 | 0.0400 | +258bps | +2bps |

Poland 10-year | (PL10YT=RR) | 5.4380 | 0.0340 | +279bps | +2bps |

FORWARD RATE AGREEMENTS | 3x6 | 6x9 | 9x12 | 3M interbank | |

Czech Rep | (CZKFRA), (PRIBOR=) | 3.57 | 3.57 | 3.55 | 3.50 |

Poland | (PLNFRA), (WIBOR=) | 4.41 | 4.07 | 3.74 | 4.92 |

Note: FRA quotes are for ask prices | |||||

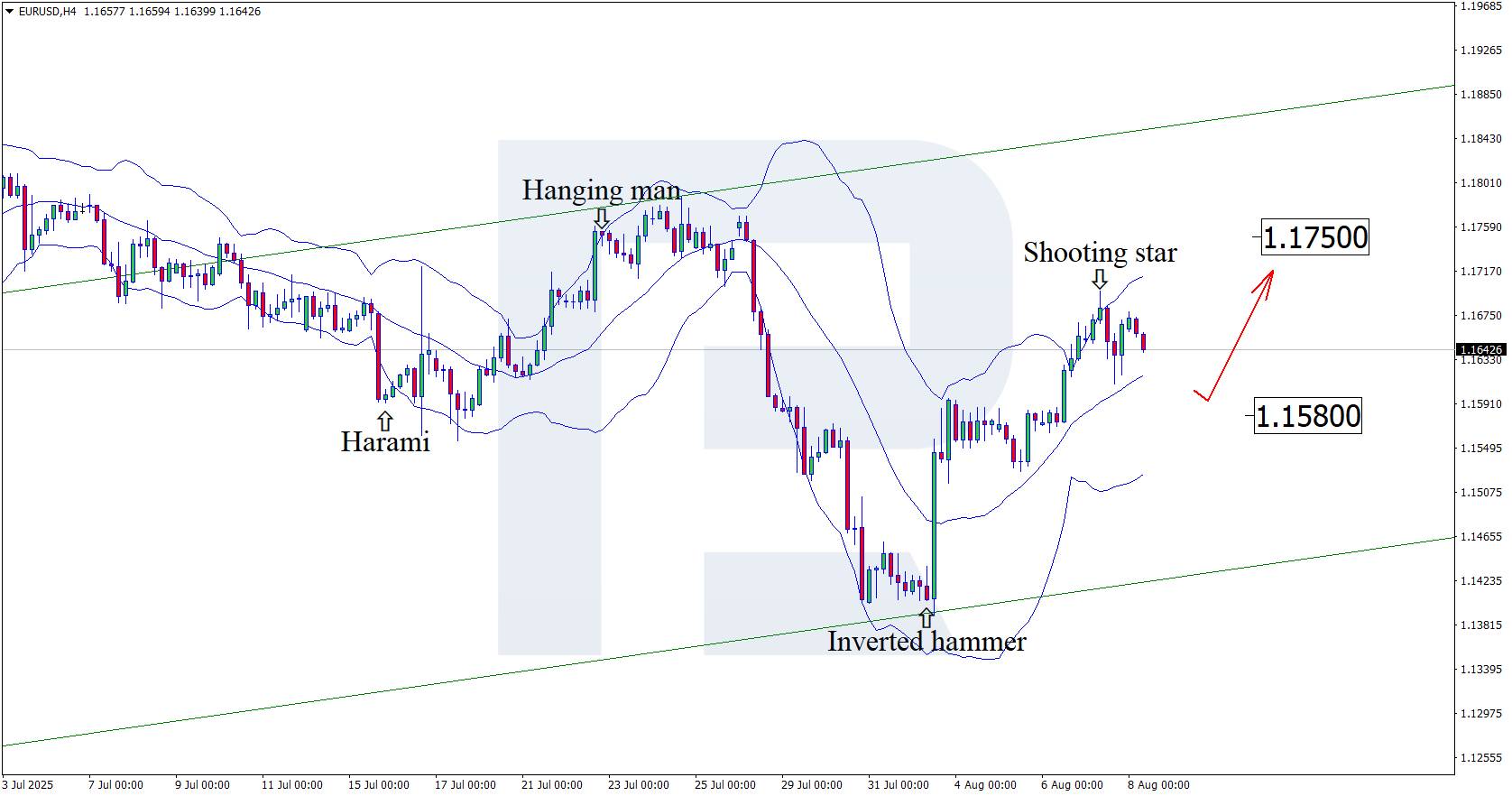

The appointment of Stephen Miran to the FOMC Board and expectations of Federal Reserve monetary policy easing weigh on the USD. Technical analysis of EURUSD suggests a move towards the 1.1750 resistance level after the correction is completed.

The USD continues to lose ground against the euro, and with the ECB’s upcoming decision, the EURUSD rate could soar towards 1.1750.

The EURUSD outlook remains positive for the euro. The market faces uncertainty around the US Federal Reserve. The appointment of Stephen Miran to the FOMC Board surprised many investors. Expectations of Fed monetary policy easing are gradually weakening the US dollar. This news benefits the euro, which continues to strengthen as confidence in the USD wanes.

The ECB shows no rush to ease monetary policy amid some inflation stabilisation, with July’s figure holding steady at 2%, matching previous forecasts.

The central bank maintains a wait-and-see approach regarding interest rate changes, providing significant support to the euro. The next eurozone rate review is scheduled for September, and many economists believe the ECB may keep the rate unchanged, given the current level of inflation risks.

On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair may continue a corrective wave in line with this signal. Considering the recent sharp rise in quotes, a pullback towards the nearest support level at 1.1580 is possible. A rebound from this support would open the way for a continued upward movement.

However, today’s EURUSD forecast does not rule out a rise towards 1.1750 without testing the support level.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up