Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ether led weekly crypto gains, rising 5.7% amid institutional inflows and smart money accumulation. The rally followed optimism around upgrades and market sentiment, as Bitcoin neared but failed to break $100,000.

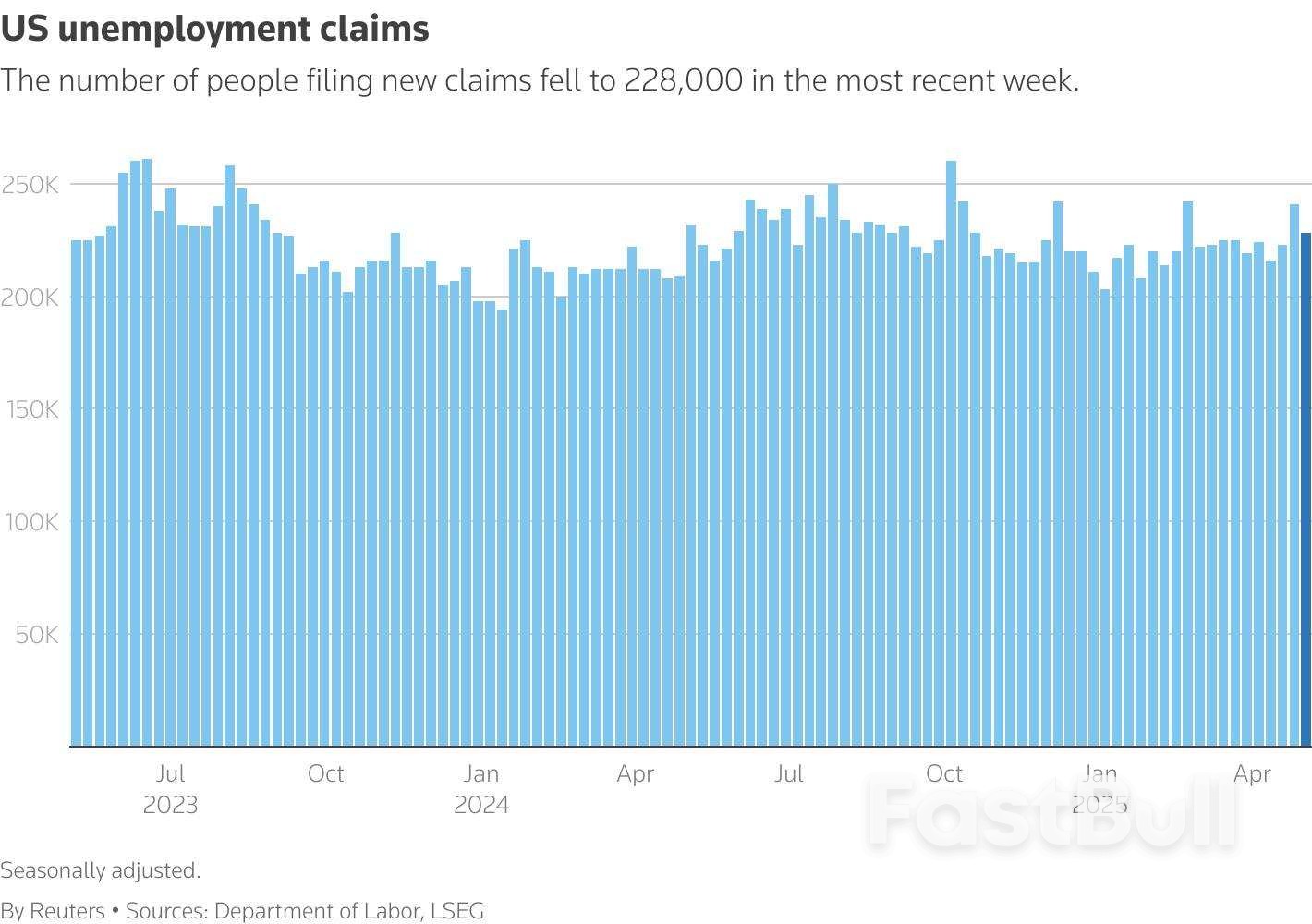

The number of Americans filing new applications for unemployment benefits fell sharply last week as the spring break-related boost from the prior week faded, suggesting the labor market continued to chug along, though risks are mounting from tariffs.

Employers are hoarding workers after difficulties finding labor during and after the COVID-19 pandemic. But that could become tougher to maintain as other data from the Labor Department on Thursday showed worker productivity declining for the first time in nearly three years in the first quarter, boosting labor costs.

The weakness in productivity, if sustained, could pressure margins for businesses at a time when they are facing higher costs from President Donald Trump's sweeping import duties.

"Companies in the face of trade war uncertainty are holding onto their workers for now," said Christopher Rupkey, chief economist at FWDBONDS. "The million-dollar question is, how long can companies tough it out as first-quarter productivity statistics show unit labor costs soared?"

Initial claims for state unemployment benefits dropped 13,000 to a seasonally adjusted 228,000 for the week ended May 3. Economists polled by Reuters had forecast 230,000 claims for the latest week. The decline unwound some of the boost from school spring breaks in New York state, which had lifted claims to a two-month high.

Unadjusted claims for New York tumbled 15,089 last week. They had soared 15,418 in the prior week, attributed to layoffs in the transportation and warehousing, accommodation and food services as well as public administration and educational services industries. There were also significant decreases in claims in Massachusetts and New Jersey.

But filings vaulted 6,906 in Michigan, potentially hinting at layoffs in the automobile industry amid duties on motor vehicles and parts. General Motors (GM.N), opens new tab and Ford Motor (F.N), opens new tab have pulled their annual forecasts. General Motors said it expected a $4-$5 billion tariff hit on profits, while Ford estimated the drag at $1.5 billion.

A separate program for unemployment compensation for federal employees (UCFE), which is reported with a one-week lag, still showed little impact of the mass firings of public workers, part of the Trump administration's unprecedented campaign to drastically shrink the federal government.

Many workers have taken severance packages, which will run out in September, while others have been put on paid leave after courts ordered their reinstatement.

Trump's tariffs, including hiking duties on Chinese imports to 145%, have soured business and consumer sentiment, heightening economic uncertainty. Trump sees the tariffs as a tool to raise revenue to offset his promised tax cuts and to revive a long-declining U.S. industrial base.

Economists say it is only a matter of time before the weakness in business and consumer surveys spills over to so-called hard data like claims, inflation and employment reports.

The Federal Reserve on Wednesday kept its benchmark overnight interest rate in the 4.25%-4.50% range, with policymakers at the U.S. central bank noting that "the risks of higher unemployment and higher inflation have risen."

Fed Chair Jerome Powell told reporters "the tariff increases announced so far have been significantly larger than anticipated," adding "if sustained, they're likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment."

The dollar rose against a basket of currencies. U.S. stocks opened higher.

A column chart titled "US unemployment claims" that tracks the metric over a recent period.

Worker hoarding accounts for most of the labor market's resilience. Some companies more exposed to the trade tensions have started laying off workers, though on a small scale.

An Institute for Supply Management survey last week showed manufacturing employment remained depressed in April, noting that "layoffs were the primary tools used, an indication that head-count reduction is becoming more urgent."

Rising economic uncertainty has added to companies' hesitancy to hire more workers, leaving those who lose their jobs experiencing long bouts of unemployment.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, decreased 29,000 to a seasonally adjusted 1.879 million during the week ending April 26, the claims report showed.

The unemployment rate was unchanged at 4.2% in April, but the median duration of joblessness jumped to 10.4 weeks from 9.8 weeks in March. The economy added 177,000 jobs in April.

In a separate report, the Labor Department's Bureau of Labor Statistics said nonfarm productivity, which measures hourly output per worker, fell at a 0.8% annualized rate in the first quarter. That was the first decline since the second quarter of 2022 and followed a 1.7% growth pace in the October-December quarter. Productivity grew at a 1.4% rate from a year ago.

The quarterly drop in productivity was flagged by the government's advance gross domestic product report for the first quarter published last week, which showed the economy contracting at a 0.3% rate, the first decline in three years.

The economy was swamped by a flood of imports as businesses rushed to bring in goods before tariffs kicked in.

Unit labor costs - the price of labor per single unit of output - jumped at a 5.7% rate in the first quarter after rising at a 2.0% rate in the October-December period. Labor costs increased at a 1.3% rate from a year ago.

"The drop in worker productivity likely increases caution from firms to invest or expand operations this year, especially given the elevated uncertainty surrounding tariffs and supply chains," said Ben Ayers, senior economist at Nationwide.

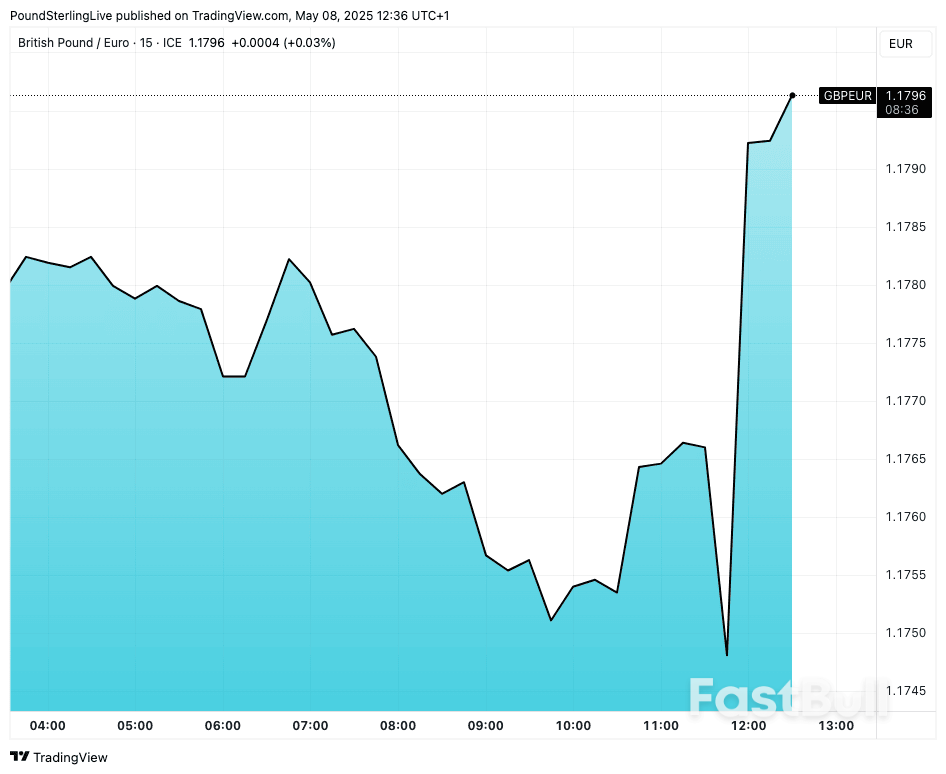

While commenting to reporters after signing the first (of many) trade deal with the UK, President Trump told Americans that they "better go buy stocks now."

And they did...

This comment followed his now ubiquitous shot across The Fed's bow:

*TRUMP: FED'S POWELL IS ALWAYS LATE

*TRUMP: EVERYONE IS CUTTING BUT THE FED

*TRUMP: IF POWELL WOULD LOWER RATES, IT WOULD BE LIKE JET FUEL

*TRUMP: US DOING WELL EVEN WITHOUT FED CUT

The market has now erased all of the post-Livberation Day losses.

U.S. wholesale inventories increased slightly less than initially estimated in March amid decreases in the stocks of electrical, lumber, apparel and farm products.

Stocks at wholesalers rose 0.4%, revised down from the 0.5% gain estimated last month, the Commerce Department's Census Bureau said on Thursday. Economists polled by Reuters had expected the rise in inventories would be unrevised.

Inventories, a key part of gross domestic product, advanced 0.5% in February. They rose 2.2% on a year-on-year basis in March. Businesses front-loaded imports in the first quarter, seeking to avoid President Donald Trump's sweeping duties on foreign goods, resulting in a large trade deficit.

Most of the imports ended up as inventory.

The government's advance gross domestic product estimate for first quarter published last week estimated that business inventories increased at a $140.1 billion annualized rate after rising at only a $8.9 billion pace in the October-December quarter. Inventories added 2.25 percentage points to GDP, the most since the fourth quarter of 2021.

That was, however, insufficient to offset the drag from the trade gap. Trade sliced off a record 4.83 percentage points from GDP, resulting in the economy contracting at a 0.3% rate, the first decline in three years. The economy grew at a 2.4% pace in the fourth quarter.

Sales at wholesalers increased 0.6% in March after rising 2.0% in February. At March's sales pace it would take wholesalers 1.30 months to clear shelves, unchanged from in February.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up