Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks BOC Monetary Policy Report

BOC Monetary Policy Report U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

AllUnity, a joint venture involving DWS, has received regulatory approval from Germany’s BaFin to issue a euro-denominated stablecoin, marking a milestone for regulated digital assets in Europe....

July has historically been a bullish month for GBP/USD going back to the Bretton Woods Agreement in 1971 - will it hold this month?

July Forex Seasonality Key Points

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market.

As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy. In other words, past performance is not necessarily indicative of future results.

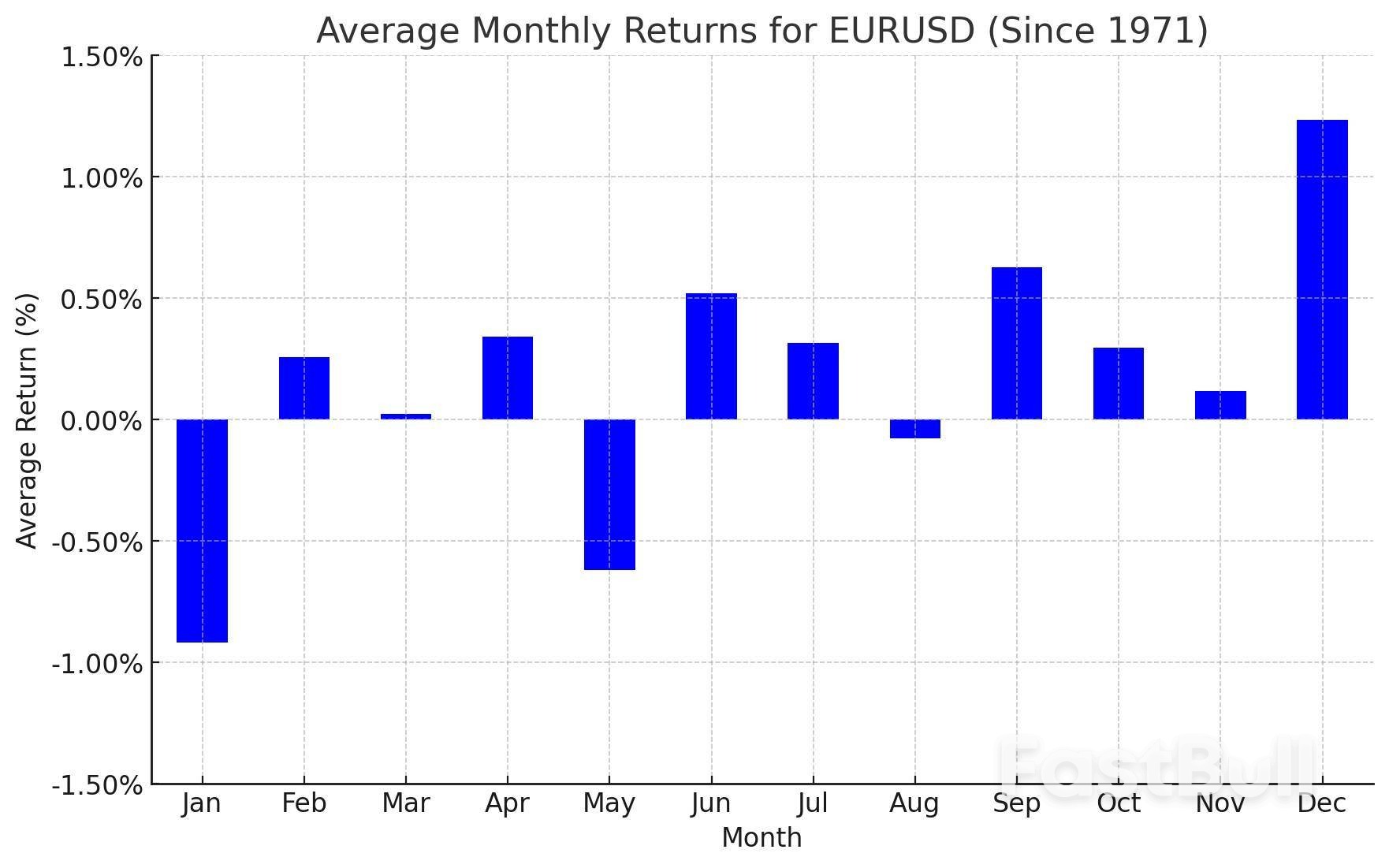

Euro Forex Seasonality – EUR/USD Chart

Historically, July has been a modestly bullish month for EUR/USD, with the world’s most widely-traded currency pair sporting an average return of +0.32% over the last 50+ years. In June, EUR/USD followed its bullish seasonal trend, surging nearly 4% to reach its highest level in over 3.5 years.

While the momentum and seasonal tendency point to the potential for continued gains in July, it’s worth noting that the pair is very stretched relative to its medium- and long-term moving averages, suggesting that a near-term dip in the first half of the month may be more likely than usual.

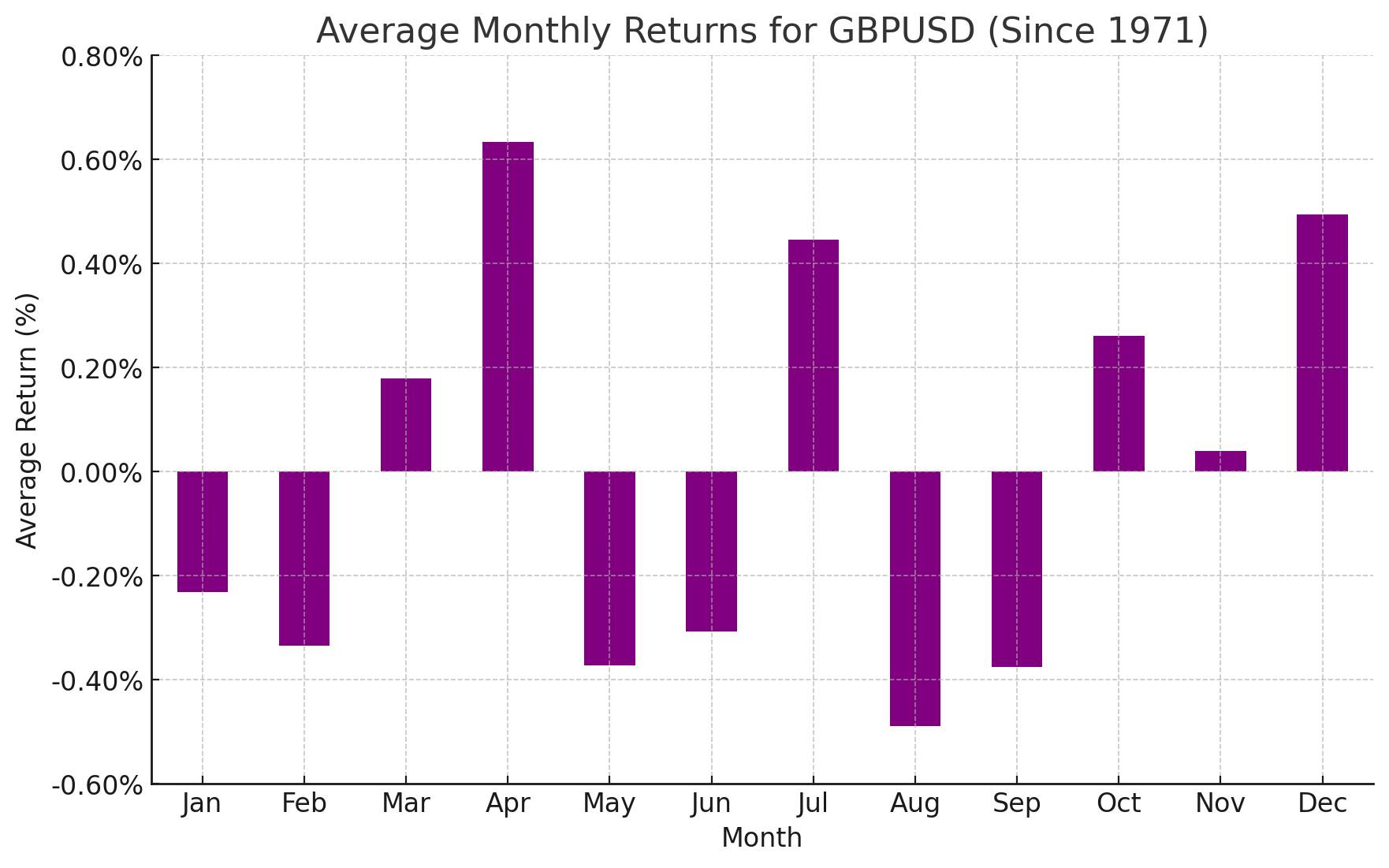

British Pound Forex Seasonality – GBP/USD Chart

Looking at the above chart, GBP/USD has historically seen strength in July, with average returns of around +0.45% since 1971. Like the euro, the British pound traded higher in June to reach multi-month highs amidst broad-based US dollar weakness. After a run of five straight “up” months, it may be more difficult for bulls to build on this year’s gains through the summer without a near-term pullback or consolidation first.

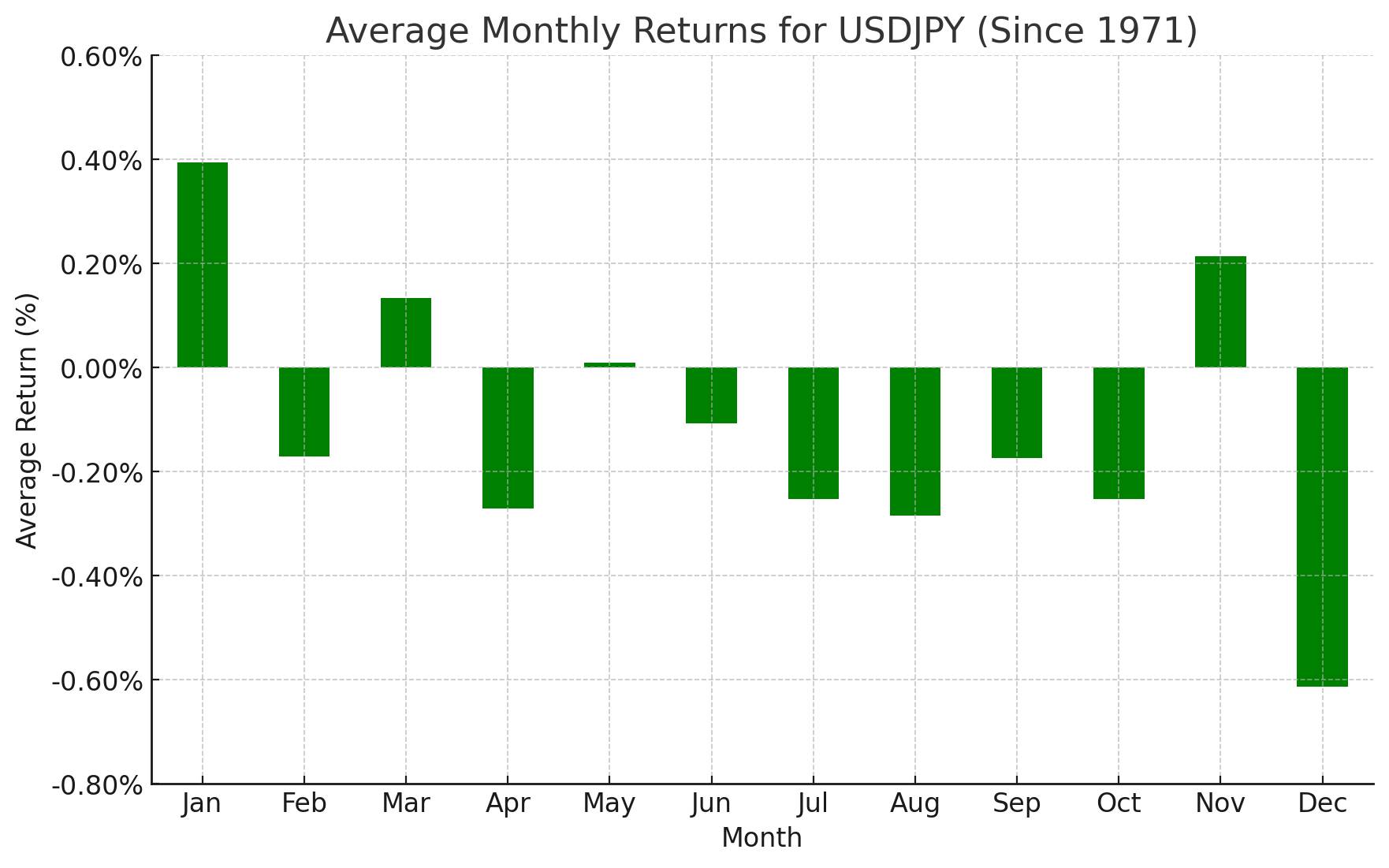

Japanese Yen Forex Seasonality – USD/JPY Chart

July has historically been a modestly bearish month for USD/JPY, with the pair falling by an average of -0.25% since the Bretton Woods agreement. In line with its long-term seasonal trend, USD/JPY saw relatively quiet trade in June amidst a lack of clear progress in trade negotiations between the US and Japan. Traders will be watching the 2-year lows at 1.3950 for a potential breakdown if the seasonal trend asserts itself again this month.

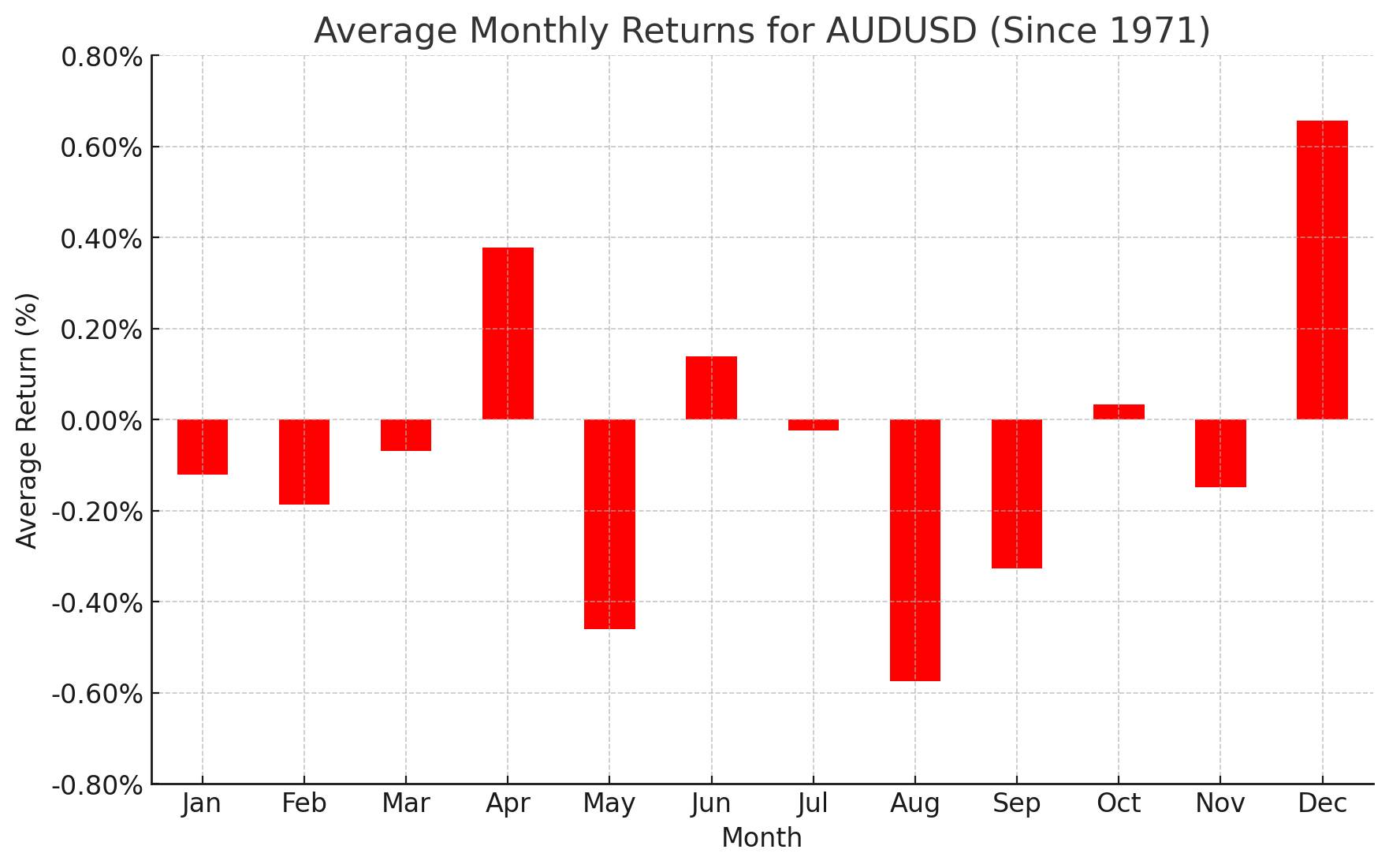

Australian Dollar Forex Seasonality – AUD/USD Chart

Turning our attention Down Under, AUD/USD has historically seen quiet price action in July, with an average move of -0.2% going back to 1971. Last month, AUD/USD rallied more than 2%, following its bullish seasonal trend to break above the 61.8% Fibonacci retracement of the September 2024 to April 2025 drop at 0.6550. Following four straight positive months, a consolidation in line with the seasonal trend this month would not be surprising.

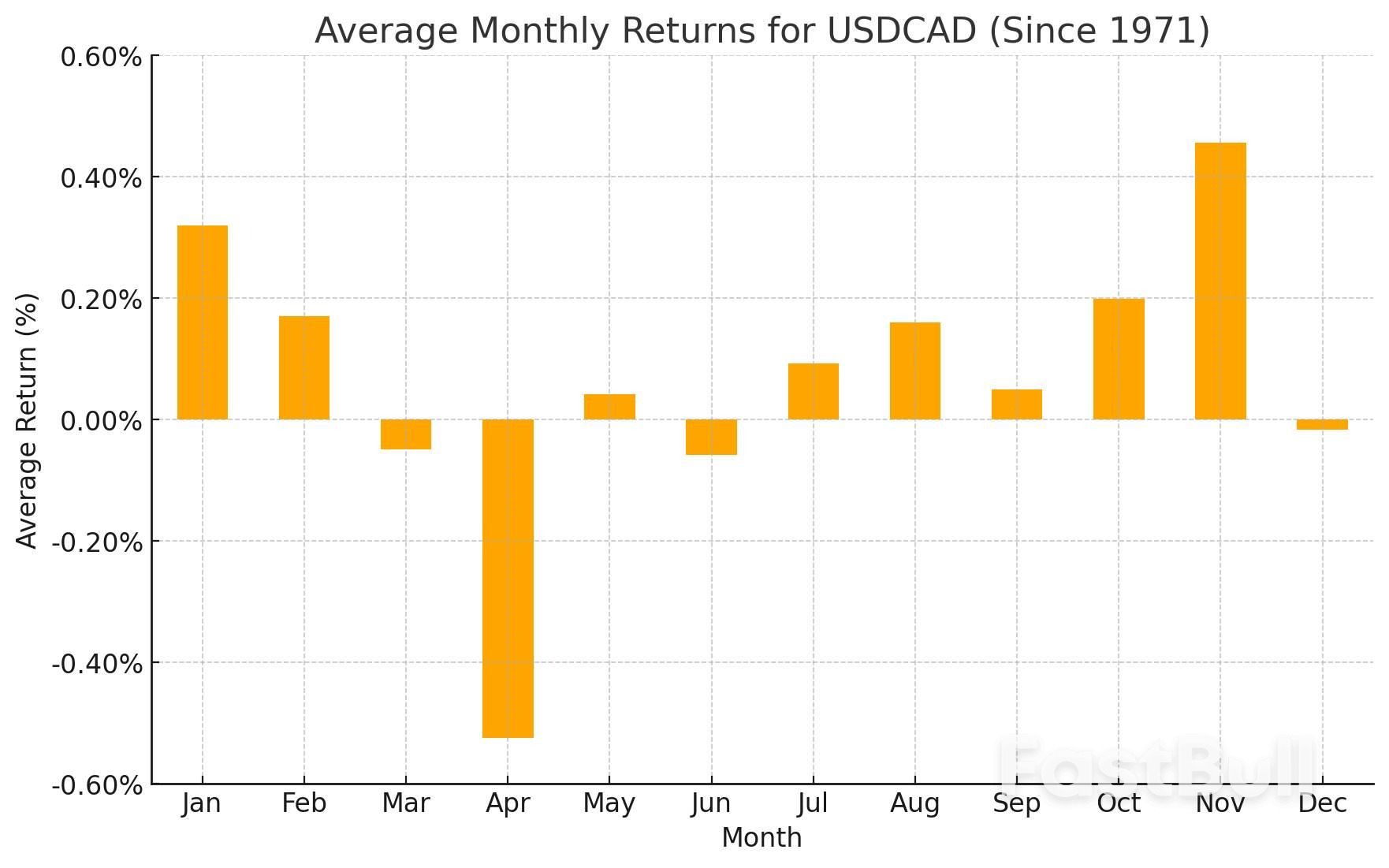

Canadian Dollar Forex Seasonality – USD/CAD Chart

Last but not least, July has been a modestly positive month for USD/CAD, with an average historical return of +0.09%. The US dollar fell against its Northern rival last month, and bulls are starting to warily eye the 1.5-year low at 1.3425 as a key support level that needs to hold to keep any semblance of optimism intact.

As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year–so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

The US Senate yesterday narrowly approved Trump’s so-called “big, beautiful budget bill.”

Elon Musk, who had previously criticised the bill for potentially adding $3.3 trillion to the national debt, warned that Republican lawmakers who supported it would face political consequences. In a post on X, Musk wrote:“Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame! And they will lose their primary next year if it is the last thing I do on this Earth.”

He also reiterated his intention to establish a third political force under the name “America Party.”

In response, President Trump issued sharp threats:

→ to apply federal pressure on Musk’s companies by revisiting existing subsidies and government contracts (estimated by The Washington Post at $38 billion);

→ to deport Musk back to South Africa.

The market responded immediately to this renewed escalation in the Trump–Musk conflict. Tesla (TSLA) shares fell by over 5% yesterday, forming a significant bearish gap.

Eight days ago, we analysed the TSLA price chart, continuing to observe price action within the context of an ascending channel (indicated in blue). At that point:

→ In mid-June, when the initial Musk–Trump tensions surfaced, TSLA managed to hold within the channel. However, as of yesterday, the price broke below the lower boundary, casting doubt on the sustainability of the uptrend that had been in place since March–April;

→ The price breached the lower channel limit near the $315 level — a zone that previously acted as support. This suggests that $315 may now serve as a resistance level.

As a result, optimism related to the late-June launch of Tesla’s robotaxi initiative has been eclipsed by concerns that the Musk–Trump confrontation may have broader implications.

If the former allies refrain from further escalation, TSLA may consolidate into a broadening contracting triangle (its upper boundary marked in red) in the near term, ahead of Tesla’s Q2 earnings release scheduled for 29 July.

US President Donald Trump threatened Japan with tariffs of up to 35% as he ramped up tensions for a third straight day, fueling fears of a worst-case scenario among market players and raising doubts over Tokyo’s tactics in trade talks.

Japan should be forced to “pay 30%, 35% or whatever the number is that we determine, because we also have a very big trade deficit with Japan,” Trump said, again flagging the possibility that across-the-board tariffs could go much higher than the 24% initially penciled in for July 9. “I’m not sure we’re going to make a deal. I doubt it with Japan, they’re very tough. You have to understand, they’re very spoiled.”

Market participants and analysts warned against taking Trump’s comments at face value and suggested that some kind of deal will eventually get done. But they also warned that Prime Minister Shigeru Ishiba’s government may need to change tack from a friendly and firm stance that is now leading the two sides to brinkmanship.

“The ball is in Japan’s court now, and if Tokyo hesitates, it’s all over,” said Chihiro Ota, senior strategist at SMBC Nikko Securities. “If Japan doesn’t properly respond to Trump’s call to the table, he’ll only get more hostile. Ishiba should get on the phone with him right away.”

Trump’s latest threat fits in with a high-pressure deal-making strategy that sometimes results in big last-minute concessions on both sides, as seen with China, but market players still need to game out how to position themselves should talks founder.

While few analysts see Japan’s stocks collapsing on a no-deal scenario, some of them forecast the Nikkei 225 to fall into the 38,000 range, a decline of more than 4%, rather than rallying above 40,000 if there’s an agreement.

The Nikkei 225 was down 1% at 39,593 at the end of the morning session Wednesday while the yen was trading at 143.57 against the dollar, up around 0.1%.

Japan has so far stood firm in negotiations over across-the-board reciprocal tariffs, insisting that they be removed along with additional sectoral tariffs on autos, steel and aluminum. The car duties are particularly painful for Japan as the industry contributes the equivalent of almost 10% of gross domestic product and employs around 8% of the workforce.

Tokyo has insisted that a “win-win” deal must encompass all the tariffs in one go with Ishiba preferring no deal to a bad deal ahead of a July 20 upper house election. The prime minister on Wednesday reiterated his view that focusing on jobs and investment in the US was the way forward, just like it was for Nippon Steel as it patiently sought to change Trump’s view and take over US Steel.

But as July 9 gets closer, some observers say more needs to be done.

“We have to work on Trump himself, to first try to avoid the tariffs to be imposed from July 9,” said Ichiro Fujisaki, former Japanese ambassador to the US, adding that the president’s remarks show that Tokyo hasn’t brought enough to the table yet.

“We don’t have something like rare earths but the US is dependent on Japanese industry as well. About half of materials for making semiconductors come from Japanese industry,” Fujisaki said, pointing to a possible area of leverage, too.

In the meantime, market players are evaluating the potential scale of the fallout.

“There is a lot more risk of things falling apart than is being priced in by the market,” said Zuhair Khan, a fund manager at UBP Investments. “There is always the risk of a policy blunder by either side.”

He points to the 32,000 Nikkei level on the day Trump first announced the reciprocal tariffs. “If the probability of a no deal is 25% then the Nikkei should be at 38,000.”

The point of imposing a deadline in negotiations is to create an opportunity for leverage, so it’s not surprising to see Trump pushing high tariffs as a threat to push for better deals as the date approaches, said Phillip Wool, head of portfolio management at Rayliant Global Advisors Ltd.

“There’s also an element of political theater here, as Trump’s narrative to American voters is that the US has been bullied on trade for so long, and there’s clearly a desire to look ‘tough’ on trade,” Wool said. “But there has to be a face-saving deal at some point so that it looks like the negotiation was truly a success as opposed to the mutually assured destruction of impasse and perpetually high tariffs.”

Like some other market players, he is wary of an overly pessimistic knee-jerk response to each remark Trump makes. If there is a big selloff in a worst-case scenario, Wool sees it as a great buying opportunity for long-term, active investors.

Strategists are split on how a bad scenario might play out for the yen. While some such as SBI Liquidity Market Co.’s Marito Ueda see the possibility of risk aversion sparking a strengthening of Japan’s currency to the 138 range against the dollar, others see a weakening as more likely.

A stalemate in trade talks would likely delay the Bank of Japan’s next interest rate hike, especially if it led to tariffs of up to 35% in the meantime, said Akira Moroga, chief market strategist at Aozora Bank. Still, movement would slow after the 145 mark, making a push past 147 difficult, he said.

Still, the consensus is that a deal will be reached sooner or later, and that Japan will have to concede more ground to achieve it.

“If it’s concluded I don’t think it’s going to be a win-win situation,” said Fujisaki. “Maybe a capital-letter ‘WIN’ for US, but a small letter ‘win’ for Japan.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up