Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US Dollar weakened amid tariff appeal uncertainty and global risk aversion. Technical charts show pressure below key levels, with support near 98.50 and resistance above 100, as markets await major economic events.

Dollar Index Monthly Chart, June 2, 2025.

Dollar Index Monthly Chart, June 2, 2025. Dollar Index Weekly Chart, June 2, 2025.

Dollar Index Weekly Chart, June 2, 2025. Dollar Index Daily Chart, June 2, 2025.

Dollar Index Daily Chart, June 2, 2025.Russia and Ukraine said they had agreed at peace talks on Monday to exchange more prisoners of war and return the bodies of 12,000 dead soldiers.

The warring sides met for barely an hour in the Turkish city of Istanbul, for only the second such round of negotiations since March 2022.

Turkish President Tayyip Erdogan described it as a great meeting and said he hoped to bring together Russia's Vladimir Putin and Ukraine's Volodymyr Zelenskiy for a meeting in Turkey with U.S. President Donald Trump.

But there was no breakthrough on a proposed ceasefire that Ukraine, its European allies and Washington have all urged Russia to accept.

Moscow says it seeks a long-term settlement, not a pause in the war; Kyiv says Putin is not interested in peace.

Kremlin aide Vladimir Medinsky said Russian negotiators had handed their Ukrainian counterparts a detailed memorandum outlining Moscow's terms for a full ceasefire.

Medinsky, who heads the Russian team, said Moscow had also suggested a "specific ceasefire of two to three days in certain sections of the front" so that the bodies of dead soldiers could be collected.

Each side said it would hand over the bodies of 6,000 dead soldiers to the other.

In addition, they said they would conduct a further big swap of prisoners of war, after 1,000 captives on each side were traded following a first round of talks in Istanbul on May 15.

Ukrainian Defence Minister Rustem Umerov, who headed Kyiv's delegation, said the new exchange would focus on those severely injured in the war and on young people.

Umerov also said that Moscow had handed a draft peace accord to Ukraine and that Kyiv - which has drawn up its own version - would review the Russian document.

Ukraine has proposed holding more talks before the end of June, but believes that only a meeting between Zelenskiy and Putin can resolve the many issues of contention, Umerov said.

Zelenskiy's chief of staff, Andriy Yermak, said Kyiv's delegation had requested the return of a list of children who it said had been deported to Russia.

Moscow says such children were moved in order to protect them from fighting. Medinsky said there were 339 names on Ukraine's list but that the children had been "saved", not stolen.

Ukraine had a day earlier launched one of its most ambitious attacks of the war, using drones to target Russian nuclear-capable long-range bomber planes in Siberia and elsewhere.

Angry war bloggers urged Moscow to retaliate strongly.

While both countries, for different reasons, are keen to keep Trump engaged in the peace process, expectations of a breakthrough on Monday had been low.

Ukraine regards Russia's approach to date as an attempt to force it to capitulate - something Kyiv says it will never do - while Moscow, which advanced on the battlefield in May at its fastest rate in six months, says Kyiv should submit to peace on Russian terms or face losing more territory.

Putin set out his opening terms for an immediate end to the war last June: Ukraine must drop its ambitions to join the Western NATO alliance and withdraw its troops from the entirety of the four Ukrainian regions claimed and largely controlled by Russia.

According to a proposed roadmap drawn up by Ukraine, a copy of which was seen by Reuters, Kyiv wants no restrictions on its military strength after any peace deal, no international recognition of Russian sovereignty over parts of Ukraine taken by Moscow's forces, and reparations.

Russia currently controls just under one fifth of Ukraine, or about 113,100 sq km, about the area of the U.S. state of Ohio.

Putin sent his army into Ukraine on February 24, 2022, after eight years of fighting in eastern Ukraine between Russian-backed separatists and Ukrainian forces.

The United States, which under Trump's predecessor Joe Biden was Ukraine's main source of advanced weaponry in the war, says over 1.2 million people have been killed and injured in the conflict since 2022.

Trump has called Putin "crazy" and berated Zelenskiy in public in the Oval Office, but the U.S. president has also said he thinks peace is achievable and that if Putin delays, the U.S. could impose tough sanctions on Russia.

S&P 500 1-hour chart. Source: Cointelegraph/TradingView

S&P 500 1-hour chart. Source: Cointelegraph/TradingView

Federal Reserve Bank of Dallas President Lorie Logan said the US central bank can remain patient as it assesses risks to both inflation and unemployment.

“We’re seeing risks on both sides of our dual mandate that appear fairly balanced,” Logan said Monday during a banking conference hosted by the Dallas Fed. “That leaves us well positioned to wait for the data, to be patient and, if we get significant information that really changes the outlook on the balance of risks, we’ll be prepared to respond.”

Fed officials have said it could take months to gain clarity on the economic impacts of sweeping policy changes, particularly around trade. Investors widely expect policymakers to keep borrowing costs unchanged when they meet June 17-18 in Washington. Many economists have pushed their calls for rate cuts further into the second half of the year.

Logan repeated her view, shared by many of her colleagues, that it’s crucial to make sure tariff-driven price increases don’t feed a more persistent rise in inflation. Some survey-based measures of long-run inflation expectations have risen but most officials still view expectations as well anchored.

The Dallas Fed chief added that policymakers ought to closely monitors both survey and market-based gauges. Market-based measures have been stable but can, she said, be distorted by liquidity issues.

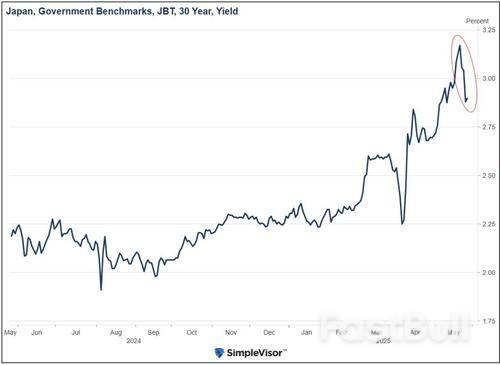

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets.

To wit, consider the following statement from Jim Bianco on Thoughtful Money:

“If these deficits are really going to kick in and cause problems, these rates are going to go much higher than this.”

The bond market paradigm shift we observe is that some people believe the governments and central banks of the largest nations are no longer managing interest rates.

For those who believe in this paradigm shift, we ask a simple question: Why Would They Stop Now?

The governments and central banks of developed countries have long-standing policies that keep high levels of public and private debt serviceable.

Moreover, these same policies aim to incentivize further debt accumulation.

The bearish voices in the bond market, claiming a paradigm shift is underway, show a disregard for history.

Bond bulls and bears can all agree that global fiscal debt trends are not sustainable.

However, do you think the governments are now willing to pay the price for such malfeasance?

Two years ago, the Japanese government uncapped its interest rates, and not surprisingly, they have surged higher.

However, with their 30-year bond approaching 3%, they announced that they are considering adjusting their debt issuance patterns. As shown below, its 30-year bond fell 35 basis points after the announcement.

Bond yields in the US and around the world fell in sympathy.

Governments around the world will preserve their debt-driven financial systems and economies by keeping a lid on interest rates.

Again, ponder the one simple question if you believe in the paradigm shift: why would the governments and central banks stop manipulating the bond market now?

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up