Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

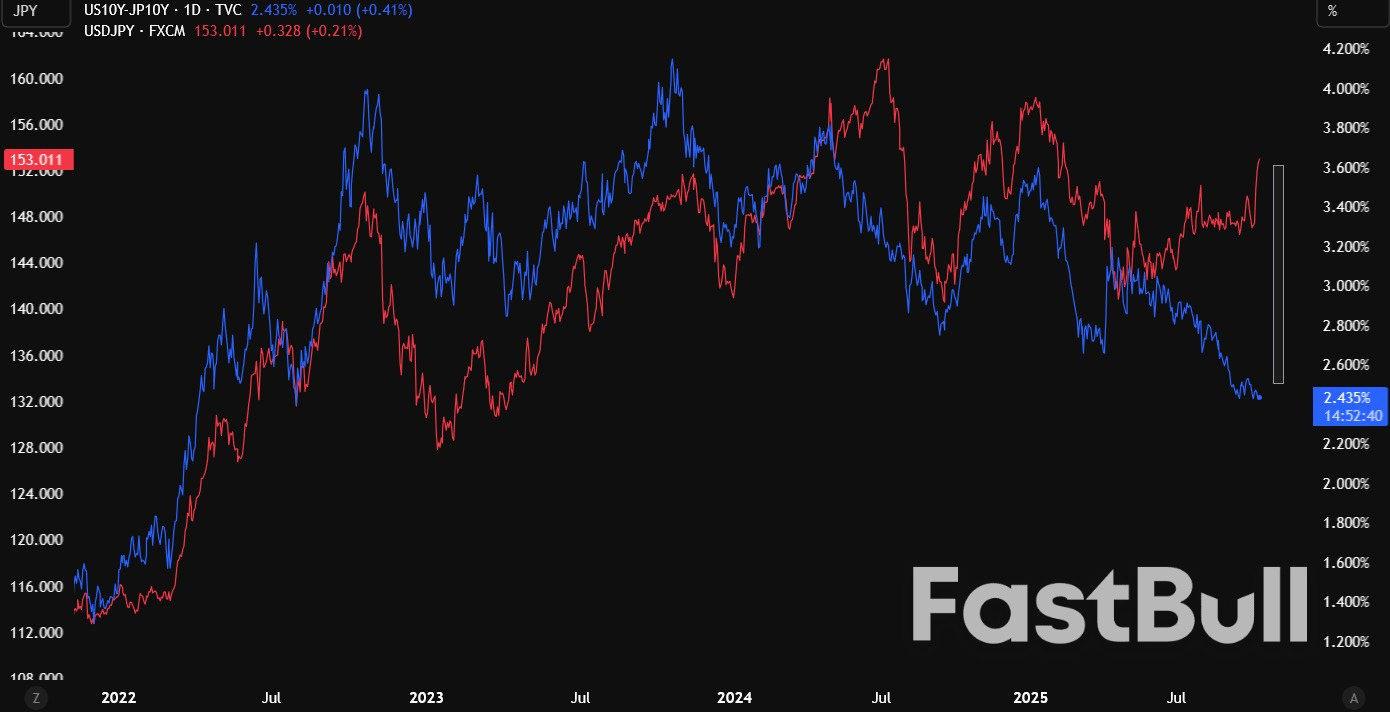

Yen stabilizes as traders reassess Takaichi's fiscal policies; Euro pressured by French political uncertainty and budget challenges; Fed's more hawkish tone influences dollar amid rate cut expectations.

The dollar was mixed on Thursday as a selloff in the Japanese yen appeared exhausted for now, while the euro was dented by political uncertainty.

The yen reached its weakest level since mid-February against the greenback on concerns that Sanae Takaichi, the newly elected head of Japan's ruling party, will introduce more fiscally expansive policies.

But the yen got a modest bid on Thursday as traders evaluated how much room she will have to stimulate the economy.

“Traders are turning a little bit more sceptical on the Takaichi administration's capacity for passing fiscal stimulus and pushing back against the Bank of Japan's tightening plans,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

“That's a reflection of underlying inflation dynamics in Japan. The reality is that Japanese households are agitating for change because inflation is running at elevated levels,” Schamotta said.

Takaichi said on Thursday she will immediately issue an order to compile a package of steps to cushion the economic impact of rising living costs once chosen by parliament to become next prime minister.

The dollar was last flat on the day at 152.67 yenafter earlier reaching 153.21, the highest since February 13.

The euro, meanwhile, has dropped since Prime Minister Sebastien Lecornu tendered his and his government's resignation on Monday. The political paralysis has made it challenging to pass a belt-tightening budget sought by investors that are increasingly worried by France's expanding deficit.

French President Emmanuel Macron’s office said on Wednesday he would appoint a new prime minister within 48 hours.

The single currency was last down 0.15% at $1.1608. The dollar index gained 0.15% to 99.00 and reached 99.10, the highest since August 1.

The dollar is being aided by some more hawkish commentary by Federal Reserve officials.

Minutes from the U.S. central bank’s September meeting released on Wednesday showed that officials agreed that risks to the U.S. job market had increased enough to warrant an interest rate cut but remained wary of high inflation.

“We are seeing a more hawkish tone from Fed policymakers, both in the minutes from September's meeting as well as ongoing commentary. And that's pushing back on market expectations for further aggressive easing,” said Schamotta.

Traders are pricing in a 95% chance that the Fed cuts rates by 25 basis points at its October 28-29 meeting, while the odds of an additional cut in December have dropped to 82%, from 90%, in the past week, according to the CME Group’s FedWatch Tool.

New York Fed President John Williams backs more interest rate cuts this year given the risk of a further slowdown in the labor market, he said in an interview published by the New York Times on Thursday.

Traders are also focused on how long the U.S. federal government shutdown will last, with the economy likely to take a bigger hit the longer it drags on.

The U.S. Internal Revenue Service said on Wednesday it will furlough more than 34,000 employees due to the government shutdown, effectively shuttering taxpayer call centers.

In cryptocurrencies, bitcoingained 0.44% to $123,478.87.

Gold prices held above $4,000 an ounce on Thursday as investors assessed the Israel-Hamas ceasefire deal, while broader geopolitical and economic uncertainty alongside expectations for U.S. rate cuts sustained bullish sentiment towards the metal.

Silver hit a record high, bolstered by gold's record-breaking rally, growing investor demand and a supply deficit.Spot gold was steady at $4,038.49 per ounce at 1132 GMT. U.S. gold futures for December delivery fell 0.3% to $4,057.80.Gold prices rose above $4,000 per ounce for the first time on Wednesday, hitting a record high of $4,059.05.

Silver was up 1.5% at $49.63 per ounce. The metal has gained over 70% this year, benefiting from the same factors as those driving gold's rally as well as tightness in the spot market.

"The interesting aspect about the silver market is that the net long positions are only modestly higher so this is not a rally based upon speculative interest. It's got some pretty solid fundamentals attached to this move in the silver price," said independent analyst Ross Norman.U.S. President Donald Trump announced that a ceasefire and hostage deal had been reached between Israel and Hamas under the first phase of his plan to end the war in Gaza.

"Gold's rally is facing resistance as the Gaza diplomatic breakthrough reduces risk-off flows, while the ongoing U.S. dollar recovery undermines bullion's strength, leaving it vulnerable to pullbacks," said Nikos Tzabouras, Senior Market Analyst at Tradu."However, the bullish bias remains intact, and the path to new all-time highs is still wide open."

The U.S. dollar index (.DXY), opens new tab hovered near a two-month high, making dollar-priced bullion more expensive for overseas buyers.

Geopolitical risks, including the Middle East crisis and the war in Ukraine, alongside strong central bank gold buying, ETF inflows, U.S. rate cut expectations, and economic uncertainties stemming from tariffs, have all contributed to gold's rally.

The metal has gained more than 53% year-to-date and is on track to record the largest annual gain since the 1979 oil crisis.

Federal Reserve officials agreed that risks to the U.S. job market were high enough to warrant a rate cut, but remained wary amid stubborn inflation, according to minutes of the September 16–17 meeting released on Wednesday.

"The ongoing U.S. government shutdown has injected momentum into (gold's) trade, alongside mounting fiscal concerns in Japan and France amid recent political leadership changes," UBS said in a note.

Non-yielding gold thrives in a low interest-rate environment and during times of economic and geopolitical uncertainty.

"If risk sentiment continues to improve, this may drag gold prices lower in the near term as investors rush back toward riskier assets," said Lukman Otunuga, senior research analyst at FXTM.

Platinum edged 0.1% higher to $1,663.71 and palladium gained 1.9% to $1,476.76, hitting a more than two-year high.

Key points:

North Korean leader Kim Jong Un has praised the legacy of the ruling party and called for renewed loyalty to socialism in a speech ahead of Friday's 80th anniversary of the founding of the Workers' Party of Korea, state media KCNA reported.Chinese Premier Li Qiang, a delegation from Russia's ruling party led by chairman Dmitry Medvedev as well as Vietnam's Communist Party chief To Lam, are among foreign dignitaries due to attend celebrations in the isolated state this week.

Vietnam's government confirmed Lam and his delegation had departed for Pyongyang on Thursday for the first visit by a Vietnamese Communist Party leader to North Korea in nearly 20 years. Cooperation agreements were expected to be signed during the visit, according to people familiar with the planning.Kim visited the Party Founding Museum in Pyongyang on Wednesday with senior party officials and delivered what state media called a "significant speech" honouring the party's founders and revolutionary forerunners, KCNA said.

The North Korean leader paid tribute to his late grandfather and state founder Kim Il Sung and anti-Japanese fighters for laying a "solid cornerstone" for the party's enduring strength and success, the report said.Reflecting on eight decades of party history, Kim said it was a time for the current generation to renew its understanding of its "revolutionary obligations and duties" to complete the socialist cause begun by its predecessors.Kim also pledged to preserve the party's ideological purity and vitality "without decrepitude and discolouration," calling the Party Founding Museum a "sacred sanctuary" representing the party's tradition.

Last month, the North Korean leader stood side by side with Chinese President Xi Jinping and Russian President Vladimir Putin at a massive military parade in Beijing to celebrate the 80th anniversary since Japan's defeat at the end of World War Two, a move aimed at bolstering Kim's diplomatic standing.Nuclear-armed North Korea has not yet confirmed whether a military parade will take place to mark this week's holiday.South Korean officials said there were signs that Pyongyang will stage a military parade to commemorate the founding of the Workers' Party of Korea, the Yonhap news agency reported last week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up