Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Transport operator ComfortDelGro on Nov 20 announced senior leadership changes, which included the creation of a new "point-to-point mobility officer" role.

Transport operator ComfortDelGro on Nov 20 announced senior leadership changes, which included the creation of a new "point-to-point mobility officer" role.

Derek Koh will step down from his role as chief financial officer (CFO) in 2026, and retire at the end of March. He will also give up his two other senior roles – as deputy chief executive officer and chief corporate services officer.

Having spent seven years in his roles, he will next assume an advisory role, to aid in the transition and ensure "continuity of strategic initiatives", said the company in a bourse filing.

Stepping into Mr Koh's CFO role would be the current group deputy CFO, Christopher David White.

Mr White, who has more than two decades of experience in finance, has been with ComfortDelGro since 2019, overseeing group-level financial governance, performance management and integration of international finance operations. He is concurrently the group head of investor relations.

The newly created role of group chief point-to-point mobility officer will be filled by Liam Griffin, who has been the group's current head of point-to-point mobility in the UK. Mr Griffin is also chief executive officer of ComfortDelgro's London subsidiary, Addison Lee.

ComfortDelGro chairman Mark Greaves said: "The board views these forward-looking appointments as essential to the ongoing evolution of the group as a leading global multi-modal mobility operator."

He added that these internal appointments enable "continuity" and provide the necessary structure to advance the group's future growth plans.

Shares of ComfortDelGro fell 1.4 per cent or two cents to $1.45 as at 10.57am on Nov 21, after the announcement. The Straits Times Index was down 0.9 per cent.

At the time of writing, gold trades at $4077 per troy ounce, having erased gains made prior to the months-delayed September US Nonfarm Payrolls release.

Relatively unchanged at -0.02% in today's session, gold currently trades approximately 7.00% shy of all-time highs made in October, and remains on pace to secure a remarkable yearly gain of over 50% in 2025.

Gold (XAU/USD): Key takeaways 20/11/2025

Having had at least some dealings with the financial markets for the best part of ten years now, today marks a special occasion, being the first time I'm discussing nonfarm payrolls on the 20th of the month.

While I can only speak for myself, I'm happy to see NFP back on the calendar in any capacity, especially considering the lack of economic data in the last month or so.

With that said, this brings us back to today, and, albeit representing conditions from some time ago, today saw the release of September's nonfarm payroll report, which beat expectations by +69,000 jobs.

Keeping our focus on precious metal markets, let's discuss some implications for gold, as well as further macroeconomic themes currently at play.

September jobs beat to further Fed hawkish tilt:

Let's start by addressing the most recent and obvious fundamental happening in the last twelve hours – the September NFP report.

Delayed just shy of two months owing to the US government shutdown, September's numbers beat expectations by some margin. However, the report also noted rising unemployment to 4.4%, its highest level since 2021, as well as downward revisions to both July and August numbers.

While this is fairly mixed on the surface, markets have received some assurance that the US labour market was stronger than expected before the US government shutdown took place.

Speaking of which, we've also recently had confirmation from the Bureau of Labor Statistics that October's NFP release will not be postponed indefinitely, and alongside the delayed release of November's report, today serves as the last NFP report available before the Federal Reserve votes again on interest rates early December.

Tying this all together, and considering the most recent data, albeit two months old, shows some buoyancy in the US labour market, this will not only somewhat relieve the pressure for further rate cuts by the Fed, but further vindicates a pre-existing hawkish tilt, best described by Vice Chair Jefferson's commitment to "proceed slowly" in the current easing cycle.

On gold pricing, there's no surprise that any notion of higher interest rates spells trouble for the current rally in gold pricing, with price action in the last week or so, alongside the Fed's increasingly hawkish stance, testament to this.

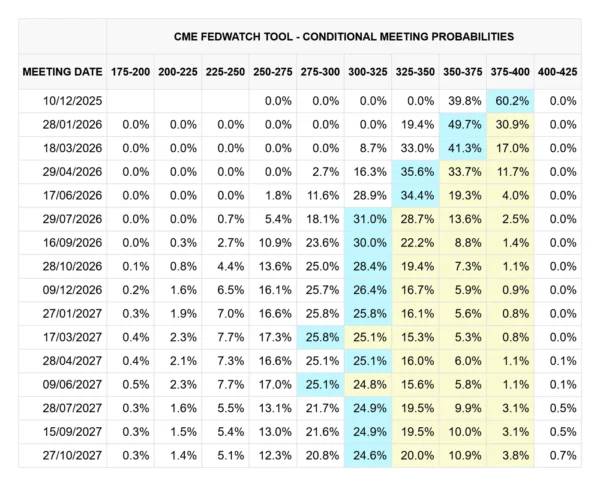

At the time of writing, the CME FedWatch tool predicts rates will be maintained in the upcoming meeting, currently at odds of 60.2%, with a 39.8% chance of a rate cut.

It's worth noting that, just a few short weeks ago, directly following the October decision, markets had almost 'nailed-on' a consecutive rate cut in December, with this change of expectations going some way in explaining the pullback seen in precious metal pricing.Split room highlighted in October FOMC Minutes:

Released yesterday, minutes shared from the October rate decision highlight an increasingly divided group of policymakers ahead of the December decision, adding further rationale to expectations of rates being left unchanged.

In brief, the meeting can be summarised as follows:

For reasons discussed above, at least one result is a dampening of gold upside, which would likely receive a second wind if rates were to be cut.Gold as a hedge against policy failure:

While the above casts some shadow on gold upside, markets are currently asking one question: How can the Fed make the right decision with no data?

On this basis, and despite the notion that higher interest rates are inherently gold negative, there is some evidence that markets are using gold as a hedge against policy failure.

Put simply, and while the Fed could be forgiven considering the lack of data, suppose a decision to hold in December was found to be, in hindsight, the wrong decision when more data is made available, this could spell trouble for the dollar, making gold a more attractive option to store wealth by comparison.

Albeit a minor theme at play, this could offer some precious metals upside, as markets are less confident of the Fed's grasp on current conditions, although by no fault of their own.

XAU/USD: Daily (D1) chart analysis:

I'm pleased to say that, as per my previous coverage, the first price target of $4,090 was hit in yesterday's session.

Going forward, here are some other levels to consider:

Price targets and support/resistance levels:

While, in fairness, my commentary above suggests a somewhat bearish angle in the short term for gold, it's essential to remember that gold has rallied in response to other macro factors this year, despite a staunchly hawkish Fed for much of 2025.

To the downside, the yellow metal remains well supported by many moving averages, as well as the key psychological level of $4,000, which was breached for the first time earlier this year.

Otherwise, and in the immediate, we have seen a few pin bars to suggest that there is further bullish appetite for gold, despite a more hawkish Fed putting a lid on 2025 upside – at least for now.

Samsung Electronics said on Friday it has named its mobile chief TM Roh as a new co-CEO and head of its device experience division, which oversees the company's mobile phone, TV and home appliance businesses.

The appointment returns Samsung to its traditional co-CEO structure, which divides oversight of its chip and consumer divisions, after the company had been operating under a sole-CEO setup following the sudden death of co-CEO Han Jong-Hee in March.

Roh has been serving as acting head of the consumer business since April, following Han's death.

Ryu Young-ho, a senior analyst at NH Investment & Securities, said Samsung had made a "safe and predictable" choice, adding that the appointment appeared aimed at further strengthening competitiveness.

Ryu noted that Samsung's strongest-performing businesses so far this year have been memory chips and mobile, and by naming TM Roh as co-CEO, the company is signaling it wants to put more weight behind those divisions.

The memory business is benefiting from a favourable market, he said, but is also showing progress as Samsung works to narrow the gap with rivals in the AI chip race under co-CEO Jun Young-hyun's leadership of the division.

The reshuffle comes after Samsung's appointment earlier this month of a new head of its business support office, a key decision-making body at the technology giant that serves chairman Jay Y. Lee.

The body functions as a strategy unit that acts as a mini-control tower inside Samsung Group, South Korea's top conglomerate whose businesses range from chips to smartphones, ships and pharmaceuticals, and coordinates across business units and affiliates, analysts said.

Samsung Electronics shares were down 4.2% as of 0105 GMT, compared with a 3.2% fall in the benchmark KOSPI.

Analysts said the move was not related to the leadership changes, noting that Asian stocks broadly fell after U.S. tech shares slid on concerns over AI valuations and as U.S. jobs data failed to provide clarity on the interest rate outlook.

Greek Prime Minister Kyriakos Mitsotakis aid he's optimistic about the country's economic outlook over the next 18 months, adding that Greece's rebound reflects a broader trend of southern Europe outperforming traditional economic powerhouses.

"Greece has staged over the past years what I consider to be a pretty remarkable comeback," Mitsotakis said in an interview with Bloomberg News Editor-in-Chief John Micklethwait at the New Economy Forum in Singapore on Friday. "We have proven that the Greek crisis belongs to the past."

The Greek economy has been outperforming most of its European peers and is only one of a few countries in the region achieving budget surpluses. All major rating companies have placed Greece back in the investment grade zone and continue to upgrade the country's sovereign rating status, citing fiscal discipline as the main reason for doing so.

Southern Europe is now doing better than traditional leaders such as Germany and France, according to Mitsotakis. Politically, he said Greece also shows that the center can hold, even as far-right movements gain traction elsewhere in Europe.

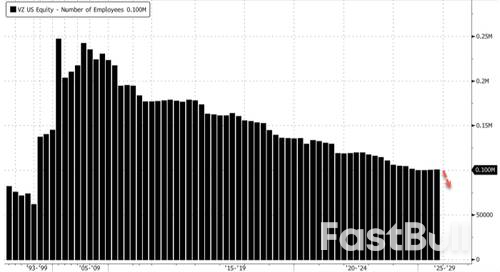

Verizon CEO Dan Schulman released a public letter to the company's 100,000-person workforce on Thursday morning, revealing that more than 13,000 job cuts will begin today. The timing is optically displeasing, coming just one week before the Thanksgiving holiday.

"Today, we will begin reducing our workforce by more than 13,000 employees across the organization, and significantly reduce our outsourced and other outside labor expenses," Schulman wrote in the letter.

Schulman said Verizon established a $20 million Reskilling and Career Transition Fund for departing workers, focused on training, digital skills, and job placement in the era of artificial intelligence.

"This fund will focus on skill development, digital training and job placement to help our people take their next steps. Verizon is the first company to set up a fund to specifically focus on the opportunities and necessary skill sets as we enter the age of AI," the CEO noted.

Schulman's letter comes one week after the Wall Street Journal reported that Verizon was planning about 15% in job cuts, or about 15,000 workers.

Bloomberg's latest data suggests that 13,000 job cuts equal about 13% of its roughly 100,000-person workforce. WSJ notes this would be the largest workforce reduction on record for the carrier.

Also, last week, Verizon chairman Mark Bertolini told CNBC's Becky Quick on "Squawk Box" that the company needs to "do something different" as it undergoes its leadership change.

Separate but notable...

So we guess that the "something different" is making 13,000 workers have a miserable holiday season.

Wall Street futures inched higher on Thursday evening, steadying after a whipsaw session that ended with deep losses as an earnings-driven rally in Nvidia reversed course, while investors further priced out bets on a December interest rate cut.

NVIDIA Corporation (NASDAQ:NVDA) fell slightly further in aftermarket trade, following a 3.1% loss during the main session as investors soured on its third quarter earnings. Losses in Nvidia spilled over into broader tech shares, amid growing concerns over an artificial intelligence-fueled bubble.

Sectors beyond tech also lost ground as strong September payrolls data spurred bets that resilience in the labor market will give the Federal Reserve even less impetus to cut interest rates.

S&P 500 Futures rose nearly 0.3% to 6,576.0 points, while Nasdaq 100 Futures rose 0.2% to 24,186.25 points by 19:40 ET (00:40 GMT). Dow Jones Futures rose 0.3% to 45,970.0 points.

Markets took some support from President Donald Trump signing an order to lower U.S. import tariffs on some Brazilian agrigoods, which could help lower food costs in the country.

Wall Street indexes tumbled on Thursday, logging wild swings as investors digested Nvidia's earnings.

While the top and bottom line figures were strong, some analysts raised concerns about Nvidia's rapidly growing inventories, while comments from management did little to quell broader concerns about an artificial intelligence bubble and circular investing.

Investor Michael Burry, famous for predicting the 2008 financial crisis, also criticized Nvidia's earnings, and warned that true end demand for AI was far less than what valuations were suggesting.

Nvidia slid 3% after initially rising 5%, logging a nearly $400 billion swing in valuation. The stock fell 0.2% in aftermarket trade.

Beyond Nvidia, positive earnings from top retailer Walmart Inc (NYSE:WMT) offered some support, with the stock rallying 6.5% during the main session.

The S&P 500 fell 1.6% to 6,538.97 points on Thursday. The NASDAQ Composite slid 2.2% to 22,078.05 points, while the Dow Jones Industrial Average fell 0.8% to 45,752.26 points. All three indexes have fallen for five of the past six sessions.

Wall Street was also pressured by investors further scaling back bets that the Federal Reserve will cut interest rates in December. This notion was furthered chiefly by stronger-than-expected nonfarm payrolls data for September.

Strength in the labor market and sticky inflation give the Fed less impetus to cut interest rates further. The minutes of the Fed's October meeting, released earlier this week, also showed policymakers largely split over a December cut.

Markets are pricing in a 31% chance for a 25 basis point cut in December, down from 45.8% last week, CME Fedwatch showed.

Morgan Stanley analysts said they no longer expected a December cut, after Thursday's payrolls reading.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up