Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Chinese yuan has risen to 8.5% of global daily currency transactions, edging closer to overtaking the British pound as the fourth most-traded currency...

Japan will get its second prime minister in just over a year when the ruling Liberal Democratic Party holds a leadership election on Oct. 4. If one of the two candidates leading the opinion polls wins, the country could have either its first female prime minister or its youngest leader since World War II.The new leader will replace outgoing Prime Minister Shigeru Ishiba, who was forced to resign after a historic upper house election loss in July. But whoever takes over will inherit the same challenges Ishiba faced: trying to pass legislation in a parliament where the LDP lacks a majority as a ruling party in both chambers for the first time since it was founded in 1955.

It’s a difficult moment for Japan, which is contending with new US tariffs, inflation that’s squeezing household budgets and sluggish global trade. Also looming in the background: a shrinking, aging population and the question of how to keep funding ballooning social security costs.The LDP is holding a leadership contest on Oct. 4 in which all of its members can vote. Each of the party’s 295 parliamentary lawmakers receives one ballot, while another 295 votes are distributed among its broader membership base of around 916,000 people. If the first round of voting doesn’t produce a candidate with a majority, a runoff round is held immediately between the top two contenders.

Once the party has chosen a leader, it goes to a vote in parliament — usually within a few days but sometimes within a few weeks. The candidate must win a majority of parliamentary votes to become prime minister. In theory, opposition parties could band together to nominate and elect a non-LDP prime minister, but that’s unlikely given their fragmentation.The new LDP leader’s term is three years. However, depending on how they handle policies and how their party performs in future elections, they could lose their position earlier — as was the case for Ishiba.

Sanae Takaichi, a former economic security minister, is one of the two leading candidates to succeed Ishiba as the LDP leader according to recent opinion polls. If elected, she would likely become Japan’s first female prime minister. Her election may trigger concerns in the market over her more fiscally aggressive stance. Takaichi narrowly lost to Ishiba in a runoff in the LDP’s leadership race last year. This time she appears to have tempered her messaging on fiscal and monetary policy while also showing openness to cooperating with opposition parties to secure support for legislation.

Agriculture Minister Shinjiro Koizumi is the other frontrunner. At 44, Koizumi would represent a generational change at the helm of the party — a shift that could resonate with swing voters who see the older guard as out of touch. The son of one of Japan’s most famous reformist premiers, Koizumi has become the face of the LDP’s efforts to bring down the price of rice — a high-profile initiative with major cultural and political ramifications. He’s seen some success with the initiative. Koizumi placed third in the first round of voting in the LDP leadership election in 2024, behind Takaichi and Ishiba.

Also in the race is the government’s chief spokesperson, Yoshimasa Hayashi, who has styled himself as a safe pair of hands capable of handling crises. Hayashi, one of Ishiba’s closest aides, represents a continuity candidate for the LDP.The other candidates are former Foreign Minister Toshimitsu Motegi and former Economic Security Minister Takayuki Kobayashi. Neither is likely to win the contest, according to the polls, but how their votes swing in the expected runoff between the top two candidates could ultimately determine the outcome of the leadership race.

Ishiba became prime minister last year at a time when voters were already deeply dissatisfied with the LDP’s handling of a slush-fund scandal that implicated senior party members in the illicit funneling of money from fundraising events. As a result, public distrust in the party — compounded by frustration over what was perceived as inadequate support for households facing high living costs — eroded the LDP’s standing in the recent elections.The LDP and its coalition partner Komeito lost their majority in the upper house of parliament in a July 20 vote. They had already suffered a similar setback in a lower house election last October. The two election defeats, both under Ishiba’s leadership, triggered calls within the LDP for him to take responsibility and step down.

Ishiba remained in office despite growing calls for his resignation, saying he needed to address important challenges for Japan — including easing cost-of-living pressures and negotiating and implementing new tariff rates with the US.Nevertheless, criticism persisted, and on Sept. 7 Ishiba announced his decision to step down. He also cited confirmation from the US that it would lower tariffs on imports of Japanese cars as a factor in the timing of his resignation.Whoever becomes the next leader will face mounting pressure to help households deal with inflation, which has been at or above the central bank’s 2% target for more than three years. While the economy has grown for five consecutive quarters, voters remain worried about the high cost of living.

The new LDP leader will have to get creative to win back public support after Ishiba’s attempt to ease the pain of inflation with cash handouts failed to resonate, while opposition parties gained traction by calling for a tax cut.For financial markets, Japan’s political instability adds to uncertainty. Investors will be watching closely for the new leader’s stance on macroeconomic policy. Japan has already begun moving away from years of aggressive monetary easing; the Bank of Japan has been gradually increasing interest rates. This has pushed up government borrowing costs, complicating efforts to fund stimulus measures.

A leader who maintains the current path of economic stimulus would likely support stability in the markets. Any signs of more aggressive fiscal spending — or resistance to central bank rate hikes, positions Takaichi has held in the past — could spark volatility, especially in the bond market, where super-long yields are rising, reflecting concerns among investors about the nation’s fiscal discipline.

Oil prices extended losses yesterday after reports that OPEC+ may be bringing supply back onto the market at a quicker-than-expected pace. The group is currently unwinding its voluntary supply cuts of 1.66m b/d, which were planned to be brought back gradually at 137k b/d per month. There are now reports that it may go with three monthly supply hikes of around 500k b/d each. If true, this will increase the scale of the surplus through the fourth quarter of this year and next year. The market should get more clarity on 5 October, when the group decides on output levels for November.

Numbers overnight from the American Petroleum Institute were somewhat supportive for crude oil and bearish for refined products. US crude oil inventories are reported to have fallen by 3.7m barrels over the last week, while Cushing crude oil stocks fell by 693k barrels. Gasoline and distillate inventories increased by 1.3m barrels and 3m barrels, respectively. The more widely followed inventory report from the Energy Information Administration will be released later today.

Middle distillate cracks remain well-supported amid concerns over market tightness. However, gasoil stocks in the Amsterdam-Rotterdam-Antwerp (ARA) region continue to recover, hitting their highest level since May. Russia’s diesel export ban for resellers should have a limited impact on flows. Yet the move doesn’t help sentiment in a market already concerned about tightness. It could also open the door for further restrictions on middle distillate exports at a later stage.

Iron ore prices had a choppy session yesterday after Bloomberg reported that China’s state-run iron ore buyer told steel mills to temporarily stop purchasing all new iron ore cargoes from miner BHP amid a pricing dispute. This is an escalation from earlier in September, when the state-run trader told mills to stop buying BHP’s Jimblebar blend.

The latest data from the National Statistics Institute of Chile shows that domestic copper output dropped by 10% year-on-year (-4.9% month-on-month) to 423.6kt in August, following an accident that halted mining and smelting activities at Codelco’s El Teniente mine towards the end of July. This was the largest annual drop reported over a two-year period. It is estimated that Codelco reported losses of ~33kt of copper due to the incident, while also trimming its 2025 output guidance. However, cumulative copper output over the first eight months of the year is still up 1% YoY to total 3.5mt.

Cocoa prices came under additional pressure yesterday, with London cocoa falling almost 2.5% and reaching its lowest levels since February 2024. Attention in the cocoa market is shifting to the 2025/26 season. Expectations are that the market will experience another surplus in the new marketing year, alleviating concerns about tightness that have plagued the cocoa market in recent years.

The latest estimates from the Buenos Aires Grain Exchange show that the Argentina soybean crop could fall by 3.6% YoY to 48.5mt for the 2025/26 season. The downward revision in production estimates is largely attributed to lower area. In contrast, corn production could rise by 18.4% YoY to 58mt, on higher acreage estimates of 7.8m hectares (+9.9% YoY). Similarly, wheat production is expected to be around 22mt, up 18.3% YoY.

The Japanese yen is stepping into the FX spotlight, battling the Australian dollar for top weekly performer — with the AUD lifted by the RBA’s hawkish pause and firm domestic data.A rare sight in 2025, the yen is beginning to dominate broader currency performance, as fundamentals start to assemble in its favor.Political momentum is shifting, with LDP contenders Takaichi and Koizumi pulling ahead in Friday’s LDP party leadership race and hinting at a possible renegotiation of Japan’s trade deal with the US.

With US rate differentials projected to narrow on the back of FOMC cuts, and the BoJ inching toward normalization, the yen’s case for strength into year-end looks interesting.Let’s explore USDJPY multi-timeframe charts (and a few other yen crosses) to see where the it stands.

Daily Chart

Combined with a sudden u-turn in the USD, the yen started to price a more hawkish BoJ policy going forward forming the most consistent selloff in the pair since May 2025.The three daily candles took prices from a failed test of the 150.00 handle (149.960 Monday highs) to two handles lower as we speak.The 50-Day Moving average is coming at the mid-range pivot and will be one of the last level for USDJPY bulls to show up.

Daily momentum is turning negative, and when looking at these candles closing at their lows, it seems that this is the beginning of a move.Of course, the 146.00 to 150.00 range holds until it breaks, but fundamentals could be pointing to a breakout

The pair is evolving in an intraday steep downward channel, with prices now becoming oversold.With the tight price action, it would be surprising to see a sudden reversal higher (if it does, look for a breakout of the channel) – The overall bearish flows and daily outlook are strong so keep that in mind.Month-end flows could also be coming into play – Watch the reactions at a potential break of the 50-Day MA (147.75).

Levels of interest for USDJPY trading:

Resistance Levels

Support Levels

Immediate pivot, mid-range and 50-day MA 147.80 to 148.00 (testing)

Other yen crosses showing at key levels

GBPJPY now way below 200.00

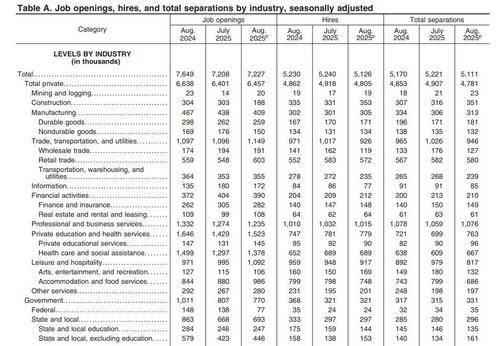

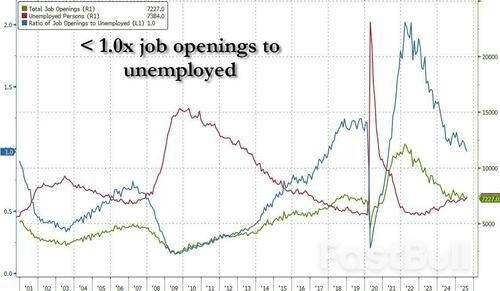

One month ago, before that catastrophic August jobs print (and first negative monthly print in years) and before the devastating 911K negative payrolls revision, we looked at the just published very ugly JOLTS report and correctly predicted the September rate cut (and also subsequent easing). Of note, the report showed not only that job openings plunged and came below the lowest estimate, but that for the first time since April 2021, there were more unemployed workers than job openings.

Fast forward to today when the already ugly labor market picture got even uglier, when moments ago the BLS reported the latest, August, JOLTs report (which may very well be the last Federal labor market report for a long time once the government shuts down at midnight tonight) and which showed that job openings remained depressed, if rising modestly from the upward revised July print of 7.208MM (up from 7.181MM), to 7.227MM, and beating muted estimates of 7.2MM.

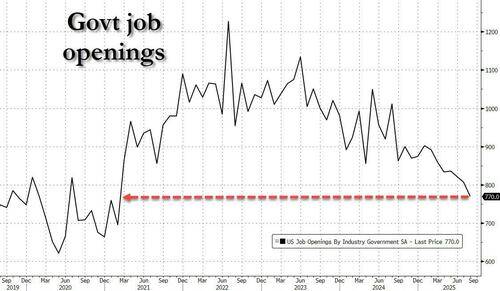

Indeed, as shown in the chart below, the best news about today's report is that ahead of the government shutdown which will lead to mass government worker layoffs, the number of government job openings was already the lowest since Feb 2021.

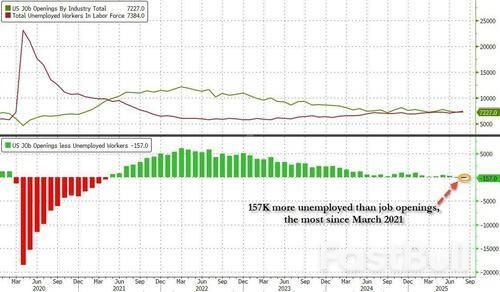

In the context of the broader jobs report - which may or may not print this Friday - the most important data was what we predicted ahead of today's JOLTS report, namely that the number of unemployed workers is now greater than job openings.

And sure enough, after four years of the US labor market dodging the bullet, its luck has finally run out because whereas in June the labor market was still supply-constrained, when there were 342K more openings than jobs in the US, in July we are finally back to demand constrained, with 28k fewer job openings than unemployed workers, the first negative print this series since April 2021. One month later, it's gotten much worse, with 157K more unemployed than job openings, the highest differential since March 2021.

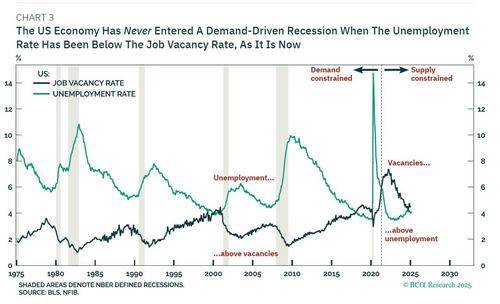

As we discussed previously, The US never entered a recession in a period when there were more job openings than unemployed workers (i.e. the job market was supply constrained). As of this moment, we know it is no longer supply constrained and is instead demand constrained.

Said otherwise, in August the number of job openings to unemployed dropped further below 1.0x, after spending the past 4 years above it.

While the job openings data was ugly and potentially the first harbinger of the coming recession - things were even uglier below the surface, starting with hiring where the number of new hires tumbled by 114K to 5.126MM the lowest since June 2024, while at the same time the number of people quitting their jobs - also known as the take this job and shove it indicator - also slumped by 75K to 3.091MM, the lowest of 2025.

Well, as we said last month, it likely has to do with the DOL - which recently lost its previous commissioner after Trump fired her two months ago - starting to factor in the collapse in the shadow labor market, the one dominated by illegal aliens, and the replacement of illegals with legal, domestic workers which in turn is pushing the labor market into a demand-constrained imbalance. Last month we said "the question is how long until this appears in much weaker than expected payrolls prints" and we got the answer just two days later when we got a truly catastrophic jobs report, which was then cemented by the full year revisions on Sept 9 which we correctly predicted would show "another 600K-900K in jobs that were never there and were simply imagined by the Biden DOL, in the process greenlighting not only a 25bps rate cut, but potentially a jumbo 50bps... just like exactly one year ago."

It ended up being 911K, but what is more important for today is that today's JOLTS report was not terrible but it certainly was ugly enough to ensure that the Fed cuts in three weeks time if the government shuts down tonight and is closed indefinitely, preventing the Sept jobs report from being published this Friday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up