Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China announced on Thursday it is issuing streamlined rare earth export licenses, fulfilling a key promise made during the recent meeting between U.S. President Donald Trump and Chine...

China announced on Thursday it is issuing streamlined rare earth export licenses, fulfilling a key promise made during the recent meeting between U.S. President Donald Trump and Chinese President Xi Jinping that helped ease trade tensions between the two countries.

In early April, Beijing added several rare earth elements and magnets to its export control list, requiring dual-use licenses for exports. This move caused China's exports of rare earth magnets to drop significantly in April and May, forcing some global automakers to temporarily halt parts of their production.

"China has been actively making use of general licenses and other facilitation measures to promote compliant trade in dual-use items," state news outlet Xinhua reported on Thursday, citing a Commerce Ministry weekly briefing.

Commerce Ministry spokesman He Yadong told reporters at the weekly briefing, "As long as export license applications for rare earth-related items are for civilian use, the government has given timely approval."

The new general licenses are designed to allow more exports under year-long permits for individual customers, according to reports from early November.

We expect growth to slow to 0.9% next year (from 1.4% this year), for three reasons.

First, spending power is expected to stagnate; real household disposable incomes are set to grow by 0.5% in 2026, versus 1.5% this year. Wage growth is falling quickly, while employment growth is likely to be negligible. Rate cuts are a slow burner. Most mortgages are fixed for five years, while savings income will decline more quickly.

Second, the public sector – having been a key offset to private sector weakness in 2025 – will be less supportive. Real departmental spending will grow at half the rate seen in 2024 and 2025, while income tax is rising as a share of GDP. The deficit is set to drop a full percentage point to circa 3.5%. Fiscal policy will be a drag in 2026.

Finally, business investment is likely to weaken, at least in the first half of the year. Confidence has fallen on the delivery of – and uncertainty about – future tax hikes. Global challenges aren't helping.

We expect inflation to fall from 3.6% now to almost 2% in April. Food inflation has likely peaked. The marked fall in wage growth points to lower services inflation, helped by more contained regulatory price hikes and slower rental growth. The government's decision to lower energy bills should trim 0.3pp off headline CPI too.

Hawks at the Bank of England fear that elevated inflation rates in 2025 – particularly for food – will fuel a more sustained episode of price pressure akin to 2022. We disagree. The jobs market is considerably weaker. Firms' pricing power has receded. Though a risky call after several years of sticky inflation, we think 2026 will finally show the UK as less of an outlier. The Bank is set to narrowly vote on a December rate cut. And as the tide turns on inflation, we expect two more next year – and the risk is we get more.

Twelve months ago, our bold call correctly argued that more tax rises were inevitable in 2025. The same isn't necessarily true in 2026. Adverse economic forecasts are less likely to force the chancellor's hand, given greater 'headroom' under the fiscal rules. The fact that issuance and the deficit will be falling next year is a reminder that the UK isn't the "next France".

Yet the Autumn Budget failed to address many longer-term challenges. Public spending pressures are growing. Taxes on average workers are comparably low. That, against a backdrop of mounting political pressure, means a change of political leadership can't be ruled out. May's local elections are a key flashpoint.

Changing leaders isn't easy; 20% of Labour MPs would need to back a rival candidate when none currently exists. But were it to happen – or even if the risk of it rises – bond yields would likely spike on the perception that a more left-leaning PM would hike borrowing. This would be against a backdrop of growing populism on the political right.

Politics is the biggest risk for UK bond markets in 2026.

Key points:

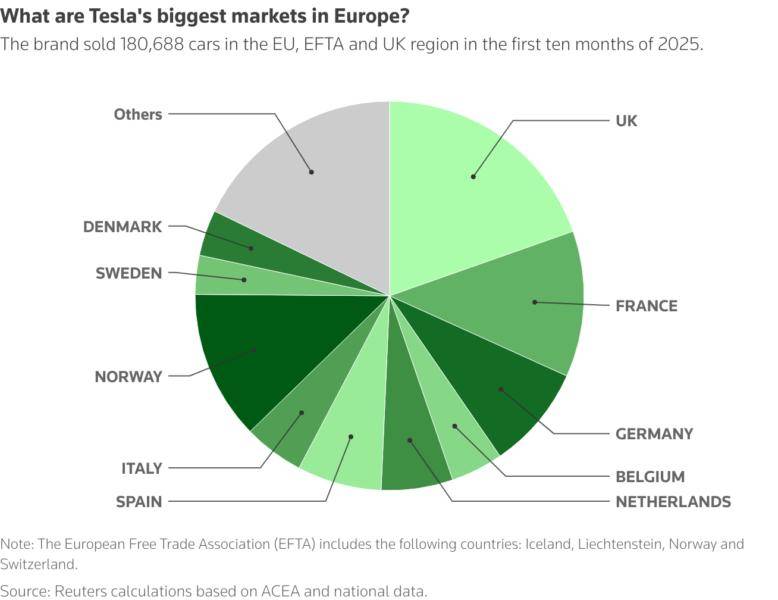

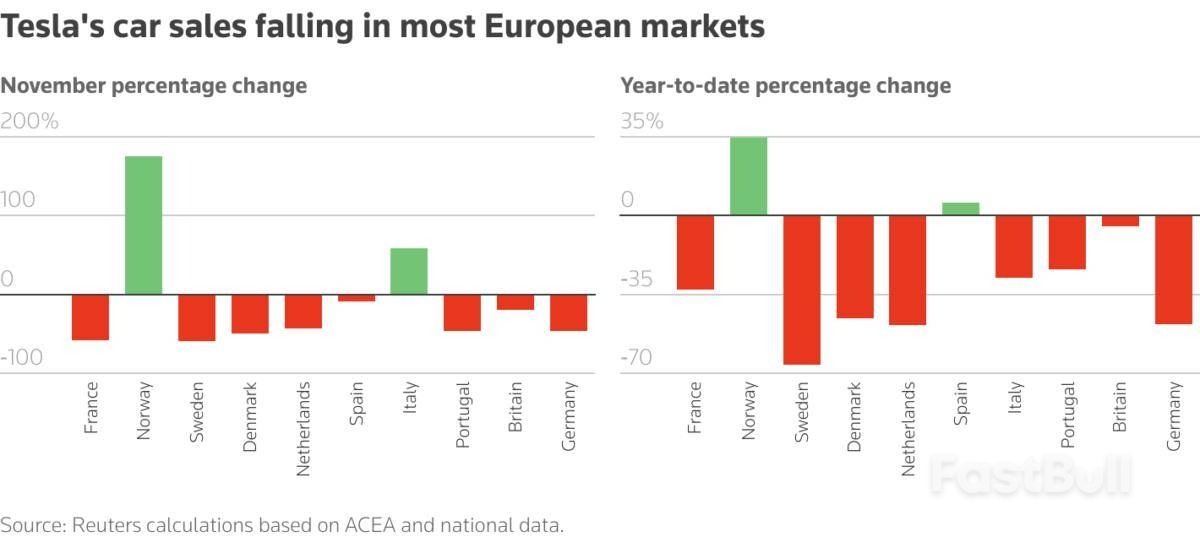

Tesla'sUK car registrations dropped in November, industry data showed on Thursday, following steep declines in other European markets in the month amid intense competition particularly from Chinese rivals.

November registrations, a proxy for sales, of Tesla cars in the UK fell 19% to 3,784 from 4,680 cars a year ago, preliminary data from research group New AutoMotive data showed.

Data from the Society of Motor Manufacturers and Traders (SMMT) showed a 17.2% year-on-year decline to 3,772 Tesla sales in the UK, lagging other legacy automakers and Chinese rivals.

The numbers are slightly different as SMMT and New AutoMotive use different sources of data and methods of calculation.

The U.S. EV maker, which recently started rolling out new versions of its best-selling Model Y SUV, has been struggling with an aging lineup and growing competition in a crowded European market, especially from new entrants from China.

There are now more than 150 electric models available to British motorists, according to EV buying advice site Electrifying.com.

Amid the assortment of EV brands, registrations by Tesla's Chinese peer BYD, which also sells hybrids and plug-in hybrids, more than tripled in November.

Customer sentiment for Tesla has also fallen in recent months, after CEOElon Muskpublicly praised right-wing political figures and after his short stint as head of the U.S. Department of Government Efficiency.

The brand's November drop in registrations is in line with a 20% fall in Germany and a slump of almost 60% in France and other European markets, which were only partly offset by record-breaking sales in Norway.

Overall, total new car registrations in Britain fell 6.3% to 146,780 vehicles for November, according to New AutoMotive, while SMMT logged a slight 1.6% decline to 151,154 vehicles.

Those of battery-electric cars fell 1.1% to 38,742 vehicles, while plug-in hybrid registrations jumped 3.8% to 16,526, New Automotive data showed.

"On the surface, some consumers may feel that BEVs have increased in cost, but this is not necessarily the case," said Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte.

"The new EV mileage charge will increase running costs of electric vehicles, but changes to the Expensive Car Supplement threshold may mean some drivers are actually better off over the course of their lease period," Hamilton added.

China's major state-owned banks bought dollars in the onshore spot market this week and held on to them in an unusually strong effort to rein in yuan strength, according to people with knowledge of the matter.

The dollar buying came as the yuanleapt to a 14-month high on Wednesday and extended a trend of state banks leaning against yuan gains in order to smooth its rise.

But unlike their usual trading strategy, the lenders did not appear to recycle the dollars into the swap market, market sources said, noting the move was likely aimed at tightening dollar liquidity and so raising the cost of long yuan bets.

Back-end dollar/yuan swap points have since dropped, reflecting a deeper negative carry of owning yuan with the one-year tenor (CNY1Y=) down from a one-month high hit last week.

The state bank actions were meant to moderate the pace of yuan rallies rather than reverse an upward trend, said one of the sources. All requested anonymity because they are not allowed to discuss the matter publicly.

Slower yuan gains also make it harder to hold long positions because profits don't make up for the difference in interest income between dollars and the much lower-yielding yuan.

State banks sometimes trade on behalf of the central bank, but they could trade on their own behalf or execute orders for their clients.

China's central bank, the People's Bank of China did not immediately respond to a request for comment.

The Chinese currency has gained about 3.3% on the dollar year-to-date and on Thursday looked set for the biggest annual rise since the pandemic year of 2020.

The appreciation of the tightly managed currency has been helped by authorities' signalling their tacit approval, with the middle of the yuan's daily trading band repeatedly set firmer than market expectations.

But it has been smoothed by the state banks, prompting speculation the aim is a gradual rise that would avoid sudden yuan purchases by exporters and project the sort of stability that can encourage global use of the currency.

Dollar buying came on Thursday in tandem with a surprisingly soft midpoint fixingwhich has knocked the yuan from its 14-month high to trade about 0.1% weaker at 7.0694 per dollar.

BlackRock, under CEO Larry Fink's leadership, announced on October 2023 that the rising $12 trillion U.S. national debt will drive increased crypto adoption, highlighting Bitcoin's potential as a financial safe haven.

This announcement underscores crypto's viability amid fiscal uncertainties, with BlackRock's significant Bitcoin ETF allocations reflecting institutions' strategic shifts toward digital assets due to escalating national debt risks.

BlackRock has announced a massive allocation of $100 billion towards Bitcoin ETFs. This decision comes in the wake of mounting concerns about the rapid increase in the U.S. national debt, as highlighted by BlackRock's CEO, Larry Fink.

CEO Larry Fink, known for steering BlackRock's investment strategies, expressed concerns in his 2025 Chairman's Letter. He emphasized that escalating U.S. deficits could shift financial power towards digital assets like Bitcoin, encouraging greater crypto adoption.

The investment in Bitcoin ETFs by BlackRock is anticipated to bolster institutional demand for cryptocurrency assets. This move aligns with broader market trends where crypto is seen as a safer alternative in light of increasing national debt.

Institutional flows into Bitcoin are expected to strengthen digital finance infrastructure. The pivot illustrates a significant shift in how institutions approach financial stability amid a looming economic uncertainty driven by national debt. As Larry Fink, CEO of BlackRock, aptly put it, "BlackRock has allocated approximately $100 billion toward Bitcoin ETFs, demonstrating substantial institutional financial commitment to crypto as a hedge against mounting U.S. debt."

The rising U.S. debt levels are prompting institutional investors to reassess their asset allocations. Bitcoin, often dubbed as digital gold, stands to gain traction from these dynamics, serving as a hedge against fiscal instability.

Over time, growing institutional interest, supported by regulatory clarity and market conditions, may solidify Bitcoin's position as a viable asset class. BlackRock's strategic actions, highlighting the economic value of diverse asset holdings, could inspire similar corporate investments.

Thousands of Indianairline IndiGo passengers suffered flight cancellations and delays for the third day on Thursday, as the airline grapples with new government regulations that affect its staff's working hours.

At least 175 IndiGo flights were canceled as of early Thursday, the Reuters news agency reported, with 150 more flights canceled on Wednesday. Passengers were left stranded at major Indian airports including New Delhi, Hyderabad, Pune and Bengaluru.

The airline accounts for 60% of domestic flights in India.

The Indian government announced last year new regulations for flying and staff that came into effect in early November.

They include:

It is unclear why the new regulations only started to affect IndiGo this week. Other Indian airlines, including Air India and Spicejet, have not had to cancel flights.

The airline, which has long prided itself on its punctuality, acknowledged the delays in a statement shared by multiple Indian news websites.

"A multitude of unforeseen operational challenges, including minor technology glitches, schedule changes linked to the winter season, adverse weather conditions, increased congestion in the aviation system, and the implementation of updated crew rostering rules (Flight Duty Time Limitations), had a negative compounding impact on our operations in a way that was not feasible to be anticipated," IndiGo said.

It said it has introduced "calibrated adjustments" to address the delays, suggesting the issue might last another 48 hours.

India's aviation watchdog, the Director General of Civil Aviation (DGCA), has scheduled a meeting with IndiGo officials on Thursday to further inspect the matter.

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planes.

IndiGo staff often proudly announce "IndiGo Standard Time" when boarding has been completed ahead of schedule, a play on "Indian Standard Time."

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planesImage: Pius Koller/imageBROKER/picture alliance

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planesImage: Pius Koller/imageBROKER/picture allianceWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up