Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)A:--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)A:--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)A:--

F: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)A:--

F: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)A:--

F: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)A:--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Mexico Trade Balance (Nov)

Mexico Trade Balance (Nov)--

F: --

P: --

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)--

F: --

P: --

U.S. PCE Price Index Prelim QoQ (SA) (Q3)

U.S. PCE Price Index Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q3)

U.S. GDP Deflator Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Canada's gross domestic product report for October on Tuesday will mark Statistics Canada's final major data release of 2025, and we anticipate a 0.2% decline in growth.

Canada's gross domestic product report for October on Tuesday will mark Statistics Canada's final major data release of 2025, and we anticipate a 0.2% decline in growth.

It's slightly higher than StatsCan's preliminary estimate released a month earlier for a 0.3% contraction. If October's decline is realized, it would represent the steepest monthly drop in GDP since February.

Still, early indicators such as hours worked and our tracking of consumer spending suggest a possible recovery in November. We continue to expect a soft 0.5% annualized increase in GDP for Q4.

In October, we see weakness mostly from goods-producing sectors, while output among service industries remained essentially unchanged.

Non-conventional oil production in Alberta contracted sharply (-5%) in October after four consecutive months of expansion. Manufacturing output declined as well, partially reversing September's gains. StatsCan's October mineral production data indicated modest recovery in mining output, following declines in the prior two months, helping to cushion some weaknesses in other sectors.

For services, home resales rose 0.8% month-over-month in October, bolstering real estate activity. Arts and entertainment saw a boost from the Blue Jays' playoff run, although the gain was likely reversed quickly in November. Offsetting stronger activities was the Alberta's teacher strike temporarily weighing on education services. Wholesale and retail volumes also fell, by 0.7% and 0.6% respectively.

Early November indicators suggest signs of stabilization. Hours worked increased a larger 0.4%, and our tracking of RBC consumer spending data indicates continued strength, especially in discretionary purchases as the holiday shopping season ramps up. This is consistent with StatsCan's advance retail indicator, which shows sales rebounded by 1.2% in November. Overall, we continue to expect modest growth in Q4.

Delayed Q3 U.S. GDP report will be released on Tuesday after the U.S. government shutdown. We look for headline GDP growth of an annualized 2.5% quarter-over-quarter—a deceleration from Q2's 3.8%. Much of Q3's expansion was driven by household consumption, particularly within services. Excluding volatile net trade, final domestic demand likely remained resilient, albeit growing slightly slower than in Q2.

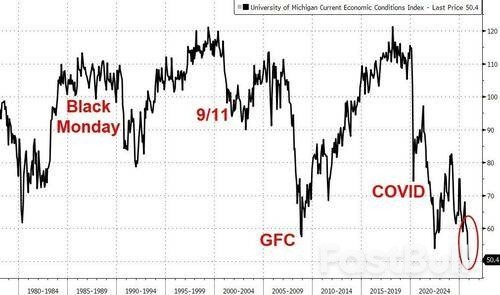

The final print for UMich's sentiment survey for December was a doozy...

While the headline sentiment gauge and Expectations ticked up, Current Conditions slipped further...

...to an all-time record low... yes... worse than during Oct 1987's crash, 9/11, the GFC, and COVID...

This - as you might guess - is very unusual with stocks at record highs and as we have labored extensively this year, UMich's survey seems rife with bias

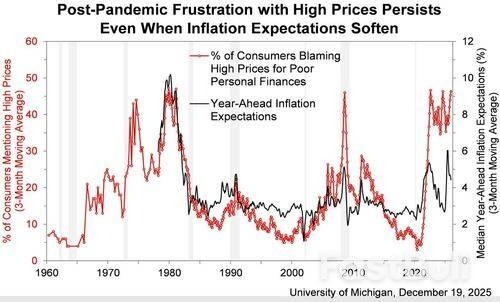

UMich claims that post-pandemic frustration with high prices persists...

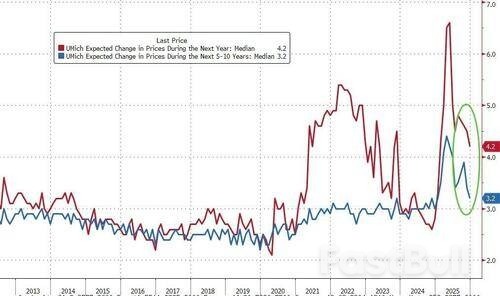

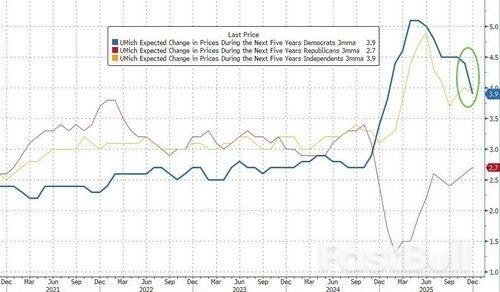

Which is incredible since inflation expectations are plunging...

As Democrats realize their TDS-driven hyperinflation fears were utter bullshit after all (shame on all those MSM pundits)...

Buying conditions for durable goods fell for the fifth straight month, whereas expectations for personal finances and business conditions rose.

"Despite some signs of improvement to close out the year, sentiment remains nearly 30% below December 2024, as pocketbook issues continue to dominate consumer views of the economy," Joanne Hsu, director of the survey, said in a statement.

Labor market expectations lifted a bit this month, though a solid majority of 63% of consumers still expects unemployment to continue rising during the next year.

Hsu concludes: "This year, we saw a spike in inflation expectations that softened very quickly, while high-price mentions have remained consistently high. It appears that consumers have yet to internalize the post-pandemic level of prices as a new normal, which influences how they view the economy."

European Union (EU) countries on Thursday approved a deal to delay the anti-deforestation law by a year following pushback from industry and concerns the digital system to enforce it was not ready, the Council of the EU said, clearing the final legal hurdle for the delay to pass into law.

The world-first policy would ban imports into the EU of cocoa, palm oil and other commodities linked to forest destruction, requiring foreign exporters of these commodities to provide due diligence statements proving their products did not contribute to forest destruction.

Originally due to apply from December 2024, the law was designed as a key plank of the EU's green agenda. Brussels had already delayed it by a year, but that did not quell opposition from industry and trade partners including Brazil, Indonesia and the US, which said complying with the rules would be costly and hurt their exports to Europe.

Under the amended EU law, large companies will now have to comply from December 30, 2026, followed by smaller firms with a turnover of less than €10 million (RM47.88 million) in the products affected, from June 30, 2027.

The EU proposed delaying the law for a second time in September, citing concerns about the readiness of information-technology systems needed to support it.

Food majors such as Nestle, Ferrero and Olam Agri had warned that further delays to the law endangered forests worldwide. The policy aims to end the 10% of global deforestation fuelled by EU consumption of imported goods.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up