Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

French Prime Minister Adviser: We Have Signed 20 Cooperation Agreements Around The World Including With Indonesia

Russia's Nornickel Says Fourth-quarter Copper Production Was 112,015 Tons, Up 12% From The Previous Quarter

Iraq's Former Prime Minister Nour Al-Maliki Says We Reject USA Intervention In His Country's Internal Affairs, After He Was Nominated By Shi'Ite Alliance To Head New Government

Russia's Nornickel Says Sees Nickel Output At 193-203 Kt In 2026, Palladium At 2.415-2.465 Moz

French Prime Minister Adviser On Strategic Minerals: Cooperation Between Malaysia's Malaco Mining And France's Carester On Rare Earths Refining In Pilot Stage

Kremlin On Csis Report Estimate Of 1.2 Million Russian Troop Casualties In Ukraine War: Such Reports Should Not Be Seen As Reliable

Kremlin On Report Russia Is Withdrawing Forces From An Airport In Northeastern Syria: This Is A Question For Defence Ministry

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Near-term US recession risk is low, but there are pockets of weakness that could mutate into a downturn later this year. The weaker dollar, though, will be key to whether the US avoids that fate and stocks a significant decline.

Near-term US recession risk is low, but there are pockets of weakness that could mutate into a downturn later this year. The weaker dollar, though, will be key to whether the US avoids that fate and stocks a significant decline.

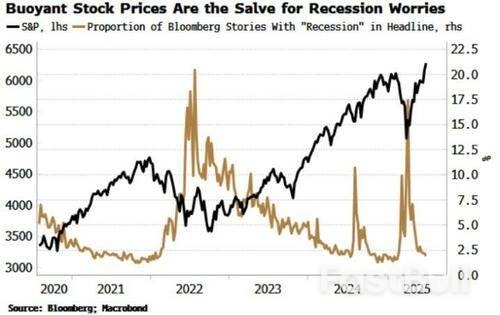

For now, it’s gone quiet on the recession front.

Not long ago, there was febrile speculation that a downturn was imminent, despite a lack of support from leading data.

Since then, the clamour has died down, and that can make one a little uneasy. Not necessarily because we should be worried about an imminent recession, but it does imply the market is now less prepared for bad news, which increases the likelihood of a disproportionate impact on asset prices.

My Recession Gauge – an amalgamation of 14 separate recession indicators – has fallen and is well under the activation threshold. But there are areas of weakness in the economy that could trigger anxiety and cause stock markets to drop, at least temporarily.

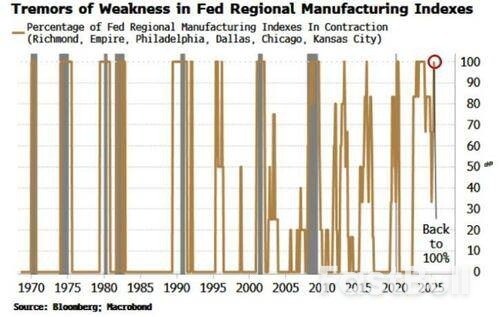

One notable point can be found in the Federal Reserve’s regional manufacturing indexes. Individually they are very volatile. But when they act in concert, they give a more reliable indication. The combined signal has recently jumped back to 100%, with all the indexes now in the contraction zone.

As we can see from the chart above, this particular data point has given a few false positives in the past, so it is not perfect. But equally it’s not something that should be ignored, as manufacturing is one of the most leading sectors in the economy. Moreover, recessions are pervasive. So a nationwide decline in manufacturing is best monitored.

We might also see other signs of economic weakness in the coming months. One point to focus on might be whether the rise in WARN (advance layoff) notices presages weakness in unemployment claims and the wider labour market. Another area to watch is the housing market, and whether that starts to become a wider problem.

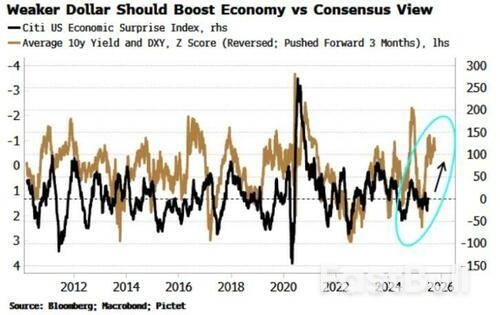

None of these guarantee a recession however, especially if the weaker dollar eases financial conditions to keep a downturn at bay. The drop in the US currency should also translate into a boost for stock earnings.

More broadly, though, dollar weakness and (at least for now) relatively stable yields are typically consistent with economic data improving relative to the consensus.

There are more malign effects from the weaker dollar also in the pipeline such as higher inflation, but at least through the rest of this year, it might be enough to forestall a return of recession angst.

U.S. equity funds saw a significant drop in net investments in the week through July 9 on caution over President Donald Trump's threats of fresh tariffs on trading partners, even though stocks surged to new records on rising demand in the artificial intelligence sector.

Investors acquired just $2.1 billion worth of U.S. equity funds during the week when compared with a robust $31.6 billion worth of net accumulations in the prior week, data from LSEG Lipper showed.

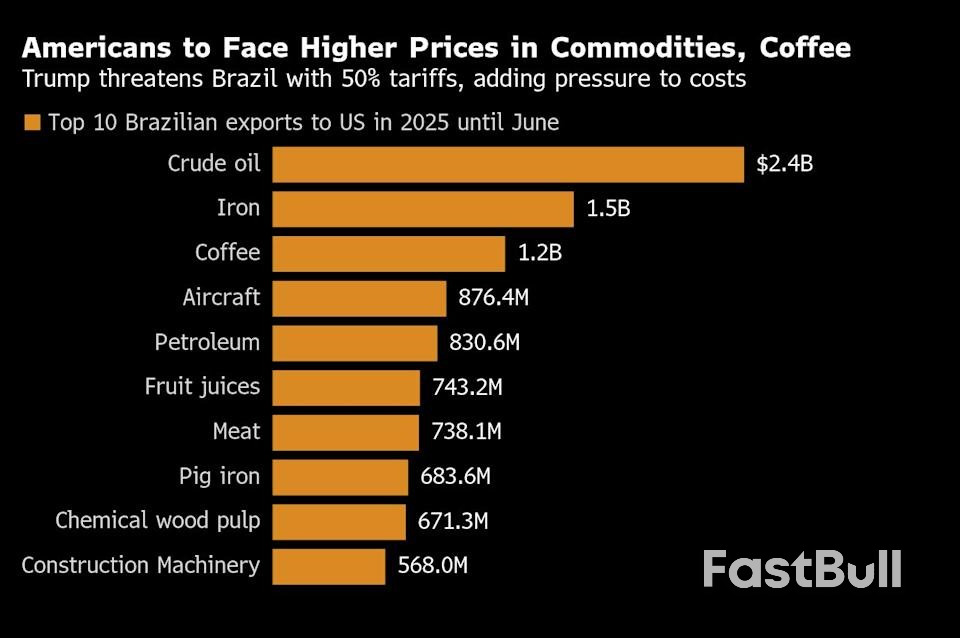

President Trump this week extended the tariff deadline until August 1 to facilitate trade negotiations, but announced noticeably higher duties for some key trading partners including Japan, South Korea, Canada and Brazil alongside a 50% tariff on copper.

U.S. multi-cap funds saw the first weekly net investment in four weeks to the tune of $1.8 billion. Large-cap, mid-cap and small-cap funds, meanwhile, suffered net outflows of $2.83 billion, $785 million and $472 million, respectively.

Sectoral funds saw net purchases extended into a second successive week, with approximately $1.28 billion flowing into these funds. Tech drew in $1.7 billion but healthcare saw net outflows of $874 million.

U.S. money market funds faced a net $9.78 billion weekly outflow, ending two weeks of buying.

Inflows into U.S. bond funds, meanwhile, cooled to a three-week low of $4.34 billion.

Short-to-intermediate investment-grade funds received $1.76 billion with weekly net investments dropping by 57% over the week. General domestic taxable fixed income funds received just $634 million compared with a net $3.03 billion purchase in the prior week.

Short-to-intermediate government and treasury funds, meanwhile, attracted $982 million, the largest amount in four weeks.

Daily NVIDIA Corporation

Daily NVIDIA CorporationWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up