Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Joesley Batista, co-owner of a sprawling business empire led by the meat-processing giant JBS NV, is quietly positioning himself as a connector trying to defuse political tensions between the Trump administration and Venezuela's ruling regime.

Joesley Batista, co-owner of a sprawling business empire led by the meat-processing giant JBS NV, is quietly positioning himself as a connector trying to defuse political tensions between the Trump administration and Venezuela's ruling regime.

Batista traveled to Caracas last week in a bid to persuade President Nicolás Maduro to heed Trump's call to step down and allow for a peaceful transition of power, according to people with knowledge of the trip. He met with Maduro on Nov. 23, days after US President Donald Trump held a phone call with the country's leader to urge him to leave Venezuela, according to the people, who asked not to be identified without permission to speak publicly.

Trump administration officials were aware of Batista's plans to visit Caracas and reinforce the president's message, but he went on his own initiative and wasn't asked to go on behalf of the US, according to some of the people familiar with the trip.

"Joesley Batista is not a representative of any government," said J&F SA, the Batista family's holding company, in a statement. It offered no further comment.

The White House declined to comment. Neither Venezuela's Information Ministry nor Vice President Delcy Rodriguez's office responded to requests for comment about Batista's visit.

The trip, which hasn't been previously reported, marks the latest attempt to defuse tensions after Trump threatened land strikes in Venezuela following months of lethal attacks against alleged drug trafficking boats. The US says the Maduro regime is illegitimate, a criminal group that stole an election last year and facilitates the export of cocaine from Colombia, resulting in American deaths.

Batista's effort to mediate with Maduro followed the biggest US military deployment in the waters around Latin America in decades, and more than 20 US attacks on alleged drug-running boats near the coasts of Venezuela and Colombia that killed more than 80 people. Trump on Wednesday reiterated that assaults on land will start very soon.

"We know every route, we know every house, we know where they manufacture," Trump said at a White House event.

Batista's efforts to add to various attempts at dialogue, including by US envoy Richard Grenell, Qatari diplomats, and financial and oil investors with interests in Venezuela. While the proposals vary regarding how long Maduro would remain in power and whether he would go into exile, they all aim to avoid an escalation of attacks that until now have been waged in international waters.

Secretary of State Marco Rubio in an interview broadcast this week cast doubt on the possibility that the US could negotiate a deal with Maduro to get him to stop drug traffickers, saying the Venezuelan leader has repeatedly broken commitments over the years. Rubio said it's still worth trying to reach an agreement.

In many ways, Batista has the perfect profile to bridge the divide with Maduro. He's the rare figure with good relationships with both Trump and the Maduro regime.

JBS owns Colorado-based chicken producer Pilgrim's Pride Corp., which gave $5 million to Trump's inaugural committee, the largest single donation. JBS this year won Securities and Exchange Commission approval to list its shares in New York, overcoming fierce opposition from environmental groups and advocacy investors over concerns about past bribery scandals involving the Batista brothers and the company's alleged role in cattle-driven deforestation of the Amazon.

Batista met with Trump earlier this year to advocate removal of tariffs on beef and a detente with Brazilian President Luiz Inácio Lula da Silva after a clash over the prosecution of his predecessor and Trump ally Jair Bolsonaro. JBS is the world's largest meat supplier and has more than 70,000 employees in the US and Canada.

The Batista family's ties to Venezuela go back at least a decade. JBS and Maduro years ago negotiated a $2.1 billion deal to supply Venezuela with meat and chicken at a time when the nation was experiencing acute food shortages and hyperinflation. The contract was facilitated by Venezuelan socialist hardline politician and current Interior Minister Diosdado Cabello.

Maduro has ruled Venezuela through increasing repression since 2013, weathering oil sanctions that Trump imposed in January 2019, under his first term.

J&F owns oil production in Argentina. The firm had considered investing in a Venezuelan oil joint venture centered on assets that belonged to ConocoPhillips and were seized by the government of Maduro's predecessor and patron, Hugo Chávez, in a wave of nationalizations in 2007.

Batista has become increasingly intertwined with power circles since helping transform the butcher shop founded by his father in the 1950s into the world's largest meat producer — with crucial help from Brazil's development bank during Lula's previous administrations. The company became the largest donor to political campaigns in Brazil in 2014, when Lula's successor, President Dilma Rousseff, was reelected.

Years later, Batista admitted to bribing hundreds of politicians — including a finance minister — in return for funding from state-run banks and pension funds. In 2017, he famously recorded an off-the-agenda meeting with President Michel Temer as part of a plea-bargain deal with Brazilian authorities in exchange for immunity. The scandal rocked the country and triggered one of the deepest stock-market routs in Brazil's modern history — a day that was subsequently branded "Joesley Day."

The Trump administration has continued its aggressive approach toward Venezuela. It designated the Cartel de los Soles, a narcotrafficking organization allegedly headed by Maduro and senior Venezuelan officials, as a foreign terrorist organization the day after Batista's visit to Caracas, ratcheting up pressure.

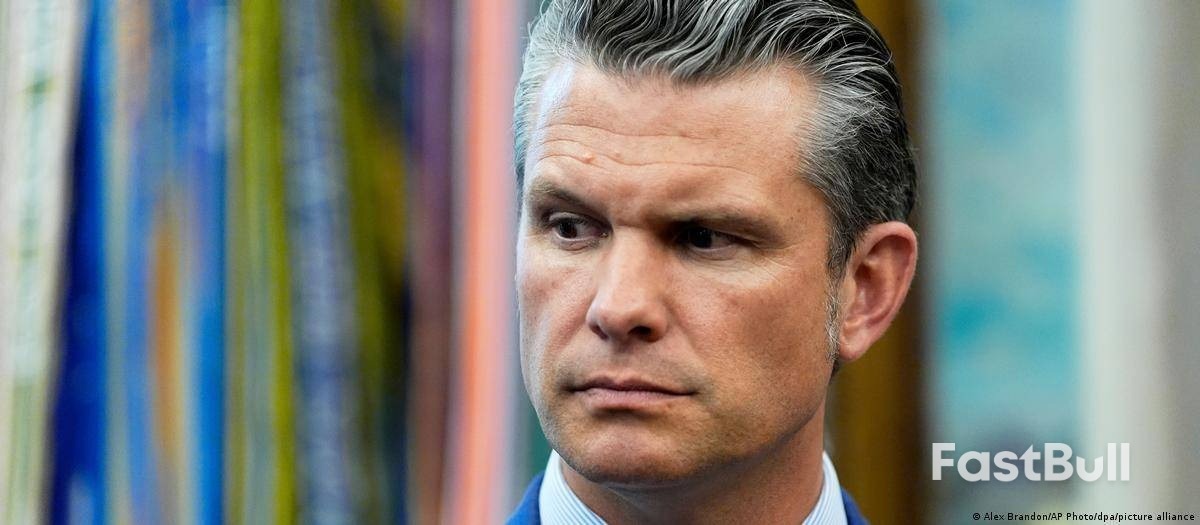

US Defense Secretary Pete Hegseth put American troops and mission at risk when he used the Signal mesaging app on his personal device to discuss planned strikes against Houthi militants in Yemen, a report by the Pentagon's watchdog has found.

That's according to US media, including CNN and ABC, and news agencies. They cite sources familiar with the results of the investigation by the Pentagon's inspector general, which hasn't yet been publicly released.

Hegseth didn't violate rules on classification, the report found according to the sources, because as the head of the Pentagon, he has the authority to declassify information.

But the information shouldn't have been discussed on the commercial app, the report said. That's because the information was so sensitive that it could have endangered the lives of American troops and the mission itself if it was intercepted.

Hegseth declined to sit for an interview with the inspector general, sources said, citing the report, instead provided written answers. He also only provided a small number of his Signal messages for review.

The meant the investigation had to rely on screenshots published by The Atlantic magazine, whose editor-in-chief was accidentally added to the Signal chat, according to sources.

The classified review was delivered on Tuesday evening to Congress.

A partially redacted version of the report is expected to be released publicly later this week, possibly on Thursday.

White House press secretary Karoline Leavitt said that the review affirms the Trump administration's statements that "no classified information was leaked, and operational security was not compromised."

"President Trump stands by Secretary Hegseth," Leavitt said in a statement on Wednesday.

The Pentagon said the review exonerated Hegseth.

"This matter is resolved, and the case is closed," Pentagon spokesperson Sean Parnell said in a statement to CNN.

Hegseth's use of the commercial messaging app came to light when editor-in-chief at The Atlantic magazine, Jeffrey Goldberg, was mistakenly added to a Signal chat by then-national security adviser Mike Waltz.

Signal is encrypted but it isn't authorized for carrying classified information and isn't part of the Defense Department's secure communications network.

The group chat included Vice President JD Vance, Secretary of State Marco Rubio, Director of National Intelligence Tulsi Gabbard and others.

They discussed March 15 military operations against the Iran- backed Houthis in Yemen.

In March, the US launched strikes against Houthis rebels in Yemen, who had been attacking shipping in the Red SeaImage: U.S. Central Command/REUTERS

In March, the US launched strikes against Houthis rebels in Yemen, who had been attacking shipping in the Red SeaImage: U.S. Central Command/REUTERSThe chat included messages in which Hegseth revealed the timing of strikes hours before they happened and information on aircraft and missiles involved.

Waltz sent real-time intelligence on the aftermath of the military action.

It later came out that Hegseth had created a second Signal chat with 13 people that included his wife and brother where he shared similar details of the same strike.

Hegseth is currently under fire over the killing of two people who survived a first US strike on their alleged drug-trafficking boat off the coast of Venezuela in early September.

On Tuesday, Hegseth said he hadn't seen any survivors before they were killed in a second strike.

The initial strike reportedly left two survivors clinging to the boat's burning wreckage. The survivors were then killed in a a so-called follow up "double tap" strike ordered by a Special Forces commander.

The Washington Post alleged last Friday that the second strike followed Hegseth's direct spoken order to kill all of those on board.

The killings raise fresh questions of the legality of the Trump administration's strikes on vessels they say are carrying illicit drugs to the United States.

Rates to ship commodities from energy to bulk ores across the world's oceans are heading for a rare year-end surge as conflicts, sanctions, and swelling output upend global supply lines.

Daily earnings to transport crude on key routes have seen the biggest jump this year, up 467%, while rates to ship liquefied natural gas and commodities such as iron ore have increased more than fourfold and twofold, respectively. Freight costs typically dip at year-end due to seasonal weakness in demand.

Vessels are spending more time at sea transporting cargo, contributing to the spike, and several shipping executives expect tightness in the broader market to continue at least through early next year.

"We're seeing an old school, extremely tight physical shipping market," Lars Barstad, the chief executive officer of Frontline Management AS, which operates a fleet of oil tankers, including very-large crude carriers, said on an earnings call late last month. "We're not seeing any kind of weakness."

For crude tankers, rates rallied following a ramp-up in Middle Eastern production, along with higher Asian demand for their barrels after US sanctions on two Russian oil giants. Meanwhile, the cost to ship LNG from the US to Europe recently climbed to the highest level in two years as new projects in North America tied up more vessels to deliver the fuel.

A benchmark measure for ships hauling bulk commodities, including grain and ore, rose to a 20-month high at the end of November as anticipation grew over a major iron ore project in Guinea coming online and weather-related delays off China squeezed supply. More broadly, hostilities around key routes have contributed to an overall increase in costs.

Attacks by Iran-backed Houthis in Yemen on merchant ships in the Red Sea have forced some vessels to transit around Africa, increasing so-called ton-miles — a key metric of demand that multiplies the cargo volume by delivery distances — signaling cargoes are being transported longer than usual.

Freight rates have eased slightly from a peak at the end of November, but elevated costs are reverberating across the shipping market. Buyers of US LNG have contemplated delaying cargo loading, while some owners of oil tankers are seeking to maximize earnings.

In recent weeks, supertanker operators have focused on longer journeys to lock in higher profits, forcing some Indian refiners to use two smaller vessels — rather than the usual one — to get their Middle Eastern crude purchases delivered on time, according to shipbrokers.

However, even as shipping companies enjoy a rare boom after years of bruising earnings, many are cautious about investing in the rejuvenation of fleets, or making big strategic decisions. New ships are expensive, while rates could plunge with more vessels and the potential reopening of the Red Sea.

"If you're a shipowner, you have made money, you are not under distress," said Jayendu Krishna, a director at Drewry Maritime Services. "But you're not in a great party like mood," due to the uncertain industry outlook, he added.

Australia's household spending handily surpassed expectations in October to post its biggest increase since January 2024, boosting the case for an interest-rate hike next year.

Spending advanced 1.3% from September to exceed economists' expectations for a 0.6% gain, Australian Bureau of Statistics data showed on Thursday. From a year earlier, consumption climbed 5.6% versus estimates for a 4.6% increase.

In response, yields on three-year government bonds jumped above 4% for the first time since January, climbing as much as 6 basis points, while the currency gained. Money market traders boosted bets for a rate hike next year, with the odds for a May move climbing to 55%, from 18% seen Wednesday.

"Discretionary spending surged this month led by goods as promotional events saw households spend more on clothing, footwear, furnishings and electronics following months of weaker spending in these categories," said Tom Lay, head of business statistics at the ABS.

"Services spending also rose in October, as major concerts and cultural festivals drove up demand for catering, hospitality and hotel stays in major cities."

While the Reserve Bank cut rates three times since February to 3.6%, it's expected to keep borrowing costs unchanged at next week's meeting amid signs that inflation pressures may be rebuilding. Money markets are wagering the RBA's next move will be a hike in 2026.

Gross domestic product data released on Wednesday showed Australia's household savings ratio climbed to 6.4% from 6% three months earlier, underpinned by higher incomes.

RBA Governor Michele Bullock said Wednesday that the board is closely watching inflation to see whether recent pressures are transitory or more persistent and will act if necessary, in a signal that further policy easing is unlikely.

Household spending accounts for more than half of Australia's economic output and, as a result, is closely watched by policymakers.

Donald Trump's aides and allies are discussing the possibility of making Treasury Secretary Scott Bessent the top White House economic adviser — in addition to his current job — should the president pick Kevin Hassett as the next chair of the Federal Reserve, according to people familiar with the matter.

Tapping Bessent to lead the White House's National Economic Council would allow him to consolidate oversight of Trump's economic policies if Hassett — the current NEC director — becomes the next leader of the US central bank, an announcement Trump has hinted at in recent days. The people spoke on the condition of anonymity to discuss potential moves that have not been finalized.

If Bessent is also named to the NEC, he would become the chief arbiter of the administration's economic portfolio spanning the purview of both the Treasury Department and White House. It would also give Bessent a West Wing office, granting him even more physical proximity to the president.

A White House official said any personnel changes should be considered speculation until announced by the president. A representative for the Treasury Department did not respond to a request for comment.

Trump is known to make surprise personnel decisions, meaning that any potential moves for Hassett or Bessent aren't final until they're made public.

Still, having multiple titles is a hallmark in the Trump administration. The Treasury secretary is also already serving as the acting Internal Revenue Service commissioner. Having Bessent take on the NEC role would mirror Secretary of State Marco Rubio's multi-faceted job. Rubio also leads the National Security Council, serves as the acting archivist of the United States and was the acting head of the US Agency for International Development before it was abolished.

It's not clear if Trump will want to continue to appoint senior people to multiple roles. Several top economic jobs within the administration are currently unfilled or without permanent leadership.

The National Economic Council works on all economic issues out of the White House including taxes, health care and energy and serves as a key policy coordinator for those ideas and plans across the federal government.

But the NEC has played a diminished role in Trump's second term, with the office focusing less on developing policy than was the case under prior presidents. Hassett has largely served as an advocate for Trump's policies, giving public speeches and routinely appearing on TV.

Trump said he's made his decision on a Fed pick, narrowing a list of roughly 10 candidates down to one. The president called Hassett a "potential Fed chair," but also said he would wait until early 2026 to make an official announcement.

"He's a respected person that I can tell you. Thank you, Kevin," Trump said on Tuesday.

Other finalists for central bank chair have included Fed Governors Christopher Waller and Michelle Bowman, former Fed Governor Kevin Warsh and BlackRock's Rick Rieder.

Fed chair and governor picks typically represent the most direct way for presidents to influence the central bank. Trump has been vocal in criticizing the Fed for moving too slowly to cut borrowing costs and for expensive renovations of its campus.

Whomever Trump picks for Fed will require Senate confirmation as chair, and to the board itself if they're not already a governor. The NEC job does not require Senate approval.

The U.S. Census Bureau said on Wednesday it was adopting several strategies, including shortening the window for Principal Federal Economic Indicators collection, to get economic data back to their original release schedule "as quickly as possible."

"For our PFEIs to return to their original release schedules, processing stages must be accelerated and condensed where possible while still adhering to established quality standards," the Census Bureau said in a statement posted on its website.

A record 43-day shutdown of the government has delayed economic releases. The October employment and consumer price reports have been canceled because the shutdown prevented the collection of data, which could not be done retroactively.

"For example, if the typical process allows 10 business days to obtain response, narrow it to seven days," the agency said. "For construction indicators that use field representatives, there may be an opportunity to collect two reference periods simultaneously."

It was also temporarily reallocating resources to prioritize high-value review and correction while ensuring the shorter analysis period would not negatively impact data quality. While there were no changes to the treatment of nonresponses as the process was automated, the Census Bureau said more attention was being paid to "mitigate any negative effects of reduced response stemming from a shorter collection window."

There was minimal change to the seasonal adjustment process, which is mostly automated. The agency, however, said "there may be an opportunity to readjust resources to help fast-track review and validation component of seasonal adjustment."

Seasonal adjustment is used to strip out seasonal fluctuations from economic data. The Census Bureau is also temporarily reallocating resources to fast-track review, approval and dissemination processes.

"By leveraging the strategies above, a Census Bureau PFEI such as monthly wholesale trade could temporarily reduce its total processing time from 30 to 20 days," the agency said.

"If the indicator is starting 40 days behind schedule due to the lapse (in government funding), it could return to its original release cadence within four reference periods after implementing the acceleration strategy."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up