Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

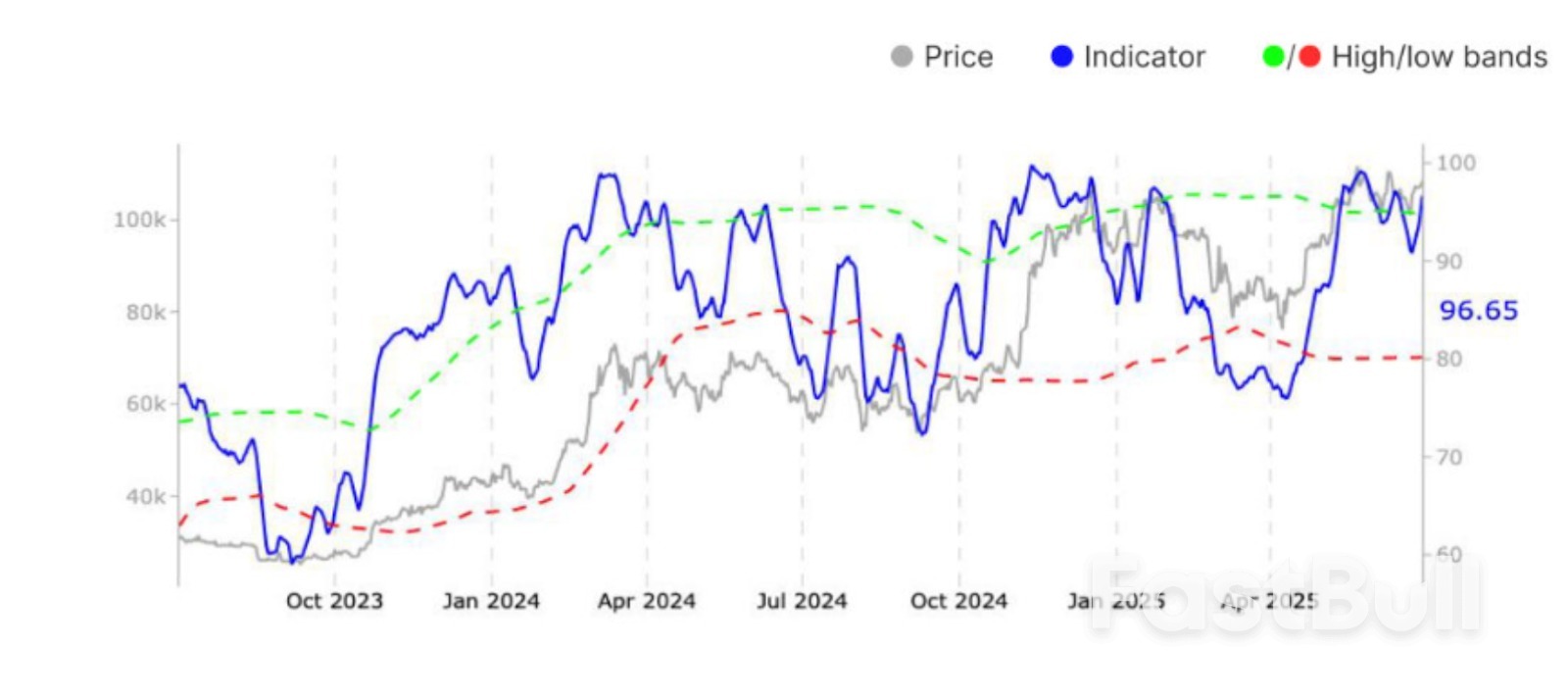

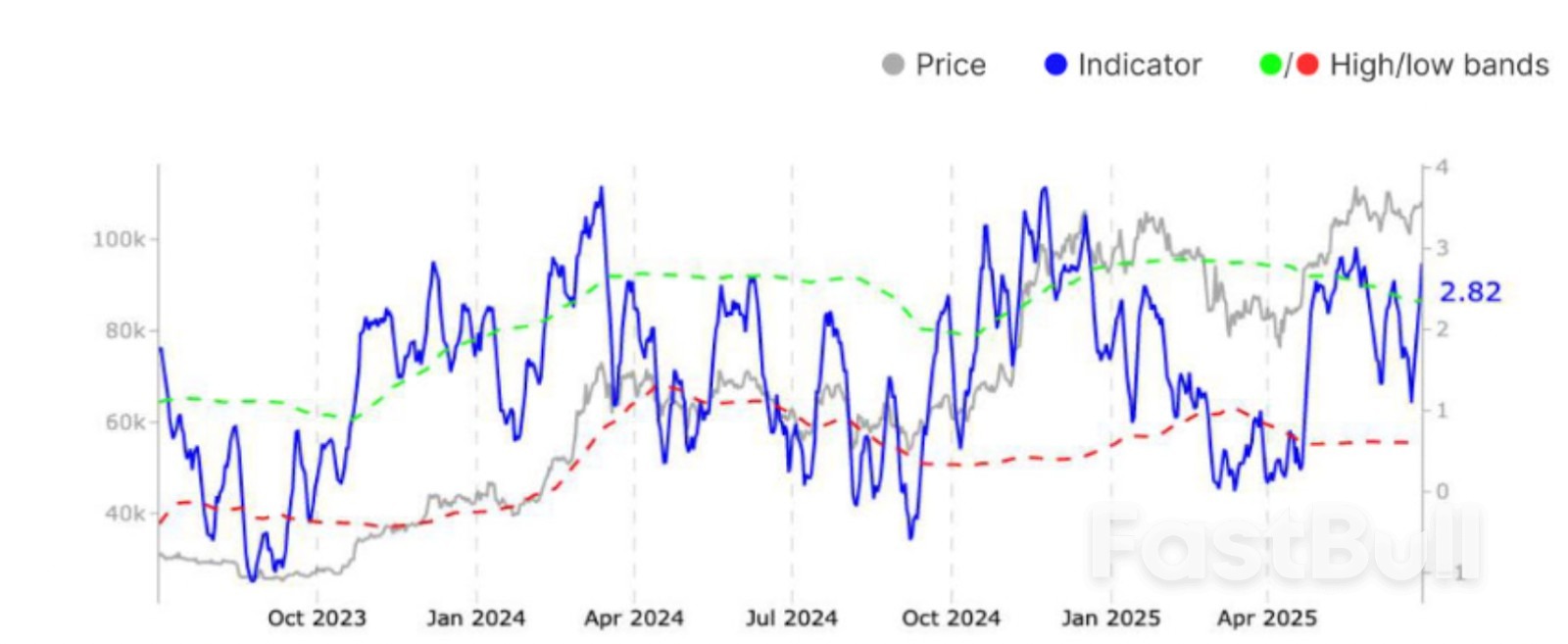

Bitcoin’s high profitability signals a possible correction in the short term amid increasing calls for $200,00 BTC price later in 2025.

One month after the BLS reported that in April the labor market rebounded, as the number of job openings rose sharply by 191K to 7.4 million, and far above estimates of a 7.1 million print, moments ago we got another indication that the labor market is staging a remarkable rebound when the BLS reported that in May the number of job openings soared by 374K to 7.769 million, the highest since Nov 2024 and smashing estimates of a drop to 7.3 million (from an upward revised 7.395 million print).

According to the BLS, the number of job openings increased in accommodation and food services (+314,000) and in finance and insurance (+91,000). The number of job openings decreased in federal government (39,000)

but the highlight is that after a mysterious spike last month which prompted us to muse if DOGE had achieved anything at all, we got a resounding answer today when the BLS confirmed that last month's jump was an outlier and the number of Federal government job openings tumbled by almost a third, from 128K to just 89K, the lowest since covid.

In the context of the broader jobs report, it appears the US labor market may have dodged a bullet because whereas in March the labor market was almost demand constrained, when there were just 117K more openings than jobs in the US, since then the differential has risen and in May the number of job openings was 532K more than number of employed workers, suggesting the onset of a labor recession has once again been punted.

As noted previously, until this number turns negative - which it almost did but may have now averted for the foreseeable future - the US labor market is not demand constrained, and a recession has never started in a period when there were more job openings than unemployed workers.

Said otherwise, in May the number of job openings to unemployed rose for the first time in months, from 1.0x to 1.1x.

While the job openings data was a surprising big beat and continued rebound, there was some mixed news on the hiring side where the number of new hires dipped modestly to 5.503 million from 5.615 million, which was the highest in over a year, so hardly screaming collapse in the labor market. Meanwhile, the number of workers quitting their jobs - a sign of confidence in finding a better paying job elsewhere - rose modestly after dropping the previous month, and in May it grew to 3.293 million from 3.215 million.

Well it may have to do with the DOL starting to factor in the collapse in the shadow labor market - the one dominated by illegal aliens - and the replacement of illegals with legal, domestic workers. And since this will surely lead to higher wages, we doubt many Trump supporters will hate the development, even if it means an increase in inflation down the line.

Daily US Dollar Index (DXY)

Daily US Dollar Index (DXY) Daily Gold (XAU/USD)

Daily Gold (XAU/USD)

In 11 years of European Central Bank retreats to the Portuguese resort of Sintra, euro-region crises have too often been an embarrassing distraction.

That makes this week’s gathering fairly remarkable. While the seminars unfolded on Tuesday, data showed inflation at exactly 2%. As Bundesbank chief Joachim Nagel mused on Bloomberg Television, “we’re at our target, and this is really good news.”

So what is the ECB’s next challenge? On Monday evening, President Christine Lagarde offered a reasoned guess: even more of the same.

“The world ahead is more uncertain,” she told attendees over dinner. “That uncertainty is likely to make inflation more volatile.”

Her remarks explained the ECB’s latest strategy review, unveiled yesterday, that keeps officials committed to a “symmetric” approach, focused on either an undershoot or an overshoot of 2%.

But as Lagarde suggested, they’re concerned about greater swings in consumer prices. And while the worry during the last review in 2021 was on the risk of inflation being too low, this time the ECB has just emerged from the worst price growth in the history of the euro. Officials are preoccupied about a repeat — not least because cost changes seem to happen so fast these days.

“If wages then adjust only gradually to these price increases – as we saw in recent years – inflation may remain above target for longer as wage growth slowly catches up,” Lagarde said. “This, in turn, can raise the risk of inflation expectations de-anchoring on the upside.”

A related worry came from the Bank for International Settlements on Sunday. Its officials warn that consumers, scarred by recent inflation, may be far less tolerant of price shocks than they were before the pandemic.

US Treasury Secretary Scott Bessent isn’t persuaded, at least with regard to Americans. Questioned on Bloomberg Television about whether import levies could stoke inflation — a preoccupation both of the BIS and the Federal Reserve — he was dismissive.

“We have seen no inflation from tariffs,” he said. “If we do, which we don’t have to, then they would be a one-time price adjustment. Nothing is more transitory than that.”

Time will tell. Given the volatile environment they’re operating in, neither Lagarde nor Fed Chair Jerome Powell, who will speak together on a panel today, show much sign of being convinced of that for now.

Live from Sintra: Bloomberg’s Francine Lacqua moderates the policy panel at the ECB Forum featuring Jerome Powell, Christine Lagarde, Andrew Bailey and Kazuo Ueda. From 2:30 p.m. London time on July 1 on Bloomberg Television, TLIV on the terminal and Bloomberg.com .

The first seminar of the ECB’s Sintra forum today looked at a sore question for Europeans: why does the American economy perform so much better than theirs?

The answer, according to a paper by Benjamin Schoefer, an associate professor at the University of California at Berkeley, may be uncomfortable for Europeans. He says a large part of the problem may be a rigid employment environment that discourages changes in roles and careers.

“The institutional landscape of European labor markets looks much as it did in the 1980s — high taxes, strong job protection, collective wage setting, and mandated worker voice have proven resilient,” he wrote.

That model “delivered relatively equitable growth” for decades along with other advantages, Schoefer says, before adding a caveat. “These benefits may lose currency as the material gap continues to widen,” he wrote.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up