Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

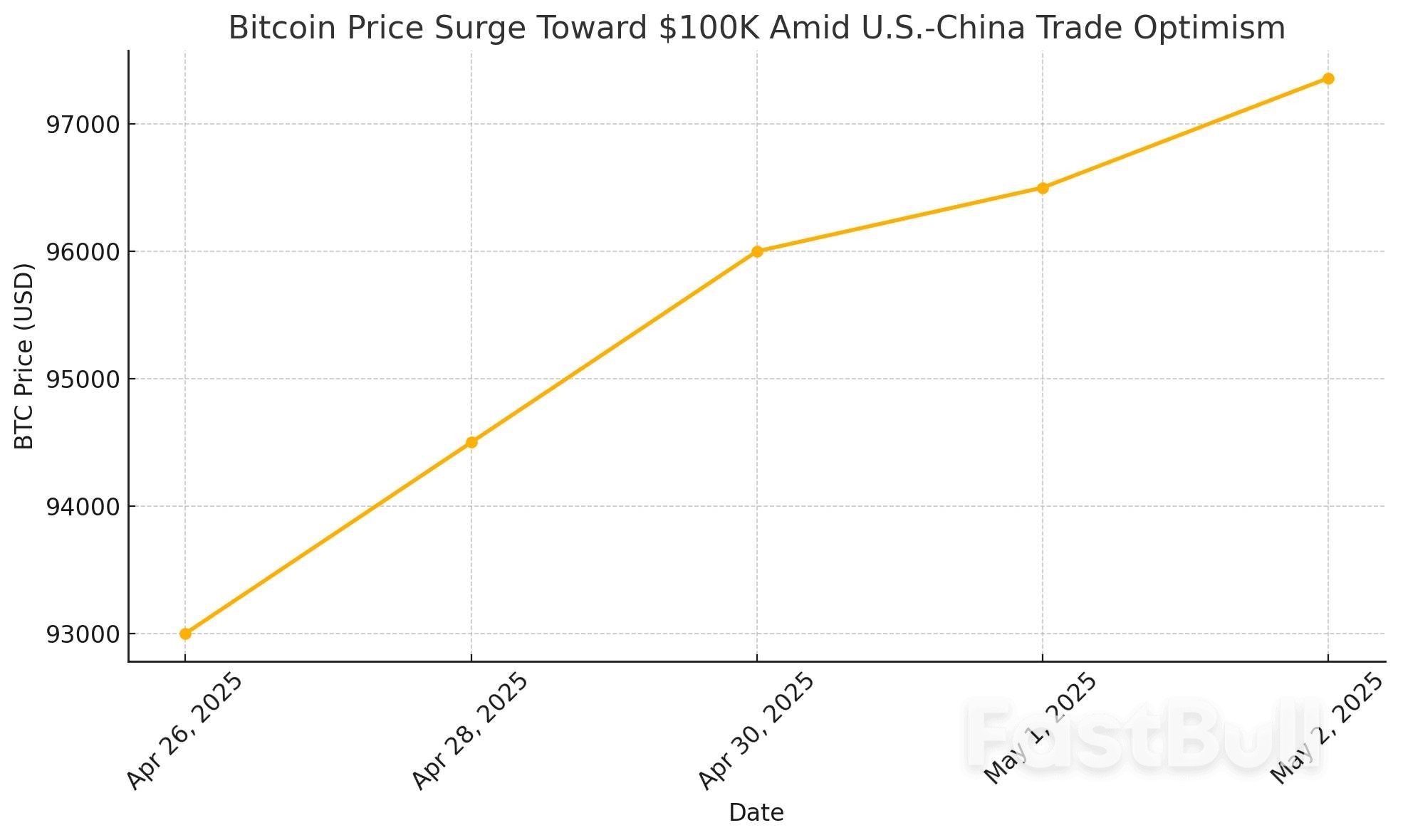

Bitcoin surges on geopolitical optimism as it has officially broken above $97,000, reaching its highest level in weeks, as optimism around a potential U.S.-China trade breakthrough fuels global risk-on sentiment.

Bitcoin surges on geopolitical optimism as it has officially broken above $97,000, reaching its highest level in weeks, as optimism around a potential U.S.-China trade breakthrough fuels global risk-on sentiment. The world’s largest cryptocurrency is riding the wave of macroeconomic momentum, institutional inflows, and strategic demand in emerging markets.

“Bitcoin has become a geopolitical barometer,” said analyst Joe Burnett. “When tensions ease or cooperation increases, Bitcoin typically benefits from increased market confidence.”

Bitcoin is now just a few percentage points away from the psychological $100,000 level — a threshold traders believe could trigger a fresh round of institutional inflows.

The recent surge is largely driven by speculation that the United States and China may be approaching renewed trade negotiations. Markets reacted positively to reports that diplomatic teams are exploring a potential “framework agreement” by June.

Although Polymarket odds place a full deal at just 20%, the possibility of eased tariffs and restored cross-border economic flow is enough to bolster investor confidence across risk assets — Bitcoin included.

“Crypto is a beneficiary of global stability,” said CoinMetrics’ Kyle Waters. “The more predictable the macro backdrop, the more capital is allocated to assets like BTC.”

It’s not just Bitcoin that’s booming. Altcoins and AI tokens are gaining significant traction, highlighting broader market confidence.

Kava Labs surpassed 100,000 users on its decentralized AI platform, drawing institutional interest in transparent AI infrastructure.

ETH, SOL, and TON all posted 3–6% gains in the past 24 hours.

Meanwhile, BlackRock and Fidelity have reportedly expanded BTC holdings across ETF and trust products, confirming the growing appetite from traditional finance players.

While Bitcoin’s uptrend is strong, some risks remain:

A collapse in trade negotiations could trigger a pullback.

U.S. macro data (jobs, CPI) due next week could sway Fed policy expectations.

Short-term overbought signals may cause profit-taking around $100K.

“It’s not a straight line to $100K,” warned Alex Krüger. “But we’re entering the stage where dips are getting bought aggressively.”

Can Bitcoin Hit $100K This Month?

The short answer: yes, but cautiously.

With BTC climbing above resistance, macro winds at its back, and ETF inflows rising, the setup is there. What’s missing is a final catalyst — possibly the announcement of a tangible U.S.-China trade agreement or a breakout in altcoin dominance to spread liquidity across the ecosystem.

Bitcoin’s latest surge past $97K shows that geopolitics and crypto markets are more intertwined than ever. As global leaders navigate trade diplomacy, Bitcoin remains an asset reflecting investor hope and market uncertainty.

If optimism continues to build, and no black swan events disrupt momentum, Bitcoin at $100K may not just be a dream, but a near-term reality.

Why did Bitcoin jump above $97K?

The surge was fueled by optimism around potential U.S.-China trade negotiations, institutional inflows, and macroeconomic stability.

What is the significance of a $100K Bitcoin?

$100,000 is a psychological and technical milestone. Reaching it could attract more institutional investors and reinforce Bitcoin’s status as digital gold.

Are there any risks to Bitcoin’s rally?

Yes. Breakdown in trade talks, unexpected Fed moves, or profit-taking near $100K could cause short-term pullbacks.

What altcoins are also rising?

ETH, SOL, TON, and AI-related tokens like those on Kava Labs’ platform have seen significant gains alongside BTC.

The dollar dipped on Friday, with investors nervous about chasing its recent rebound too much further ahead of important U.S. jobs data, but it remained set for a weekly rise against nearly all peers.

The risk-sensitive Aussie and kiwi dollars climbed in Asia trade as European and Asian shares continued a rally that began on Wall Street against the backdrop of updates from China and Japan on tariff discussions with the Donald Trump administration.

And that dollar selling then broadened out into other currencies with the greenback down 0.45% on the Japanese yen at 144.76, the euro up 0.35% at $1.1330 and China's offshore yuan at a near six-month top of 7.225 per dollar.

Nonetheless, the U.S. dollar was still on track for a third straight weekly advance. Alongside U.S. Treasuries and shares, it has bounced from steep declines last month as President Donald Trump's erratic tariff policies drove fears of a recession and sapped confidence in U.S. assets.

"The dollar has benefited from month-end flows," said Kenneth Broux, head of corporate research FX and rates at Societe Generale.

He said the dollar had been supported earlier this week by the Bank of Japan's dovishness on Thursday, as well as strong earnings reports from U.S. tech giants, the rally on Nasdaq (.IXIC), opens new tab and flows into U.S. equities.

"Maybe the whole 'sell America' story looked a little bit overdone. And we saw Japanese investors also buying the most foreign bonds in eight weeks, tempering expectations that everybody in the world is going to sell Treasuries," Broux said.

Shaping moves on Friday, U.S. Secretary of State Marco Rubio told Fox News late on Thursday that talks with China will come up soon. His comments came on the heels of a Chinese state media report seen as a signal of Beijing's openness to trade negotiations.

Beijing was "evaluating" an offer from Washington to hold talks over Trump's tariffs, China's Commerce Ministry said on Friday.

The China-exposed Australian dollar rose 0.77% to $0.6432.

Separately, Japan's top trade negotiator, Ryosei Akazawa, said he deepened talks on trade, non-tariff measures and economic security cooperation with U.S. Treasury Secretary Scott Bessent in Washington on Thursday.

And Finance Minister Katsunobu Kato said Japan could use its $1 trillion-plus holdings of U.S. Treasuries as leverage in trade talks with Washington.

Market participants are now looking to the non-farm payrolls (NFP) report at 1230 GMT for an indication on when the Federal Reserve will resume cutting rates. Wall Street economists are forecasting 130,000 new jobs created last month, compared with a print of 228,000 seen in March.

Many investors expect Trump's chaotic trade policy to hurt the U.S. economy, but until now it has been too early for this to be seen in hard economic data. It is likely too early for the payrolls to offer much more than a hint either, but it could help.

Societe Generale's Broux said a number far from the consensus would actually be better, helping clarify whether the U.S. was heading for a recession, which would mean more Fed rate cuts, or would avoid a sharp slowdown.

In terms of currencies, "the question is whether we sell that dollar rally again, because that has been the modus operandi in FX now for a couple of weeks", he said.

Spain suffered several power glitches and industry officials sounded repeated warnings about the instability of its power grid in the build up to its catastrophic blackout on Monday.

The government has ordered several investigations into the blackout. Industry experts say that whatever the cause, the mass outage and earlier smaller incidents indicate the Spanish power grid faces challenges amid the boom of renewables.

A surplus of energy supply can disrupt power grids in the same way as a deficit, and grid operators must maintain balance.

In the week before the blackout, Spain saw several power surges and cuts.

A power cut disrupted railway signals and stranded at least 10 high-speed trains near Madrid on April 22. Transport Minister Oscar Puente said excessive voltage in the power network had triggered disconnections to protect substations.

On the same day, Repsol's (REP.MC), opens new tab Cartagena refinery saw its operations disrupted by power supply problems.

The grid suffered from significant instability in the days before the blackout, said Antonio Turiel, a senior researcher with the Spanish National Research Council.

Spain's grid operator REE did not reply to a request for comment. Spain's energy ministry declined to comment.

Spain has ordered inquiries involving government, security agencies and technical experts. A high court judge has launched a probe into whether a cyber attack was to blame.

The Spanish power grid had been on a knife edge for several days due to power system imbalances, said Carlos Cagigal, an energy expert who advises private firms on renewable and industrial projects.

Prime Minister Pedro Sanchez and power grid operator REE's chief Beatriz Corredor have both said record levels of renewable energy were not to blame for Monday's blackout.

But REE and Europe's power grid lobby ENTSO-E had both previously warned that the rapid rise of power generation from renewables could destabilise the grid.

Small renewable generators were putting extra pressure on the infrastructure, REE said in a 2024 report, and REE's parent company Redeia (REDE.MC), opens new tab said in February the grid lacked information from smaller plants to be able to operate in real time.

The risk of power cuts is rising, Redeia warned because the closure of coal, gas-fired and nuclear plants reduces the grid's balancing capacities.

"This could increase the risk of operational incidents that could affect supply and the company's reputation," the company said.

Solar farms generate direct current (DC) power which doesn't have a frequency like alternating current (AC) power generated by conventional plants. DC power needs to be converted to AC in inverters to be transmitted via grids.

If solar generation drops, the grid requires backstop AC power to prevent frequency dropping below dangerous levels after which most power contributors disconnect from the grid.

"Shutting down the nuclear plants may put electricity supply at risk," REE's former chair Jordi Sevilla told Spanish news website Voxpopuli in January. Spain plans to shut down all seven nuclear reactors by 2035.

The planned closure of two nuclear reactors at southwestern Spain's Almaraz plant, starting in 2027, will increase the risks of blackouts, European power lobby ENTSO-E said in April.

REE responded to ENTSO-E by saying there was no risk of a blackout and it could guarantee stable energy supply.

Less than a week later, Almaraz temporarily shut down the two units citing abundant wind energy supply as making operations uneconomic. One unit was still offline on Monday.

The blackout across Spain and Portugal knocked out communications and transport systems, shut down industry and offices and brought commerce to a virtual standstill.

The blackout could have shaved 1.6 billion euros ($1.82 billion), or 0.1%, off GDP, Spain's business lobby estimated.

U.S. stock index futures rose on Friday as hopes of a de-escalation in a punishing U.S.-China trade war offset disappointing earnings updates from Apple and Amazon.

Global stocks rose as Beijing said on Friday it was "evaluating" an offer from Washington to hold talks over U.S. President Donald Trump's 145% tariffs on China.

Their back-and-forth over tariffs has kept investors on edge, with both sides unwilling to be seen backing down in a trade war that has roiled global markets and upended supply chains.

Still, Trump's reversal of some tariffs on global trade partners has helped U.S. stock indexes recover sharply from recent losses. The tech-heavy Nasdaq closed on Thursday at levels last seen before April 2, dubbed "Liberation Day", when Trump unveiled massive global tariffs.

Despite signs of reprieve on the trade front, the rapid shifts in U.S. tariff policies have forced some companies to warn of business impacts or pull earnings forecasts amid worries of higher costs and a hit to economic growth.

Apple slid 2.9% in premarket trading after the iPhone maker trimmed its share buyback program by $10 billion and CEO Tim Cook told analysts that tariffs could add about $900 million in costs this quarter.

Amazon.com was down 1.6% after the company forecast second-quarter operating income below estimates as concerns about tariffs and its impact on consumer spending clouded the outlook.

At 06:09 a.m. ET, Dow E-minis rose 224 points, or 0.55%. Nasdaq 100 E-minis climbed 63.25 points, or 0.32%, and S&P 500 E-minis were up 26.75 points, or 0.48%.

Investors also await the Labor Department's closely watched employment report at 8:30 a.m. ET (1230 GMT) for clues on the health of the U.S. labor market.

The report is expected to show nonfarm payrolls increased by 130,000 jobs last month after rising by 228,000 in March. Part of the anticipated step-down in payrolls would be due to the fading boost from warmer weather.

Average hourly earnings are forecast to have risen by 0.3%, matching March's gain.

Among other stocks, Block slumped 21.3% after cutting its profit forecast for 2025 and missing estimates for quarterly earnings, as the payments firm grapples with muted consumer spending.

Airbnb dipped 4.5% after the vacation rental platform forecast second-quarter revenue largely below Wall Street estimates and signaled softening demand in the U.S.

Eurozone inflation stayed locked at 2.2% in April, missing the forecast of 2.1%, according to flash figures published Friday by Eurostat.

The number didn’t move from where it was in March, even though economists had expected it to dip closer to the European Central Bank’s 2% target.

Analysts surveyed by Reuters had predicted a small decline from March’s 2.2% as inflation appeared to slow over recent months. That didn’t happen. Headline inflation stayed flat, showing no sign of easing further this time around.

Underneath the headline number, core inflation went up. It rose to 2.7% in April from 2.4% the month before. Core inflation excludes food, energy, tobacco, and alcohol. The rise shows that the broader pressures on prices aren’t done yet.

Services inflation also jumped, reaching 3.9%, up from 3.5% in March. Both numbers show that while the overall inflation rate held steady, deeper parts of the economy are still running hot.

Across the bloc, national figures also came in. On Wednesday, Germany’s federal statistics office said it expects harmonized consumer prices to rise 2.2% in April. That’s a drop from the month before, but still slightly higher than what was forecast.

Meanwhile, France posted a harmonized inflation rate of 0.8%, a bit higher than expected too. These figures are harmonized for consistency across the Eurozone.

Speaking last week, European Central Bank President Christine Lagarde told CNBC, “We’re heading towards our [inflation] target in the course of 2025, so that disinflationary process is so much on track that we are nearing completion.”

Christine added that the ECB would be “data dependent to the extreme” when making calls on interest rates. She didn’t give a timeline for more cuts but warned that the medium-term path for inflation was uncertain.

Christine and other policymakers raised concerns about possible trade retaliation from Europe in response to U.S. tariffs, now a growing risk under President Donald Trump’s administration. They also mentioned that big fiscal plans like Germany’s infrastructure package could affect future price levels.

Last month, the ECB cut its key interest rate, bringing the deposit facility rate down to 2.25%. That rate had peaked at 4% in mid-2023. The bank is keeping its eyes on inflation trends and will adjust again only if the numbers justify it.

This week also saw new signs of life in the Eurozone economy. Preliminary data showed that the bloc’s GDP grew 0.4% in the first quarter of 2025. That beat forecasts, which expected 0.2% growth. It also followed a revised 0.2% growth in the final quarter of 2024.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up