Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

I gues Japan is now a bad guy too!

I gues Japan is now a bad guy too!

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The recent dip in the broader crypto market was led by the gloomy momentum recorded in Bitcoin price.Besides, the altcoins also followed suit, erasing around 1% from the global crypto market cap to $3.78 trillion, indicating a cautious stance of traders.

The recent dip in the broader crypto market was led by the gloomy momentum recorded in Bitcoin price.

Besides, the altcoins also followed suit, erasing around 1% from the global crypto market cap to $3.78 trillion, indicating a cautious stance of traders.

Notably, the dip in the recent BTC USD value could be attributed to a flurry of factors, including geopolitical tensions and waning institutional interest.

For context, Donald Trump has fueled the market concern with his threat to impose hefty tariffs on China.

In retaliation, China also said that the country would stand firm against the decision, which has spooked the investors.

As a result, the crypto market bleeds heavily, falling from the brief $4.15 trillion market cap of last week.

Simultaneously, Bitcoin price also slipped last week, falling to as low as $104k amid a broader market selloff.

Now, some analysts have further fueled concerns, saying that the BTC USD bull cycle is coming to an end.

So, let’s take a quick tour of the recent performance of the BTC price and the potential reasons behind the selloff.

Besides, we would also explore what lies ahead for the flagship crypto in the coming days.

BTC price today was down more than 0.5% and traded at $111,479, and its one-day volume fell 10% to $73 billion.

Notably, the crypto has touched a 24-hour high and low of $112,294 and $109,721, respectively.

The massive selloff has resulted in a weekly crash of over 10% in Bitcoin price. Besides, its monthly loss was recorded at 4%.

As said earlier, this dip could be attributed to the geopolitical tensions and waning institutional interest.

According to CoinGlass data, the BTC USD Futures Open Interest fell 0.4% over the last 24 hours to $653.94k BTC.

However, on the CME Exchange, the Open Interest (OI) was up around 2.35%, while Binance saw the largest decline of 2.42%.

So, here we take a look at the potential reason behind the dip in Bitcoin price before exploring what may lie ahead for the asset.

A flurry of factors may have weighed on the sentiment, triggering a widespread selloff in the market.

However, it appears that the soaring geopolitical tensions might have caused the most damage in the market, acting as a negative catalyst for the decline.

The trade war tensions have so far weighed on the investors’ sentiment, causing volatility across the financial market, let alone the crypto sector.

Having said that, the recent tensions between the US and China might have fueled the concerns. This has also forced the retail traders as well as institutions to stay on the sidelines.

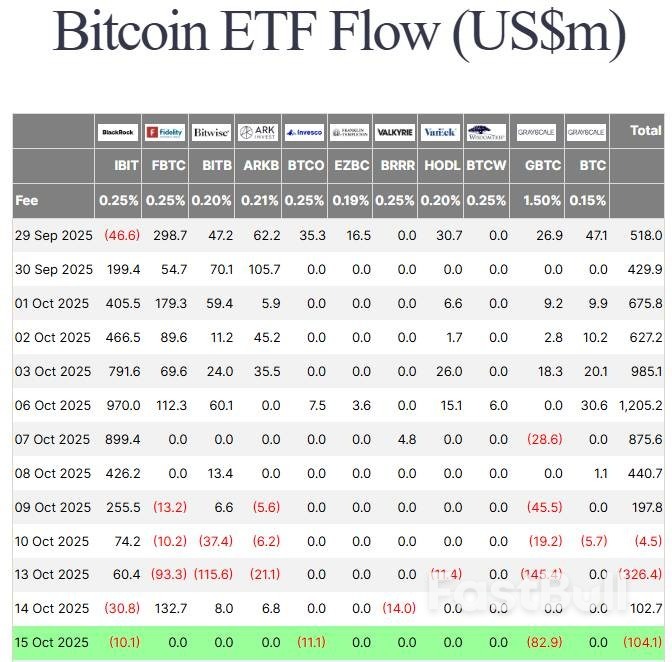

For context, Farside Investors’ data showed that the US Spot Bitcoin ETF has once again recorded an outflow of $104.1 million on Wednesday, October 15.

The investment instrument recorded an inflow of $102.7 million the previous day, on October 14, which has allayed some concerns of traders.

However, the continuing outflow since October 10 has weighed on the sentiment, indicating that the institutions are shifting focus from Bitcoin.

US Spot Bitcoin ETF Fund Flow | Source: Farside Investors

US Spot Bitcoin ETF Fund Flow | Source: Farside InvestorsAmid the gloomy momentum, analyst Captain Faibik has further fueled concern with his latest Bitcoin price prediction.

In a recent X post, the expert said, “I’m not bullish on Bitcoin anymore. That’s it.”

Besides, he said that “Bitcoin bull run is nearing its end.” This comment has sparked discussions among traders, with his prediction of a massive correction ahead further fueling market concerns.

Bitcoin Price Analysis | Source: Captain Faibik, X

Bitcoin Price Analysis | Source: Captain Faibik, XHowever, expert Michael van de Poppe has shared a different outlook, evaluating the monthly chart of BTC USD. Poppe noted that the monthly chart looks “pretty much fine.”

BTC USD Price Action | Source: Michael van de Poppe, X

BTC USD Price Action | Source: Michael van de Poppe, XBesides, he has advised traders to buy the dip, predicting that an all-time high is incoming.

According to Poppe, BTC USD finds major support at $107k, and as long as the support holds, the future trajectory looks bullish.

In addition, his chart reveals that Bitcoin price faces major resistance at $119,504. Once this support is broken, BTC could target a new all-time high.

Bitcoin Price Prediction | Source: Michael van de Poppe, X

Bitcoin Price Prediction | Source: Michael van de Poppe, XHowever, investors should tread cautiously amid the ongoing volatile scenario in the market.

With the geopolitical tensions weighing on traders’ sentiment, the market may face a major pullback in the coming days.

The post Bitcoin Price Slips: Bull Run Coming To An End? appeared first on The Coin Republic.

Minneapolis Federal Reserve President Neel Kashkari said Thursday he does not think that there is a big chance the labor market will weaken sharply or inflation will surge, though of the two, "there’s more risk of a labor market negative surprise than a big uptick in inflation."

"On the other hand, if I were to guess which mistake we’re more likely making, I think we’re more likely betting that the economy is really slowing more than it really is," Kashkari told a town hall in Rapid City, South Dakota.

Kashkari supported the Fed’s quarter-point interest-rate cut in September and feels two more such cuts will be warranted by the end of the year, he said last month. Like many of his colleagues, he sees the rate cuts as a form of insurance against dire outcomes that may not actually materialize.

Last year, for instance, the Fed cut rates to shore up what many policymakers feared was a rapidly softening labor market, and the economy proved to be unexpectedly resilient, he said.

As for inflation, Kashkari said Thursday that he thinks it is unlikely the inflation rate will rise to 4% or 5%, "because we can do the math of what tariff rates translate into what inflation. So I think the risk of inflation is more of one of persistence - that it’s not so much of a one time event, but that it stays at 3% for an extended period of time."

The Fed targets 2% inflation; in August it was 2.7% by the Fed’s targeted measure. Some of Kashkari’s policymaking colleagues say the Fed should be cautious about cutting rates when the inflation rate is too-high and rising

Though the ongoing federal government shutdown is delaying the publication of economic data, Fed policymakers have enough unofficial data through private sources and their own community and business outreach efforts to have a pretty good idea of economic conditions, Kashkari said.

"We can make our way through while the shutdown is happening," Kashkari said. "But the longer it goes on, the less confidence I have that we are reading the economy appropriately, because there’s no substitute for the gold standard government data that we rely on."

President Donald Trump has his sights once again on ending the Ukraine conflict, announcing another meeting with Russian Vladimir Putin after a first summit in Alaska failed to yield progress.

The president framed the decision, announced after he spoke with Putin for more than two hours Thursday, as a plan to bring peace at last to a conflict that he once claimed he’d solve within a day. But it also deflates any pressure that had been building on Putin in recent weeks as Trump vented frustration with the Russian leader’s foot-dragging to end the war.

Trump’s call with Putin also preempted a meeting he’s set to have on Friday with Ukrainian President Volodymyr Zelenskiy. Trump had adopted an increasingly warmer tone toward Zelenskiy in recent weeks as he cooled on Putin — a stark change from his more frigid stance toward the Ukrainian leader earlier in his administration, including a public dressing down in the Oval Office earlier this year.

Even more worrying for Zelenskiy, Trump equivocated on Thursday about both the possibility of sending long-range Tomahawk missiles as well as a Senate push for punishing sanctions against Russia.

“We need Tomahawks for the United States of America, too,” Trump told reporters in the Oval Office. “So I don’t know what we can do about that.” Of sanctions, he said the Republican push for tough new measures “may not be perfect timing, but it could happen in a week or two.”

Both Ukraine and Russia have sought to take advantage of Trump’s momentum after the Gaza summit that halted fighting between Hamas and Israel — though to opposite ends. Zelenskiy believes Trump’s growing frustration with Putin could lead him to apply the pressure the White House has so far resisted. He’ll renew pleas for air defense and assistance in sourcing new energy supplies along with the coveted Tomahawks.

But Trump has yet to sign off on issuing those to Ukraine, and Putin in his call with Trump warned the US president doing so “would cause significant damage to relations between our countries, not to mention the prospects for a peaceful settlement,” according to a readout by the Kremlin.

Sergey Radchenko, a Cold War historian and professor at the Johns Hopkins School of Advanced International Studies, said it was “almost foolhardy” for Trump to agree to another meeting given that the Alaska summit in August produced no agreement despite all the fanfare. What’s needed, he said, was to combine pressure with communication.

“I’m seeing a lot of efforts at dialogue,” Radchenko said. “I’m not yet seeing maximum pressure.”

Instead the US president appears to be relying on carrots to lure Putin to the table. Trump noted the two leaders spoke extensively about the prospects for trade after the war ends. According to the Kremlin, Trump stressed the economic opportunities would be “colossal.”

With the plans for lower-level dialogue and an eventual leaders’ summit, “Putin is essentially buying time, delaying the delivery of much-needed United States weapons to Ukraine and the implementation of the energy sanctions that Trump has promised,” according to Maria Snegovaya, senior fellow for Russia and Eurasia with the Europe, Russia, and Eurasia Program at the Center for Strategic and International Studies.

The venue of Trump’s planned summit with Putin — Budapest — is also likely to be viewed with skepticism from European allies as an attempt by the Russian leader to drive a wedge between the US and Europe. Hungarian Prime Minister Viktor Orban has been the target of fierce criticism from its European Union and NATO allies for maintaining close ties with Russia, even after Putin invaded Ukraine. This has included speaking out against EU sanctions on Moscow, barring the delivery of weapons to Ukraine and locking Hungary into a long-term gas contract with Russia.

Trump has put the onus on Europe to cut off all energy supplies from Russia as a precondition for the US to take tough measures on Russia. But after the European Union drastically cut purchases of Russian oil and gas since the onset of its war on Ukraine, Hungary has been one of the few countries in the bloc to continue to rely on Russian imports.

Despite the European tensions, Trump has long seen Orban as a close ally on the world stage, part of a small cohort of MAGA-allied foreign leaders. As such, the American president may see Budapest as friendly territory for a summit with his Russian counterpart.

The Hungarian leader said in a post on social media platform X that preparations for the “USA-Russia peace summit” were underway, adding that “Hungary is the island of PEACE!”

For Trump, holding a second Putin summit carries considerable risk if there’s no plan by the White House to simultaneously impose costs on Russia, according to Celeste Wallander, an adjunct senior fellow at the Center for a New American Security and a top Pentagon official in charge of Russia and Europe during the Biden administration.

If the summit ends with no acceptable agreement, it would once again “allow Putin to use the opportunity to send a message to the world that he’s kind of in control of the narrative,” she said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up