Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Javon Marks identifies a bullish MACD divergence as BTC prints lower lows in price but higher lows on momentum indicators.MACD lines are converging with RSI stabilizing, suggesting a potential breakout above recent swing highs may follow technical confirmation.BTC remains supported by its long-term trendline as accumulation rises, with whales buying dips according to the A/D line.

Bitcoin ($BTC) is showing technical signals of an imminent bullish reversal since its momentum indicators are diverging from its current price action. The setup indicates decreasing downward momentum with declining prices, a signal typically monitored to track the changes in market cycles.

As noted in a tweet by Javon Marks, this divergence on the chart of Bitcoin may have the price making a strong move up if supported by any further technical signals. The MACD lines are converging right now, which suggests there could be an impending bullish crossover. Such a crossover would terminate the existing downtrend if confirmed with rising volume and a close above the local high.

The current chart on the BTC/USD depicts a classic divergence condition in which the prices make lower lows but the MACD indicator makes higher lows. Such divergence indicates a weakening in the momentum to the downside, which is usually the precursor to a reversal or a bounce.

On the weekly graph, Bitcoin is still above an enduring ascending trendline that has experienced consistent buying pressure since late 2022. Every price drop to this trendline has witnessed an upside reaction, maintaining the general bullish setup in place.

Stochastic RSI on the weekly chart is in the zone of overselling. The %D and %K lines are both beneath 20 and are set to cross above it soon. This is usually considered a buying signal. The Relative Strength Index (RSI) is steady at 45.89 and indicates neutral momentum with a tendency to recover.

Source : TradingView

Source : TradingViewThe A/D line is rising, which points to ongoing buying pressure even on the recent corrections. The rising A/D line is evidence to support the argument that larger participants are still on the buy side on declines.

Bitcoin is trading at $82,542.35 and is up 2.02% in the past 24 hours. If the price breaks above the recent swing high, an upside move to the upper $80,000s becomes technically achievable. Sustained momentum can put Bitcoin in the position to revisit levels above $90,000 based on market affirmation.

Current technical configurations, ranging from the bullish divergence on MACD to oversold Stoch RSI conditions and price stability against trendline support, put BTC into a pivotal technical position.

The post Bitcoin MACD Divergence Could Trigger Bullish Reversal, Says Analyst appears on Crypto Front News. Visit our website to read more interesting articles about cryptocurrency, blockchain technology, and digital assets.

The milestone serves as a reminder of Bitcoin's sustained relevance and impact on the global financial landscape, provoking diverse reactions from market stakeholders as substantial price fluctuations continue.

Bitcoin, the pioneering cryptocurrency, reached its 15-year milestone, marking a profound influence on the digital finance sector. Introduced by Satoshi Nakamoto, it has consistently demonstrated resilience amidst market volatility.

The cryptocurrency community globally celebrated this milestone, emphasizing the enduring innovation Bitcoin represents. This event reinforces digital currency's role in transforming traditional financial systems worldwide.

Investors expressed mixed outlooks on Bitcoin's future, balancing optimism with caution due to its inherent price spikes. The anniversary serves as a focal point for evaluating blockchain technology's influence on investment strategies.

Bitcoin's maturation points towards increased regulatory scrutiny and financial sector integration.

However, historical trends suggest cyclical market adjustments are commonplace, providing seasoned analysts with ample data to gauge Bitcoin's enduring value.

Comparable to past anniversaries, Bitcoin's 15th year highlighted its speculative nature among investors. Its fluctuating valuation cycles mirror familiar patterns, providing both challenges and opportunities to market participants.

Expert commentary from Kanalcoin indicates that Bitcoin's evolution may signal new investment opportunities. Comprehensive analysis of market trends underscores its capacity for adaptation and sustained influence within the digital currency domain.

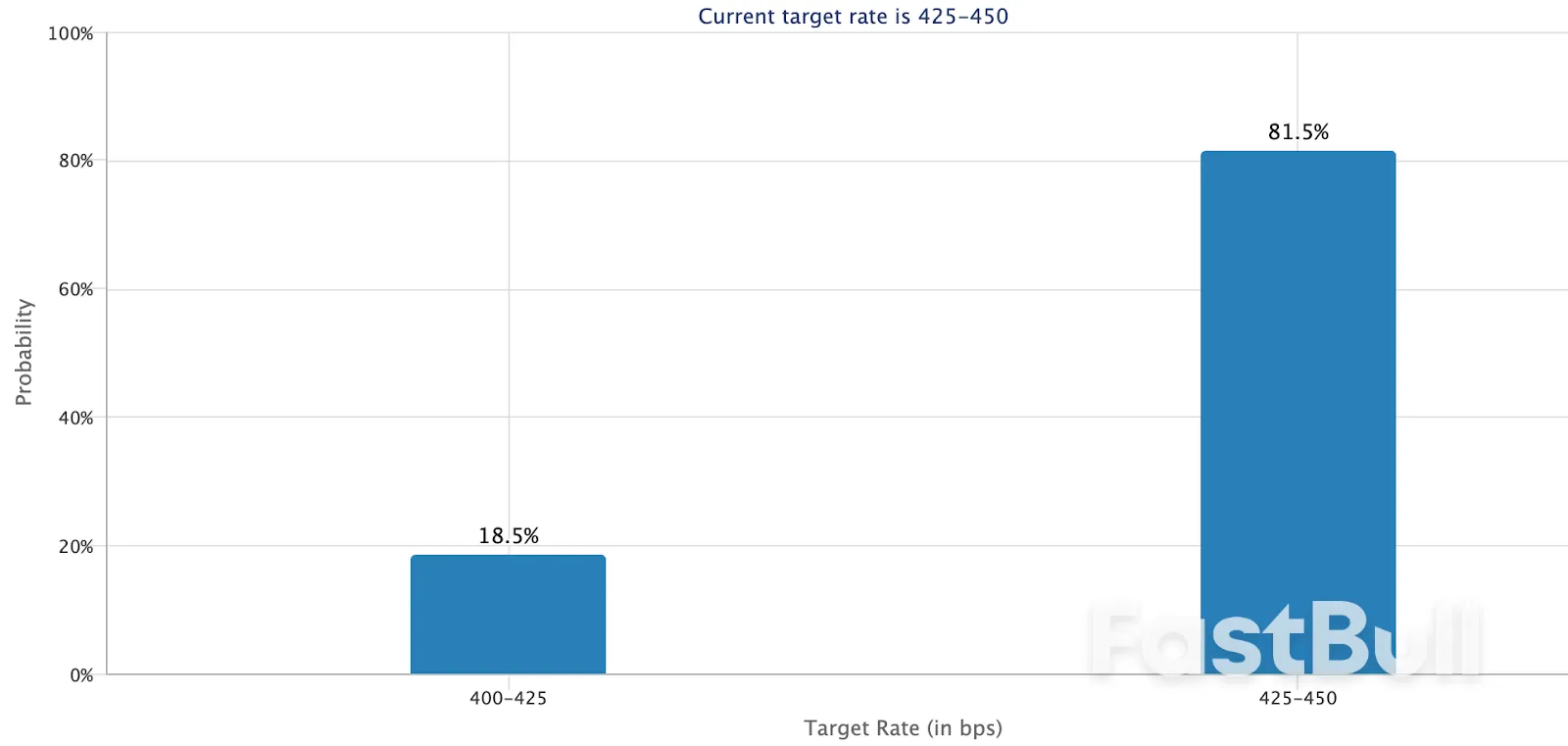

Valentin Fournier from BRN noted in a Friday report that the recent drop in inflation could increase the chances of a rate cut at the upcoming Fed meeting in May. This potential shift is seen as a critical factor that could influence both traditional markets and the cryptocurrency sector. Following the inflation report, Bitcoin has been trading well, maintaining levels above $80,000 and recently hovering around $82,300.

However, there are signs of weakness in institutional investments, with a notable capital outflow from spot Bitcoin ETFs over the past six days, suggesting that a robust upward trend has not yet been established. Fournier points to ongoing tariff disputes between the U.S. and China as a contributing factor. Nonetheless, some cryptocurrency funds on Wall Street might still see significant capital inflows soon.

Despite the increased optimism surrounding the cryptocurrency market, experts caution that March’s inflation figures may not significantly alter the Fed’s policy decisions. Ongoing tariff negotiations and global trade tensions are exacerbating economic uncertainty, resulting in a more cautious approach from the Fed. U.S. stock markets and government bonds have faced challenges since week’s beginning, compounded by President Trump’s remarks regarding the bond market’s complexities.

The latest data shows that the yield on U.S. 10-year Treasury bonds has exceeded 4.5%, indicating declining investor confidence. Mike Cahill, CEO of Douro Labs, argues that the prevailing low inflation, alongside a weakening bond market and a temporary tariff freeze, suggests structural instability rather than a clear path to recovery. Amberdata Research President Mike Marshall emphasized that turmoil in the traditional financial sector will continue to exert pressure on the cryptocurrency market over time, particularly with escalating tariffs between the U.S. and China.

Shifts in capital dynamics could mean that cryptocurrencies might soon see renewed interest as investors look for stability amidst turmoil in traditional markets. The coming weeks will be critical in determining how these economic indicators influence both investor sentiment and market strategies in the cryptocurrency space.

“There will be a kerfuffle in the Treasury markets because of all the rules and regulations,” Dimon said Friday on an earnings call. When that happens, the Fed will step in — but not until “they start to panic a little bit,” he added.

Yields, especially on longer-term debt, have jumped this week amid broader market turmoil tied to President Donald Trump’s evolving tariff policy. The moves have raised questions about the debt’s safe haven appeal and stoked fears that hedge funds may be unwinding a pair of popular leveraged trades — one on the price difference between cash Treasuries and futures, and another on the spread between Treasury yields and swap rates.

In March 2020 with Covid engulfing the world, the Treasury market seized up as investors rapidly unwound their positions. The Fed was forced to intervene, pledging to buy trillions of dollars of bonds and providing emergency funding to the repo markets. Dimon said bank rule changes are needed to avoid that happening again.

“When you have a lot of volatile markets and very wide spreads and low liquidity in Treasuries, it affects all other capital markets,” Dimon said. “That’s the reason to do it, not as a favour to the banks.”

One of the speculated changes that Trump administration regulators may pursue is exempting Treasuries from the US banks’ supplementary leverage ratio, allowing firms to buy up more of the debt without a hit to their key capital ratios.

Dimon said the issue is not just with the SLR, and listed a slew of regulations with “deep flaws” that he said required reforms so banks could become more active intermediaries in markets.

“If they do, spreads will come in, there’ll be more active traders,” he said. “If they don’t, the Fed will have to intermediate, which I think is just a bad policy idea.”

The comments build on ones Dimon made this week in his annual shareholder letter. Certain rules treat Treasuries as “far riskier” than they are, he wrote, adding that restrictions on market-making by primary dealers, together with quantitative tightening, will likely lead to much higher volatility in Treasuries.

“These rules effectively discourage banks from acting as intermediaries in the financial markets — and this would be particularly painful at precisely the wrong time: when markets get volatile,” Dimon wrote.

The euro has emerged as a surprising victor in recent market fluctuations, reaching a three-year high against the US dollar as global investors grow increasingly nervous about holding American assets. This remarkable turnaround comes in the wake of President Donald Trump’s new tariff policies, which have triggered significant market turbulence and caused a substantial shift in global investment flows. The euro’s strength has confounded earlier market consensus, which had predicted the currency would weaken below $1 if tariffs were imposed. Instead, the single currency has gained more than 5% against the dollar since April 1, the day before Trump introduced new 10% baseline tariffs on all economies and additional 20% duties specifically targeting the European Union. The currency’s rally has accelerated following Trump’s decision to pause the higher levies for 90 days, fueling the biggest single-day jump in the euro since 2015.

As of 11:13 AM EST on April 11, 2025, the EUR/USD exchange rate stood at 1.1380, representing a daily gain of 1.08%. This follows an even more impressive 2.80% surge on April 10, when the rate closed at 1.1258. The currency pair reached as high as 1.1473 during April 11 trading, marking a substantial rise from its recent low of 1.0732 recorded on March 27, 2025. Over this period, the euro has experienced a remarkable 5.06% jump, with the most dramatic movement occurring between April 9-10 when the euro decisively broke above the psychologically important 1.10 level. This upward momentum builds on gains that started weeks earlier following Germany’s announcement of a massive spending plan, creating a perfect storm of factors supporting the single currency.

The primary driver behind the euro’s unexpected strength is a significant shift in global capital flows. European investors are selling their US assets and bringing money home, with the euro area accounting for the largest share of foreign ownership of US assets by currency. This repatriation pattern is particularly potent given that foreign holdings of US assets had ballooned to $62 trillion in 2024 from just $13 trillion a decade earlier. Unlike traditional safe havens such as the Japanese yen and Swiss franc, the euro typically weakens against the dollar during periods of market stress, making its current performance all the more remarkable. The gap between German and US 10-year bond yields has widened substantially, suggesting growing investor nervousness about US debt. According to ECB policymaker Francois Villeroy de Galhau, Trump’s policies have eroded confidence in the dollar, while some analysts now project the euro could potentially rally to $1.25 if current trends continue.

The euro’s appreciation carries mixed implications for the European economy. On the positive side, increased demand for euro-denominated debt could make it easier for European governments to fund spending initiatives. The stronger euro also provides the European Central Bank with more flexibility to maintain lower interest rates even if tariffs cause inflation to rise. However, analysts warn that becoming a currency of choice could ultimately hurt European exporters who have traditionally benefited from a weaker euro during global economic slowdowns. This concern is particularly relevant as the euro’s strength has been broad-based, hitting a 17-month high versus Britain’s pound and trading around 11-year highs against China’s yuan, pushing it to a record level on a trade-weighted basis. As markets continue to adjust to the new tariff landscape, European policymakers will need to carefully balance these competing economic forces.

The post Euro Surges Against the Dollar Amid Tariff Turbulence appeared first on Tokenist.

Recently, global markets were left stunned by the dramatic swings in U.S. stocks. After plunging sharply on news of “reciprocal tariffs,” the market reversed course and surged when the White House announced a 90-day suspension of tariffs on certain countries. The Dow Jones Industrial Average soared more than 2,900 points, a 7.87% gain — its biggest one-day jump since March 25, 2020. The S&P 500 rallied 9.52%, marking its largest gain since October 29, 2008, while the Nasdaq spiked 12.16%, notching the second-largest single-day gain in its history.

The “Magnificent Seven” tech giants all soared, with their combined market cap increasing by a staggering $1.85 trillion in just a matter of hours.

This kind of rhythm must feel all too familiar. That’s right — it’s the same kind of price action we often see in altcoins. Many market analysts couldn’t help but exclaim: “U.S. stocks are swinging like altcoins. The world is one giant pump-and-dump.”

Yet the surprises from the U.S. didn’t stop there. The March CPI data came in way below expectations: year-on-year growth was just 2.4%, missing forecasts, and the month-on-month figure even dropped by 0.1%. Core CPI was equally disappointing, hitting a four-year low. The unadjusted year-over-year core CPI for March came in at 2.8%, declining for the second straight month and marking the lowest level since March 2021 — falling short of the 3.0% market forecast.

These two sets of data not only defied market expectations but also prompted investors to reassess the Federal Reserve’s policy outlook. The market’s response was swift:

In the face of such data, a significant number of market analysts now believe a Fed rate cut in June is all but certain.

Harriet Torry, an economist at The Wall Street Journal, noted that under normal circumstances, a slowdown in year-over-year CPI growth would be considered welcome news.

Naturally, this also bodes well for the crypto market. As the Fed’s benchmark interest rate retreats, the crypto space could see a fresh wave of value re-evaluation.

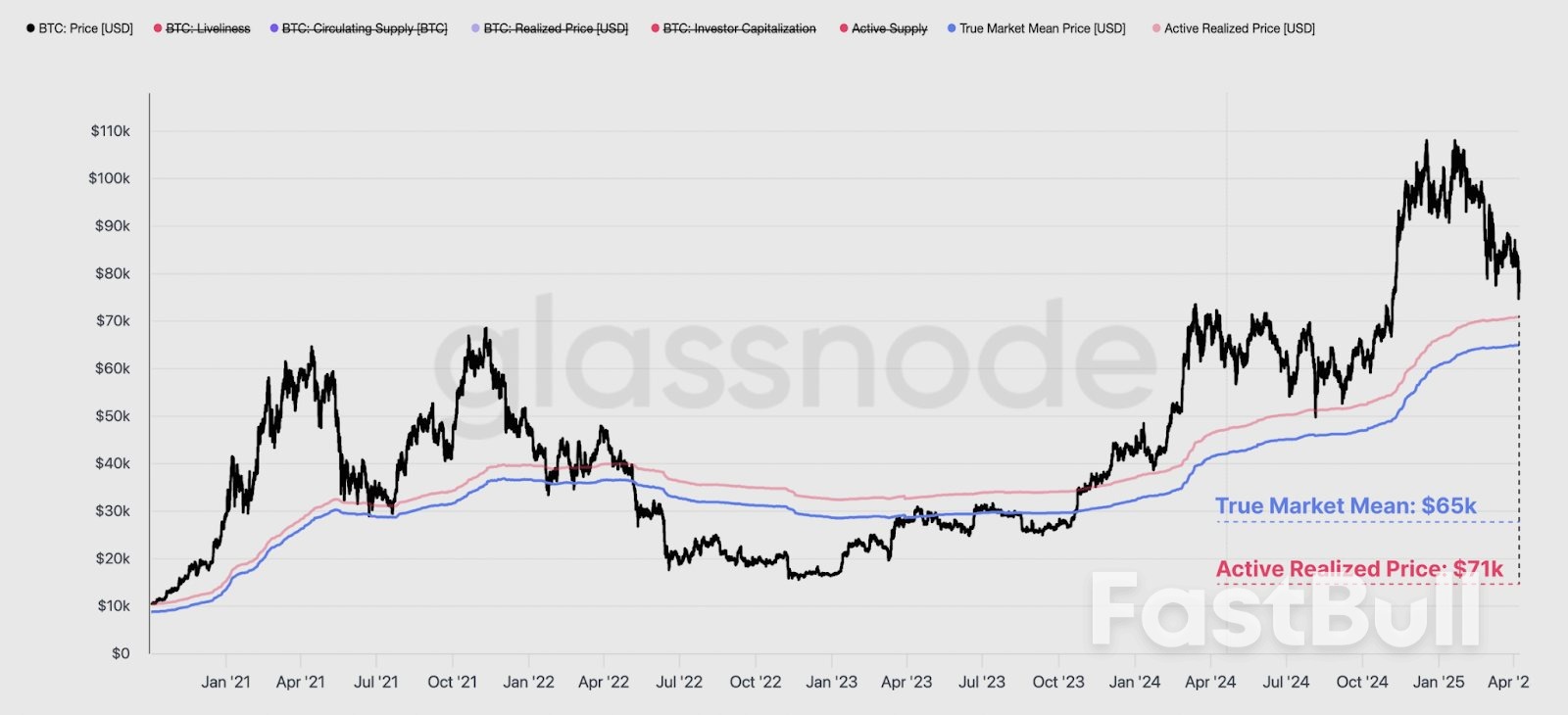

The yield on the U.S. 10-year Treasury note has fallen from its 2023 peak of 4.8% to 4.28% (with a recent low of 4.18% before rebounding by 10 basis points in the past few days). Shrinking returns on traditional fixed-income assets have pushed capital toward higher-risk assets. Take Bitcoin as an example — its correlation with Treasury yields was as low as -0.73 in 2023. The opportunity cost of holding crypto assets drops significantly in a rate-cut cycle, thereby increasing their appeal. According to Goldman Sachs models, every 25 basis point rate cut could push Bitcoin’s market cap up by 6–8%.

Bitcoin’s 90-day correlation with gold rose from 0.12 in 2023 to 0.35, peaking at 0.68 during the Silicon Valley Bank crisis. When rate cuts coincide with rising recession risks, the safe-haven value of crypto assets may be re-evaluated. A report by Grayscale points out that a 1% drop in real interest rates could raise Bitcoin’s valuation baseline by 15%.

Historically, Fed rate-cutting cycles are often accompanied by broad-based asset price increases. As liquidity eases and capital costs decline, investor appetite for risk assets grows — this is especially pronounced in the crypto market.

As high-volatility and high-risk instruments, crypto assets are highly sensitive to liquidity shifts. When the Fed signals monetary easing, idle capital tends to chase higher returns, and crypto assets — with their strong return potential — quickly become a focus.

Against expectations of fiat currency debasement, the scarcity premium of fixed-supply cryptocurrencies becomes increasingly prominent. This built-in deflationary feature adds anti-inflation appeal during a rate-cut cycle.

Rate Cuts Amplify the “Asset Shortage” Phenomenon

Lower interest rates reduce yields in traditional financial markets (e.g., bonds, money market funds), creating reallocation pressure for institutions. Long-term investors like insurers, pension funds, and family offices may divert part of their capital toward growth-oriented emerging markets.

With regulatory infrastructure — such as ETFs, custody, and auditing — steadily maturing, crypto assets are becoming increasingly viable for compliant investment. As rate cuts lead to muted returns in traditional markets, institutions are likely to include Bitcoin and Ethereum in diversified portfolios.

Crypto ETFs in Sync with the Rate-Cut Cycle

By the end of 2024, several spot Bitcoin ETFs were approved for listing in the U.S., marking a pivotal moment for institutional money to enter the crypto space openly. If rate cuts coincide with the ETF boom, we could see a dual momentum of institutional inflows and macro liquidity expansion — further amplifying the crypto market’s upside potential.

DeFi Market Reawakens

During the rate-hiking cycle, DeFi platforms struggled to compete with low-risk returns from U.S. Treasuries, leading to a decline in TVL (total value locked). As risk-free yields fall, DeFi returns become more attractive again, drawing capital back in.

Leading protocols like Compound, Aave, and Lido are already showing signs of TVL recovery. As on-chain lending rates stabilize and stablecoin interest spreads widen, capital efficiency improves — enhancing liquidity across the DeFi ecosystem.

NFT and GameFi Markets See Renewed Interest

Rate cuts free up capital, reviving user enthusiasm for high-volatility, high-engagement assets like NFTs and GameFi tokens. Historically, NFT market activity has lagged behind Bitcoin rallies and typically explodes in the second phase of a bull market. Fed rate cuts may open new upside potential for these application-layer assets.

In sum, Fed rate cuts are laying the macro foundation for a new crypto market upcycle. From liquidity injection and capital reallocation to institutional entry, on-chain activity, and financing environments — rate cuts present systematic tailwinds for the crypto sector.

As the Fed opens the liquidity floodgates, crypto assets are evolving from speculative fringe assets into mainstream macro allocation tools. This transformation is being driven by both traditional financial giants and breakthroughs in underlying technology — alongside intense market cleansing and value reconfiguration.

Of course, the market won’t turn overnight. Regulatory clarity, tech infrastructure, and security challenges still need to be addressed. But under the dual engine of “monetary easing + asset innovation,” the crypto market could be poised for a new structural rally in the coming year. For investors and builders alike, understanding the policy cycle and market tempo will be key to navigating both bull and bear.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up