Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key Points: Polymarket suggests Bitcoin may drop below $100K by 2026. Current market odds show a 38% chance of decline. Bitcoin trades near $114,000 amid market stability hopes.

Key Points:

Polymarket analysts are attributing a 53% probability to Bitcoin falling below $100,000 by 2026, reflecting market sentiment towards Bitcoin's future trajectory.

This scenario highlights Bitcoin's price volatility and potential impact on cryptocurrency trading strategies and investor confidence.

The cryptocurrency prediction platform Polymarket has generated interest with a projection that Bitcoin might dip below $100,000 by 2026. Traders currently estimate a 38% chance for Bitcoin falling beneath $105,000 by the end of August 2025.

The prediction has not been addressed in recent communications by Polymarket or its CEO, Shayne Coplan. Market participants primarily anticipate Bitcoin to consolidate around $120,000 in the coming months, as indicated by on-chain analysis data.

The potential decline affects sentiments towards Bitcoin and other cryptocurrencies like Ethereum and Solana. Market analysts note that current trading patterns show reduced volatility, reflecting expectations of continued sideways movement for Bitcoin.

Despite speculative predictions, no substantial capital reallocation or institutional activity explicitly responds to these odds. Bitcoin's trading prices remain stable, hovering near $114,000 as of August 2025, suggesting limited market upheaval from the Polymarket forecast.

Community reactions express cautious optimism, with developers continuing updates on Bitcoin's protocol. Discussions on social platforms reflect market fatigue but align largely with expectations of short-term stability for Bitcoin, as suggested by Polymarket. An anonymous Polymarket analyst shared insights: "Market odds indicate a 38% chance of Bitcoin dropping below $105,000 by the end of August 2025." source

Insights suggest that should Bitcoin's price materially decrease, it might trigger shifts in financial strategies, especially for traders reliant on leveraged positions. Comparative historical trends show that Polymarket odds typically mirror trader sentiment but rarely dictate major price changes.

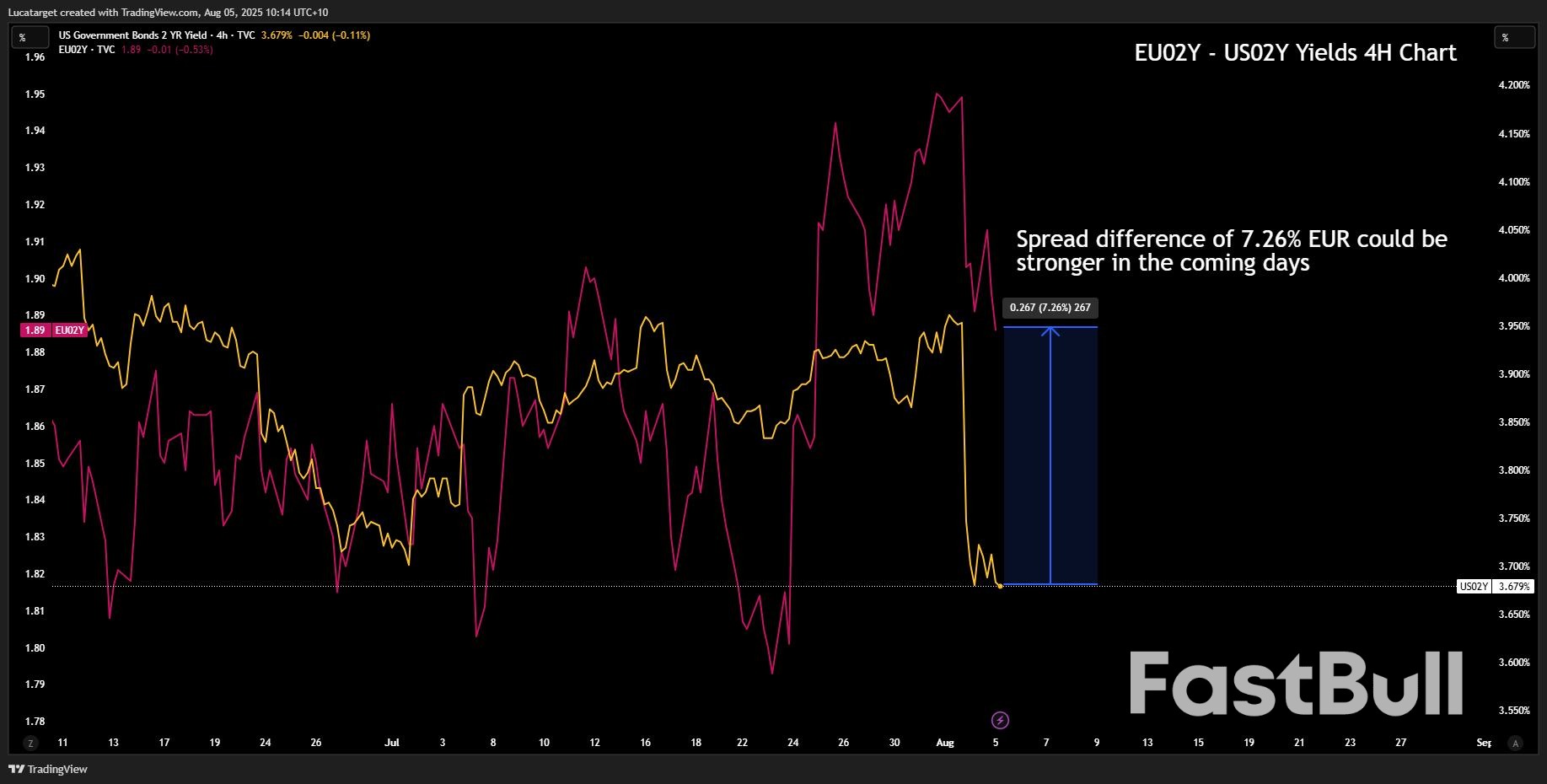

ECB and Fed communication is crucial; any signal on rates or emergency intervention could rapidly change sentiment. The Bank of England rate decision looms (Aug 7). More China trade, PMI, and inflation data this week will determine if the world’s second-largest economy can stabilize or if more commodity/FX downside is coming. U.S. ISM and S&P services readings, plus JOLTS data, are the day’s pivotal macro releases, closely tied to rate cut bets and the global growth story.

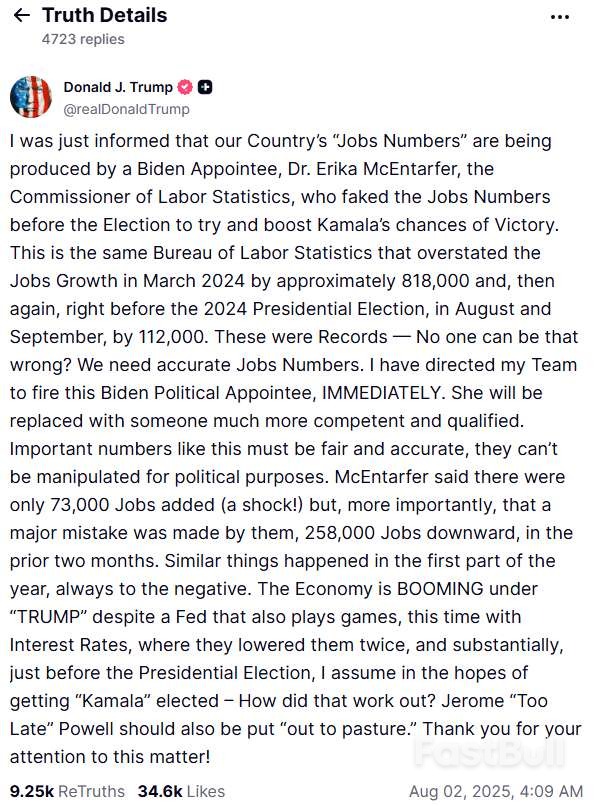

The U.S. dollar is under persistent pressure today, as weak jobs data, increased Fed rate cut expectations, and ongoing political and trade uncertainties drive short-term bearish sentiment. Most major and EM currencies are stronger against the dollar, while only safe-haven flows offer some localized support. Volatility and downside risk are likely to persist in the coming sessions. The U.S. session was marked by significant volatility, with markets reacting to a trio of shocks: weak jobs data, heightened trade/tariff anxiety, and political turmoil affecting key economic institutions.The most impacted assets were U.S. stocks, which saw a sharp sell-off followed by a strong rebound; the U.S. dollar and Treasury yields, which fluctuated on changing rate cut expectations; and gold, which remained a key gauge of risk sentiment. The market remains highly sensitive to political events and macroeconomic data, which are unpredictably shifting the outlook for U.S. policy, the dollar, and global risk sentiment.Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

Gold is well-supported by a confluence of weak U.S. economic data, expectations of monetary easing by the Federal Reserve, and persistent geopolitical and trade-related uncertainties. While the market may experience some consolidation after recent gains, the overall outlook for gold remains constructive as long as these supportive factors are in play.Gold spot prices are trading near $3,373 per ounce as of August 4, representing a 0.31% daily gain and a 1.09% monthly increase. The precious metal reached intraday highs near $3,377, marking continued strength following Friday’s explosive rally. Gold surged to $3,350 on Friday after weak U.S. jobs data and new tariff announcements triggered massive safe-haven flows, delivering the metal’s biggest one-day gain in two months.

Next 24 Hours Bias

Medium Bullish

The Australian Dollar faces a challenging environment as domestic monetary easing expectations coincide with global uncertainty and U.S. dollar strength, keeping the currency under pressure despite Australia’s relatively favorable position in the current trade dispute landscape. Near-term bearish bias prevails as RBA rate cut expectations weigh on the currency, while global trade tensions and U.S. dollar strength provide additional headwinds.The RBA policy decision on August 12 will be crucial, along with upcoming Australian PMI data and any developments in U.S.-China trade relations. Further escalation in global trade tensions or unexpected hawkishness from the RBA could shift the current trajectory.

Central Bank Notes:

Weak Bearish

The New Zealand Dollar remains under significant pressure on August 5, 2025, trading near multi-month lows as markets await crucial employment data that could show unemployment at an eight-year high. While the RBNZ has paused its rate-cutting cycle, the central bank’s easing bias and weak domestic economic signals continue to weigh on the currency.The combination of higher U.S. tariffs, expected labor market deterioration, and the prospect of further RBNZ rate cuts suggests continued downward pressure on the NZD in the near term. The New Zealand Dollar continued to trade near multi-month lows, with the NZD/USD pair falling to approximately 0.5907 on August 4, down 0.05% from the previous session. Over the past month, the NZD has weakened 1.68% against the U.S. dollar and is down 0.72% over the last 12 months.

Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

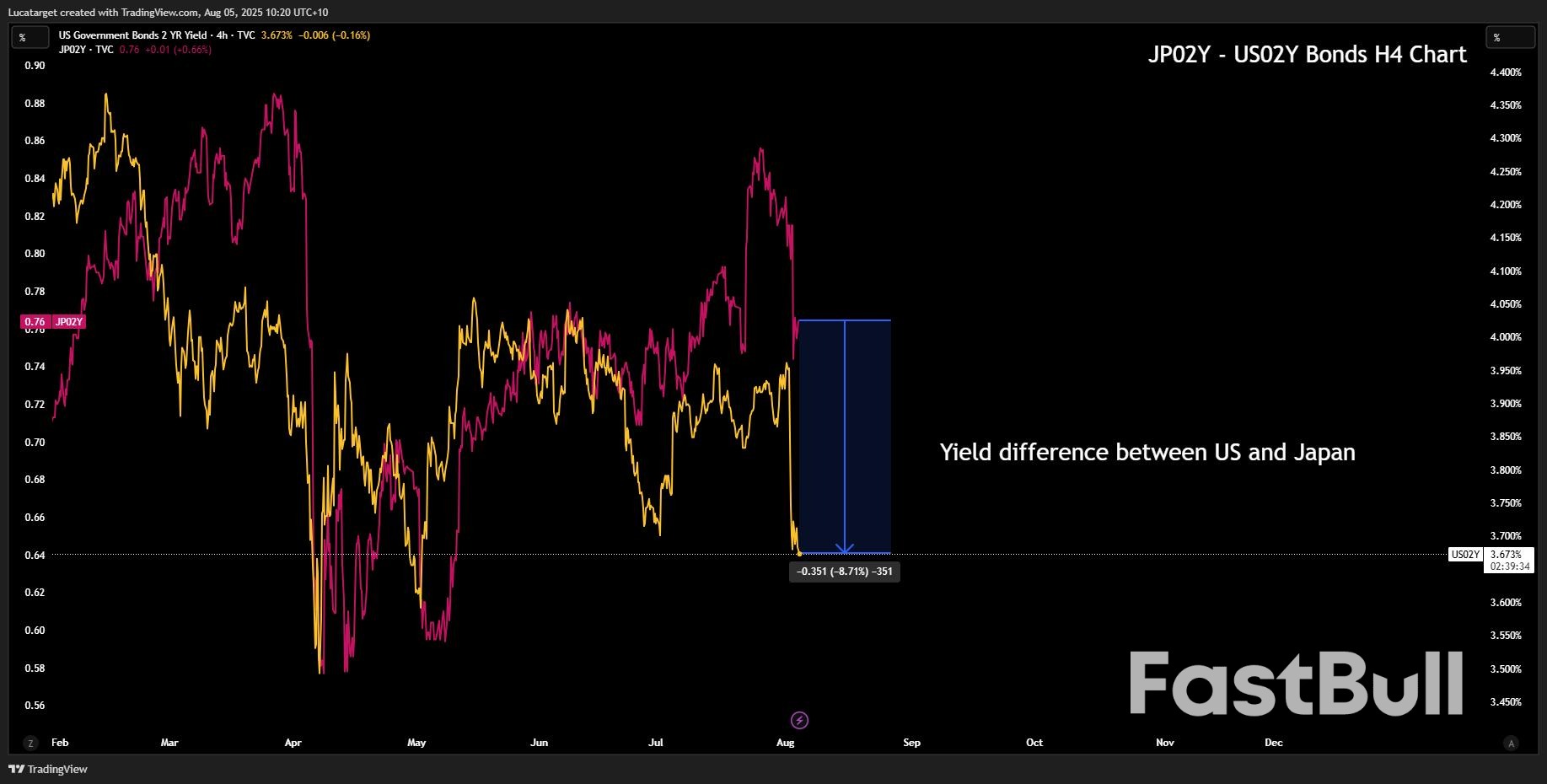

The Japanese yen faces a complex mix of supportive and bearish factors. While weak U.S. data and safe-haven demand provide near-term support, the BoJ’s cautious policy stance and domestic political uncertainty limit the currency’s upside potential. Tuesday’s BoJ meeting minutes will be crucial for determining whether the central bank is moving closer to policy tightening or maintaining its accommodative approach.The BoJ held its policy rate steady at 0.5% at the July 31 meeting but raised its core inflation forecast for fiscal 2025 to 2.7% (up from 2.2% previously) . Governor Ueda emphasized a cautious, data-dependent approach, stating the bank will continue raising rates if economic conditions align with projections. BoJ Meeting Minutes from the June meeting are scheduled for release on Tuesday, providing additional insights into the board’s rate path thinking.

Central Bank Notes:

Next 24 Hours BiasStrong Bullish

Oil prices are facing significant downward pressure as OPEC+ proceeds with planned output increases while economic growth concerns mount. The market is balancing potential supply disruptions from geopolitical tensions against weak demand signals from recent economic data, with the near-term outlook remaining cautious as prices test key technical support levels.Markets are concerned that global oil supply may outpace demand later this year, potentially boosting inventoriesOPEC+ cited “steady global economic outlook and current healthy market fundamentals” with low oil inventories as justification for the increaseGoldman Sachs maintained its forecast with Brent averaging $64/barrel in Q4 2025 and $56 in 2026, flagging downside risks to demand.Next 24 Hours Bias

Weak Bearish

Key Points:

Ethereum's open interest surged to $58 billion in July 2025, marking a significant capital shift from Bitcoin as institutional traders and whales led this speculative trend.The surge indicates increased institutional interest, potentially driving Ethereum's value up, while also raising concerns about market volatility if liquidations transpire.

Ethereum's open interest has reached an all-time high of $58 billion by late July 2025. This marks a significant increase of 100% since June, reflecting a profound shift from Bitcoin to Ethereum in the cryptocurrency market. Leading this movement, institutional traders, whales, and major asset allocators are increasingly focusing on ETH. Glassnode has highlighted that Ethereum's open interest dominance stands at nearly 40%, the highest in over two years.Ethereum open interest dominance has climbed to nearly 40%, its highest level since April 2023. Only 5% of days have seen a higher reading. This marks a clear shift in speculative focus, with capital rotating from $BTC to $ETH at the margin.

The surge in Ethereum open interest has led to considerable impacts across the industry. Market metrics like network activity, active addresses, and stablecoin supply have all surged alongside institutional interest. Financial implications include an unprecedented rise in ETH derivatives with open interest on the CME reaching $7.85 billion. Major players are reallocating capital from Bitcoin to Ethereum, further intensifying this market transformation.

Historically, such open interest surges have often ended in dramatic market shifts. As leverage builds, a vertical price movement might follow, echoing past volatility cycles during prior bull runs. "Open Interest just hit a new all-time high. The price is climbing. Leverage is stacking. This isn't a normal breakout—it's a catalyst for a vertical move.The implications of this trend are wide-ranging. Future price volatility, regulatory interest, and technological developments may ensue, bolstered by historical data, expert analysis, and on-chain trends. This underscores Ethereum's growing role in the crypto landscape.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up