Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

"...the most anticipated oil supply glut in history"...

There are some extreme dichotomies in the crude complex currently that are worth a quick look...

Amid what Eric Nuttall coined as "the most anticipated oil supply glut in history"...

... crude prices had fallen to 5-month lows just over a week ago. Then Washington unleashed sanctions on two of Russia's oil giants, Rosneft PJSC and Lukoil PJSC (and India and China suggested it would cut back on Russian oil purchases, implying demand for alternatives), prices for oil surged back higher...

OilPrice reports that India imported 19.93 million tons of crude oil last month, a 1.7% increase from August, the Economic Times reported, citing government data. The total is equal to roughly 4.87 million barrels daily.

The annual increase in imports for September was more pronounced, at 6.1%, the data also showed.

In oil products, the government's Petroleum Planning and Analysis Cell reported imports of 4.40 million tons, which was a 20.9% increase on September 2024. Product exports, on the other hand, fell by 4.8% to 6.18 million tons.

But, the publication also reported that Russian exports of crude oil to India declined by 8.4% over the three months to September amid shrinking discounts and tighter availability of barrels. The decline is expected to become sharper in the coming weeks, following the latest U.S. sanctions on Russian oil, targeting two of the largest exporters—Rosneft and Lukoil.

India needs more local discoveries of oil and gas in order to be able to meet future energy demand, the secretary of petroleum and natural gas at the Indian energy ministry said.

"One day, we will be looking at a situation where alternative forms of energy will increasingly matter more for incremental demand satisfaction than fossil fuels," Pankaj Jain said, as quoted by PTI.

Additionally, supertanker freight futures surged on Thursday and Friday after the U.S. sanctions against Russia's biggest oil firms created a rush to replace Russian barrels.

The front-month supertanker contracts on the route Middle East to China, the benchmark route, jumped by 16% on Thursday, to the highest level in nearly two years, according to data from the Baltic Exchange data cited by Bloomberg.

"We anticipate the rush for replacement crudes will be larger and more sustained because of the exhaustive list of Russian producers under OFAC sanctions," Anoop Singh, global head of shipping research at Oil Brokerage, told Bloomberg.

Supertanker rates were already rising earlier this month due to the latest tit-for-tat fees on port callings in the U.S.-China trade spat.

The port fees threaten to create additional vortexes in global oil flows.

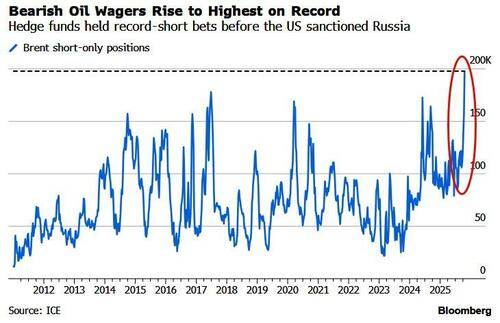

Ahead of the rally, money managers boosted bearish positions on the global benchmark by 40,233 lots to 197,868 in the week ended Oct. 21, according to ICE Futures Europe. That's the most on record... providing a lot of ammunition for a sizable short squeeze...

...as traders worldwide bet on mounting evidence that a long-anticipated supply surplus is finally underway with a flotilla of crude oil on the world's oceans expanded to a fresh high as producer nations keep adding barrels and the tankers sail further for deliveries...

Production is rising from members of the OPEC+ group of nations, which are unwinding earlier output cuts - as well as countries outside the group, predominantly in the Americas, where Guyana recently started pumping from a new offshore field and US output hit a new high.

The build-up comes at a time when demand growth is slowing, with forecasters predicting a surplus that could rise to as much as 4 million barrels a day in the early months of next year.

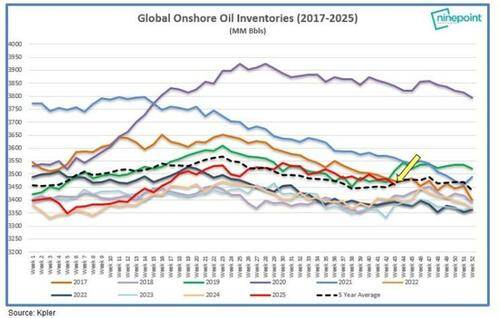

However, as Eric Nuttall reminds, inventory on land is much lower than expected...

"...onshore inventories have FALLEN by 39MM Bbls in the first 20 days of October, and are actually the tightest to the 5 year average in ~ 4 months. It wasn't supposed to be like this!"

...and much of the oil-on-water is already headed to specific processing units.

Finally, remember China is stockpiling 500k barrels-a-day for its own Strategic Petroleum Reserve, so there's plenty of demand (for bulls to squeeze on), but any progress toward peace, such as reviving Budapest meeting plans, may undermine the rally as will chatter that OPEC+ is currently expected to focus on reviving another modest sliver of oil production in December as a base case when key members meet this weekend, according to two delegates.

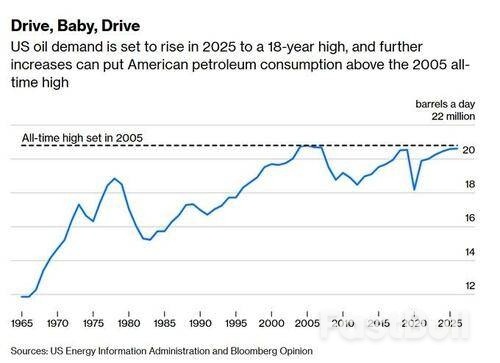

Domestic demand is booming too, as Bloomberg's Javier Blas notes, US oil consumption is heading toward a 18-year high of 20.59 million b/d in 2025. And further increases are likely.

That's a lot of supply, demand, and positioning extremes to consider.

OPEC+ is currently expected to focus on reviving another modest sliver of oil production in December as a base case when key members meet this weekend, according to two delegates.

The group led by Saudi Arabia is so far expected to focus on a third monthly increase of 137,000 barrels a day, to be discussed at a video conference on Nov. 2, the delegates said. OPEC+ is in the process of restarting 1.66 million barrels-a-day in monthly stages a bid to reclaim its share of global oil markets.

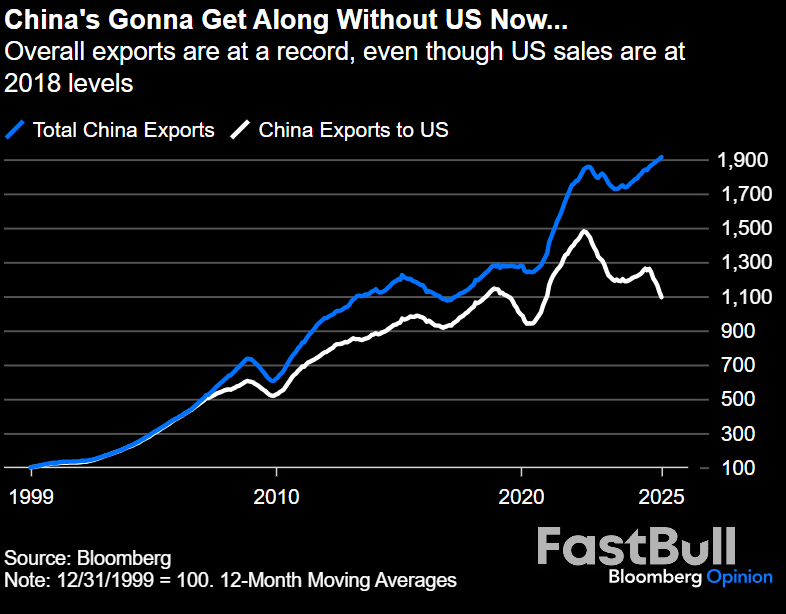

Still, the alliance's plans haven't been fully formed. World crude prices remain in flux amid signs of an impending oversupply, faltering demand in China and new US sanctions on Russia, a major OPEC+ member. The decision may also depend on the outcome of trade talks between the US and China, one of the delegates said.

Oil futures are trading near $66 a barrel in London, after jumping last week on the latest sanctions against Russian producers.

Nine of 10 oil traders, refiners and analysts surveyed by Bloomberg said they also expected a 137,000-barrel hike, while the other one predicted a larger boost.

The Organization of the Petroleum Exporting Countries and its partners have surprised markets this year by reviving production halted two years ago in order to shore up prices. The coalition restored one tranche, amounting to 2.2 million barrels a day, a year ahead of schedule, but is adopting a more careful pace with this latest layer.

Officials have said that the group's shift to opening the taps has been driven by Riyadh's desire to recoup market share ceded in recent years to rivals like US shale drillers.

There could also be a political consideration in the decision, as Saudi Crown Prince Mohammed bin Salman prepares to visit the White House on Nov. 18. President Donald Trump has repeatedly called for cheaper fuel prices, while Saudi Arabia has demonstrated a desire to strengthen ties.

In the meantime, crude traders are waiting for clarity on the impact of Washington's move to sanction Russia's top two oil producers, Rosneft PJSC and Lukoil PJSC, as Trump seeks to end the war in Ukraine.

as of 26 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 26 Oct 2025. Past performance is not a reliable indicator of future performance. as of 26 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 26 Oct 2025. Past performance is not a reliable indicator of future performance. as of 26 October 2025. Past performance is not a reliable indicator of future performance.

as of 26 October 2025. Past performance is not a reliable indicator of future performance.

Daily Natural Gas

Daily Natural GasThe US president's power to pardon is both one of the most absolute and misunderstood provisions of the Constitution. Rooted in the "prerogative of mercy" of English kings dating back to the seventh century, America's founders wanted a robust pardon power to allow "easy access to exceptions in favor of unfortunate guilt" by the justice system, as Alexander Hamilton wrote.

Today, the power has become as polarizing as the men using it. On the first day of his second term, President Donald Trump issued a sweeping pardon for people convicted for their actions in the riot at the US Capitol on Jan. 6, 2021.

In his last weeks in office, Trump's predecessor Joe Biden pardoned his son Hunter from convictions on tax and gun violations. He also offered so-called blanket pardons to five other members of his family, expressing concern they'd be unjustly prosecuted under Trump, as well as to leading government officials that Trump has labeled as political enemies and threatened to punish.

A pardon is the legal forgiveness of a crime granted by a president, governor or other executive authority. While in some US states the governor shares the power with a pardon board, the power to pardon federal crimes is the president's alone.

It's not an expungement; the conviction remains on the record. Nor is it a statement on either the guilt or innocence of the individual.

Pardons come under the broader presidential power of executive clemency, which also includes lesser forms of presidential mercy, such as:

Reprieves and remittances are rare in modern times.

Every president except two – William Henry Harrison and James Garfield, who died in office – has issued pardons. Cumulatively, presidents have granted almost 35,000 individual acts of clemency, beginning with the first known pardon by George Washington for the offense of smuggling rum from Barbados in casks smaller than 50 gallons.

The power had generally fallen into relative disuse in recent decades, reserved by presidents, for the most part, for use around the holidays and at the end of their terms.

But Biden was an avid pardoner. As he was leaving office, he released 1,499 convicts serving home confinement – including some convicted of public corruption, commuted 37 death sentences, and shortened the sentences of 2,490 drug offenders who he said received disproportionately long sentences.

As of the last day of his presidency, he had issued a total of 79 pardons and 4,168 commutations to named individuals, which makes him the most prolific employer of presidential clemency in history, granting it more times in a single term than all of his last seven predecessors combined.

In granting a pardon, a president is often communicating his views on justice, mercy, norms and social mores.

The list of those receiving pardons reads like a social history of the US, as presidents seek to heal old conflicts and reconcile the country with a more punitive past. Wars, insurrections, prohibition, the war on drugs – all have been followed years or decades later by rounds of clemency.

In a clear precedent for Trump's pardons of Jan. 6 insurrectionists, Washington himself pardoned 10 ringleaders of the tax protest known as the Whiskey Rebellion in the 1790s who had been convicted of high treason. Presidents Abraham Lincoln and Andrew Johnson pardoned Confederate soldiers and Gerald Ford pardoned their general, Robert E. Lee.

Some pardons are seen as being more motivated by self-interest. President Richard Nixon pardoned influential US labor leader Jimmy Hoffa, who had been convicted of jury tampering and fraud and later supported Nixon's reelection bid. Bill Clinton pardoned financier Marc Rich, the husband of a major campaign donor, after Rich had been indicted for tax evasion and striking oil deals with Iran during an embargo. On Oct. 23, Trump pardoned Binance founder Changpeng Zhao, who served four months in federal prison for failing to maintain an effective anti-money laundering program at the cryptocurrency exchange. The pardon came after Zhao and Binance became key backers of the Trump family crypto venture World Liberty Financial Inc.

The founders intentionally created the pardon power with few strings attached. Hamilton wrote that it "should be as little as possible fettered or embarrassed."

The Supreme Court has held that because it's a power explicitly given to the president in the Constitution,"its limitations, if any, must be found in the Constitution itself."

In other words, a pardon is valid as long as it doesn't violate some other provision of the Constitution. Those cases are undoubtedly narrow; some commentators have argued that acceptance of a bribe for a pardon could possibly invalidate it, but even that isn't clear.

The Constitution does contain two clear limitations. Presidents can grant pardons only for "offenses against the United States," meaning only federal and not state crimes. And there's an exception for cases of impeachment: the president can't use the power to frustrate the power of Congress to remove him or other officials from office.

Neither Congress nor the courts have the power to overturn presidential pardons. However, a president can revoke a pardon if the documents haven't yet been delivered to and accepted by the person receiving clemency.

George W. Bush in 2008 granted a pardon to real estate developer Isaac Toussie, who had been convicted of mail fraud. But just a day later, after learning Toussie's father had made donations to Bush's Republican Party, the president reversed his decision and instructed that the pardon not be given. Because Toussie hadn't received the paperwork, the clemency didn't take effect.

A president could similarly attempt to revoke an undelivered pardon issued by a predecessor. In 1869, Andrew Johnson awarded pardons to three people convicted of fraud. But just days later, President Ulysses S. Grant took office and recalled the members of the US Marshals Service delivering the paperwork, and the pardons were withdrawn.

Most legal scholars say he can't, based in part on the plain language of the power. The Constitution says that the president has the power to "grant" pardons, which means to "bestow" or "transfer" them — in other words, give them to someone else. In addition, in a legal memo crafted just before Nixon's resignation in 1974, the Justice Department's Office of Legal Counsel held that the president can't self-pardon "under the fundamental rule that no one may be a judge in his own case." In any event, Ford pardoned Nixon for any alleged Watergate crimes.

But the question has never been tested, and even scholars who oppose the idea of the self-pardon concede that it's an open question. Regardless, there's a workaround: A president could temporarily cede power to the vice president, who could issue a pardon as acting president.

The president can't grant a pardon for a crime that has not yet been committed, which would be the equivalent of a lifetime get-out-of-jail-free card.

But a person can be pardoned after committing a crime and before any charges have been brought. A seminal 1866 Supreme Court case dealing with Confederate soldiers, Ex parte Garland, held that the pardon power "extends to every offense known to the law, and may be exercised at any time after its commission, either before legal proceedings are taken or during their pendency, or after conviction and judgment."

Yes. A president doesn't need to identify the crime committed in order to issue a pardon. The most famous example is Ford's pardon of Nixon for all offenses carried out while he was president.

Biden's 11th-hour pardons of family members and officials identified as enemies by Trump also fall into this category. The relatives included three siblings and two of their spouses. The officials included retired General Mark Milley, infectious diseases expert Anthony Fauci, and the members of Congress and staff who served on the committee that investigated the 2021 attack on the US Capitol and recommended that Trump be prosecuted for his role in it.

Those on the panel included Liz Cheney, a former Wyoming Republican congresswoman who helped lead the investigation, and now-Senator Adam Schiff, a Democrat from California who also led the prosecution in Trump's first impeachment trial. Biden also pardoned US Capitol and DC Metropolitan police officers who testified before the committee.

Biden's pardon of his son Hunter included the gun and tax evasion charges for which he was convicted but also any other offenses he may have committed for the previous 11 years.

And Trump in his first term pardoned a number of allies, including former political adviser Stephen Bannon and Albert Pirro Jr., the ex-husband of Fox News host Jeanine Pirro, for unspecified "offenses against the United States individually enumerated and set before me for my consideration."

No. Presidents have granted pardons often to people they believed to be innocent or otherwise victims of injustice. For example, Trump posthumously pardoned boxer Jack Johnson, who was convicted in 1913 of transporting a woman across state lines for "immoral purposes" — a crime that frequently formed the basis of racist prosecutions. Biden pardoned service members convicted of violating a now-repealed military ban on consensual gay sex. And in one of his last acts of clemency, he posthumously pardoned Marcus Garvey, a Black nationalist icon convicted of mail fraud in 1923. Civil rights activists have long argued Garvey's prosecution was racially motivated.

The popular notion that a pardon implies guilt comes from a 1915 Supreme Court ruling in the case of Burdick v. United States, which said that a pardon "carries an imputation of guilt; acceptance a confession of it." Ford kept a dog-eared copy of the decision in his wallet as vindication of his pardon of Nixon.

But later courts have not viewed that "imputation of guilt" as essential to the Burdick decision, which held that someone granted a pardon has the right to refuse it.

"The answer is undoubtedly no," a federal appeals court ruled in February 2024. "The plain language of the Constitution imposes no such limit."

But as a practical and historical matter, it helps to have a record. In that 2024 decision, the Fourth Circuit Court of Appeals ruled that Trump's verbal statement to former Cleveland Browns running back Jim Brown that "I'm gonna do this" and "I want this done" weren't enough to free a man serving a life sentence for drug trafficking and murder.

No again. There's a history of categorical pardons, granting clemency for everyone convicted of a certain offense. President Jimmy Carter used this power to give amnesty to draft dodgers after the Vietnam war and Biden used it for marijuana offenses, for example. In those cases, people convicted of the specified crime can apply to the Office of the Pardon Attorney in the Justice Department, for a certificate that verifies they're covered by the pardon.

There are two procedural paths. The first, which President Barack Obama followed, requires someone seeking a pardon or commutation to file with the Office of the Pardon Attorney. The office generally considers applications only after a five-year waiting period, and won't consider posthumous pardons or those for misdemeanors. After a thorough review – including an FBI background check – the recommendation goes to the attorney general, the White House Counsel's Office and then to the president, who may grant or deny it.

The second model, favored by Trump, is much looser. In his first term, he often took recommendations from celebrities such as Kim Kardashian and Sylvester Stallone, skipped the waiting period and background check, and signed pardons in pomp-filled ceremonies.

Most presidents use a combination of the two, with the more controversial pardons often following the direct path to the president.

One reason to bypass the bureaucracy: The backlog of pardon applications reached record highs under Biden before his final grants brought the logjam down to pre-Trump numbers.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up