Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Bank of England cut interest rates on Thursday after a narrow vote by policymakers but it signalled that the already gradual pace of lowering borrowing costs might slow further.

The Bank of England cut interest rates on Thursday after a narrow vote by policymakers but it signalled that the already gradual pace of lowering borrowing costs might slow further.

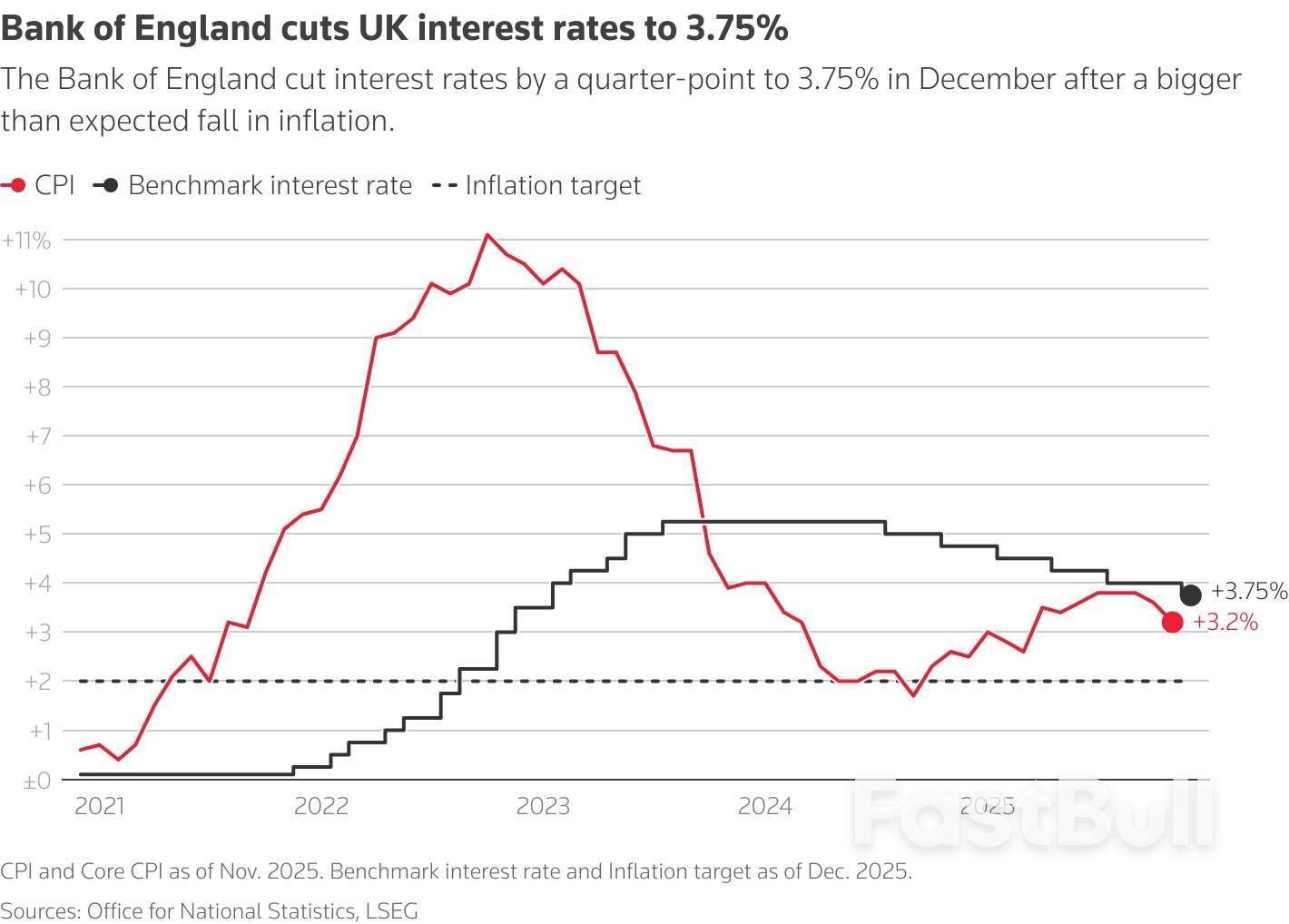

After a big drop in inflation and a new forecast from BoE staff that the economy is stagnating, five Monetary Policy Committee members voted to lower the BoE's benchmark rate for the sixth time since August 2024 to 3.75% from 4%.

The four other members supported no change as they worried about the potential for inflation - still the highest among the Group of Seven economies - to remain too high.

Analysts polled by Reuters last week had mostly expected a 5-4 vote for a rate reduction as Britain's economy struggles to grow and inflation falls.

Governor Andrew Bailey changed his view and voted for a cut as he sees inflation returning close to the BoE's 2% target as soon as April or May next year, about a year earlier than forecast by the central bank just last month.

But he cautioned that inflation still posed some risks.

"The calls will become closer, and I would expect the pace of cuts, therefore, to ease off at some point," he told broadcasters. "But I'm not going to judge exactly when that is, because it's too uncertain at the moment."

Sterling strengthened by as much as a cent against the U.S. dollar after the decision, before paring gains.

Interest-rate-sensitive two-year gilt yields - which were at their lowest since August 2024 before the decision was announced - rose as much as 6 basis points as investors saw slightly less chance of more than one rate cut next year.

A line chart with the title 'Britain's inflation and interest rates'

A line chart with the title 'Britain's inflation and interest rates'Sanjay Raja, chief UK economist at Deutsche Bank, said he was sticking to his forecast of two more quarter-point cuts in 2026 - in March and in June - but said there was a chance the BoE could move more slowly and ultimately have to cut rates more.

James Smith and Chris Turner, economists at ING, said the lines between the two MPC camps had become more blurred. Some of the policymakers who voted for a rate cut showed signs of concern about high wage growth while others among those who called for a hold hinted at diminishing inflation risks.

"That said, we don't view today's decision as a game-changer," they wrote in a note to clients. "Fundamentally, the Bank - or most officials at least - still think further cuts are likely. It has not changed our mind that the Bank will cut rates twice more next year."

Among the senior policymakers who voted against the rate cut, Deputy Governor Clare Lombardelli said she remained more concerned about the risk of inflation proving stronger than expected and the recent data had only softened "at the margin".

Chief Economist Huw Pill said he saw a bigger risk of inflation getting stuck too high than too low.

But Catherine Mann said her decision not to vote for a rate reduction was "quite finely balanced".

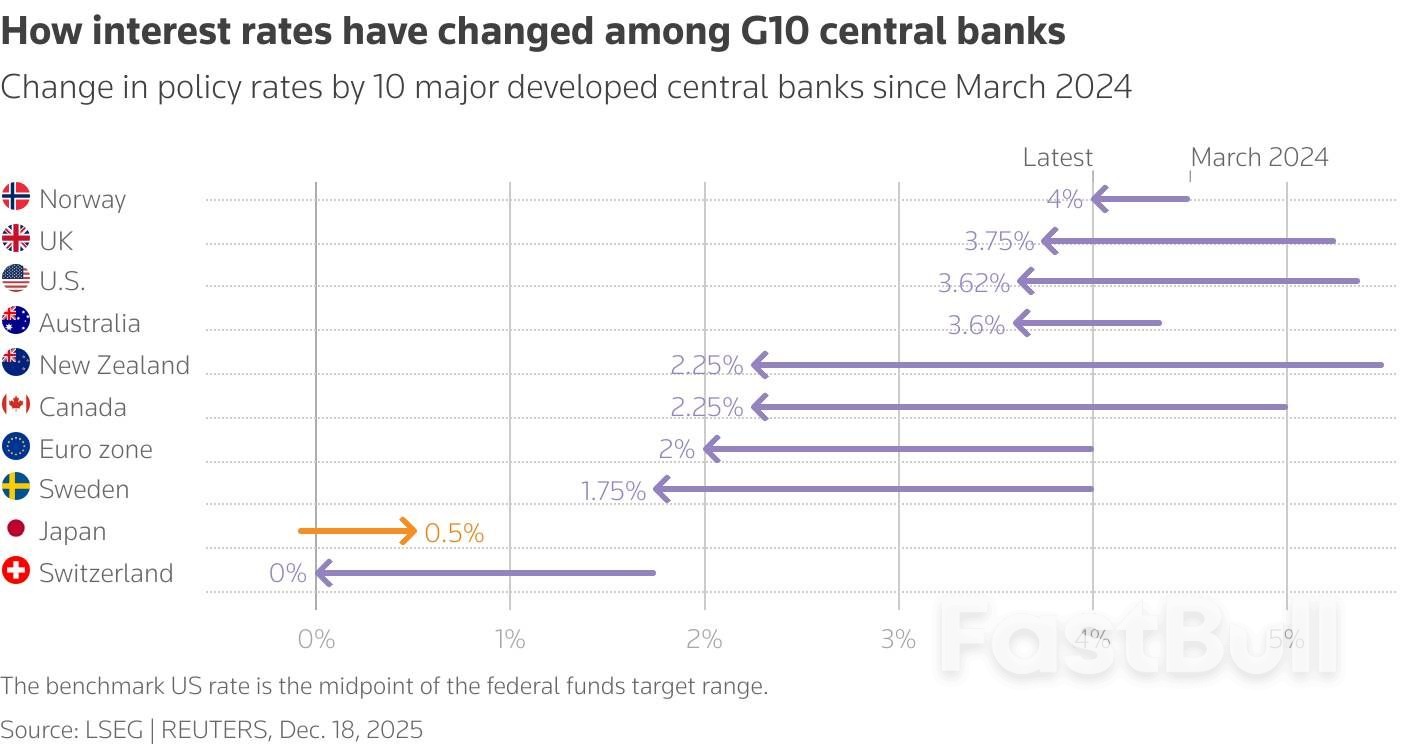

The cut took Bank Rate to its lowest level in nearly three years although it is still almost double the European Central Bank's equivalent rate which it kept on hold on Thursday.

British inflation remains higher than among peer economies - in part because of finance minister Rachel Reeves' decision last year to raise taxes on employers - even after it fell unexpectedly sharply to 3.2% in data released on Wednesday.

Data on Tuesday showed a weakening jobs market including the highest unemployment rate since 2021.

The BoE said it now expected the economy to stagnate in the last three months of 2025, down from a forecast of 0.3% growth made last month, although it thought underlying growth was stronger at about 0.2% a quarter.

Britain's economy shrank by 0.1% in the three months to October amid reports that businesses put investment projects on ice in the run-up to Reeves' budget on November 26.

The BoE said the budget would bring down inflation in 2026 by about half a percentage point due to one-off measures which would then push it up a bit in the following two years.

The budget measures would add at most 0.2% to the size of the economy in 2026 and 2027.

Other major central banks are believed to be close to halting their rate cuts. The U.S. Federal Reserve last week signalled one more move in 2026, while the ECB has probably already come to the end of its monetary loosening cycle.

An arrow chart with the title 'How interest rates have changed among G10 central banks'

An arrow chart with the title 'How interest rates have changed among G10 central banks'U.S. President Donald Trump's move to relax marijuana regulations could ease some burden for cannabis companies, but will likely keep doors to access capital from big banks closed, experts said.

Cannabis companies, once in the spotlight during their boom, have limitations to access capital, often relying on smaller banks or alternative lenders, credit unions that come with higher borrowing costs. The executive order seeks a speedy reclassification of marijuana that would ease federal restrictions on research that could lead to new medical marijuana products.

While Trump's order that reclassifies cannabis as a controlled substance is good news for cannabis companies and removes red tape, including compliance costs, large lenders will remain on the sidelines unless it is federally legal, as lending could spark risks.

"Rescheduling is great progress, but I do not expect it to open the lending floodgates for cannabis operators, or for it to be materially behavior-altering for larger banks," said Samantha Gleit, a partner at Feuerstein Kulick leading the firm's debt finance and corporate restructuring practices.

"Until there is full federal legalization, lending and providing treasury services to cannabis companies will continue to be a banking hurdle, particularly for the larger institutions that need to maintain their FDIC ensured status."

Even under a reclassification, marijuana would still be treated as a controlled substance on a federal level and its use subject to tight restrictions and criminal penalties.

"For big banks, this isn't the moment they ... start handing out term sheets. You might see some regional or tech-savvy banks start edging closer to the pot of gold, but not (the big banks)," said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.

Most major American and Canadian banks declined comment. Some others referred questions to the American Bankers Association.

The American Bankers Association, which represents major banks, said it would continue to call on Congress and the administration to pass the bipartisan SAFER Banking Act, which would give financial institutions the legal certainty they need to offer banking services to cannabis and cannabis-related businesses in the states where it has been legalized.

"Because cannabis remains illegal under federal law, proceeds from its sale are still considered illicit, which carries significant risks for banks that want to serve the industry," a spokesperson said.

For Ari Raptis, CEO of cannabis distributor Talaria Transportation, the news brings optimism but core challenges on accessing capital remain.

"From a financial standpoint, this improves a lot of optics, but not access. Capital follows clarity and clarity still hasn't arrived yet," Raptis said.

The table below presents a summary of the latest financial aggregates statistics.

| Monthly | Year-ended | ||||

|---|---|---|---|---|---|

| Oct 25 | Nov 25 | Nov 24 | Nov 25 | ||

| Total credit | 0.7 | 0.6 | 6.3 | 7.4 | |

| – Housing | 0.6 | 0.6 | 5.4 | 6.6 | |

| – Personal | 0.1 | −0.5 | 2.0 | 3.9 | |

| – Business(a) | 0.8 | 0.7 | 8.6 | 9.2 | |

| Broad money | 0.7 | 0.3 | 5.6 | 7.1 | |

(a) Lending to non-financial businesses. Sources: ABS; APRA; RBA | |||||

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for theeffects of breaks in the series. Data for the levels of financial aggregates are notadjusted for series breaks, and growth rates should not be calculated from data on thelevels of credit.

Historical levels and growth rates for the financial aggregates have been revised owing tothe resubmission of data by some financial intermediaries, the re-estimation of seasonalfactors and the incorporation of securitisation data. The RBA credit aggregates measurecredit provided by financial institutions operating domestically. They do not capturecross-border or non-intermediated lending.

Since the July 2019 release, the financial aggregates have incorporated an improvedconceptual framework and a new data collection. This is referred to as the Economic andFinancial Statistics (EFS) collection. For more information, seeUpdates to Australia's FinancialAggregates and the July 2019 Financial Aggregates.

Since the March 2023 release, series that exclude lending to warehouse trusts in business credit were added tothe financial aggregates.

When the Mexican Senate voted last week to approve a 50% tariff rate on a broad swathe of countries – China, India, Brazil, South Korea, Vietnam, and Taiwan among them – politicians from President Claudia Sheinbaum's ruling Morena party pretended they did it for their own reasons. Nobody in Asia believes that this is a bold declaration of economic independence, however. It's seen instead as opening a new and unexpected front in Donald Trump's trade war on the world.

The vote waived the senators' usual right to discuss amendments in committees, and it passed 76-5, with the opposition abstaining. Officials grandly delivered the usual lines that accompany measures cutting off trade: That they would protect local industry, that revenue would increase by almost $3 billion, that there would be more money to spend on supporting the unemployed.

But the real reason is that Sheinbaum is spooked by the deadline, six months away now, for reviewing the US-Mexico-Canada Agreement. The speed with which she pushed the legislation through and its timing are no coincidence: Trump said earlier this month that he might let NAFTA's successor expire, or "maybe work out another deal" that ensured the US wasn't "taken advantage of." Nobody wants that can of worms reopened.

About 80% of Mexico's exports cross its northern border, and more than 80% of those are tariff-free under USMCA. The country depends upon US markets for 30% or so of its output. Mexican politicians are clearly scared enough that even acts of economic self-harm, like 50% tariffs, seem worth trying.

For the countries affected by the new rates out of Mexico City, this is a sobering reminder that they have more than just the US president to deal with. Trade is a complicated, disaggregated affair, which is why we have multilateral arrangements like the World Trade Organization. For much of 2025, we could pretend that wasn't the case, with everyone scrambling to conclude their own bilateral deal with the US. But Sheinbaum shows that the trade conflicts Trump has launched are a cascading war, not some controlled confrontation.

Some will be hit particularly hard. One of the few industries in India that has carved out a successful export niche for itself is auto components. New tariffs may render them uncompetitive inputs for the giant factories along the US border serving America's insatiable appetite for cars.

But a significant proportion of Indian exports to Mexico aren't about the US at all. It is consistently among the top three or four destinations in the world for small, fuel-efficient cars, for example. These aren't meant for Americans, but they've been hit with tariffs anyway. Sheinbaum is paying Trump protection money, but she's taking it from the pockets of Indian producers.

And from her own citizens, of course. Opposition lawmakers pointed out that official modelers had given up on trying to estimate the effects of such a drastic change to Mexican trade policy. Citgroup's economists think that this will keep domestic inflation above 4% next year. All the other downstream, predictable effects of tariffs will apply: loss of competitive advantage, factories that face supply crunches, retaliation in fields where you don't expect it.

And what happens if Trump decides that he doesn't care about such expensive professions of loyalty, and shuts down USMCA anyway? Mexico City will have to rebuild trade relations with the rest of the world from scratch, but capitals from Brasilia to Beijing may not be particularly warmly disposed at that point.

Many countries in Asia had hoped that America-first trade policy – even if disruptive – might end up forging a united front against Chinese dominance of manufacturing. Sheinbaum's surrender shows us a different path. In this alternative world, some countries will quietly enact the US president's policies for him. The others will, perhaps with China in the lead, find a multilateral path to isolate collaborators.

Countries across Asia and beyond now know that it isn't just their relationship with the US that is threatened, but with multiple other nations as Trump tries to push everyone into his dream, high-tariff world. He has already asked the European Union, for example, to impose 100% tariffs on China and India. It is unlikely to agree. Some countries will raise high and unpredictable trade barriers against each other and the world, while the rest will seek security and prosperity by integrating faster and further. Sheinbaum may have picked the wrong side.

In his first term, Trump promised to have Mexico pay for his wall. In his second term, he has succeeded. So what if the wall is one of tariffs, and not bricks?

Japan's central bank might increase interest rates to 0.75% tomorrow, December 19, 2025, in Tokyo, marking the highest level since 1995 according to Bank of Japan sources.

A possible hike could impact global markets by strengthening the yen, placing pressure on cryptocurrencies like Bitcoin and Ethereum sensitive to interest rate changes.

Japan's central bank is deliberating an increase in interest rates to 0.75%. This decision follows economic improvements and diminishing U.S. trade tensions. Market participants anticipate the outcome of the meeting to influence global trends. "The bank is weighing a potential December hike, noting fading U.S. tariff risks and improving economic projections," said Governor Kazuo Ueda.

Led by Governor Kazuo Ueda, the Bank of Japan is contemplating this move amidst internal debates. Board members Tamura and Takata have pushed for tighter monetary policies due to ongoing inflationary pressures. Further deliberation is scheduled for December.

Economists predict possible shifts in global risk assets if the yen strengthens. The Bank of Japan's recent trend towards normalizing interest rates aligns with historical precedents from the 1990s, creating a cautious optimism among financial analysts. The proposed rate increase underscores Japan's focus on economic stability. Historical analysis suggests that similar actions previously influenced global markets significantly. The ongoing monetary discussions highlight the importance of strategic financial planning.

The Japanese government has compiled a record fiscal 2026 draft budget totaling more than 120 trillion yen ($770 billion), reflecting Prime Minister Sanae Takaichi's push for aggressive fiscal spending as well as the need to please opposition parties.

The budget proposal, set to be approved by the cabinet Dec. 26 for submission to parliament, exceeds the fiscal 2025 budget totaling 115 trillion yen and is raising alarms in the market over a rising debt load.

This comes after the fiscal 2025 supplementary budget enacted by parliament Tuesday, the largest since the COVID-19 pandemic. Takaichi ordered an increase in that budget, from the 14 trillion yen in general-account spending proposed by the Finance Ministry up to 17.7 trillion yen.

In a Nov. 27 meeting of the Council on Economic and Fiscal Policy, the prime minister questioned Japan's use of supplementary budgets in recent years to adjust spending levels.

"I think it's very much necessary to properly allocate the needed funding in the initial budget," she said.

The total fiscal 2026 budget request made in the summer, under Takaichi's predecessor Shigeru Ishiba, came to a record 122.4 trillion yen. The proposed budget drafted later in the year was adjusted based on economic conditions and Finance Ministry assessments, and also was changed to reflect the new government's policy priorities.

Takaichi has made "crisis management" investments a centerpiece of her growth strategy, naming 17 priority areas requiring heavy spending including artificial intelligence, semiconductors, shipbuilding and quantum computing.

Funding also is needed to make school lunches free -- a policy agreed on in the coalition agreement between Takaichi's Liberal Democratic Party and the Japan Innovation Party -- and to scrap a tax surcharge on gasoline. Defense spending needs to be increased as well, as Japan aims to reach its target of 2% of gross domestic product.

The budget, which would take effect in April, also illustrates the ruling parties' tenuous hold on power. The LDP-Japan Innovation coalition holds a bare majority in the lower house but lacks a majority in the upper house, meaning cooperation with opposition parties remains necessary to pass the bill.

As such, some budget revisions reflect demands from other parties. These include roughly 100 billion yen for tuition-free high school and 5.5 billion yen to rework high-cost medical fees, requested by Japan Innovation and the opposition Constitutional Democratic Party, respectively. Demands by the opposition Democratic Party for the People and former LDP coalition partner Komeito added another 900 billion yen.

Some in the government call for reining in spending, arguing that the budget should not exceed the originally requested sum of 122.4 trillion yen.

The yield on 10-year Japanese government bonds is nearing 2%, and the Bank of Japan is expected to raise interest rates at its policy board meeting concluding Friday.

A minister with an economy-related portfolio expressed approval of a rate hike, saying "when the market has priced it in to this extent, they'd be held responsible if they did the opposite."

Increased government spending amid rising interest rates risks stoking anxiety in the markets. Higher interest rates not only increase the government's debt repayment burden, but also affect consumers through higher mortgage rates.

Takaichi has been speaking more frequently about taking fiscal risks into account. In a news conference Wednesday, she stressed that her government's fiscal policy is "absolutely not focused on scale," adding that it will "properly consider sustainability" through "balanced, strategic fiscal spending."

The government is on track to issue less debt in fiscal 2025 than fiscal 2024, though this owes largely to Ishiba's government curbing bond issuance for the initial budget. Over 60% of the cost of the new supplementary budget will be funded with bonds.

The dollar lost ground against the Japanese yen and Swiss franc on Thursday after data showed a lower-than-expected rise in U.S. inflation, while the euro eased after the European Central Bank held interest rates steady.

The U.S. Consumer Price Index rose 2.7% year-on-year in November, according to Labor Department data, compared with a 3.1% increase forecast by economists polled by Reuters.The dollar weakened 0.12% to 155.50 against the Japanese yen and was down 0.14% to 0.79405 against the Swiss franc .

"The margin of error shouldn't be this great and it is questionable whether what we got in this release is going to make its way into the more traditional data collection discussion," said Marvin Loh, senior global market strategist at State Street in Boston.

"One of the things that ends up being a challenge in terms of changing expectations significantly is that we're already pricing in a Fed that gets to neutral within the next 12 months. So you either need to aggressively push against the neutral and/or start believing that there's a recession that will make you go below neutral and I don't think we're anywhere near there," Loh said.

The longest federal government shutdown in U.S. history had impacted data collection for the inflation report. The Federal Reserve tracks the Personal Consumption Expenditures Price Index for its 2% inflation target.

President Donald Trump said on Wednesday the next Fed chair will be someone who believes in lower interest rates "by a lot".All of the known candidates - White House economic adviser Kevin Hassett, former Fed Governor Kevin Warsh and current Fed Governor Chris Waller - advocate for interest rates to be lower than they are now.

The euro edged lower in choppy trading after the European Central Bank kept its policy rates steady and took a more positive view on a euro zone economy that has shown resilience to global trade shocks.

The euro was last down 0.14% at $1.17240 against the dollar.

"Today's meeting offered no new information to change our view on the most likely policy path or the surrounding risk balance," Barclays analysts led by Mariano Cena said in an investor note. "We continue to expect the ECB to remain on hold for the next two years and see the risk tilted towards lower, not higher, policy rates over our forecast horizon."

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, edged up 0.06% to 98.435.

Sterling rose after the BoE delivered its fourth rate cut this year, although markets pushed back their expectations for further easing, with the next cut not fully priced until June, from April prior to the decision.

Sterling strengthened 0.09% to $1.33846.

"Interest rate markets have reduced their bets on further easing, likely on account of both the finely balanced nature of upcoming decisions and the Governor's comment that room for further reductions is becoming more limited. Two-year sterling swap rates are roughly five basis points higher," said Tom Priscott, FX trader at Investec.

"The pound may have further room for upside as traders recalibrate their outlooks for 2026 through the afternoon," Priscott said.

The Swedish and Norwegian central banks both kept their main interest rates on hold, in line with expectations. The Swedish crown was last down 0.29% at 10.8855 per euro, while Norway's crown was last down 0.52% at 11.9173 per euro.

The Bank of Japan looks almost certain, opens new tab to raise short-term interest rates on Friday to 0.75% from 0.5% as high food costs keep inflation above the central bank's 2% target.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up