Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Today, Governing Council maintained the policy interest rate at 2.25%. We have three main messages......

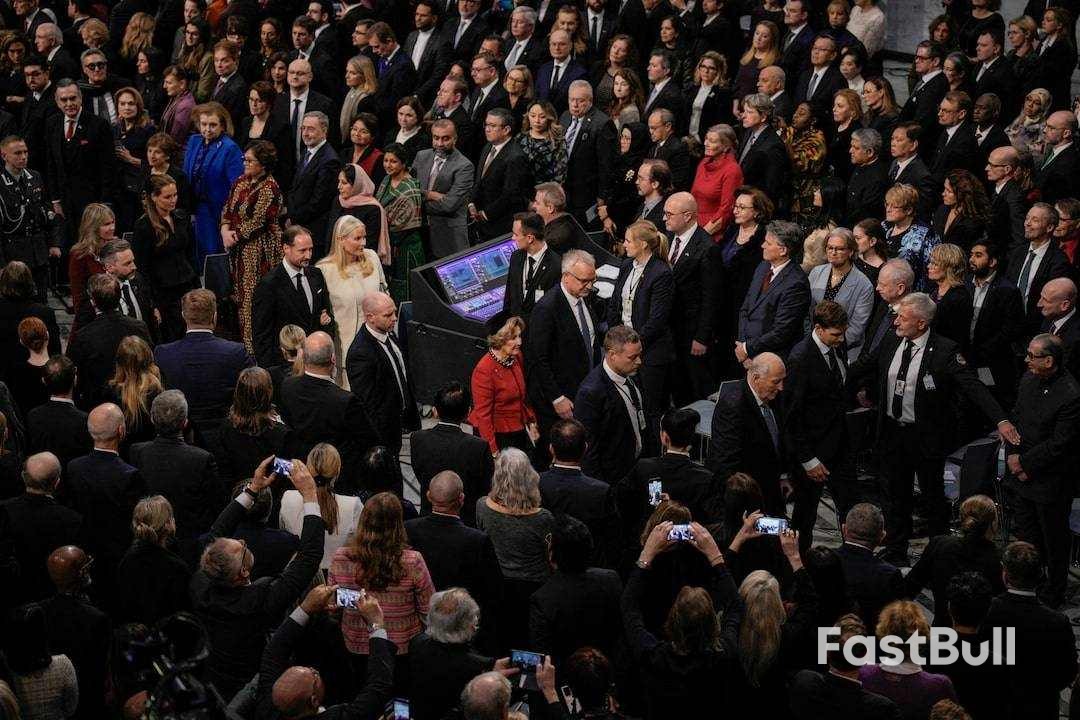

Nobel Peace Prize laureate Maria Corina Machado arrived in Oslo in the middle of the night on Thursday, the head of the Nobel committee said, after she failed to reach the Norwegian capital in time to receive her award at a ceremony held hours earlier.

The 58-year-old engineer had secretly left Venezuela for Oslo in defiance of a decade-long travel ban imposed by authorities in her home country and after spending more than a year in hiding.

"I can confirm that Maria Corina Machado has arrived in Oslo," Joergen Watne Frydnes told people gathered in the lobby of the Grand Hotel, where Nobel laureates traditionally stay.

"She is on her way here, but she will go straight to meet her family ... We'll see you all tomorrow."

Her daughter, Ana Corina Sosa Machado, accepted the Nobel Prize in her name and delivered a speech by her mother in which she said democracies must be prepared to fight for freedom in order to survive.

In her speech, Machado said that the prize held profound significance, not only for her country but for the world.

"It reminds the world that democracy is essential to peace," she said via her daughter, whose voice cracked when she spoke of her mother. "And more than anything, what we Venezuelans can offer the world is the lesson forged through this long and difficult journey: that to have a democracy, we must be willing to fight for freedom."

Machado left Venezuela by boat on Tuesday and travelled to the Caribbean island of Curacao, from where she departed on a private plane for Norway, according to a person familiar with the matter.

The source, who had been briefed by Machado's camp, said her escape from the Venezuelan coast was handled by her security staff. The White House did not immediately respond to a request for comment on Machado's travel to Curacao, which was first reported by the Wall Street Journal.

A large portrait of a smiling Machado hung in the Oslo City Hall to represent her. The audience cheered and clapped when Norwegian Nobel Committee head Joergen Watne Frydnes said during his speech that Machado would be coming to Oslo.

Evoking previous laureates Nelson Mandela and Lech Walesa, he said fighters for democracy were expected "to pursue their aims with a moral purity their opponents never display".

"This is unrealistic. It is unfair," he said.

"No democracy operates in ideal circumstances. Activist leaders must confront and resolve dilemmas that we onlookers are free to ignore. People living under the dictatorship often have to choose between the difficult and the impossible."

"Freedom is a choice that must be renewed each day, measured by our willingness and our courage to defend it. For this reason, the cause of Venezuela transcends our borders," she said in her prepared speech.

"A people who choose freedom contribute not only to themselves, but to humanity."

In 2024, Machado was barred from running in the presidential election, despite having won the opposition's primary by a landslide. She went into hiding in August 2024 after authorities expanded arrests of opposition figures following the disputed vote.

The electoral authority and top court declared President Nicolas Maduro the winner, but international observers and the opposition say its candidate handily won and the opposition has published ballot box-level tallies as evidence of its victory.

In her speech, Machado said Venezuelans did not realise in time that their country was sliding into what she described as a dictatorship.

Referring to the late president Hugo Chavez, who was elected in 1999 and held power until his death in 2013, Machado said: "By the time we recognised how fragile our institutions had become, a man who had once led a military coup to overthrow democracy, was elected president. Many thought that charisma could substitute the rule of law."

"From 1999 onward, the regime dismantled our democracy."

President Nicolas Maduro, in power since 2013, says U.S. President Donald Trump is trying to overthrow him to gain access to Venezuela's vast oil reserves and that Venezuelan citizens and armed forces will resist any such attempt.

When Machado won the Nobel Peace Prize in October, she dedicated it in part to Trump, who has said he himself deserved the honour.

She has aligned herself with hawks close to Trump who argue that Maduro has links to criminal gangs that pose a direct threat to U.S. national security, despite doubts raised by the U.S. intelligence community.

The Trump administration has ordered more than 20 military strikes in recent months against alleged drug-trafficking vessels in the Caribbean and off Latin America's Pacific coast.

Human rights groups, some Democrats and several Latin American countries have condemned the attacks as unlawful extrajudicial killings of civilians.

The Bank of Canada held its key policy rate steady at 2.25% on Wednesday as widely expected, and Governor Tiff Macklem said the economy was proving resilient overall to the effect of U.S. trade measures.

There was maybe a little bit of pushback around some of the excitement that followed the recent strong employment numbers... The Bank noting that their outlook hasn't really changed despite a few good data prints in Canada.

We do acknowledge maybe a little bit more progress is being made, a little bit more resilience in the economy. But at the end of the day, it is a fairly cautious tone and it leads me to be very comfortable with the idea that the bank will be on hold for quite some time.

Overall, I think the bank is watching the incoming data to see which path it may go. There are signs that Canada is adjusting to the trade shock but there's some lingering softness as well. So I think they'll keep their cards close to their chest and just watch the incoming data to see if additional policy action is needed.

The market is trying to figure out what the odds are for the next Bank of Canada action. Maybe a little premature on (pricing in) a hike but that's what markets do.

Mexican lawmakers gave final approval for new tariffs on Asian imports, broadly aligning with US efforts to tighten trade barriers against China, as President Claudia Sheinbaum seeks to protect local industry.

Mexico's Senate on Wednesday voted in favor of the bill that imposes tariffs of between 5% and 50% on more than 1,400 products from Asian nations that don't have a trade deal with Mexico. The bill passed with 76 votes in favor, five against and 35 abstentions.

The new levies will take effect starting next year and hit a wide range of products from clothing to metals and auto parts, with the massive output of Chinese factories emerging as the legislation's focus.

Passage of the bill took place against the backdrop of Sheinbaum's high-stakes trade talks with President Donald Trump and pressure to match his priorities, fueling hopes Mexico's levies on Chinese goods could ease punishing US tariffs on goods like Mexican steel and aluminum.

While Sheinbaum has publicly denied any connection to Trump's own tariff onslaught against the Asian giant, the new import levies resemble the US leader's approach.

For decades, Mexico has embraced free trade more than nearly any other country in the Americas, inking dozens of trade deals with nations all across the globe. But Sheinbaum's leftist Morena party is now moving in a different direction.

Mexico's finance ministry estimates the new tariffs will raise nearly 52 billion pesos ($2.8 billion) in extra revenue next year.

Sheinbaum sent the proposal to Congress in early September, but lobbying from Asian governments and domestic opponents — from business lobbies and critical legislators — delayed its passage.

Manufacturers reliant on inputs made in China, India and South Korea, among others, warned of rising costs that could fan inflation. Some lawmakers, including from the ruling party, sought to avoid a dispute with a rising region many consider crucial to the diversification of Mexican export markets.

Sheinbaum's embrace of the tariffs track with US concerns regarding so-called transshipment of Chinese exports through other countries, and follow action by Canada last year to also emulate US levies on electric cars, steel and aluminum from China.

Chinese officials have sharply criticized the latest Mexican tariffs as unwarranted and harmful.

According to the tariff legislation, Chinese cars will face among the steepest tariffs at 50%. The country's massive auto sector currently holds 20% of the Mexican market, up dramatically from minimal vehicle imports just six years ago.

Mexican officials and local auto associations backed the import levies in a bid to protect national vehicle production, a major driver of Mexico's manufacturing sector.

Along with the new tariffs, lawmakers approved a measure that will empower Mexico's Economy Ministry, responsible for trade policy, to adjust the import levies as it sees fit.

The measure states that the ministry "may implement specific legal mechanisms and instruments for the importation of goods from countries with which the Mexican state does not have a free trade agreement in force." The provision cites the flexible mechanism's goal of ensuring supplies of key imports under competitive conditions.

The policy could provide Mexican officials with useful tools ahead of next year's review of the North American USMCA trade pact with US and Canadian negotiators.

Former Bolivian President Luis Arce was arrested as part of a corruption investigation linked to his time as economy minister, officials said on Wednesday.

Arce's detention comes only a month after he left office and less than two months aftercentrist candidate Rodrigo Paz won the October runoff election.

The election campaign this year was dominated by economic concerns as Bolivians expressed a desire for change, with many having grown disillusioned with the country's Movement Toward Socialism party, widely known as MAS.

Bolivians chose to elect Paz this year, and with that, brought about an end to two decades of socialist rule in the Latin American country.

In a video posted to TikTok, Vice President Edmand Lara confirmed the news about Arce's detention.

Lara went on to say Arce would be the first of many targets as the new government seeks accountability.

"Those who have stolen from this country will return every last cent," Lara said, before ending his video by wishing "death to the corrupt."

According to officials, the corruption probe is from the period of time when Arce served as economy minister during the socialist presidency of Evo Morales, who was in office from 2006 to 2019.

Arce, 62, became president in 2020. He ended a five-year term and did not seek reelection following the August vote, with his presidency facing a number of shortages of fuel and foreign currency which led to widespread protests.

The former president is accused of authorizing transfers from the public treasury into the personal accounts of political leaders.

One alleged beneficiary was former lawmaker Lidia Patty, who was arrested last week for allegedly receiving close to $100,000 for a tomato cultivation project.

Sources in the prosecutor's office told AFP that Arce will have to answer to charges of dereliction of duty and "economic misconduct."

Maria Nela Prada, Arce's minister of the presidency and closest ally, agreed the charges seemed to stem from his period as economy minister.

Speaking outside the headquarters of a special police force dedicated to fighting corruption, she insisted on Arce's innocence. "Of course he's innocent, I can confirm that," she said.

Australia's labour market weakened in November as the number of full-time workers declined sharply, although the jobless rate held steady, the Australian Bureau of Statistics (ABS) said on Thursday.

The seasonally adjusted unemployment rate remained at 4.3%, unchanged from October, and missed market estimates of 4.4%.

Employment declined by 21,300 in November, contrasting forecasts of a 20,000 increase, and reversed from a 41,100 rise seen in October.

Full-time roles fell by 57,000, with men accounting for 40,000 of the decline. Part-time work rose by 35,000, partly offsetting the losses, with female part-time employment increasing by 29,000.

The participation rate slipped by 0.2 percentage points to 66.7%, reflecting fewer people engaged in the labour market.

ABS head of labour statistics Sean Crick said both employment and unemployment levels eased, contributing to a narrower pool of active jobseekers. He added that employment growth over the past year, at 1.3%, has lagged population growth of 2%.

The report comes after the Reserve Bank of Australia held interest rates unchanged earlier this week, citing rising inflationary risks.

On December 10, the Fed announced a 25 basis point cut to its key interest rates, confirming market expectations. However, behind this seemingly routine decision lie deep divisions: split votes, unclear economic context, and unprecedented political pressures. In a context marked by the absence of key economic data due to the shutdown, interpreting the U.S. monetary strategy becomes increasingly complex and potentially destabilizing.

The U.S. Federal Reserve announced, on Wednesday, December 10, a new 25 basis point cut to its key interest rates as markets had anticipated, bringing the Fed Funds Rate range to 3.50 % – 3.75 %.

This marks the third consecutive cut since September. This decision, although expected by markets, was not unanimous within the monetary policy committee. According to the official statement, "uncertainty regarding economic prospects remains high", and the committee "judges that downside risks to employment have increased in recent months".

The internal dissensions, rarely so marked, were made public :

This tension is also explained by the lack of updated on-chain economic data, a direct consequence of the extended U.S. government shutdown. The latest available unemployment rate, from September, is 4.4 %, while inflation then reached 2.8 %, above the 2 % target.

Several key indicators, such as job creation and consumption data, have not been published for several weeks, leaving the Fed in a delicate position. Due to lack of visibility, some members preferred to wait, while others judged it necessary to act now to support the labor market.

Your 1st cryptos with Coinbase This link uses an affiliate program.

Beyond internal tensions, this monetary decision comes in a particularly sensitive political context.

President Donald Trump has intensified his criticism of Jerome Powell, whom he blames for monetary policy still too restrictive. Powell's term expires in spring 2026, and the White House has already launched consultations to replace him with a more accommodative profile.

According to several sources, Kevin Hassett, former economic advisor to Trump, is among the favorites. Trump makes no secret that he expects the future Fed chair to lead a more accommodative policy. This growing politicization of the central bank fuels concerns about the institution's future independence.

In parallel, the composition of the FOMC will evolve in 2026: four new voting members from regional banks will join the committee, according to the usual rotation system. This renewal could change the internal balance of debates, especially if profiles more favorable to low rates are appointed or promoted by the executive.

In the economic projections published this Wednesday, the Fed anticipates only one rate cut for 2026, while markets expect two. This divergence between the institution's discourse and market expectations increases uncertainty, notably for investors seeking visibility.

The Fed resists Trump and maintains its stance despite political pressures. By opting for a measured cut, it asserts its independence while accommodating the markets. The question remains whether this stance will hold against the economic tensions of 2026 and investors' growing expectations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up