Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

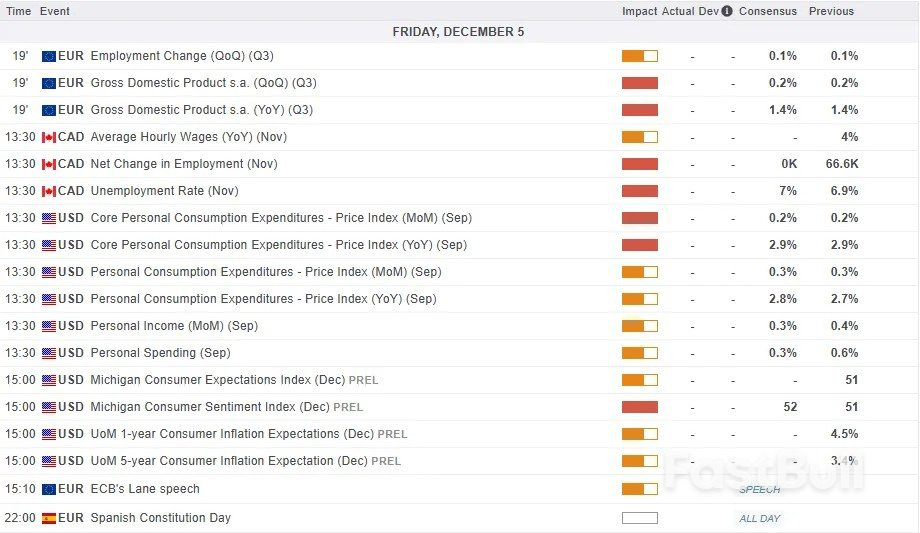

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Australian dollar is about to extend its longest streak of daily gains of the decade.

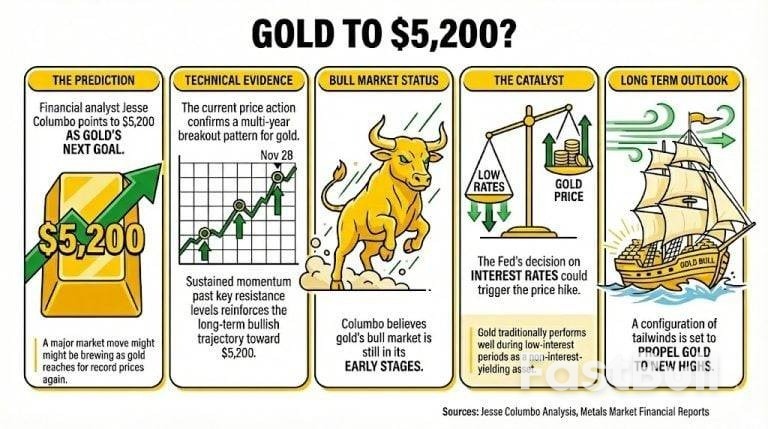

Gold and metals market financial analyst Jesse Columbo believes that a major market move might be brewing, and that gold could reach record prices once again.

In a recent analysis on the state of the gold market, Columbo pointed out $5,200 as gold's next goal, having already registered several all-time high prices this year.

Columbo states that the recent price breakout that gold experienced on November 28 is part of the evidence leading to this new price goal. He explained that this move is the third of its kind happening this year, and that if prices follow their previous behavior, it could reach this number.

Nonetheless, Columbo is even more bullish about gold long-term, as he believes there is a configuration of tailwinds that will propel gold to new highs, having recently explained that gold's bull market is still in its early stages.

The Fed's long-awaited decision on interest rates might also become another catalyst for a hypothetical price hike, as gold traditionally performs well during low-interest periods as a non-interest-yielding asset.

The expectation of a quarter-point rate cut is widespread, meaning that if the Federal Reserve fails to deliver, prices might decrease temporarily.

Phillip Streible, chief metal strategist at Chicago's Blue Line Futures, pondered on this outcome. Talking to Sputnik, he stated:

The overwhelming expectation for December is that there will be another Fed rate cut. If that doesn't happen, be prepared for downside that could even exclude December as a winning month.

Even so, most firms predict gold will keep rising in 2026 and beyond, as central banks and investors are expected to maintain growing demand for the metal as an inflation and uncertainty hedge with no clear substitute.

Russian President Vladimir Putin has underlined Moscow's willingness to provide "uninterrupted shipments of fuel" to India, as the U.S. pressures New Delhi to give up importing their oil.

Putin made the offer during a joint address with Indian Prime Minister Narendra Modi on Friday, part of his first visit to the country since Russia's full-scale invasion of Ukraine in 2022, which triggered widespread sanctions.

The sanctions forced Russia to seek new customers for its exports. India has become the second biggest buyer of Russian crude oil, after China, with a report Finland-based Centre for Research on Energy and Clean Air showing India bought 38% of Russian crude exports in October.

In October, President Donald Trump sanctioned two of Russia's largest oil companies, Rosneft and Lukoil. This followed a tariff of 25% on India for buying Russian oil in August. But India has to walk a tightrope because it has close ties to the U.S. while also relying on Russia for fuel and access to military hardware.

Putin questioned U.S. pressure on India in an interview to an Indian television channel on Thursday.

The United States still buys nuclear fuel from Russia for its own nuclear power plants, Putin said in the interview, adding: "If the U.S. has the right to buy our fuel, why shouldn't India have the same privilege?"

While Trump has acknowledged that India has cut back its Russian oil imports, experts told CNBC that this may be a temporary trend.

Apart from crude oil, Russia's Rosatom is also delivering reactors and reportedly fuel for India's Kudankulam nuclear power plant in Tamil Nadu, which has a combined capacity of 6000MW.

India and Russia have an energy partnership, the Russian president said, adding that Moscow had been is reliable supplier of "oil, gas, coal and everything that is required for the development of India's energy".

Last month, India announced a "historic deal" with Washington, in which Indian state-owned oil companies signed a one-year deal to import around 2.2 million tonnes per annum of liquefied petroleum gas from the U.S.

Singapore's High Court yesterday upheld the conviction of opposition leader Pritam Singh for lying to a parliamentary committee, in connection with a case involving a former lawmaker from his party.

In February, the leader of the Workers' Party, the only opposition party with seats in Singapore's Parliament, was convicted on two counts of lying to a parliamentary committee under oath and was fined S$7,000 (around $5,400) for each count.

The charges were related to Singh's handling of a scandal involving Raeesah Khan, a former Workers' Party MP, who admitted that she had repeatedly lied to Parliament in August 2021 about alleged police mistreatment of a victim of sexual assault. During a parliamentary committee investigation, she claimed that the party's leaders, including Singh, had told her to "continue with the narrative," despite knowing about the lie.

Khan was fined S$35,000 for lying and abusing her parliamentary privilege, and subsequently resigned from the party and from Parliament. The committee later concluded that Singh had not been truthful to the committee and recommended a criminal investigation into his conduct. Prosecutors agreed, and in March 2024, charged him with making two false statements during the committee's proceedings.

During yesterday's hearing, Justice Steven Chong said the lower court judge's decision to convict Singh on both charges was sound and supported by the evidence, despite quibbling with some small elements of the case, Channel News Asia reported.

After the hearing, Singh, 49, told the press that he was "disappointed" with the decision but accepted it "fully and without reservation," the BBC reported. He said he took responsibility for taking "too long" to respond to Khan's lie, but that he remains committed to working for the betterment of all Singaporeans. Singh also paid his fines at the courthouse after the hearing.

In a statement posted on Facebook after the verdict, the Workers' Party said that it was "studying the Court's verdict and grounds of decision," noting that it has "weathered many challenges over the years."

"Our commitment to serving the people of Singapore remains unwavering," it added. "We are deeply grateful to everyone who has stood with us, in moments of progress and through difficult times."

Despite his conviction in February, Singh was allowed his seat in Parliament and led the Workers' Party into a general election in May, during which it increased its share of the vote to 14.99 percent (up from 11.22 percent in 2020), and increased its share of parliamentary seats from 10 to 12. However, the party largely failed to make headway outside its existing strongholds of support, and its increased vote share was largely cannibalized from other opposition parties.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up