Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Market Update] Spot Gold Continued Its Rebound, Returning Above $4,900 Per Ounce, Rebounding Nearly $250 From Its Daily Low, With A Daily Gain Of 2.5%

[Market Update] Spot Silver Continued Its Rebound, Breaking Through $75/ounce, Rising Nearly 6% Intraday And Rebounding $11 From Its Intraday Low

Bank Of Japan's Masu: It's True Japan's Negative Real Interest Rate Is Likely Behind Rises In Property Prices

Bank Of Japan's Masu: If There Is Sufficient Data That Convinces US We Should Act, Then We Should Act Without Hesitation

Bank Of Japan's Masu: Don't Have Specific Timeframe In Mind On How Soon Bank Of Japan Should Raise Rates To Levels Deemed Neutral To Economy

[Market Update] Spot Silver Broke Through $74/oz, Up 4.69% On The Day. Spot Gold Broke Through $4870/oz, Up 1.90% On The Day

Bank Of Japan's Masu: I'M Not Saying That Food Prices Are Rising In A Way That Needs Immediate Policy Action

[Market Update] Both WTI And Brent Crude Oil Prices Continued Their Upward Trend, With WTI Crude Oil Rising Above $64 Per Barrel, Up 1.33% On The Day. Brent Crude Oil Rose Above $68 Per Barrel, Up 1.43% On The Day

Bank Of Japan Board Member Masu: Bank Of Japan Is Not Behind The Curve In Dealing With Inflation

[Market Update] Spot Gold Has Climbed Back Above $4,850 Per Ounce, Rebounding Nearly $200 From Its Daily Low, Up 1.52% On The Day

[Market Update] Spot Silver Rose 4.00% Intraday, After Falling More Than 8% Earlier, And Is Currently Trading At $73.64 Per Ounce

Toyota: Assume Average Euro Rate Of 174 Yen In Fy2025/26 Versus Previous Assumption Of 169 Yen

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)A:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

No matching data

View All

No data

Cryptocurrency as a whole has come a long way since Bitcoin’s introduction, and privacy coins were once heralded as the ultimate solution for financial anonymity.

Designed to keep transactions confidential and identities hidden, these specialized cryptocurrencies sparked interest and controversy from day one. However, in 2025, with evolving regulations, innovative technology, and changing user priorities, the relevance of privacy coins feels increasingly uncertain. Are they still useful? Or are they becoming relics in a more transparent crypto ecosystem? Let’s take a closer look at their history, current trends, and what the future may hold.

To understand where privacy coins stand today, it’s essential to revisit their origins and the reasons they captured attention in the first place.

Privacy coins are a type of cryptocurrency designed to prioritize user anonymity and the confidentiality of transactions. Unlike Bitcoin and Ethereum, where transactions are publicly recorded on the blockchain, privacy coins hide transaction details—including amounts, sender addresses, and recipient addresses.

Privacy technologies such as ring signatures, zk-SNARKs, and stealth addresses make this level of confidentiality possible. For example, Monero uses ring signatures to obscure the origin of funds, while Zcash employs zk-SNARKs to prove transactions occurred without revealing specific details. In short, these coins aim to protect user identities in an increasingly monitored digital world.

The rise of privacy coins was driven by a growing demand for financial privacy. In the early days of crypto, Bitcoin was mistakenly thought of as an anonymous way to send value. When users realized Bitcoin transactions could be traced, privacy coins emerged to fill the gap.

These coins appealed to individuals seeking to safeguard their financial activities—whether to protect personal information or avoid surveillance. They also resonated with libertarians and privacy advocates who saw them as a tool for resisting government control and protecting freedom.

However, with anonymity came controversy. Privacy coins became heavily associated with illegal activities, such as money laundering and transactions on darknet markets. While many users employed these coins for lawful purposes, their misuse by bad actors attracted the attention of global regulators.

From the start, privacy coins faced intense scrutiny from governments and financial institutions. Nations like Japan and South Korea banned their use entirely, citing concerns about tax evasion and criminal activity. Some exchanges in the US and Europe delisted privacy coins due to increasing compliance demands.

Regulators’ primary concern has always been the inability to trace transactions. Transparent blockchains like Bitcoin allow law enforcement to track illicit financial flows when necessary, but privacy coins make this nearly impossible. Over the years, this regulatory pressure has made it harder for privacy coins to gain mainstream traction.

Various technologies can bring privacy to blockchain and crypto.

Various technologies can bring privacy to blockchain and crypto.Fast forward to the present day, and privacy coins still exist, but the landscape around them has shifted dramatically. Several key trends define their status today.

As cryptocurrency adoption has gone mainstream, the demand for privacy coins has seen mixed results. On one hand, some industries and regions still rely on them. Privacy advocates, journalists, and political dissidents in authoritarian countries use these coins to protect themselves. On the other hand, stricter regulations and penalties have discouraged usage in developed economies.

Interestingly, privacy coins have made a small comeback within niche sectors. For instance, in the gaming industry or among decentralized communities valuing privacy, these coins have carved out specific use cases. However, their overall market share remains small compared to more broadly adopted assets like Bitcoin and Ethereum.

Technological innovation has kept privacy coins competitive despite decreasing popularity. In 2025, advancements like zk-STARKs (an evolution of zk-SNARKs) and adaptive anonymity protocols have improved the efficiency and security of privacy features. These upgrades make transactions even harder to trace while reducing computational costs.

Moreover, some privacy concepts have migrated to mainstream blockchains, creating hybrid solutions. For example, Ethereum's layer-2 solutions now include optional privacy features, making it easier for users to toggle between transparent and private transactions. This integration raises questions about whether standalone privacy coins can maintain relevance in the long run.

Regulators haven’t let up in their efforts to control or eliminate privacy coins. Compliance requirements have reached new levels of intensity. Most centralized exchanges outright refuse to list privacy coins due to Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. Some countries, like the US and EU nations, have imposed severe penalties for their misuse.

Still, enforcement isn’t universal. Nations with looser regulatory oversight or a history of favoring cryptocurrency innovation—such as certain parts of Asia and Africa, remain havens for privacy coin activity.

So, what lies ahead for privacy coins? Several possibilities may shape their trajectory beyond 2025.

There’s little doubt that privacy coins will remain a regulatory target. Governments are wary of their capacity to enable untraceable transactions, and this concern will likely lead to stricter enforcement. Over time, some privacy coins may migrate underground, appealing exclusively to users willing to take legal risks. Others could attempt to adapt by incorporating semi-compliant features—but at the cost of losing their appeal to hardcore privacy advocates.

Instead of withering away completely, privacy-focused technology could integrate into broader crypto ecosystems. Already, major blockchains like Ethereum are experimenting with privacy solutions that offer the best of both worlds: transparency when required and privacy when desired. If this trend continues, standalone privacy coins could lose relevance as these features become standard on larger platforms.

Decentralized finance (DeFi) is also an area ripe for privacy innovation. Users of DeFi platforms might begin demanding more anonymity features, and privacy coins that integrate with DeFi protocols could see renewed interest.

The question of survival depends largely on whether these coins can adapt. If innovation stagnates or regulations become unbearable, they may fade into obscurity. However, as long as there’s demand for privacy in financial transactions, they’ll likely retain a small but dedicated user base. Their future may reside not in the mainstream but in specialized markets where privacy is non-negotiable.

Privacy coins occupy a unique, controversial space in the cryptocurrency world. While they’ve lost some of their early momentum due to regulatory crackdowns and technological competition, they remain valuable to those who prioritize financial privacy. The evolution of anonymity technology, combined with the steady push for compliance, will determine their survival in the years to come.

For avid crypto enthusiasts or those concerned with personal privacy, the next few years will be critical. Will privacy coins adapt or disappear? Only time will tell. One thing is clear: as the conversation around privacy, transparency, and control evolves, so too will the tools we use to navigate the crypto space.

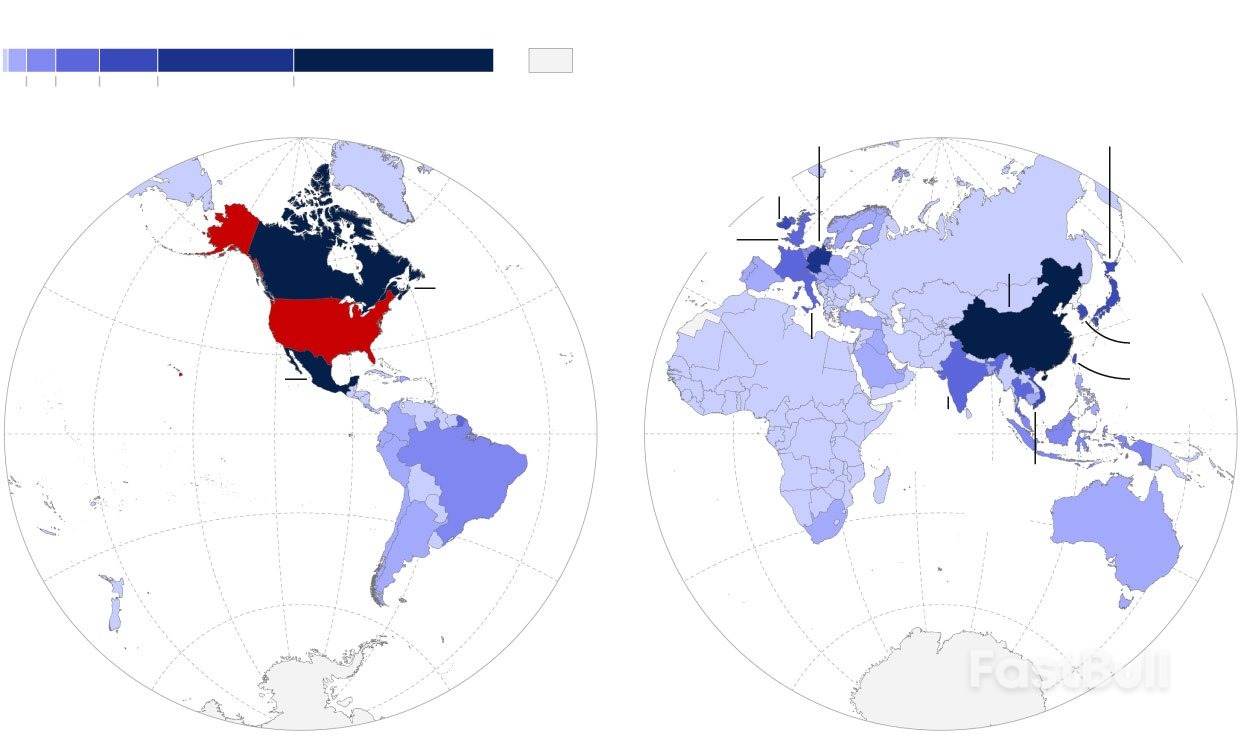

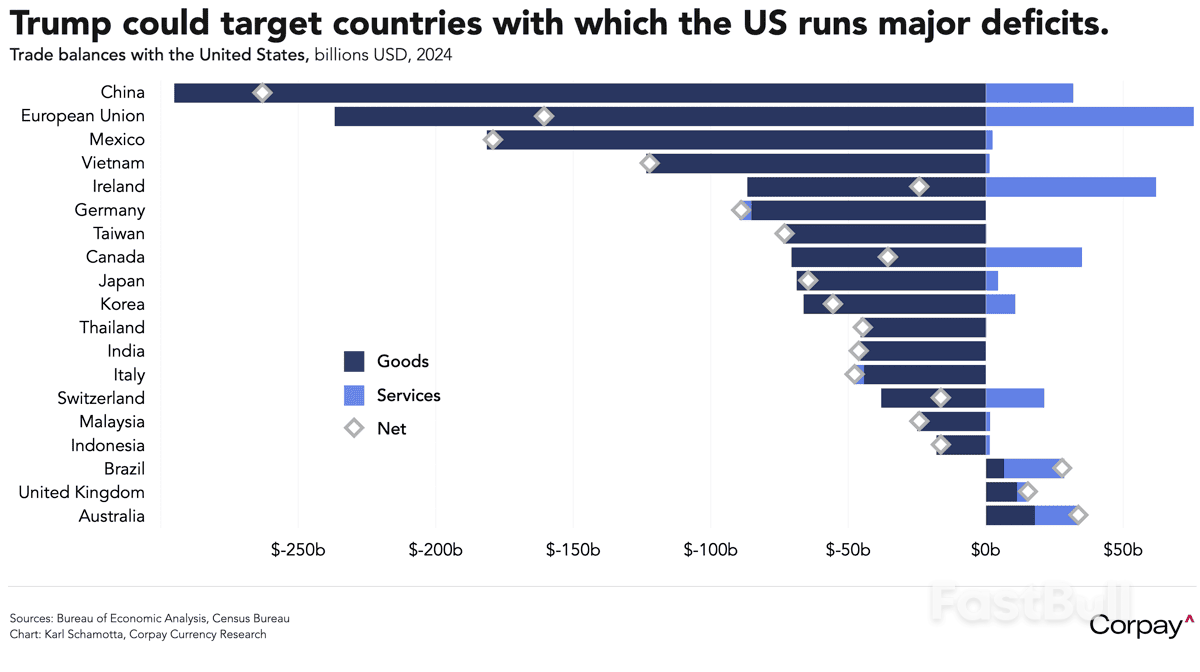

Donald Trump declared the "Liberation Day" tariffs aiming to bolster U.S. industries. The policy affects over 25 countries, triggering market volatility. Trump's history of influencing markets continues, with crypto sectors responding swiftly.

Bitcoin's value rose by 2.3% to $66,500, while Ethereum gained 3.1%, reflecting confident market reactions to tariffs. Markets also saw significant trading volume, with heightened activity on exchanges and derivatives markets.

GameStop's $1.5 billion investment to "buy the dip" underscores institutional confidence in Bitcoin's potential amidst tariff-induced turbulence. Social media suggests bullish sentiment, with retail traders viewing this as a buying opportunity.

Financial markets are navigating this volatility, with historical trends suggesting that similar economic measures previously led to significant Bitcoin appreciation. Experts propose Bitcoin's future price could ascend significantly, indicating strategic interest across sectors.

Fred Krueger, Mathematician and Author, emphasized the role of Bitcoin in today's market dynamics: "Bitcoin is a portable digital gold, especially in the face of tariffs."

Despite the absence of immediate regulatory responses, the market's enthusiasm remains cautious yet optimistic. Investors eye digital assets for safeguarding wealth, anticipating advantages if geopolitical tensions escalate further.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up