Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

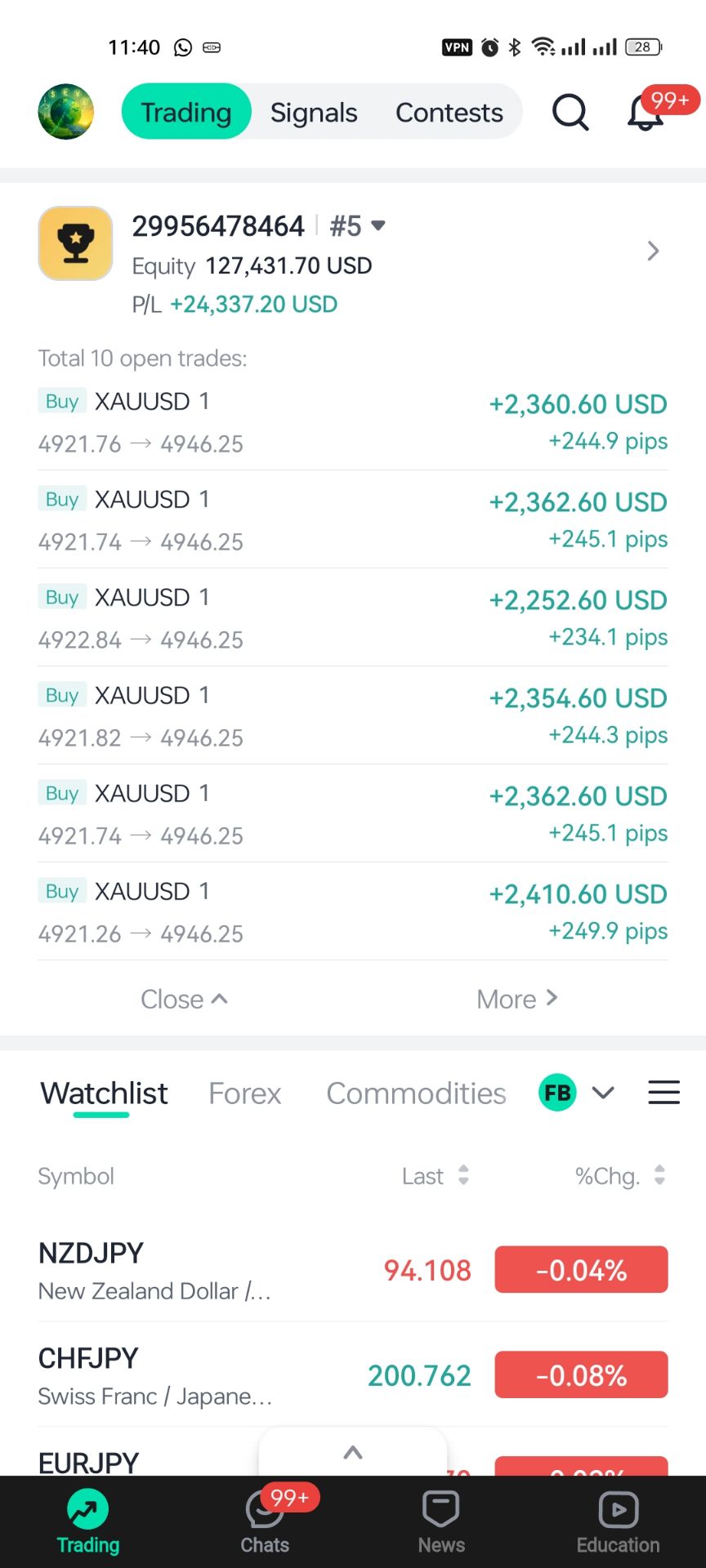

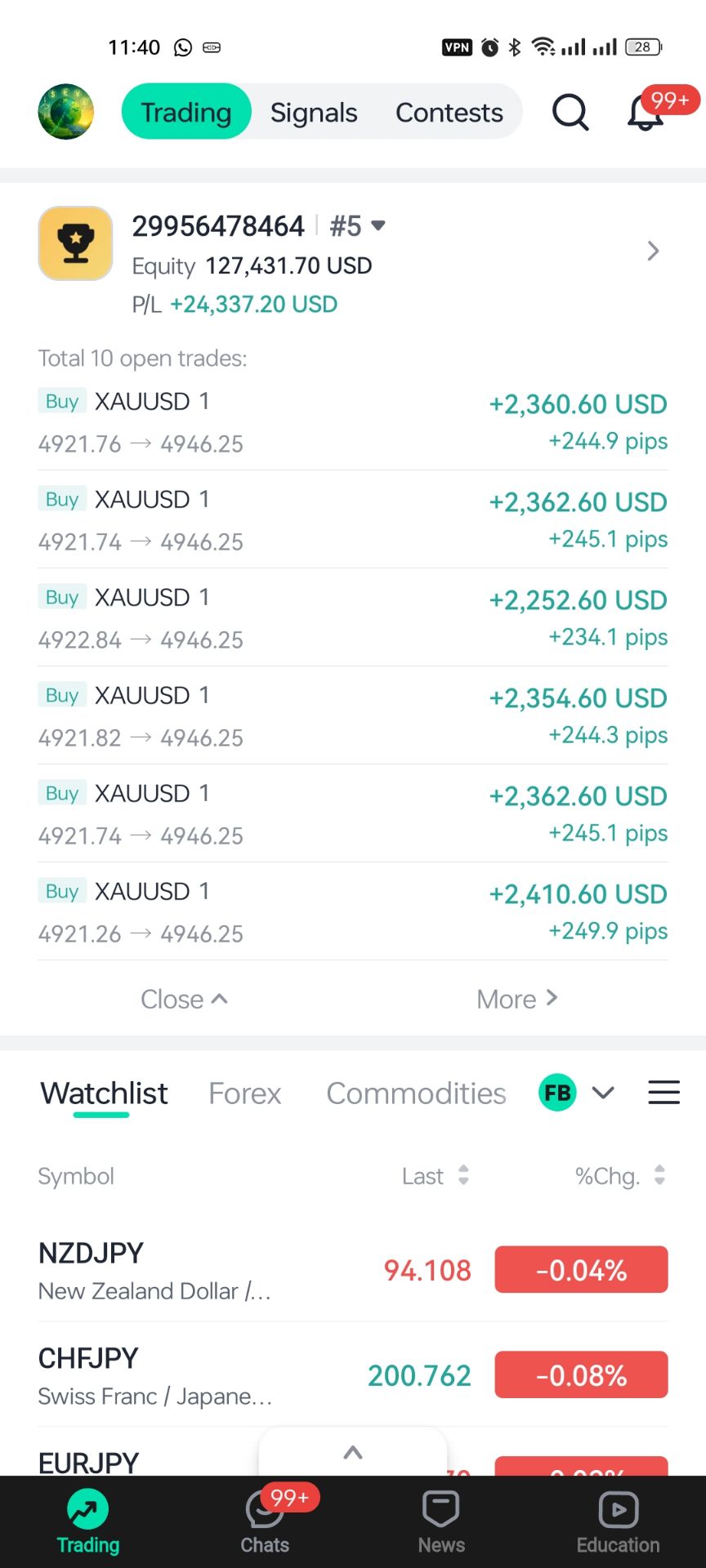

Signal Accounts for Members

All Signal Accounts

All Contests

A U.S. Official Said The Iranian Revolutionary Guard Had Planned To Conduct Live-fire Military Exercises In The Strait Of Hormuz On Sunday And Monday, But Canceled The Exercises After Receiving A Warning From The United States

U.S. Trade Representative Greer: The Government Will Work With Congress To Modernize And Reform The Africa Trade Preference Program

U.S. Trade Representative Greer: The African Growth And Opportunity Act's Trade Preference Program Has Been Authorized To Be Extended To December 31, 2026, With Retroactive Effect Until September 30, 2025

USA Trade Representative Greer: President Trump Signed Into Law Legislation That Reauthorizes African Growth And Opportunity Act

A South Korean Trade Negotiator Stated That Discussions Regarding The Proposed Additional Tariffs On South Korea Are Currently Underway Among Various U.S. Departments

Rare Earth Concept Stocks Generally Closed Higher, With Niocorp Up 21.75%, Critical Metals Up 20.25%, USA Rare Earth Up 17.46%, Uuuu Up 16.75%, Mp Materials Up 9.30%, Metal Mining Etfetf Up 5.02%, And Uuraf Down 2.15%

[Hong Kong And Macao Affairs Office: Panama Embarrassing Itself And Reaping The Consequences] An Article From The Hong Kong And Macao Affairs Office Of The State Council Stated That The Panamanian Supreme Court Recently Ruled On The Grounds Of So-called "unconstitutionality" That The Renewal Of The Panama Canal Port Concession Agreement For A Hong Kong Company Was Invalid. This Ruling Disregards Facts, Breaches Faith, And Seriously Damages The Legitimate Rights And Interests Of Hong Kong Companies. It Is Therefore Rightfully Opposed By The Chinese Government And The Hong Kong SAR Government, And Has Been Strongly Condemned By All Sectors Of Hong Kong Society

New Zealand-Run Global Dairy Trade Price Index Rises 6.7%, With An Average Selling Price Of $ 3830/Tonne - Auction

The US AI Software Pioneer Index Closed Down 5.22% At 101.34 Points. US Stocks Fell Sharply In Early Trading And Continued To Fluctuate At Low Levels After 23:00 Beijing Time

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

No matching data

View All

No data

Adam Kinzinger net worth in 2025 is estimated at around $4 million. This figure reflects his transition from 12 years in Congress, Air National Guard service and new media roles at CNN.

Adam Kinzinger’s journey from Air Force pilot to U.S. Congressman and now CNN political analyst shows how a public career can transform into personal prosperity. As of 2025, adam kinzinger net worth is estimated near $4 million—reflecting not just government service, but strategic post-Congress income growth through media, speaking, and investments.

As of 2025, estimates place Adam Kinzinger’s total assets at roughly $4 million. This valuation represents the combined results of his twelve years in Congress, ongoing Air National Guard service, and his transition to television commentary. Analysts tracking adam kinzinger net worth 2025 note that the majority of his recent growth came after leaving public office, when he diversified his income sources.

Congressman Adam Kinzinger’s career earnings began modestly with a U.S. Air Force pilot salary in the early 2000s before entering the House of Representatives in 2011. His government salary remained capped at $174,000 per year. However, his exposure in national politics opened doors to consulting, book contracts, and media roles that accelerated his income trajectory. Observers examining what is adam kinzinger net worth often cite his ability to pivot from public service to private opportunities as the key factor behind his financial growth.

The combination of stable government pay and post-retirement consulting income defines adam kinzinger net worth today. His financial disclosure filings show relatively low debt levels, suggesting consistent asset growth since leaving the House.

While serving in Congress, Kinzinger earned a fixed annual salary of about $174,000—comparable to other federal legislators. This cap limited potential net worth expansion during his tenure, as outside income and investments are strictly regulated for sitting members. His government benefits and military pension contributed to long-term stability but not immediate wealth accumulation.

After stepping down in early 2023, Kinzinger’s earnings rose significantly. Joining CNN as a senior political commentator reportedly increased his annual income well beyond his congressional salary. Public estimates of the adam kinzinger cnn salary range from $400,000 to $600,000 per year, excluding appearance bonuses and event speaking fees. Combined with book royalties and PAC consulting, his post-congressional period became the most financially rewarding of his career.

| Income Source | Before Leaving Congress | After Leaving Congress |

|---|---|---|

| Annual Salary | $174,000 | $400K–$600K (CNN & Speaking) |

| Military Pension | Deferred | ~$70K–$90K annually |

| Book Deals & Royalties | Minimal | $150K+ |

| Total Estimated Annual Income | ≈$174K | $600K–$800K+ |

These figures highlight how the transition from elected official to media figure redefined congressman adam kinzinger net worth. His financial disclosures after 2023 reflect a newfound liquidity and independence uncommon among former lawmakers, making him one of the few who grew wealthier after leaving Washington.

During his twelve-year tenure in the U.S. House of Representatives, Adam Kinzinger earned an annual base salary of $174,000. Including allowances and benefits, his total congressional earnings over this period are estimated to exceed $2 million. Despite this steady income, congressional salary alone rarely leads to major wealth accumulation. Analysts evaluating what is adam kinzinger net worth note that his true financial growth began only after leaving Congress.

While serving in Congress, Kinzinger maintained his Air National Guard commission, eventually reaching the rank of Lieutenant Colonel. This dual career path allowed him to accrue military pension benefits even while holding elected office. His pension contributions, paired with federal savings plans, helped build a foundation for long-term financial stability that continues to enhance adam kinzinger net worth 2025 projections.

The final 2023 disclosure showed moderate but solid wealth growth compared to previous filings. Congressman Adam Kinzinger net worth was characterized by liquidity and retirement-focused investments rather than luxury assets or high-risk ventures.

A congressional salary limits external business opportunities due to federal ethics rules. While it provided security, it could not match the earning potential available to private-sector commentators or authors. Leaving office opened pathways to lucrative contracts such as the adam kinzinger cnn salary and consulting engagements, proving that post-political life could be more profitable than public service.

Kinzinger’s break from Donald Trump and the GOP establishment in 2021 effectively cut ties with major conservative donors. This decision temporarily slowed financial support for his campaigns and reduced access to traditional fundraising channels. However, it also allowed him to redefine his image as an independent voice in national media.

His outspoken criticism of Trump increased media visibility, leading to a surge in interviews, book offers, and television appearances. Within months of leaving office, he secured a contract with CNN as a senior political analyst. Estimates of the adam kinzinger cnn salary suggest he now earns several times more annually than he did as a congressman. This shift elevated adam kinzinger net worth beyond the limitations of his prior public service pay.

Serving on the January 6th Committee positioned Kinzinger as a national figure, boosting his credibility among centrist audiences and media networks. His televised appearances increased public demand for his commentary, turning controversy into income potential. The exposure also enhanced his long-term book and speaking value, providing recurring revenue that continues to sustain adam kinzinger net worth 2025 estimates.

Unlike most former legislators tied to partisan identities, Kinzinger successfully built a bipartisan brand appealing to moderate Americans. His balanced media persona has attracted corporate event invitations and paid speaking opportunities across industries. Such engagements diversified congressman adam kinzinger net worth sources while reinforcing his image as a credible independent analyst.

Adam Kinzinger’s Air Force career began in the early 2000s as a pilot, where he earned an average salary of $60,000–$80,000 annually. His service in Iraq and Afghanistan provided additional hazard pay and benefits. The discipline and leadership experience he gained during this period laid the groundwork for financial consistency, a major component of adam kinzinger net worth.

Upon achieving the rank of Lieutenant Colonel, Kinzinger became eligible for a lifetime military pension. Estimates place this pension at around $70,000–$90,000 annually depending on years of service and duty points. This steady post-retirement income ensures a secure financial baseline regardless of fluctuations in his media or consulting revenue.

Throughout his political career, Kinzinger maintained both military and congressional roles—a rare dual-income arrangement among lawmakers. This combination provided stable cash flow, health benefits, and future pension rights, forming a reliable safety net. Analysts evaluating what is adam kinzinger net worth often highlight this dual strategy as key to his long-term wealth preservation.

After retiring from Congress, Adam Kinzinger became a CNN political commentator and public speaker. He also runs the Country First PAC, focusing on bipartisan leadership initiatives. These new ventures, combined with his military pension, form the main sources supporting adam kinzinger net worth today.

According to the Federal Reserve, total U.S. household net worth surpassed $150 trillion in 2025. While this figure reflects the nation’s overall prosperity, individual earnings like those contributing to adam kinzinger net worth represent a much smaller share tied to personal career paths and investment decisions.

Adam Kinzinger is officially a Republican, though his moderate and anti-Trump stance often puts him at odds with his party’s leadership. Since leaving Congress, he has adopted a more centrist political tone, which broadened his media appeal and helped expand his financial standing.

In summary, adam kinzinger net worth reflects a remarkable transition from public service to private opportunity. His estimated $4 million fortune in 2025 showcases how a disciplined military background, principled politics, and strategic post-congress ventures like media and consulting can redefine long-term financial success.

US import volumes are projected to slow through the year-end holidays and into 2026, as tariff uncertainty weighs on cargo owners and the outlook for consumer spending remains clouded, new data show.

According to Descartes Systems Group's latest Global Shipping Report, the volume of US container imports slipped 0.1% last month compared with September, marking only the second October in the past decade to show a month-over-month decline and "a clear sign of importer caution."

The October total of 2.31 million 20-foot equivalent container units, or TEUs, was 7.5% lower the year-earlier level and left the year-to-date tally just 0.9% higher than the total during the first 10 months of 2024. Separate figures from the National Retail Federation and Hackett Associates predict year-on-year declines in inbound container volumes of 14.4% for November and 17.9% in December.

US importers are facing "persistent geopolitical friction and regulatory volatility, which drive higher levels of supply chain uncertainty and complexity as policies shift and evolve quickly," Jackson Wood, director of industry strategy at Descartes, said in the report released Monday.

President Donald Trump's return to the White House in January kicked off a rollercoaster year for manufacturers, retailers and other US industries dependent on goods from abroad. They're mostly absorbing his higher import taxes, while small businesses in particular are struggling to manage supply networks without a clear picture of their landed costs.

The future of Trump's tariff reach was thrown into fresh doubt last week as the Supreme Court sounded skeptical about the constitutionality of his broad use of import taxes.

Starting Monday, the US' 20% fentanyl tariff on imports from China is reduced to 10%, and a significant increase in "reciprocal" duties on Chinese goods set to take effect is paused for a third time, this time for a year. The 10% duty Trump imposed using emergency powers remains in place while it's under the high court's review.

Tariff mitigation efforts by retailers earlier in the year may have spared Americans major disruptions like shortages and price spikes during the holiday shopping season, according to the National Retail Federation.

"Store shelves are well-stocked and the effect on prices has been minimized, largely thanks to retailers taking steps like front-loading imports during times of low or delayed tariff increases or absorbing the costs themselves," NRF vice-president for supply chain and customs policy Jonathan Gold said in a statement Friday.

The NRF and Hackett Associates' port-tracking data project a soft finish to the year. If realised, the nearly 18% plunge forecast for December would be the slowest month since March 2023.

The NRF and Hackett Associates' Global Port Tracker forecasts 2025 to close at container volumes totaling 24.9 million TEUs, down 2.3% from last year's total. The first quarter of 2026 is likely to see weak year-on-year comparisons, too, partly because shipments were pulled forward to avoid tariffs.

"These conditions make market forecasting highly uncertain," Hackett Associates founder Ben Hackett said. "Our trade outlook is for a small decline in imports this year compared with 2024 and a further, larger decline in the first quarter of 2026."

According to an analysis published last week by Vizion, a tech company that provides supply-chain visibility, the "new normal" in freight brings subdued demand.

"For the first time since March 2023, monthly import volumes are falling below the two million TEU threshold, signalling what freight industry experts now characterise as a 'goods recession,'" Vizion said in a blog post. "This contraction represents a structural shift rather than temporary volatility."

Monthly trade data last week confirmed that the US market is in decline for Chinese manufacturers.

China's total shipments abroad fell for the first time in eight months, dropping 1.1% from a year earlier, according to official data released Friday. Shipments to all nations except the US rose 3.1%, not enough to compensate for the more than 25% decline to America.

AP Moller-Maersk A/S CEO Vincent Clerc said it's hard for the world's number two container carrier to decipher whether the recent soft demand in North America was an inventory correction after the pulling-forward of orders earlier this year, or whether it's reflecting fundamentally weak demand.

Still, he said there are signs of resilience in an outlook otherwise dimmed by trade policy unknowns.

"As far as the next six months are concerned, we expect still quite a resilient demand into North America with goods starting now to pick up pace compared to what we have seen in the last couple of quarters," Clerc told Bloomberg Television on Thursday.

"One of the core risks that we see is the uncertainty that there is," he said, noting that a recent US-China truce offers reprieves on tariffs and ship fees that are only temporary. "The long-term playing field is still unclear."

At the Port of Long Beach in Southern California, CEO Mario Cordero said he expects to close 2025 near the facility's record volume set last year of 9.6 million 20-foot equivalent container units, or TEUs, even with a slowdown over the next two months.

"We're looking forward to a moderate increase in cargo in 2026," Cordero told reporters Friday, though he said much depends on the economy, including how much and when tariffs filter through to consumer prices, and on the status of the US-China trade war.

For example, soybean exports leaving the Port of Long Beach dropped 93% in the first nine months of 2025 compared with the year before, according to the port, the nation's second-busiest. That's because China refused to purchase the commodity from US farmers in retaliation for Trump's trade war. China has since agreed to restart soybean purchases.

Cordero said goods categories like winter clothing, toys and furniture, are on the decline, while the boom in artificial intelligence is spurring an increase in electronics and other products related to data centers.

A surging Hong Kong market has led to a boom in structured products linked to the city's equities, so much so that it's overtaken issuance from Japan and Korea, according to JPMorgan Chase & Co.

Structured products tied to the biggest single stocks listed in Hong Kong, including Alibaba Group Holding Ltd. and Tencent Holdings Ltd., have emerged as the "new anchor" of regional volatility supply, "significantly" outpacing index-linked issuance this year, strategists including Tony Lee wrote in a note dated Friday.

In 2025, the instruments supplied around $11 million of vega — sensitivity to changes in the price of the underlying asset — per month, almost triple the level from 2024.

China's policy pivot last year revived investors' interest, with elevated volatility at the single-stock level and the artificial intelligence frenzy together leading to more demand for accumulation and equity-linked yield products, according to the note. Meanwhile, regulatory tightening and stricter investor protection standards in Japan and Korea helped curtail issuance in those markets.

"Volatility supply in Asia has shifted toward Hong Kong," the strategists wrote, noting that Alibaba, Tencent, Meituan, Xiaomi Corp. and BYD Co. are the core underlying names for structured products issuance. "Dealers' vega positioning across these stocks currently sits near peak exposure levels, suggesting large rallies or declines in spot prices could influence volatility flows."

JPMorgan also noted that the growth in single-stock issuance has affected regional volatility dynamics, primarily boosting dispersion trades, where investors are long single-stock volatility and short index volatility.

The strategists expect the momentum to continue in 2026, with the top stocks offering liquidity depth, investor familiarity and exposure to key investment themes. Newer listings and recent index additions such as Contemporary Amperex Technology Co. and Pop Mart International Group Ltd. may "modestly broaden the base," the strategists said.

As the chart shows, the Nasdaq 100 index (US Tech 100 mini on FXOpen) has started the week on a positive note amid growing expectations that the longest government shutdown in US history may soon come to an end.

According to Reuters, a bill has been introduced in the Senate proposing amendments to extend government funding until 30 January. The news acted as a bullish catalyst for equity markets. Still, the question remains – is the risk truly behind us?

Analysing the hourly chart of the Nasdaq 100 (US Tech 100 mini on FXOpen) on 4 November, we:

→ Drew an ascending channel;

→ Noted signs of momentum exhaustion, as mentioned in our previous headline.

Since then, price action has evolved as follows:

→ The lower boundary of the channel provided support (1), prompting a brief rebound;

→ The 25,770 level acted as resistance (2) on two occasions, strengthening the bears' confidence to push for a downside breakout — which ultimately succeeded.

The index's subsequent movements have now more clearly outlined the formation of a descending channel (shown in red).

From the demand-side perspective:

→ After a false bearish breakout below 24,680 (showing characteristics of a Liquidity Grab pattern), the market staged an aggressive rally from point B;

→ Today's session opened with a bullish gap, and the price has moved above the red median line.

From the supply-side perspective:

→ The 25,500 level, where sellers gained control during the previous channel breakout, may now act as resistance;

→ If the A→B move is viewed as an impulse, today's rally appears to be a corrective rebound consistent with Fibonacci proportions — suggesting that downward momentum could resume within the red channel.

On Monday, gold advanced by more than 1% to 4,050 USD per ounce, reaching a fresh two-week high. The rally was fuelled by mounting concerns over the health of the US economy.

A softening US dollar provided further support for the precious metal, enhancing the affordability of dollar-denominated assets for international buyers.

Data released on Friday revealed that the University of Michigan's consumer sentiment index had fallen to its lowest level in nearly three and a half years. This decline is largely attributed to the ongoing US government shutdown, which has now become the longest in the nation's history. Investors are closely monitoring the situation as the US Senate moves closer to approving a Democratic-backed proposal to reopen the government.

Amid the economic uncertainty, market expectations for the Federal Reserve's next move remain divided. The probability of a 25 basis point rate cut in December is currently priced at approximately 67%, unchanged from the end of last week.

H4 Chart:

On the H4 chart, XAU/USD is forming a consolidation range around 3,988 USD. A breakout to the upside is expected to initiate a growth wave towards 4,075 USD, which may then be followed by a decline to 4,020 USD (testing the level from below). A subsequent breakdown from this range could extend the correction towards 3,660 USD, where the downward move is anticipated to conclude. This would potentially set the stage for a new upward wave targeting 4,400 USD. The MACD indicator supports this outlook, with its signal line above zero and pointing upward, suggesting continued near-term bullish momentum.

H1 Chart:

On the H1 chart, the market is also consolidating around 3,988 USD. An upward breakout is likely to propel prices towards 4,075 USD, after which a decline to at least 4,020 USD is expected. The Stochastic oscillator aligns with this view, as its signal line is positioned above 80 and appears poised to reverse downward towards 20, indicating potential for a near-term pullback.

Gold is trading at a two-week high, supported by economic concerns and a weaker US dollar. While the near-term technical structure suggests potential for further gains towards 4,075 USD, a subsequent correction towards 4,020 USD is anticipated. The broader outlook remains constructive, with a deeper corrective move towards 3,660 USD expected to present a buying opportunity ahead of a potential resumption of the broader uptrend.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up