Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Elon Musk’s launch of the “America Party” and political clash with Trump sparked an 8% drop in Tesla shares, raising investor concerns over his divided focus and Tesla’s weakening global position.

President Putin continues playing hardball and sending tough signals in the face of Trump administration criticisms, and after on Monday the White House confirmed it is reversing course on its recent pause on weapons to Ukraine, as it will instead send more.

Russia overnight launched an unprecedented 728 Shahed drones as well as decoy drones, accompanied also by 13 cruise and ballistic missiles, Ukraine's air force announced Wednesday.

Source: State Emergency Service of Ukraine

Source: State Emergency Service of UkraineUkrainian President Volodymyr Zelensky described that the northwestern city of Lutsk, near the borders with Poland and Belarus, suffered the most intense attacks and damage, and ten other regions were also targeted.

Lutsk hosts military airfields frequently used by Ukrainian cargo planes and fighter jets, and has long been a region crucial to military logistics and a hub for foreign military.

Zelensky said that the Kremlin was "making a point" with this fresh attack, especially as it comes so closely on the heels of the Pentagon U-turn concerning weapons shipments to Kiev.

"This is a telling attack — and it comes precisely at a time when so many efforts have been made to achieve peace, to establish a ceasefire, and yet only Russia continues to rebuff them all," he wrote on X.

"Our partners know how to apply pressure in a way that will force Russia to think about ending the war, not launching new strikes," Zelensky added, and called for more Western anti-Moscow sanctions, particularly targeting its energy sector.

Russia's Defense Ministry meanwhile later confirmed it launched "long-range" and "precision" strikes on Ukraine overnight Tuesday, seeking to take out military airfield infrastructure. The statement claimed that "all designated targets were destroyed."

The bar on these massive drone swarm attacks keeps getting set higher, as earlier this month Russia sent a record over 500 UAVs. Never before has a single night's assault reached this level of over 700 drones and missiles.

The Ukrainian president's chief of staff, Andriy Yermak, pointed out on social media, "It is quite telling that Russia carried out this attack just as the United States publicly announced that it would supply us with weapons."

Geopolitical and war monitor blog Moon of Alabama observes of this trend:

That's nearly 100 long range drones per day which target Kiev and other bigger cities. These are by the way no longer Iran made Shahed drones but a third generation development based on the original design. These drones are now bigger. They have new engines and fly faster and higher. Their load of explosives is now about 90 kilogram, double that of the original version. For each of these drones launched against Ukraine there is an additional decoy drone flying along. The decoys look similar but are not armed and much cheaper. They are to attract the air defenses while the real drones pass through.

Recent targets have been Ukrainian refineries, industrial objects and, during the last days, recruiting offices of the Ukrainian military.

These offices are in public buildings. Their addresses are naturally known as the whole mobilization process for additional soldiers is being run by them. The recruiters are hated by the population. Ukrainians are published the addresses of mobilization offices with requests to Russia to hit them.

If true that would suggest unprecedented domestic anger directed at the Zelensky government and its notoriously harsh recruitment tactics, which have for years seen young men get nabbed on the streets and forced into vans by recruitment officers.

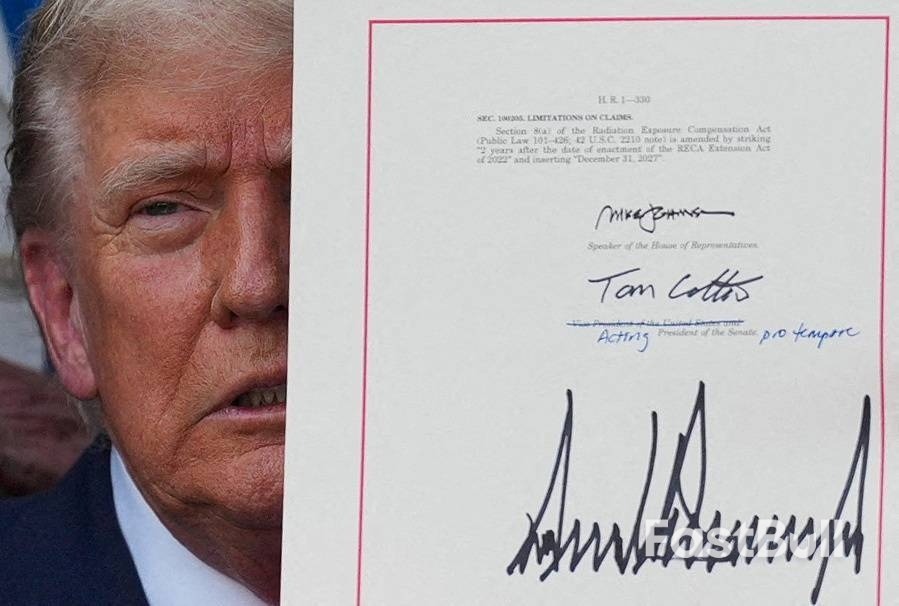

President Trump is again amping up his trade threats, unveiling a new batch of letters to country leaders outlining tariffs on goods imported from their countries beginning in August.

Trump on Wednesday posted to social media six letters, highlighted by one to the president of the Philippines dictating a 20% tariff. He also sent letters to the heads of Brunei, Moldova, Algeria, Iraq, and Libya. Those tariffs ranged from 20% to 30%.

On Tuesday, Trump said he would be imposing 50% tariffs on copper imports to the US, matching duties on aluminum and steel. He also suggested tariffs as high as 200% on pharmaceuticals.

On Wednesday, COMEX copper (HG=F) futures fell over 3%, as traders reacted to Trump's tariff threat. Trump's plan to impose heavy duties has pushed costs for US factories up, with New York futures rising 25% above other global prices on Tuesday.

Trump posted 14 letters to countries on Monday, including South Africa, Malaysia, and Thailand, outlining tariffs ranging from 25% to 40%.

Meanwhile, China warned Trump on Tuesday against restarting trade tensions and that it would hit back at countries that make deals with the US to exclude China from supply chains.

Here is where things stand with various other partners:

Vietnam: A deal with Vietnam will see the country's imports face a 20% tariff — lower than the 46% Trump had threatened in April. He also said Vietnamese goods would face a higher 40% tariff "on any transshipping" — when goods shipped from Vietnam originate from another country, like China.

European Union: The EU has signaled it is willing to accept a 10% universal tariff on many of its exports but is seeking exemptions for certain sectors. The bloc is racing to clinch a deal this week.

Canada: Canada has scrapped its digital services tax that was set to affect large US technology companies. The White House said trade talks between the two countries had resumed, with a deal by mid-July in focus.

BTC/USDT 3-day chart with RSI data. Source: BitBull/X

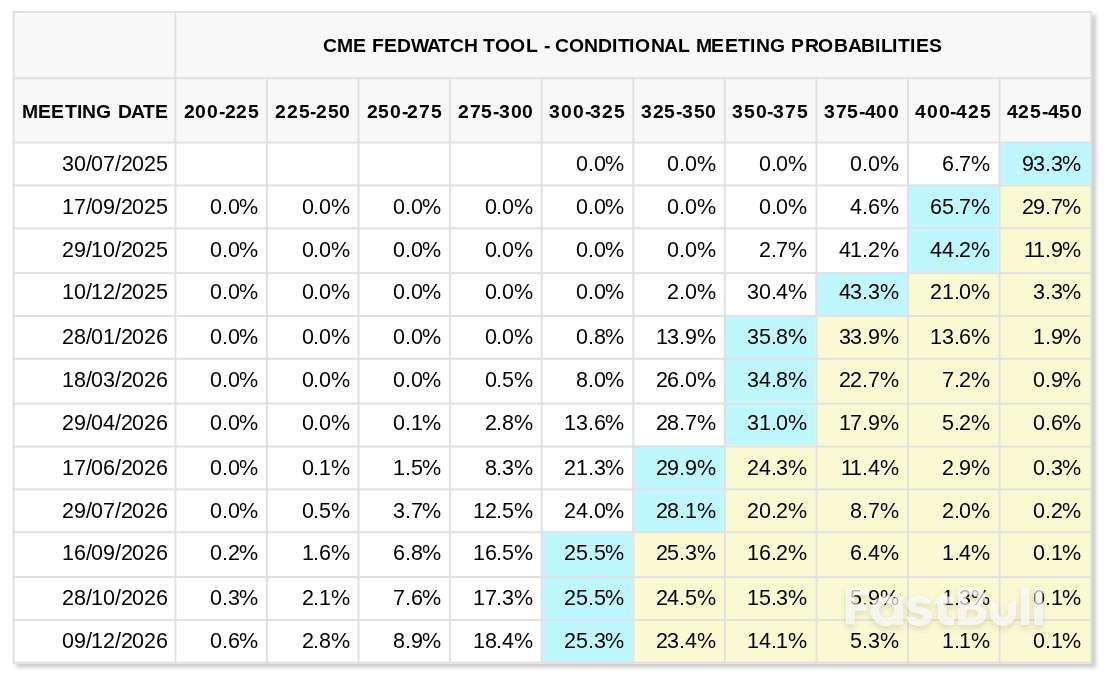

BTC/USDT 3-day chart with RSI data. Source: BitBull/X Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up