Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

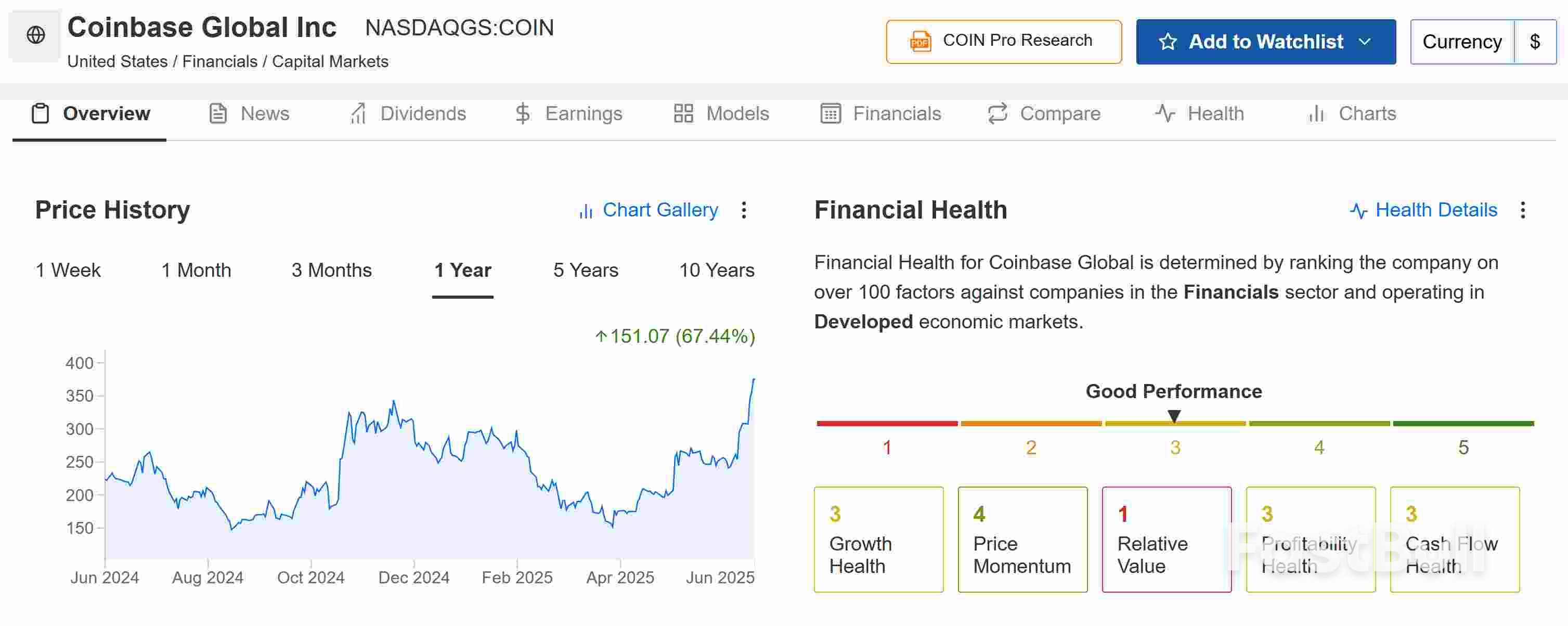

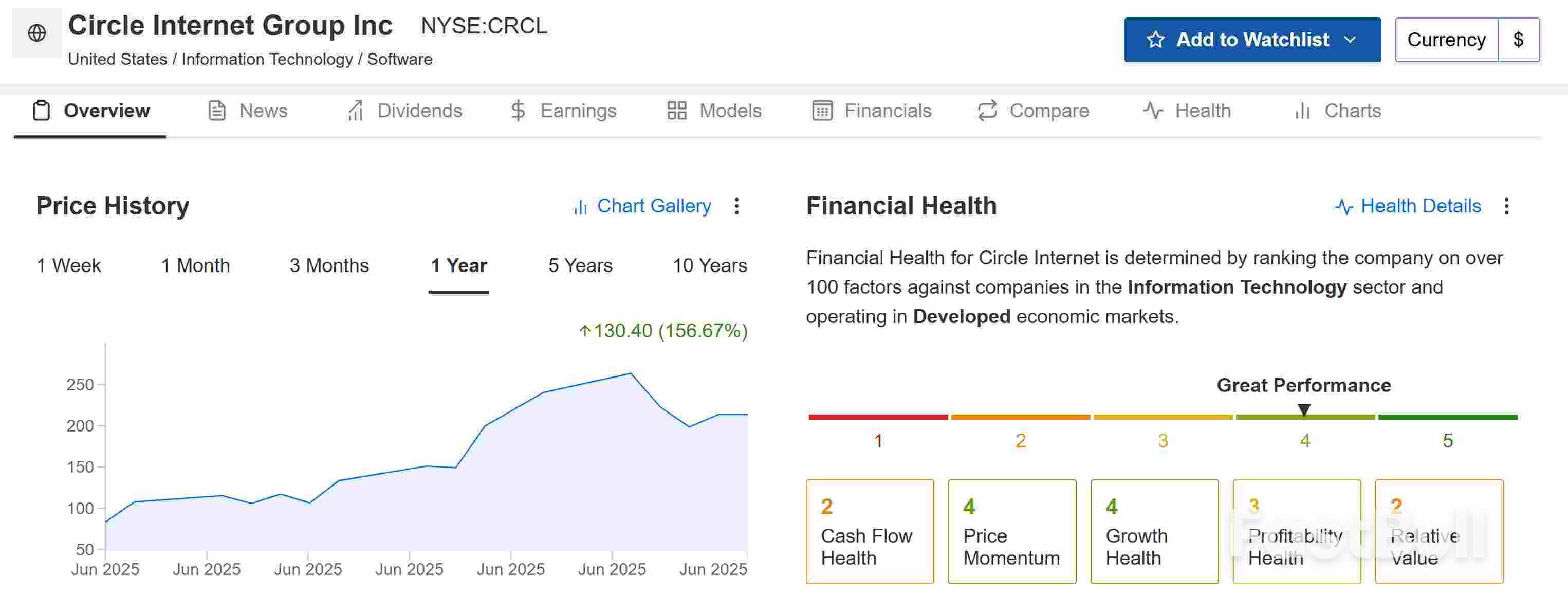

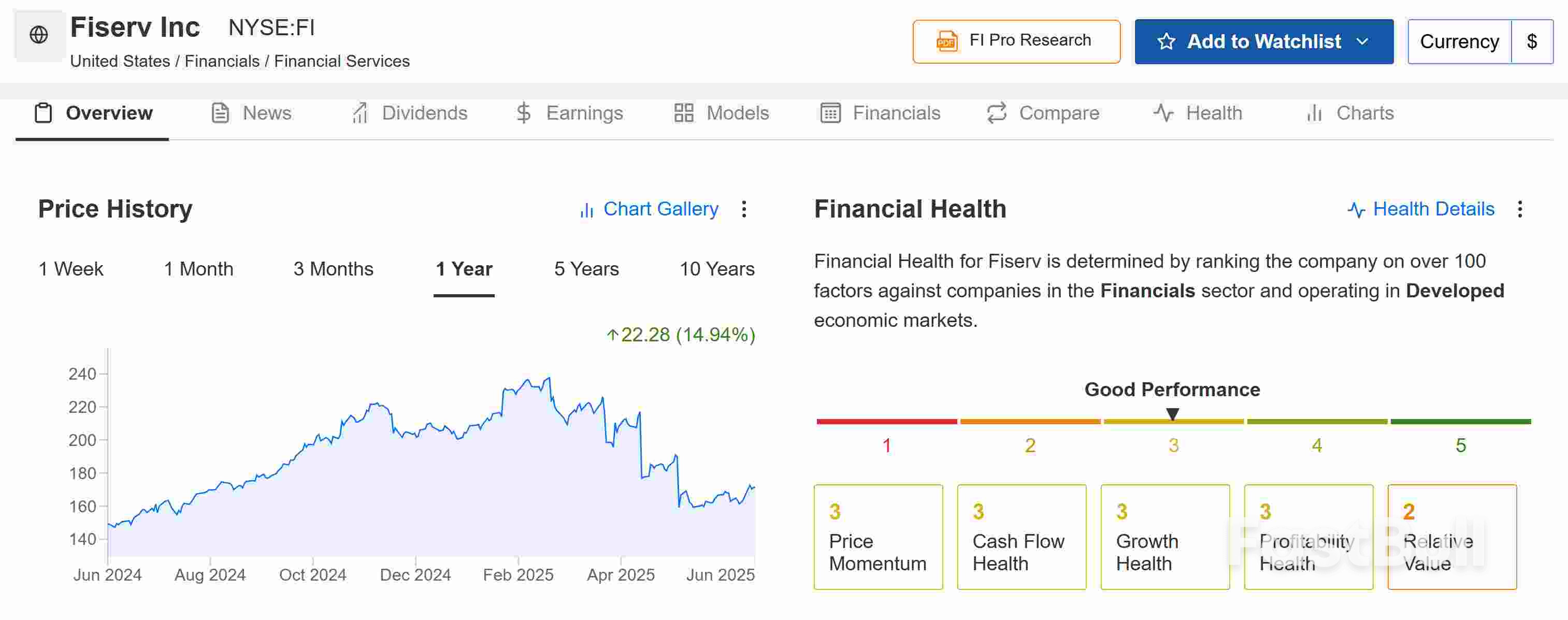

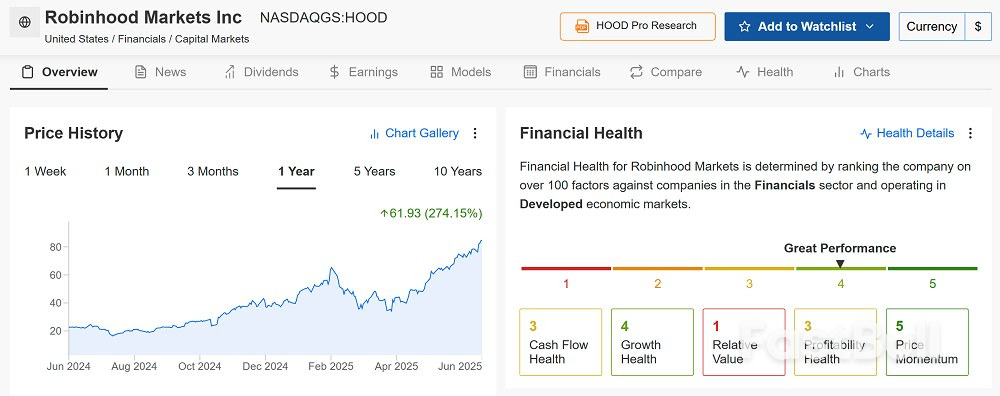

The stablecoin market is booming, and five key stocks—Coinbase, Circle, Fiserv, PayPal, and Robinhood—are well-positioned to profit by providing infrastructure, payment solutions, and access to this growing crypto sector.

US consumer sentiment rose sharply in June to a four-month high and inflation expectations improved notably as concerns eased about the economic outlook and personal finances.

The final June sentiment index increased to 60.7 from 52.2 a month earlier, according to the University of Michigan. The 8.5-point increase was the largest since the start of 2024. The median estimate in a Bloomberg survey of economists called for no change from the preliminary reading of 60.5.

“The improvement was broad-based across numerous facets of the economy,” Joanne Hsu, director of the survey, said in a statement. “With the recent moderation in both tariff levels and trade policy volatility, consumers now appear to believe that their worst fears may not come to pass and have moderated their expectations accordingly.”

Consumers expect prices to rise 5% over the next year, data released Friday showed. That is down slightly from the preliminary reading. It’s also far better than the 6.6% registered in May — the biggest monthly improvement since 2001. They saw costs rising at an annual rate of 4% over the next five to 10 years, also lower than a month earlier.

The survey, which concluded two days after US military conducted airstrikes on Iran, showed very few respondents made spontaneous mentions of the Israel-Iran conflict. However, consumers remain anxious about the potential impact of tariffs.

Consumer sentiment that is still weaker than at the start of the year has coincided with softer demand. Separate figures out earlier showed inflation-adjusted spending declined in May for the first time since the start of the year.

The latest data suggest sluggish household demand, especially for services, extended into May after the weakest quarter for consumer spending since the onset of the pandemic.

“Consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come,” Hsu said.

Consumers’ view of the job market improved, though 57% of respondents still expect unemployment to rise in the coming year.

A separate survey from the Conference Board on Tuesday found consumer confidence declined in June on concerns about the labor market. The report showed the share of consumers that said jobs were plentiful dropped to a four-year low. Meanwhile, recurring jobless claims, a proxy for those receiving unemployment benefits, stand at the highest level since late 2021.

Richmond Fed President Tom Barkin said Thursday that in coming months, businesses may face pressure to raise prices due to higher tariffs — potentially triggering consumer pushback and, in turn, layoffs.

“If businesses lose volume when they raise prices, they will need to reduce costs. If they lose margin because they are unable to raise prices, they too will need to reduce costs,” he said. “Either way, cost reduction would likely mean headcount reduction, suggesting that the current low hiring, low firing environment might come under threat.”

The Michigan survey showed the current conditions gauge rose to 64.8 from 58.9, while the expectations index climbed to 58.1 from 47.9 in May.

Sentiment improved along political lines. A gauge of sentiment among Republicans increased to the highest level since October 2020. Confidence among Democrats rose to a four-month high.

The US and China stepped closer to a full trade deal on Thursday, after making a pact to formally cement the informal understanding reached in Geneva talks in May.

“We just signed with China yesterday,” Trump said during a briefing at the White House, though he did not provide further details.

The pact marks a significant step in stabilizing trade relations between the two countries, which lapsed into feuding soon after the trade truce. China has confirmed it will deliver rare earths to the US as part of the trade framework. The US will respond by taking down its countermeasures, Howard Lutnick told Bloomberg.

The Commerce Secretary also said that trade agreements with 10 key US trading partners are imminent, as countries from Canada to Japan struggle to get over the finish line with just two weeks to go.

Meanwhile, the Trump administration has signaled a willingness to roll back the self-imposed tariff deadline of July 9 as pressure builds. Stephen Miran, chairman of the White House Council of Economic Advisers, said the tariff pause to be extended for countries negotiating "in good faith."

"I mean, you don't blow up a deal that's that's in process and making really good faith, sincere, authentic progress by dropping a tariff bomb in it," Miran told Yahoo Finance.

Trump and officials have warned that he could soon simply hand countries their tariff rates, raising questions about the status of negotiations. Miran said that he doesn't see the aggregate tariff rate falling materially below the 10% level in the long run, but some countries may negotiate more favorable duties while others will see a return of the steeper "Liberation Day" tariffs.

So far, Trump has firmed up a trade deal with the United Kingdom. In Canada, Prime Minister Mark Carney's government threatened to hike tariffs by late July on US imports of steel and aluminum, after Trump ballooned US levies on those metals. The countries are aiming for a deal by mid-July.

The European Union has also vowed to retaliate if the US sticks with its baseline 10% tariffs, according to a report in Bloomberg. Trump has threatened tariffs of up to 50% on EU imports.

One sticking point in negotiations has come from Trump's disorganized approach to his tariff policies. According to Bloomberg, some countries have resisted signing deals without knowing whether Trump's other duties — including those on metals, chips, and other materials — would still apply to them.

Meanwhile, the US economy is still figuring out the effects of the tariffs while the White House is simultaneously making a push to get the "big, beautiful" tax bill passed in the Senate. Fed Chair Jerome Powell this week reiterated that the central bank is still waiting to see the effects of the tariffs on prices before cutting interest rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up