Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Consumer Price Index (CPI) rose 0.4% month-on-month (m/m) in August, a tick ahead of the consensus forecast in Bloomberg and up from the 0.2% m/m gain in July. On a twelve-month basis, CPI was up 2.9% (from 2.7% the month prior).

The Consumer Price Index (CPI) rose 0.4% month-on-month (m/m) in August, a tick ahead of the consensus forecast in Bloomberg and up from the 0.2% m/m gain in July. On a twelve-month basis, CPI was up 2.9% (from 2.7% the month prior).

Excluding food and energy, core inflation rose 0.3% m/m (0.35% m/m unrounded), largely matching last month’s gain and meeting the consensus forecast. The twelve-month change held steady at 3.1%.

Price growth of services continued to come in on the hotter side, rising 0.35% m/m, following a similar gain of 0.36% m/m in July. Primary shelter costs rose at its fastest monthly clip in several months, while price growth of non-housing services (+0.4% m/m) remained firm for a second consecutive month.

Tariff passthrough continued to materialize in core goods prices, which were up 0.3% m/m or its fastest monthly gain since January. Price gains were most notable in apparel (+0.5% m/m), appliances (+0.5% m/m), household furniture and bedding (+0.4% m/m) and new vehicle prices (+0.3% m/m). Used vehicle prices also rose 1.0% m/m, which could in part be driven by consumer switching to used models in an effort avoid paying tariff costs.

Inflationary pressures continued to heat up in August, with broad strength in goods and services inflation. Goods prices are likely to continue to drift higher over the coming months as businesses increasingly pass-on more of the tariff costs. However, further upward pressure on services inflation looks limited against the backdrop of a cooling labor market which is likely to limit upward pressure on wage growth and keep a lid on discretionary services spending.

But nothing is a guarantee, and policymakers will need to balance the risks of reducing the policy rate by enough to breathe some life back into the labor market, but not by so much that they risk unnecessarily stoking inflation. We see the Fed delivering on three quarter-point cuts by year-end, with the first coming at next week’s meeting. We’ve long held this view, and following this morning’s release, Fed futures are pricing in a similar rate-cut path by year-end.

A few weeks ago, President Trump attempted to fire Federal Reserve Governor Lisa Cook for "cause". The identified "cause" was the alleged falsification of mortgage documents prior to her taking up the role of governor. There has been a court hearing on the matter, and we’ve just had the outcome, which is a positive one for Cook. Essentially, the court ruled that "cause" should reflect something done while actually in office, followed by the assertion that a firing based on "unsubstantiated and vague allegations" would "endanger the stability of our financial system". Cook keeps her job and gets to vote at the upcoming FOMC meeting.

But this is not over. The Justice Department is likely to appeal on the theory that even if Cooks' alleged falsification of documents is viewed as minor under some interpretations, it may still be sufficient grounds for removal. In the extreme, this could go all the way to the Supreme Court. And if it did, that court has tended to swing right. Either way, this whole affair does smack of a political agenda to make changes at the Fed by the Trump administration.

A burning question is why the markets have not reacted more negatively? After all, this does smack of political interference. Part of the explanation could lie in the perception that the allegations - while unproven - retain a degree of plausibility in the eyes of investors, at least until definitively dismissed. Some investors may also trust the courts to uphold due process, reinforcing faith in institutional safeguards.However, if Chair Jerome Powell were to get involved as an obstacle, say, for attempting to protect Cook, and were fired on that basis, that would be a whole different story. Take us there, and the market would react more dramatically. In the end, any extreme action taken to undermine Fed independence would be viewed with much suspicion by longer-dated bonds.

The front end does not care about longer-term risks, as it is slavish to where the funds rate goes. By definition, it cannot think beyond two years. But the back end is a deeper thinker, and can worry about second- and third-round effects, and especially on medium-term risks potentially being taken on inflation should the interference with the Fed be seen to be swinging policy too dovish.

This has the potential to get very messy, and could finally tip the back end over the edge – an edge it has thus far resisted crossing, even under significant fiscal pressure. How messy? It's tough to say, but we'd more than likely comfortably take out the previous 10yr and 30yr yield highs seen in this cycle.

In the wake of the latest round of weak jobs data and a downbeat assessment on the economy from the Federal Reserve’s own Beige Book report, the market is now convinced the Fed will soon resume cutting interest rates. While this is mostly aside from the Lisa Cook saga, the market’s hunger for cuts has been further fuelled by the prospect that the Fed is set to lean more dovishly in the months ahead as Donald Trump seeks to appoint new members who are more aligned with his thinking that interest rates need to be much lower than they are currently.

The anticipated changes in personnel at the Fed mean there is a perception in the market that the “new” Fed could be seen to be more willing to put the political goals of the president ahead of economic stability, similar to when Richard Nixon pressured Arthur Burns into cutting interest rates ahead of the 1972 election. In combination with a lifting of wage and price controls, this contributed to a spiralling of inflation in subsequent years.

Nonetheless, it is important to point out that no potential Fed candidate has endorsed the president’s call for 200-300bp of immediate interest rate cuts.Stephen Miran is set to be in position for the 17 September FOMC meeting, temporarily filling the governor role vacated by Adriana Kugler after she decided to step down early. Miran has somewhat controversially refused to resign from his current role as chair of the President’s Council of Economic Advisors. Instead, he is taking a temporary period of unpaid leave, raising questions about how independent he can be, given that he will be returning to work for the president in early 2026.

It will then be up to President Trump to name a permanent successor to Kugler, and with the future of Lisa Cook in doubt, plus Jerome Powell’s term as Fed Chair ending in May 2026, the composition of the FOMC will soon look very different to how it started 2025. Nonetheless, we must remember the FOMC is a committee made up of 12 voting members, and while any new members joining in the coming months may be in favour of lower interest rates right now, given the current economic conditions, there is no guarantee that will be the case if the economic situation changes.

Financial markets will also provide a stiff test for new officials. In the UK, the reason that the then newly elected Labour government gave the Bank of England independence in 1997 was to give the new political administration more economic credibility. It was believed that an independent central bank gives financial markets greater confidence that inflation would be more stable at lower levels, and this reduced term premium, which helped deliver lower market interest rates and stronger economic growth than would have been otherwise achieved. If global markets started to question the credibility of US economic policy, this could risk higher borrowing costs and slower growth, which would not be in the president’s best interests as we head towards the mid-term elections.

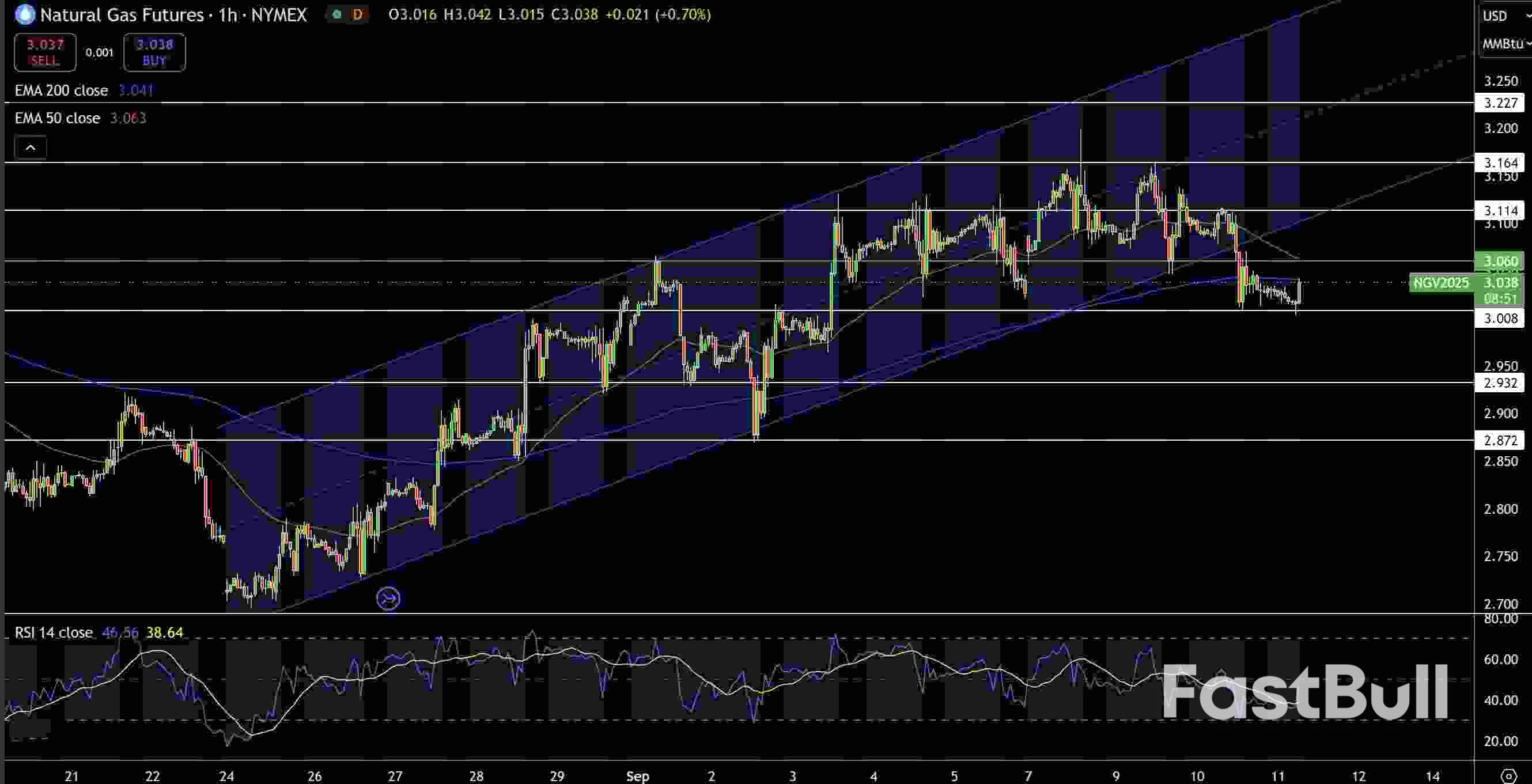

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price Chart路透社对 107 位经济学家的调查显示,几乎所有经济学家都表示,由于劳动力市场疲软掩盖了通胀风险,美联储将于 9 月 17 日将基准利率下调 25 个基点,其中大多数人预计美联储下个季度将进一步下调利率。

8月份就业增长停滞,以及截至3月份的12个月就业数据大幅下修,导致许多经济学家修改了预测,降息幅度超出了之前的预期。市场已完全消化了9月份的降息预期,目前预计今年将降息三次,而几周前仅为两次。尽管存在与关税相关的通胀风险,美联储主席杰罗姆·鲍威尔和其他政策制定者已暗示将放松货币政策。

9月8日至11日路透社调查的107位经济学家中,有105位预测,美联储下周将年内首次降息25个基点至4.00%-4.25%。上个月,61%的多数经济学家曾预测美联储将降息。

摩根士丹利首席美国经济学家迈克尔·加彭表示:“美联储目前有四个月的证据表明劳动力需求放缓,而且这种放缓似乎具有更强的持久性……简而言之,忽略当前的通胀水平,放松政策以支持劳动力市场。”

“我们认为9月份降息25个基点的可能性比大幅降息的可能性更大。”

其中两位分析师预计降息幅度为 50 个基点。

总统唐纳德·特朗普多次批评鲍威尔不愿降息。

特朗普提名的美联储理事斯蒂芬·米兰可能无法在下周的会议前及时加入董事会,而理事丽莎·库克在总统试图罢免她之后,根据法院的裁决继续留任。

许多经济学家表示,一些联储局成员下周可能会持不同意见,投票支持更大幅度的降息或维持利率不变。美联储理事克里斯托弗·沃勒和米歇尔·鲍曼反对在7月份维持利率不变。

“现在的政策制定环境非常困难。如果出现更多异议,我不会感到惊讶。”美国银行经济学家史蒂芬·朱诺表示。

“如果美联储大幅降息,以至于他们过于依赖以下说法——劳动力市场存在显著的下行风险,而他们不必担心通胀上行风险——那么我们就会陷入一种更像是政策失误的境地。”

60% 的受访者(107 位中的 64 位)预计到 2025 年底利率将下降 50 个基点,但 37% 的受访者预测到年底利率将下降 75 个基点,较 8 月份的 22% 大幅上升。

回答附加问题的 42 位经济学家中,有 26 位(超过 60%)表示,未来一年更有可能出现通胀飙升或通胀与失业率快速上升并存的情况。调查发现,预计通胀率至少在 2027 年之前都将保持在美联储 2% 的目标水平之上,而失业率预计将在未来几年徘徊在目前的 4.3% 左右。

周四晚些时候,官方数据预计将显示上个月消费者价格通胀加速。

不过,民意调查中值显示,美联储明年将再次降息 75 个基点,使联邦基金利率达到 3.00%-3.25%。

美国银行的朱诺补充道:“如果我们迎来一位更为鸽派的美联储主席(我们大概会遇到这种情况),我们确实认为美联储将在明年下半年再降息 75 个基点。”

“您愿意降息到什么程度?以及愿意降息到什么程度?这将是下一任美联储主席面试的一个关键问题。”

约 76% 的经济学家表示,他们预计在鲍威尔 5 月份任期结束期间,美联储的独立性不会受到严重削弱。

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up