Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Beta is a key measure of how a stock moves relative to the market, helping traders assess risk exposure and price volatility.

Beta is a key measure of how a stock moves relative to the market, helping traders assess risk exposure and price volatility. Understanding this indicator can help traders analyse potential price swings and portfolio stability. This article explores how beta works, its implications, and how it may be used in risk analysis.

Beta is a statistical measure that quantifies how a stock’s price fluctuates relative to the broader market. It helps traders analyse systematic risk—the kind that affects most stocks at the same time, such as economic downturns or interest rate changes. The number itself comes from regression analysis, which compares a stock’s potential returns to a benchmark index like the FTSE 100 or S&P 500.

A beta of 1.0 indicates that a share generally tracks the movements of its benchmark index. If the index gains 5%, a stock with a value of 1.0 is likely to rise by about the same amount. A beta above 1 signals greater volatility—company shares with a beta of 1.8 may rise 9% when the market gains 5%, but they also tend to fall more sharply during downturns. A value below 1 suggests lower volatility, with the asset moving less than the broader index.

High Beta Stocks (>1.0)

These stocks react strongly to market changes. High beta is common in technology, consumer discretionary, and financials, where investor sentiment drives price movements. While they offer the potential for higher returns, they also come with increased price swings.

Low Beta Stocks (<1.0 but >0)

Lower beta stocks experience smaller movements compared to an index. A value of 0.6, for example, suggests it might rise 3% if the market gains 5%. Sectors like utilities, healthcare, and consumer staples often have these types of stocks, as demand for their products tends to remain stable, except in situations such as the COVID-19 pandemic.

Negative Beta Stocks (<0)

Some assets, such as gold mining company shares, have negative beta values, meaning they move in the opposite direction of the broader market. These assets can act as a hedge when markets decline, though a negative value is relatively rare.While the beta of a stock provides insights into its volatility, it doesn’t account for company-specific risks or broader economic shifts. Investors often combine this form of analysis with fundamental and technical factors to build a more complete view of exposure.

Rather than examining price movements in isolation, traders use beta to evaluate how a stock reacts to broader trends. This helps them decide whether it aligns with their risk tolerance and market outlook.

Since beta measures sensitivity to the market, it’s useful for assessing systematic risk—the kind of risk that can’t be eliminated through diversification. A stock with a high beta will likely experience sharp swings during broader turbulence, making it appealing for those looking to capitalise on potential momentum but at the cost of greater volatility. In contrast, low-beta shares may hold up better in downturns but won’t rally as aggressively in bull markets.

Beta in Portfolio Construction

Investors often consider this metric when balancing a portfolio’s overall risk level. A portfolio heavily weighted in high-beta company shares can be more volatile, while one with low-beta stocks may offer less volatile potential returns. Some investors focus on diversified beta investing, combining high- and low-beta assets to adjust their exposure depending on overall conditions.

Beta is also a key component of the Capital Asset Pricing Model (CAPM), which estimates a stock’s expected return based on its risk level. CAPM considers the relationship between beta and market returns, helping to compare potential opportunities. If the asset is more volatile than an index but offers lower-than-expected rewards, it may not justify the added volatility.

Beta is a useful tool for assessing how a stock moves relative to an index, but it has shortcomings. Since it’s based on historical price data, it doesn’t always reflect how the asset will behave in the future. It’s important to be aware of its limitations when using it for risk assessment.

1. It Changes Over Time

Beta in a stock is not a fixed number. Company risk profiles can shift due to short-term developments, industry changes, or economic cycles, and impact a stock’s beta, meaning a stock with a value of 1.5 today might move closer to 1.0 over time as conditions evolve.

2. It Doesn’t Account for Company-Specific Risk

Beta measures systematic risk, meaning it doesn’t factor in aspects specific to a company, such as management changes, earnings surprises, or regulatory issues. Two stocks can have the same beta but react very differently to news.

3. High Beta Doesn’t Always Mean Greater Potential Returns

A stock with a beta of 2.0 might move twice as much as the market, but that doesn’t mean it will generate higher potential returns. If the asset consistently underperforms, its added volatility becomes a liability rather than an advantage.

4. Different Market Conditions Affect Reliability

Beta tends to be more stable in normal market conditions but can break down during extreme events, such as financial crises or sudden liquidity shocks. In times of panic, correlations between assets often increase, making the metric less useful for risk analysis.

Looking at beta in real-world scenarios helps illustrate how different stocks react. Two well-known examples are NVIDIA (NVDA) and Johnson & Johnson (JNJ), which have very different values.

NVIDIA – 1.76

According to Yahoo Finance, NVIDIA has a 5-year monthly beta of 1.76. This means its price is about 76% more volatile than the S&P 500. If the index gains 10%, NVIDIA’s stock could rise around 17.6%. However, in a downturn, it could fall by a similar magnitude. The tech sector is highly sensitive to market sentiment, innovation cycles, and economic conditions, making high-beta assets like NVIDIA riskier but also capable of higher potential returns.

Johnson & Johnson – 0.46

Johnson & Johnson has a 5-year monthly beta of 0.46 (source: Yahoo Finance), meaning it moves about 54% less than the market. If the index rises or falls 10%, JNJ stock might move by 4.6%. The lower value reflects the so-called stability of the healthcare industry, where consistent demand for products like medical devices and pharmaceuticals tends to lead to more resilient stock performance.

Key Takeaways

Those willing to take on more risk for higher potential returns often favour high-beta stocks like NVIDIA, while those seeking less volatility may prefer low-beta companies such as Johnson & Johnson. However, the measure ignores company-specific risks or specific short-term outperformance factors (e.g. positive earnings or product releases), and it is typically calculated over a long timeframe—5 years in this instance.

FAQ

What Does Beta Mean in Stocks?

The beta in stocks meaning refers to a measure of how much a stock moves relative to the broader market. A beta of 1.0 means it generally follows market movements, while a beta above or below 1 indicates higher or lower volatility, respectively.

What Are High Beta Stocks?

High-beta stocks have a beta greater than 1, meaning they tend to move more than the overall market. These assets often belong to technology, consumer discretionary, and financials, where price swings are more pronounced.

What Does a Portfolio Beta Measure?

Portfolio beta calculates the overall volatility of a portfolio relative to an index. It’s determined by weighting each stock’s beta based on its proportion in the portfolio. A portfolio with a value above 1 is more volatile than the market, while one below 1 is less volatile.

What Does a Stock With a Beta of 1.5 Indicate?

A stock with a beta of 1.5 is 50% more volatile than the market. If the index rises 5%, shares might increase by 7.5%, but it could also fall more sharply in downturns.

What Is β?

The symbol β is a Greek letter signifying beta. The beta meaning in finance refers to a stock’s expected performance relative to an index.

U.S. consumer prices increased moderately in July, though rising costs for goods because of import tariffs led to a measure of underlying inflation posting its largest gain in six months.

The consumer price index rose 0.2% last month after gaining 0.3% in June, the Labor Department's Bureau of Labor Statistics said on Tuesday. In the 12 months through July, the CPI advanced 2.7% after rising 2.7% in June. Economists polled by Reuters had forecast the CPI rising 0.2% and increasing 2.8% year-on-year.

Excluding the volatile food and energy components, the CPI rose 0.3%, the biggest gain since January, after climbing 0.2% in June. The so-called core CPI increased 3.1% year-on-year in July after advancing 2.9% in June.

The Federal Reserve tracks different inflation measures for its 2% target. Prior to the CPI data, financial markets expected the U.S. central bank would resume cutting interest rates in September after July's weak employment report and sharp downward revisions to the nonfarm payrolls counts for May and June.

The Fed left its benchmark overnight interest rate in the 4.25%-4.50% range last month for the fifth straight time since December.

The CPI report was published amid mounting concerns over the quality of inflation and employment reports following cuts in budget and staffing that have led to the suspension of data collection for portions of the CPI basket in some areas across the country.

Those worries were amplified by President Donald Trump firing Erika McEntarfer, the head of the BLS, early this month after stall-speed job growth in July, reinforced by sharp downward revisions to the May and June nonfarm payrolls counts.

The suspension of data collection followed years of what economists described as the underfunding of the BLS under both Republican and Democratic administrations. The situation has been exacerbated by the Trump White House's unprecedented campaign to reshape the government through deep spending cuts and mass layoffs of public workers.

Citing the need to "align survey workload with resource levels," the BLS suspended CPI data collection completely in one city in Nebraska, Utah and New York. It has also suspended collection on 15% of the sample in the other 72 areas, on average.

This affected both the commodity and services pricing survey as well as the housing survey, which the BLS said resulted in the number of collected prices and the number of collected rents used to calculate the CPI temporarily reduced. That has led to the BLS using imputations to fill in the missing information.

The price of gold has eased after Donald Trump announced tariffs would not be placed on gold bars.

His social media statement on Monday put an end to uncertainty which had sparked panic in global trade of the precious metal.

Investors sold off the metal as Trump wrote on his Truth Social platform that “Gold will not be tariffed”. The White House had earlier said it would clarify “misinformation” about tariffs on gold bars, which are duty-free.

On Friday, the price of gold futures jumped to a record high after it was reported that the US would put tariffs on imports of 1kg bars.

That decision was seen as a big setback to Switzerland, which dominates the bullion market, with $36bn (£27bn) of exports making up more than two-thirds of the country’s trade surplus with the US in the first quarter, according to Swiss customs data.

Switzerland was hit with a blanket 39% tariff on all imports from the country, from gold to luxury watches, chocolate and cheese.

However, Trump’s statement on Monday allayed concerns about bullion exports, and US gold futures dropped 2.4% to $3,407 per ounce after Trump’s post on Monday, reducing a premium over spot gold, the global benchmark, which fell 1.2% to $3,357. On Tuesday, gold prices were flat as investors awaited US inflation data.

The Swiss Association of Precious Metals Producers and Traders (ASFCMP) welcomed the statement by Trump but said it must be followed up with a “formal” decision.

“President Trump’s statement is an encouraging signal for trade stability,” said Christoph Wild, president of the ASFCMP. “However, only a formal and binding decision will provide the certainty the gold sector and its partners require.”

A White House official told Reuters that the Trump administration was preparing an executive order “clarifying misinformation” about tariffs on gold bars and other products.

The gold market, considered a safe haven investment sector for customers ranging from individual investors to sovereign funds, was thrown into disarray last week when the US Customs and Border Protection said that 1kg and 100-ounce cast bars were not exempt from tariffs.

The authorities clarified their position in response to a letter from a law firm representing a metals financier after they were suddenly faced with tariffs.

Ross Norman, chief executive of Metals Daily in London, said most physical gold being flown to New York, where the gold futures market is based, would have been held back in bonded warehouses while representatives sought urgent clarification from the White House.

“I am delighted to hear the crisis has been averted,” he said. “It will come as an enormous relief to the bullion markets, as the potential for disruption was incalculable.”

Norman said gold bullion investment was a major market in the US, where customers could buy gold in their local supermarkets, including Costco.

A kilo bar costs about £89,000 and coins, weighing an ounce, can be bought for £2,500. The metal is also used as a safe haven to hedge against inflation by commercial investors.

Bullion refers to gold and silver officially recognised as being at least 99.5% pure and is in the form of bars or ingots rather than coins.

Key points:

Australia Prime Minister Anthony Albanese said on Tuesday his Israeli counterpart Benjamin Netanyahu was "in denial" about the humanitarian situation in Gaza, a day after announcing Australia would recognise a Palestinian state for the first time.Australia will recognise a Palestinian state at next month's United Nations General Assembly, Albanese said on Monday, a move that adds to international pressure on Israel after similar announcements from France, Britain and Canada.

Albanese said on Tuesday the Netanyahu government's reluctance to listen to its allies contributed to Australia's decision to recognise a Palestinian state."He again reiterated to me what he has said publicly as well, which is to be in denial about the consequences that are occurring for innocent people," Albanese said in an interview with state broadcaster ABC, recounting a Thursday phone call with Netanyahu discussing the issue.Australia's decision to recognise a Palestinian state is conditional on commitments received from the Palestinian Authority, including that Islamist militant group Hamas would have no involvement in any future state.

Right-leaning opposition leader Sussan Ley said the move, which breaks with long-held bipartisan policy over Israel and the Palestinian territories, risked jeopardising Australia's relationship with the United States.

Albanese said as little as two weeks ago he would not be drawn on a timeline for recognition of a Palestinian state.His incumbent centre-left Labor Party, which won an increased majority at a general election in May, has previously been wary of dividing public opinion in Australia, which has significant Jewish and Muslim minorities.But the public mood has shifted sharply after Israel said it planned to take military control of Gaza, amid increasing reports of hunger and malnutrition amongst its people.

Tens of thousands of demonstrators marched across Sydney's Harbour Bridge this month calling for aid deliveries in Gaza as the humanitarian crisis worsened."This decision is driven by popular sentiment in Australia which has shifted in recent months, with a majority of Australians wanting to see an imminent end to the humanitarian crisis in Gaza," said Jessica Genauer, a senior lecturer in international relations at Flinders University.Opposition leader Ley said the decision was "disrespectful" of key ally the United States, which opposes Palestinian statehood.

"We would never have taken this step because this is completely against what our principles are, which is that recognition, the two state solution, comes at the end of the peace process, not before," she said in an interview with radio station 2GB.Neighbouring New Zealand has said it is still considering whether to recognise a Palestinian state, a decision that drew sharp criticism from former prime minister Helen Clark on Tuesday.

"This is a catastrophic situation, and here we are in New Zealand somehow arguing some fine point about whether we should recognise we need to be adding our voice to the need for this catastrophe to stop," she said in an interview with state broadcaster RNZ.

"This is not the New Zealand I've known."

World markets got a minor fillip from the expected 90-day rollover of the U.S.-China trade tariff truce, clearing one of Tuesday's two big hurdles. Now for the July inflation report.

Much rides on the consumer price report - not least markets' assumption of a Federal Reserve interest rate cut next month, but also the impact so far of rising tariffs as well as the reliability data compiled by the embattled Bureau of Labor Statistics. Annual inflation is expected to have ticked up a tenth to 2.8% and 'core' inflation built to 3.0% - the latter involving a 0.3% monthly gain, the biggest since January, and likely lifted by tariff-sensitive goods such as vehicle parts and toys.

* Chinese stocks nudged about half a percent higher after confirmation the recently-negotiated deals between Washington and Beijing officials in Stockholm would indeed see an extension of the existing deal until November. Although largely expected, the new order prevented a snapback to triple-digit tariffs between both sides and it settles for now with a 30% levy on Chinese exports to America and 10% Chinese tariffs on U.S. imports there. Wall Street futures were flat after ebbing slightly on Monday.

* Broader macro markets remained largely frozen ahead of the CPI report - with Treasury yields and the dollar flatlining and bond volatility gauges sinking to their lowest in three years. Aside from the CPI release, investors will keep half an eye on the latest NFIB small business survey for July and Federal budget data for last month too - with growing attention on the revenues being generated by unilateral tariff rises.

* Elsewhere, the Australian dollar eased marginally after the Reserve Bank of Australia delivered another widely expected quarter-point interest rate cut and Japan's Nikkei surged more than 2% on its return from holiday amid a wave of tech enthusiasm. Gold prices nursed Monday's setback after President Donald Trump said bullion would not be subject to tariff rises after all - clearing up confusion on the issue last week. Sterling was firmer after UK wage and retail numbers further dampened Bank of England easing speculation - as did better-than-forecast jobs numbers.

Today's column looks at how after a turbulent year so far, with multiple potential disturbances to U.S. bond markets, Treasuries appear to be slumbering instead and implied volatility has ebbed to its lowest in three years.

* The United States and China on Monday extended atarifftruce for another 90 days, staving off triple-digit duties on each other's goods as U.S. retailers get ready to ramp up inventories ahead of the critical end-of-year holiday season.

* Trump upended decades of U.S. national security policy, creating an entirely new category of corporate risk, when he made a deal with Nvidia to give the U.S. government a cut of its sales in exchange for resuming exports of banned AI chips to China.

* Australia's central bank cut interest rates on Tuesday for a third time this year and signaled further policy easing might be needed to meet its inflation and employment goals as the economy lost some momentum.

* Western governments are increasingly worried about becoming too reliant on China for rare earths as well as some refined metals. Their challenge is to work out how to secure supply without taxpayers being unduly burdened, explains ROI columnist Clyde Russell.

* It’s becoming increasingly difficult to get any visibility on the U.S. labor market amid all the conflicting economic data. But ROI columnist Jamie McGeever argues that one figure may be worth paying attention to more than the rest.

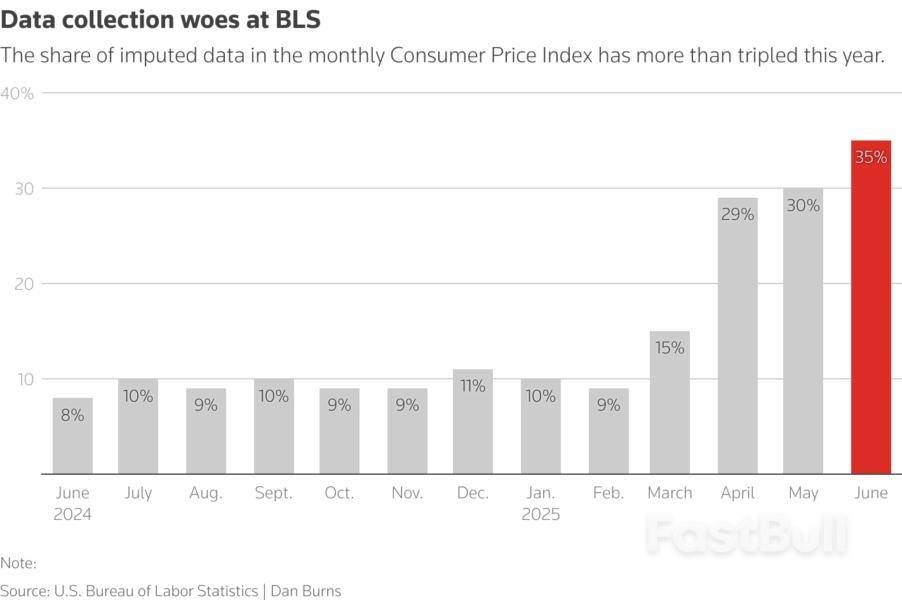

Thomson ReutersData collection woes at BLS

The Consumer Price Index report from the Labor Department's Bureau of Labor Statistics is due Tuesday amid mounting concern over the quality of inflation and employment data. Budget and staffing cuts have led to the suspension of data collection for portions of the CPI basket in some areas across the country - and Trump's firing of BLS boss Erika McEntarfer this month followed big downward revisions to May and June payroll counts.

Data collection suspensions come after years of what many describe as underfunding of the BLS under both Republican and Democratic administrations. Citing a need to "align survey workload with resource levels," the BLS suspended CPI data collection completely in one city in Nebraska, Utah and New York. It has also suspended collection on 15% of the sample in the other 72 areas, on average. The share of different cell imputation in the CPI data - essentially modeled assumptions of where prices might be - jumped to 35% in June from 30% in May. Trump on Monday said he was nominating Heritage Foundation economist E.J. Antoni as the new BLS chief.

* U.S. July consumer price index (8:30 AM EDT) NFIB July small business survey (6:00 AM EDT) July Federal budget (2:00 PM EDT)

* Kansas City Federal Reserve President Jeffrey Schmid and Richmond Fed President Thomas Barkin both speak

* U.S. corporate earnings: Cardinal Health

Elon Musk wrote on his X social media network late Monday that its parent company, xAI, "will take immediate legal action" against Apple (AAPL) for an alleged "antitrust violation" related to App Store rankings.

Tesla (TSLA) CEO Musk, whose xAI firm developed the Grok artificial intelligence chatbot, wrote, "Hey @Apple App Store, why do you refuse to put either 𝕏 or Grok in your 'Must Have' section when 𝕏 is the #1 news app in the world and Grok is #5 among all apps?"

In a later post, Musk—who co-founded ChatGPT maker OpenAI—wrote, "Apple is behaving in a manner that makes it impossible for any AI company besides OpenAI to reach #1 in the App Store, which is an unequivocal antitrust violation," and that "xAI will take immediate legal action."

Apple did not immediately respond to an Investopedia request for comment. Shares were down less than 1% in premarket trading.

Late last month, Apple CEO Tim Cook said on the iPhone maker's earnings call that the tech giant is "significantly growing" its investments and reallocating employees to focus on AI. Cook added that Apple would consider buying other companies to raise its AI capabilities.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up