Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Swiss Franc has been on a formidable run in 2025, continuing a trend that began when it reached parity with the US Dollar in November 2022.

The Swiss Franc has been on a formidable run in 2025, continuing a trend that began when it reached parity with the US Dollar in November 2022.With the American Exceptionalism theme, widening deficits, and growing trade distrust, markets have sought the CHF as a stable hedge against the Greenback.

Switzerland’s neutrality in economic and geopolitical affairs—and its low, stable inflation—make it an attractive safe haven, especially in a world facing fresh conflicts.The Franc’s rally to 2011 highs has also been fueled by regional currency trends. Since early 2025, the Euro’s strength has lifted its neighbors, adding tailwinds to the CHF.

This trend is actually one to watch in Forex where currencies tend to move in tandem with their neighbours – It’s an historic trend but got exacerbated with the ongoing geopolitics.Still, the Swissie hit a local top in July against most majors, including the Yen against which it attained weekly record highs.While the CHF’s appreciation has not been as explosive as the Euro’s, the trend had remained consistent and persistent – but is it now over?Next, we’ll look at USDCHF technicals to see if momentum can hold—or if a reversal is on the horizon.

CHF/JPY has been up-trending since May 2020 (which coincides with lows on Global Yields post-COVID peak fears), and this same trend found some steep acceleration, particularly since Liberation Day.The pair went from 109.00 lows to the current 186.00 highs.One aspect to consider when looking at this pair is the Safe-Haven nature of both currencies—the current overperformance of the Franc has marked it as the preferred option for flight-to-safety exposure.We are now seeing this trend conclude.The rest is to see if the recent highs mark an intermediate top or more one for the longer-run.

USD/CHF Daily Chart

The major pair, which had been in a steep downtrend since the beginning of 2025, has marked a double-bottom on its Daily charts during the month of July after attaining levels unseen since 2011.Since, the rebound has been consequent but with buyers failing to breach above the 0.8150 to 0.82 Main Resistance, the action is seeing more balance.Watch the 50-Day MA acting as immediate support to spot if buyers manage to respond to the 2025 Main Descending Trendline, which just acted as a supply zone for USD/CHF Sellers.The RSI Momentum was rising but is still closer to the neutral level than decisively bullish momentum.

USDCHF 4H Chart

Looking closer, sellers are bringing back the pair into its 0.80 Main Pivot Zone (0.80 to 0.8070), where reactions will be important to monitor.There are some conflicting signs between the uptrending intermediate trendline formed after the double bottom and the main descending 2025 trend.Looking at the conflicting price action, there is a high probability of a range forming around the Pivot Zone but it is still far from being confirmed, therefore the pair will have to be watched closely and may move fast depending on risk appetite.The current price action is currently seller-dominated after this morning’s miss in the US Services PMIs.

Levels to watch for the pair:

Daily Resistance Levels

Daily Support Levels

Meanwhile, price pressures increased to their highest level since October 2022 (69.9 vs 67.5), with many survey participants highlighting the impact of tariffs, especially on commodities.Gold prices had already been on a recovery from a daily low around $3349 before the data further boosted the recovery.

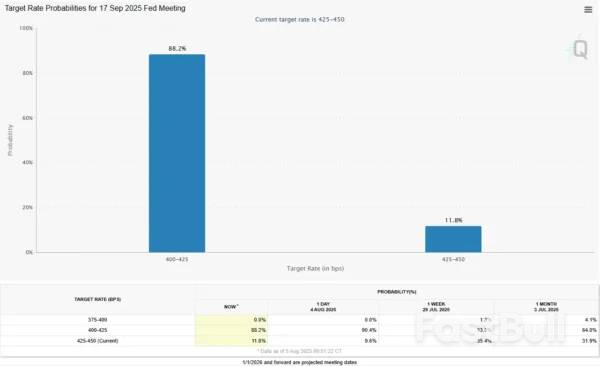

Golds looked on course for a potential correction last week before the US jobs data. The picture since then has changed dramatically however, and this underscores the age old adage, ‘trade what you see, not what you think’.The most significant change has come in the form of rate cut expectations from the US Federal Reserve. Ahead of the jobs data on Friday last week, markets were still split around the 50-50 mark on a potential rate cut in September following the Fed meeting on Wednesday.However, as of this morning the CME FedWatch Tool reflected a high 88% probability of such a cut at the upcoming monetary policy meeting in September.

The jobs data has raised hopes in the market for two or even three interest rate cuts by the end of the year, with the first expected in September and the second in October.Even cautious comments from Federal Reserve officials were seen as signs that rate cuts might be coming. San Francisco Fed President Mary Daly urged caution about expecting aggressive rate cuts, saying the job market wasn’t “too weak” and suggesting the Fed could wait a bit longer. However, she also mentioned that the Fed “can’t wait forever” and downplayed the idea that tariffs were causing long-term inflation. Markets took her comments as a sign that the Fed might still cut rates in September.

This strong belief in upcoming rate cuts is helping support gold prices. Lower interest rates make gold more attractive because it doesn’t pay interest, so the cost of holding it becomes less of a concern.Looking ahead, the next big catalyst which could shape both Fed rate cut expectations and have a material impact on Gold is likely to be the US CPI data. A strong CPI print would likely trigger a significant re-evaluation of its bullish trajectory, whereas other data points might only cause minor fluctuations.

From a technical standpoint, Gold monthly candle close for July closed as a massive shooting star which hints at further downside ahead.This also marked the first bearish monthly close since December 2024 and could be a sing of the shift in momentum between buyers and sellers.However, price action since Friday has left a potential deeper pullback at risk. On a monthly chart, a candle close above the 3439 handle will be needed to invalidate the setup and for this we will have to wait the rest of the month.

Looking at a more near-term perspective, let us look at the daily timeframe. Here we can see the recent bullish move which is approaching the most recent swing high around 3431.A daily candle close above this level will invalidate the bearish setup on the daily timeframe and put bulls firmly in control.Given that tariffs are now largely set and implementation is largely what remains, the chance that we enter a period of consolidation is shrinking.This hints that a daily candle close above the 3431 may lead to more bullish momentum.

President Donald Trump said he’d impose increased tariffs on countries buying energy from Russia while clarifying that levies on semiconductor and pharmaceutical imports would be announced “within the next week or so.”

In a divergent approach toward Asia’s giants, Trump said he’d raise tariffs on India “very substantially over the next 24 hours,” accusing its Russian oil purchases of “fueling the war machine.” By contrast, he said he was “very close to a deal” with China to extend a trade truce that saw the two countries agree to reduce tit-for-tat tariff hikes and ease export restrictions on rare earth magnets and certain technologies.

India, which hoped to lure manufacturers amid Trump’s tariff blitz, will face a double squeeze as Trump said levies on pharmaceutical imports would be announced in the next week or so, along with tariffs on semiconductors. Unlike Beijing, which used its dominance of rare earths in trade dealings with Washington, Delhi has no such leverage.

Coming just days after Trump re-set his tariff plan with rates on imports from trade partners ranging from 10% to 41%, his latest blast of trade threats and deadlines shows his quest to remake global trade in America’s favor is far from done. That’s even as the latest economic data suggests the US economy is grappling with the fallout.

Asian stocks struggled for direction in early trade Wednesday. The S&P 500 was on the brink of all-time highs on Tuesday, before losing steam.

Trump is threatening secondary tariffs on buyers of Russian oil as he ratchets up pressure on Russian President Vladimir Putin to halt the war in Ukraine. The Kremlin is weighing options for a concession that could include an air truce with Ukraine to try to head off the threat of such sanctions.

When asked if he’d follow through on a previous threat to impose tariffs on additional countries, including China, Trump said “we’ll be doing quite a bit of that.”

In an interview with CNBC earlier Tuesday, Trump indicated he would push forward with escalated tariffs on India in particular.

“We settled on 25% but I think I’m going to raise that very substantially over the next 24 hours, because they’re buying Russian oil,” Trump said. “They’re fueling the war machine. And if they’re going to do that, then I’m not going to be happy.”

He also detailed timing and discussed potential levels of US tariffs on semiconductor and pharmaceutical imports.

“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump said Tuesday in the interview on CNBC.

Trump said the US was “getting along with China very well.”

“It’s not imperative, but I think we’re going to make a good deal,” Trump said.

Still, Trump downplayed the notion that he was eager for a meeting with Chinese President Xi Jinping, saying he would only want to see his Chinese counterpart as part of an effort to conclude trade negotiations.

“I’ll end up having a meeting before the end of the year, most likely, if we make a deal,” Trump said. “If we don’t make a deal, I’m not going to have a meeting.”

“It’s a 19-hour flight — it’s a long flight, but at some point in the not too distant future, I will,” Trump added.

A preliminary deal between the US and China is set to expire on Aug. 12. That initial truce eased worries of a tariff war that threatened to choke off bilateral trade between the world’s two largest economies and also gave the countries more time to discuss other unresolved issues such as duties tied to fentanyl trafficking.

Last week, US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng met in Stockholm — the third round of trade talks between the US and Beijing in less than three months.

While Chinese officials and the Communist Party’s official newspaper had signaled satisfaction with the Stockholm talks, the pact remained fragile. Bessent had said that any agreement to extend the arrangement would be up to Trump.

Japanese workers saw their nominal wages rise at the fastest pace in four months, reflecting gains won in annual negotiations with employers and fueling market speculation that the Bank of Japan may hike its benchmark rate in coming months.

Nominal wages increased 2.5% in June from a year earlier, accelerating from a revised 1.4% gain the previous month, the labor ministry reported Wednesday. While the figure fell short of economists’ forecast of a 3.1% rise, it still marked the steepest increase since February.

Base salaries rose 2.1%, and a more stable measure, which avoids sampling issues and excludes bonuses and overtime, climbed 2.3% for regular workers. Real cash earnings fell 1.3%, a deeper decline than the 0.7% retreat expected by economists.

Wednesday’s data provide the latest evidence of robust wage growth momentum, likely keeping the BOJ on course to consider another interest rate hike this year. Following the decision last week to keep the policy rate steady at 0.5%, Governor Kazuo Ueda reaffirmed the central bank’s commitment to raise borrowing costs if economic conditions improve, emphasizing the importance of confirming a “positive mechanism” between wages and prices.

After a US-Japan trade deal was announced late last month, BOJ watchers brought forward their predictions on when the bank might next hike, with more than 40% forecasting the BOJ will move at its October policy meeting. No economists expect a move when authorities next set policy on Sept. 19, but over half of respondents expect another increase before the end of the year.

The strong wage data reflect the outcomes of this year’s annual pay negotiations, in which workers represented by the largest umbrella group for unions secured their steepest pay increases in over three decades. Roughly 70% of those gains were likely reflected in workers’ paychecks by mid-June, based on last year’s results referenced in the Cabinet Office’s monthly economic report.

Despite robust nominal wage growth, real wages continued to decline, as rising prices outpaced salary increases. The nation’s key inflation gauge reached 3.3% in June, led by surging food prices. The number of price increases by Japan’s major food and beverage companies will exceed 1,000 in August, a 53% increase compared with the same month in 2024, according to Teikoku Databank.

With persistent inflation weighing on private consumption, gross domestic product figures for the three months through June due Aug. 15 are expected to show signs of anemic growth.

The continued retreat by real wages is likely to intensify pressure on Prime Minister Shigeru Ishiba to take stronger action to help households contend with soaring costs of living. Ishiba may be forced to propose broader price relief steps beyond his party’s pledge to make one-off cash handouts.

The ruling coalition’s historic setback in last month’s upper house election left it without a majority in either house of parliament, forcing it to collaborate with opposition parties to pass legislation. Those groups are currently working to finalize a unified proposal to press for a temporary cut to the consumption tax.

Looking ahead, policymakers including those at the BOJ expect upward pressure on wages to persist, driven largely by the nation’s chronic labor shortage, which forces businesses to raise pay in order to attract and retain workers. The nation’s unemployment rate stood at 2.5% in June, remaining below 3% for more than four years.

In the first half of 2025, a record 202 companies went bankrupt due to labor shortages, partly driven by the difficulty of raising labor costs and hiring workers.

The government has been pushing for higher wages, setting a target for a record minimum wage hike in the current fiscal year.

US trade policy poses a risk to wage growth in Japan. Washington will impose a 15% tariff on most imports from Japan. That rate is significantly higher than US import levies a year ago, potentially crimping companies’ ability to boost salaries by eroding their profit margins.

President Trump has sent a message to President Luiz Inacio Lula da Silva saying the Brazilian leader could "call him anytime" to discuss the trade dispute centered on the country's treatment of ex-leader Jair Bolsonaro.Lula has defiantly responded Tuesday with the statement, "I will not call Trump because he does not want to talk." He further asserted that nobody gives him lessons in negotiations.Speaking during an event held in Brasilia, he made clear: "I don’t want people to think I am afraid of Donald Trump" and that "the US president had no right to announced the tariffs on Brazil the way he did" - especially as they make no sense.

Additional vehement complaints about the US position, at a moment a record-setting 50% tariff has taken effect for many Brazilian goods entering the US, are as follows via Bloomberg:

The Trump administration is demanding that charges against Bolsonaro, stemming from his rejection of the election results which brought Lula back to power, be dropped.However, the government has emphasized the independence of the judiciary. A week ago the US slapped sanctions on Brazilian Supreme Court Justice Alexandre de Moraes.But regional analyst Bruna Santos of the Inter-American Dialogue in Washington DC, has explained that dropping the charges against Bolsonaro is simply not going to happen.

"The ask for Lula was undoable," he was quoted in the Associated Press as saying. "In the long run, you are leaving a scar on the relationship between the two largest democracies in the hemisphere."As of Monday Bolsonaro has been ordered under house arrest, with the federal top court citing violations related to stoking resentment via social media and public messaging. For now at least, it looks like the government is backing down, despite the damage to trade relations and future economic pain.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up