Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

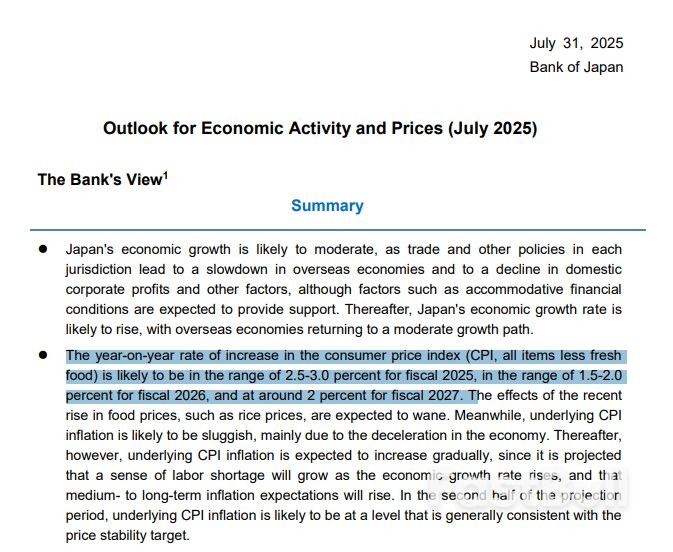

The BoJ held rates steady at 0.50% that’s no surprise. But what did raise eyebrows was the fact they bumped up their inflation forecast for 2025 to 2.7%, up from 2.2%. That’s not a small revision.

Source:RBC

Source:RBC

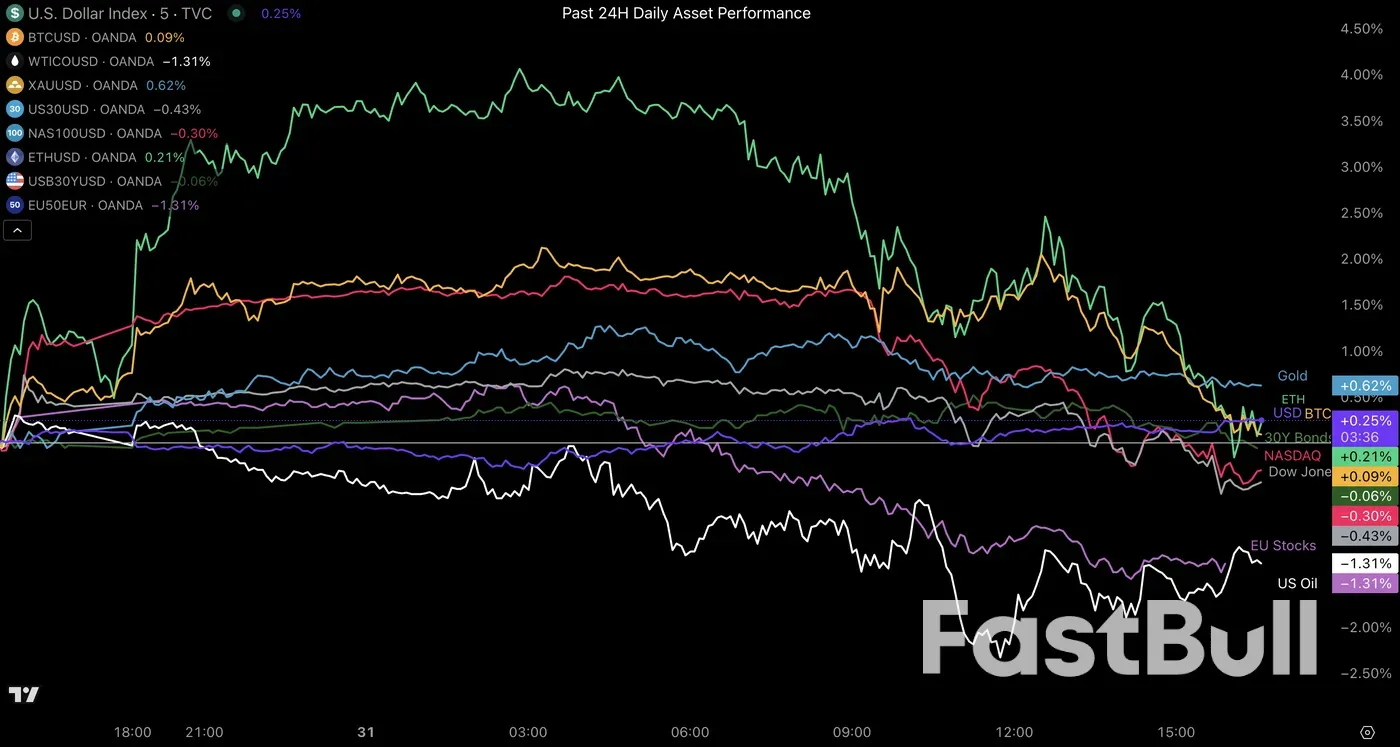

Cross-Asset Daily Performance, July 31, 2025 – Source: TradingView

Cross-Asset Daily Performance, July 31, 2025 – Source: TradingView

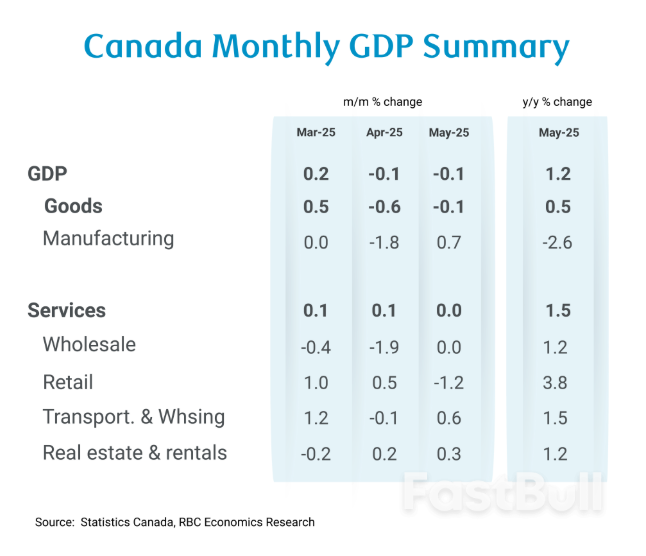

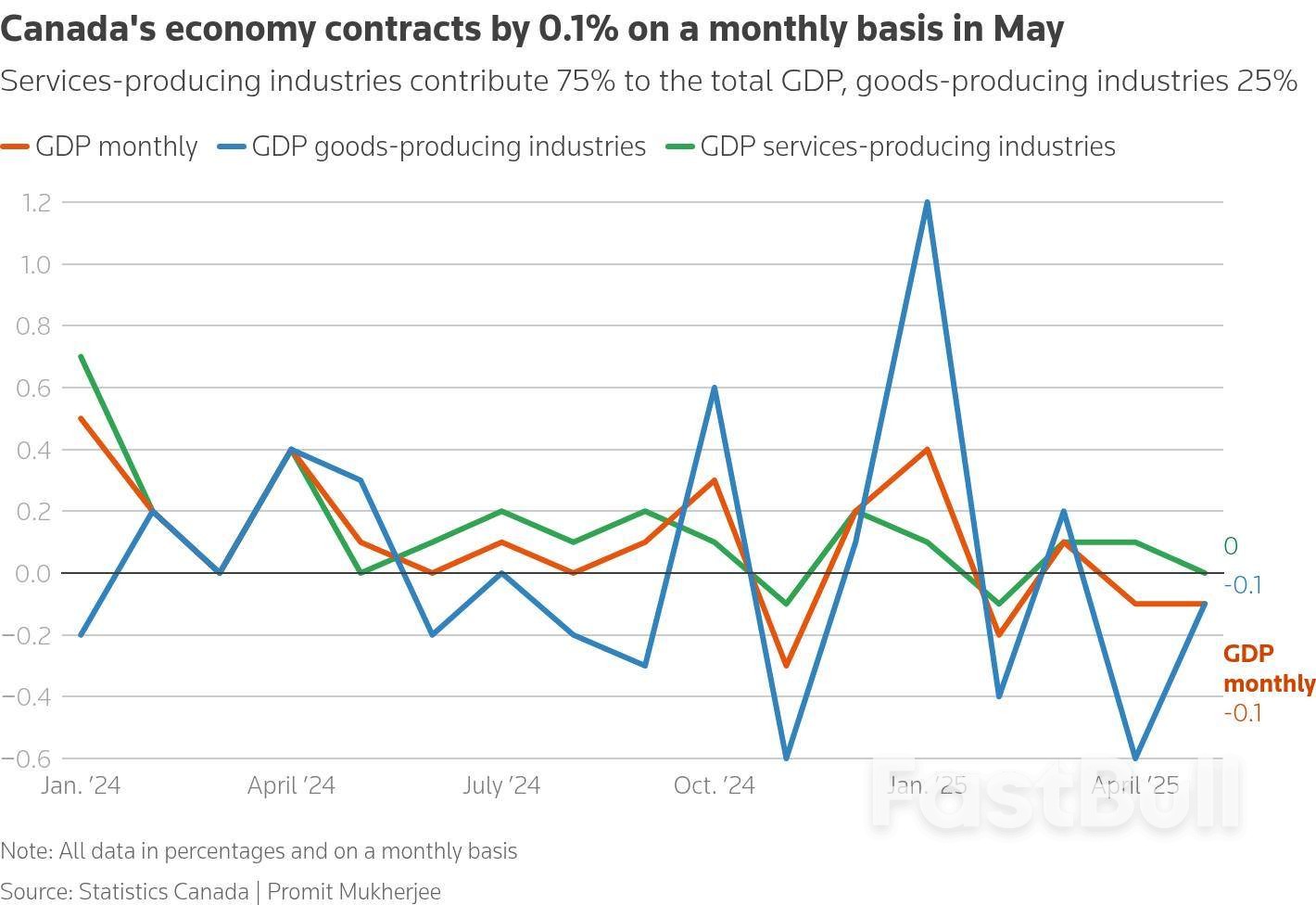

Canada's Gross Domestic Product shrank 0.1% in May on a monthly basis as expected but is likely to regain the lost ground in June as some sectors rebound, data showed on Thursday.

An advanced estimate showed GDP is likely to have expanded by 0.1% in June, and on an annualized basis it could also post growth of 0.1% for the second quarter, Statistics Canada said.

That is in contrast to the more widely held expectation for a second-quarter contraction, and could change when the final June numbers are released next month.

In May, the biggest hit to growth came from the retail trade sector which contracted 1.2%, StatsCan said, adding that activity across seven subsectors out of 12 shrank.

Retail trade is part of the larger services-producing industries that contribute up to 75% of total GDP. Overall, output from the services-producing group was flat in May as the drop in retail trade was offset by real estate and transportation.

Amongst goods-producing industries, which account for 25% of GDP, the mining, quarrying, and oil and gas extraction sector was the main laggard with activity shrinking 1% in the month.

Manufacturing expanded 0.7% on a monthly basis, after a 1.8% decline in April, largely as a result of higher inventory accumulation, the statistics agency said.

Canada's first quarter GDP expanded 2.2% on an annualized basis as exporters advanced their sales to the United States to beat a barrage of incoming tariffs. But as tariffs took effect from March, exports and industrial output took a hit.

The Bank of Canada, after announcing that it would keep rates on hold at 2.75% on Wednesday, said that it expected the economy to contract by 1.5% in the second quarter due to a 25% drop in exports.

StatsCan's forecast of even slim Q2 growth could take away the incentive for a rate cut in September, though data on inflation and job growth before the BoC's next meeting will be crucial.

Economists expressed doubt on a prospective growth in the second quarter as the data is calculated based on expenditure and income of people, unlike monthly GDP which is based on industry output.

"We will need to wait and see next month's quarterly GDP release to know whether the economy is really outperforming the Bank's expectations," Andrew Grantham, senior economist at CIBC Capital Markets wrote in a note.

Royce Mendes, head of macro strategy for Desjardins Group noted that there was lingering uncertainty about trade policy and domestic headwinds, which will continue to weigh on activity, forcing the central bank to restart cutting rates by September.

Money markets are betting around an 89% chance of the BoC holding rates on September 17, up three percentage points from before the GDP data was released .

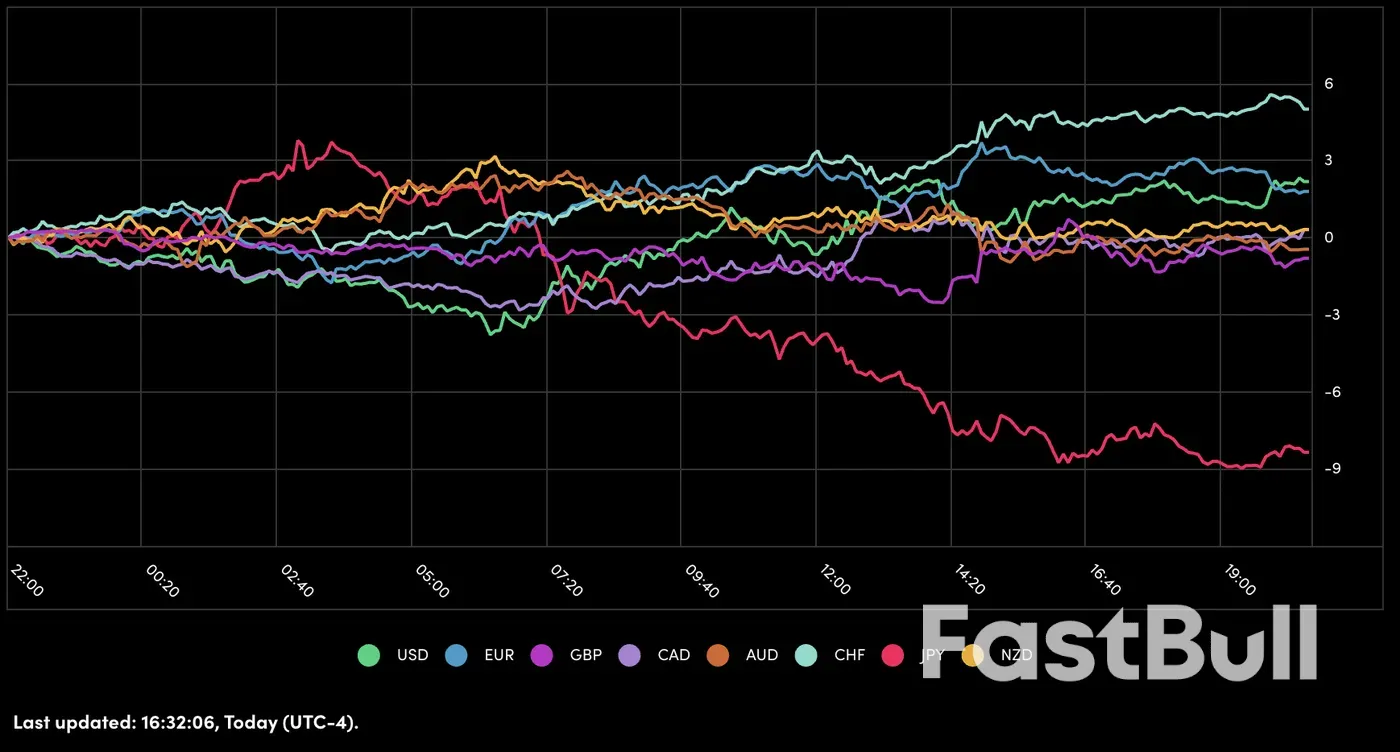

The Canadian dollar dropped 0.11% to 1.3842 to the U.S. dollar, or 72.24 U.S. cents.

The U.S. and Canada are currently locked in negotiations to hash out a trade deal by Friday in a bid to reduce tariffs, but negotiators have admitted that it may not happen by the deadline.

The GBP/USD currency pair continues to move within the framework of a downward trend and the beginning of a head and shoulders reversal pattern. At the time of publication, the pound-dollar exchange rate on Forex is 1.3206. Moving averages indicate a short-term bearish trend. Prices have broken through the area between the signal lines downwards, indicating pressure from sellers of the currency pair and a potential continuation of the instrument’s decline. At the moment, we can expect an attempt at a bullish correction of the British pound against the US dollar and a test of the resistance area near the 1.3275 level. From there, we can again expect the pair to rebound downward and continue to fall against the US dollar. The target for the pair’s decline, according to the Forex forecast, is the area at 1.3005.

An additional signal in favor of a decline in the currency pair will be a test of the trend line on the relative strength index (RSI). The second signal in favor of a decline will be a rebound from the upper border of the bearish channel. A strong rise and a breakout of the resistance area with the price consolidating above 1.3405 will cancel the scenario of a decline in the GBP/USD currency pair. This will indicate a breakout of the resistance level and a continuation of the GBP/USD pair’s growth to the area at 1.3665. Confirmation of the pair’s decline should be expected with a breakout of the support area and the price closing below the level of 1.3265.

GBP/USD Forecast and Analysis for August 1, 2025 suggests an attempt to develop growth and test the resistance area near the 1.3275 level. Then, the quotes will continue to fall with a target near the 1.3005 level. An additional signal in favor of a decline in the British pound will be a test of the resistance line on the relative strength index (RSI). A strong rise in the British pound against the US dollar and a breakout of the 1.3405 area will cancel the decline scenario. This will indicate a continuation of the rise in the Forex pair with a potential target above the 1.3665 level.

Key Points:

Germany's EU-harmonised inflation decreased to 1.8% in July 2025, surpassing market expectations amidst stagnant economic growth.

The lower-than-expected inflation may influence future European Central Bank policies, affecting EUR and potentially impacting major cryptocurrencies like BTC and ETH.

Germany's recent inflation data reveals a decline in the EU-harmonised rate to 1.8% for July 2025, surpassing market expectations. Meanwhile, national inflation remains stable at 2%, set against stagnant economic growth as reported by Destatis.

Destatis, the Federal Statistical Office, reported the inflation figures, serving as the central authority for macroeconomic data releases in Germany. The agency indicated the consistent national inflation at 2%, aligning with expectations.

The reduction in inflation highlights potential impacts on macroeconomic strategy in Europe, particularly concerning fiscal policy adjustments. There are expectations of shifts in ECB policies, though no definitive changes were announced following the data release.

Macroeconomic assets, including the EUR and European bonds, could experience volatility as markets respond to evolving inflationary trends. Despite the absence of direct impacts on cryptocurrency markets, indirect effects may influence investor sentiment toward risk assets.

Historical data suggests German inflation surprises often affect market dynamics, notably in foreign exchange movements and crypto fluctuations. Stability in EU economic indicators could encourage steady approaches by financial regulators, amidst ongoing monetary policy evaluations by the ECB.

Potential outcomes could include adjustments in ECB rate expectations to align with regional inflation data, impacting interest rates across Europe.

Key points:

Asian shares fell on Friday after the U.S. slapped dozens of trading partners with steep tariffs, while investors anxiously await U.S. jobs data that could make or break the case for a Fed rate cut next month.Late on Thursday, President Donald Trump signed an executive order imposing tariffs ranging from 10% to 41% on U.S. imports from dozens of countries and foreign locations. Rates were set at 25% for India's U.S.-bound exports, 20% for Taiwan's, 19% for Thailand's and 15% for South Korea's.

He also increased duties on Canadian goods to 35% from 25% for all products not covered by the U.S.-Mexico-Canada trade agreement, but gave Mexico a 90-day reprieve from higher tariffs to negotiate a broader trade deal."At this point, the reaction in markets has been modest, and I think part of the reason for that is the recent trade deals with the EU, Japan, and South Korea have certainly helped to cushion the impact," said Tony Sycamore, analyst at IG.

"After being obviously caught on the wrong foot in April, the market now, I think, has probably taken the view that these trade tariff levels can be renegotiated, can be walked lower over the course of time."MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 0.4%, bringing the total loss this week to 1.5%. South Korea's KOSPItumbled 1.6% while Japan's Nikkeidropped 0.6%.EUROSTOXX 50 futuresdropped 0.5%. Nasdaq futuresfell 0.5% while S&P 500 futuresslipped 0.3% after earnings from Amazonfailed to live up to lofty expectations, sending its shares tumbling 6.6% after hours.

Apple , meanwhile, forecast revenue well above Wall Street’s estimates, following strong June-quarter results supported by customers buying iPhones early to avoid tariffs. Its shares were up 2.4% after hours.Overnight, Wall Street failed to hold onto an earlier rally. Data showed inflation picked up in June, with new tariffs pushing prices higher and stoking expectations that price pressures could intensify, while weekly initial jobless claims signalled the labour market remained on a stable footing.Fed funds futures imply just a 39% chance of a rate cut in September, compared with 65% before the Federal Reserve held rates steady on Wednesday, according to the CME's FedWatch.

Much now will depend on the U.S. jobs data due later in the day and any upside surprise could lower the chance for a cut next month. Forecasts are centred on a rise of 110,000 in July, while the jobless rate likely ticked up to 4.2% from 4.1%.The greenback has found support from fading prospects of imminent U.S. rate cuts, with the dollar index up 2.4% this week against its peersto 100, the highest level in two months. That is its biggest weekly rise since late 2022.The Canadian dollarwas little impacted by the tariff news, having already fallen about 1% this week to a 10-week low.

The yenwas the biggest loser overnight, with the dollar up 0.8% to 150.7 yen, the highest since late March. The Bank of Japan held interest rates steady on Thursday and revised up its near-term inflation expectation but Governor Kazuo Ueda sounded a little dovish.Treasuries were largely steady on Friday. Benchmark 10-year U.S. Treasury yieldsticked up 1 basis point to 4.374%, after slipping 2 bps overnight.

In commodity markets, oil prices were steady after falling 1% overnight. U.S. cruderose 0.1% to $69.36 per barrel, while Brentwas at $71.84 per barrel, up 0.2%.Spot gold priceswere steady at $3,288 an ounce.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up