Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan's Deputy Chief Cabinet Secretary: We Will Not Comment On The Federal Reserve's Interest Rate Decision And Its Impact At This Time

[US Treasury Secretary Threatens Carney: Don't Provoke Disputes Ahead Of USMCA Review] According To The Associated Press, US Treasury Secretary Bessant Threatened Canadian Prime Minister Carney On The 28th, Saying That His Recent Public Comments On US Trade Policy Could Backfire During The Upcoming Review Of The USMCA Trade Agreement, Which Aims To Protect Canada From The Significant Impact Of The Trump Administration's Tariff Policies

CCTV News: Chinese President Xi Jinping Will Meet With British Prime Minister Keir Starmer, Who Is On An Official Visit To China, At The Great Hall Of The People In Beijing

Philippines Economic Planning Secretary: We See 2026 As Our Rally Point, Accelerating Efforts To Restore Public Trust

Reuters Poll - Reserve Bank Of India To Keep Repo Rate Unchanged At 5.25% On February 6, Say 59 Of 70 Economists

China Expects 9.50 Billion Passenger Trips To Be Made During 40-Day Spring Festival Holiday Travel Period - State Planning Official

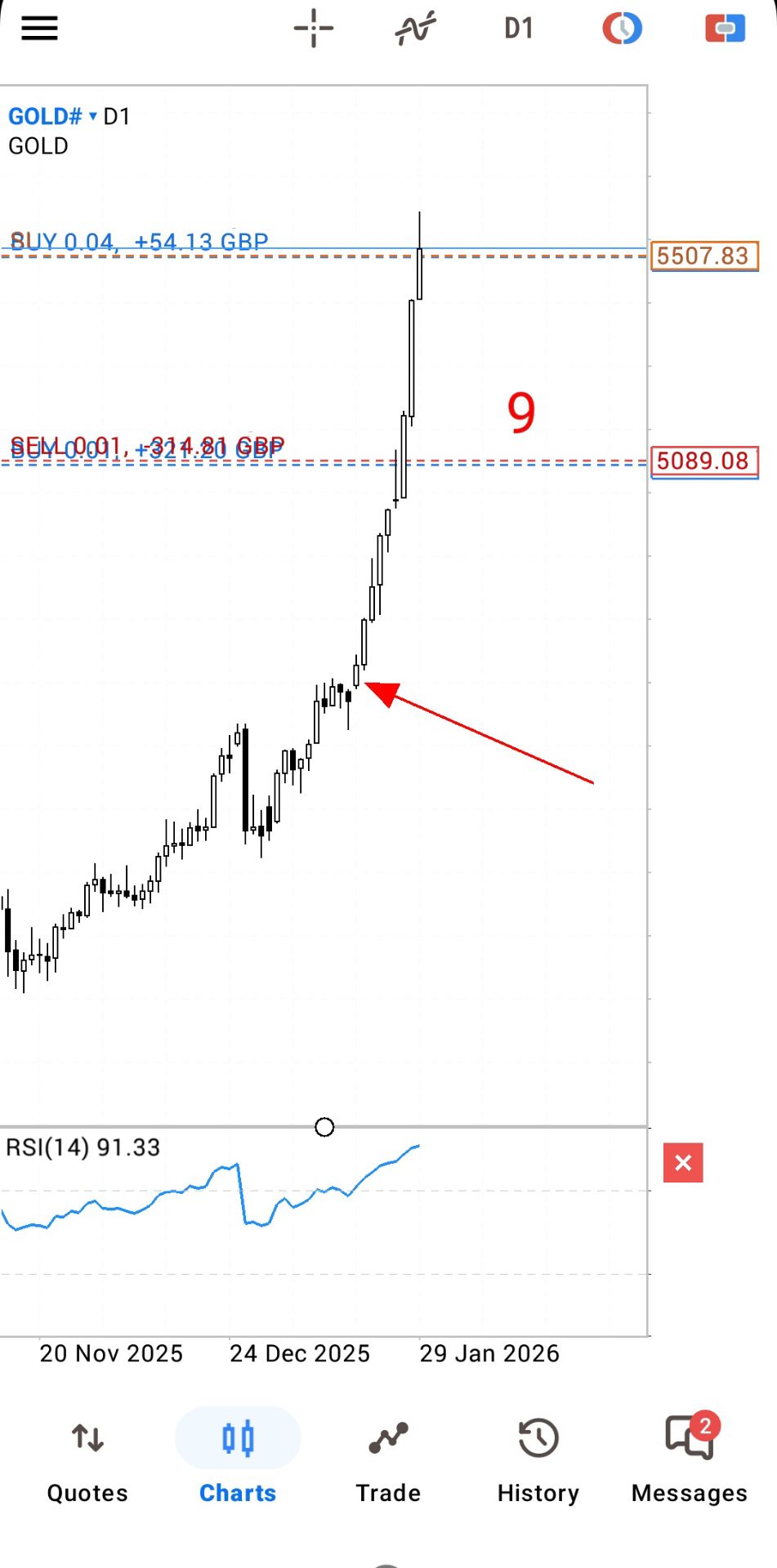

The Main Shanghai Gold Futures Contract Surged 8.00% Intraday, Currently Trading At 1250.52 Yuan/gram

The Main Lithium Carbonate Futures Contract Continued To Fall, Dropping More Than 6% Intraday, And Is Currently Trading At 160,020 Yuan/ton

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)A:--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The national average for a gallon of gas popped two pennies higher to $3.21 since last week as large swaths of the country deal with severe back-to-back storm damage.

Malaysia’s industrial production index (IPI) increased by 4.1% in August 2024, propelled by the moderate growth in the manufacturing sector, said the Department of Statistics (DOSM).

“The industrial production index (IPI) moderated to 4.1% in August 2024, as compared to an increase of 5.3% in the preceding month (July),” said chief statistician Datuk Seri Dr Mohd Uzir Mahidin.

Mohd Uzir said the increase was primarily supported by the expansion of the output in the manufacturing sector at 6.5%, compared to 7.7% in July.

“This is followed by the positive growth of 4.1% (July 2024: 7.0%) in electricity output.

“Inversely, the output of the mining sector continued to decline year-on-year (y-o-y) for two consecutive months by recording a 6.4% decline in August 2024, compared to a 5.0% decline in July,” he said in a statement on Friday.

For a month-on-month (m-o-m) comparison, DOSM said the IPI rebounded to 1.7% in August 2024 after declining by 1.5% in the previous month.

It added that the increase in manufacturing output in August 2024 was supported by the production in export-oriented industries, which softened to 6.3% growth as against 7.8% recorded in July 2024.

“The growth was mainly supported by the resilient growth observed in the manufacture of vegetable and animal oils as well as fats, which recorded an increase of 22.6% (July 2024: 21.9%), and the manufacturing of rubber products at 11.1% (July 2024: 10.5%).

“In addition, the manufacturing of computers, electronics and optical products also contributed to the increase by recording 8.7% growth (July 2024: 5.0%),” it said.

DOSM added that on a m-o-m comparison, the export-oriented industries improved by 3.0% in August 2024 versus a 3.3% decline in July.

It also said that the domestic-oriented industries continued to rise by registering 7.1%, slightly slower than the 7.5% increase recorded in the preceding month.

“This robust performance was largely influenced by a favourable growth in the manufacture of fabricated metal products, except machinery and equipment as well as the manufacture of motor vehicles, trailers and semi-trailers which increased by 10.3% (July 2024: 9.1%) and 7.7% (July 2024: 3.9%), respectively,” it said.

DOSM also noted that the IPI for several other countries, including Singapore, the US, and Taiwan, experienced higher output growth in August 2024, while China, South Korea, and Vietnam continued to grow but slower than the preceding month.

“Conversely, Japan and Thailand declined during the month. Cumulatively, throughout the first eight months this year (January–August 2024), the IPI picked up by 4.1% as compared to the same period in 2023, with all sectors posting an expansion, namely the mining index (1.8%), manufacturing index (4.4%) and electricity index (6.7%),” it added.

Crude oil prices have been on a retreat towards the end of the week but still look set to book another weekly gain, supported by the situation in the Middle East and worry about the security of supply.

In a fresh update, Reuters reported that Gulf states were lobbying with Washington to convince Israel not to target Iranian oil sites on fears that this would prompt retaliatory attacks by Iran-affiliated groups on those Gulf states’ own oil infrastructure.

“The Iranians have stated: 'If the Gulf states open up their airspace to Israel, that would be an act of war',” a Saudi analyst close to the kingdom’s ruling family told Reuters.

“The Gulf states aren't letting Israel use their airspace. They won't allow Israeli missiles to pass through, and there's also a hope that they won't strike the oil facilities,” an unnamed source from the Gulf said. The oil kingdoms had made it clear earlier that they would not be taking a side in that war.

The possibility of such a development has clear bullish implications for the price of oil in the case of an oil-focused escalation, especially in light of Israel’s apparent decision not to consult the U.S. on everything it does on the battlefield and outside it.

Hurricane Milton also helped push oil prices higher this week after it made landfall in Florida, although it did not wreak the devastation expected from a Category 5 hurricane as it lost a lot of its destructive power before landfall.

“Investors are evaluating how hurricane damage might impact the U.S. economy and fuel demand,” NS Trading president Hiroyuki Kikukawa told Reuters. “Oil prices are likely to hover around the current 200-day average levels, with the primary concern being whether Israel will retaliate against Iranian oil facilities.”

Benchmarks added some 3% on Thursday as Israel’s government met to discuss its retaliatory move against Iran. Earlier on Friday, Brent crude was hovering around $80, with West Texas Intermediate above $75 per barrel.

US September inflation printed hotter than expected and contained some important hawkish details such as rising food prices and accelerating supercore services inflation (to an annualized 3mMA of around 4%). Several Fed officials including NY’s Williams, Chicago’s Goolsbee and Richmond’s Barkin were not too worried and focused on the broader picture in which inflation is moving in the right direction. Bostic was the odd one out. In an interview with the Wall Street Journal, the Atlanta Fed president said he was comfortable with skipping a meeting if the data say that’s appropriate.

Coming shortly after a strong ISM, stellar payrolls and yesterday’s CPI, Bostic’s comments briefly sparked an uptick in yields and the dollar. The former finished lower nonetheless, unable to ignore the sharp jump in weekly jobless claims to the highest in more than a year (256k). North Carolina and Florida alone make more than 12k of the net 33k advance from the week before. Both states were hit by hurricane Helene.

Net daily changes in US yields varied between -6.4 bps (2-yr) to +1.8 bps (30-yr). Underperformance of the long end was way more significant before an excellent 30-yr bond auction called off an intraday yield sprint of almost 7 bps (30-yr). The German yield curve’s shift was similar though much less sizeable (-2.7 bps to +0.6 bps). A fragile risk environment and proper gains in oil (Brent +3.7%) provided a cushion for the dollar. EUR/USD ended slightly lower (1.0934). DXY tested the 103 big figure for the first time since mid-August.

Today’s economic calendar is a meagre one (Michigan consumer sentiment) and the US has a long weekend coming (Columbus Day on Monday). We don’t expect markets to move much in such an environment. The October US yield rally lost some steam, especially at the front where the 4% mark serves as a difficult-to-break resistance level. The dollar’s recent recovery may therefore ease a little as well. EUR/USD 1.0907 (50% retracement on the April-September EUR/USD rise) serves as first support.

The financial start of the Q3 earnings season serves as a wildcard. We’d also mention a highly anticipated stimulus announcement of the Chinese finance minister tomorrow. It’s seen as a second chance after the country’s economic planning agency underwhelmed investors on Tuesday. Hopes this time around are for a massive CNY 2tn package.

“The French economy is holding up, but our public debt is colossal. It would be both cynical and fatal not to see it, say it and recognize it.” And so French Finance Minister Armand yesterday evening unveiled a 2025 budget which delivered a combined €60.6bn in spending cuts (2/3) and tax hikes (1/3) which should reduce the deficit from 6.1% of GDP to 5% next year. The aim is to get below the 3% deficit threshold by 2029, two years after the official EU goal. The debt ratio is projected to hit 114.7 of GDP from 112.9% this year. The government uses 1.1% growth and 1.8% inflation in its calculations. In the proposal, spending cuts zoom in things like medical costs, unemployment and reducing the number of public servants.

Temporary levies on large companies (revenue > €1bn) should raise around €12bn over the next two years. Company stock buybacks would be subject to an exceptional tax when the shares are canceled. A 20% tax rate floor will be introduced for individuals earning €250k annually or couples earning double the amount to counter tax shelter effects. A controversial measure is delaying the indexation of pensions until July 1. The budget bill will be discussed in parliament starting next week and needs to be adopted by the end 2024. The government’s lack of parliamentary majority makes it extremely vulnerable to obstructions and confidence votes.

The Bank of Korea lowered its policy rate a first time this morning, from 3.5% to 3.25%, after keeping it level since January 2023. The central bank expects inflation to stabilize at the 2% target level and growth to moderate further. Growth uncertainties increased though due to the delayed recovery in domestic demand. Regarding financial stability, housing prices in the Seoul area and household debt growth are anticipated to gradually slow due to the effects of tightened macroprudential policies.

The Board will thoroughly assess the trade-offs among variables such as inflation, growth, and financial stability, and carefully determine the pace of further policy rate cuts. Five members want to keep rates steady over the next three months, with one in favor of keeping the door open for a cut. Governor Rhee’s view are not disclosed. The Korean won barely manages to gain ground this morning with USD/KRW holding near recent highs around 1350.

The ECB cut policy rates by 25 bps in June and in September. Stubborn inflation (core, services) still is a source of concern, but very weak PMI’s and soft comments of Lagarde (and other MPC members) suggest the ECB is likely to step up the pace of easing with an October cut. Spill-overs from strong US data prevented a test of the 2.0% barrier. 2.00-2.35% might serve as a ST consolidation range.

The Fed kicked off its easing cycle with a 50 bps move. Powell and Co turning the focus from inflation to a potential slowdown in growth/employment made markets consider more 50 bps steps. Strong US September payrolls suggest the economy doesn’t need aggressive Fed support for now, but the debate might resurface as the economic cycle develops. For the US 10-y, 3.60% serves as strong support. The steepening trend is taking a breather.

EUR/USD twice tested the 1.12 big figure as the dollar lost interest rate support at stealth pace. Bets on fast and large rate cuts trumped traditional safe haven flows into USD. An ailing euro(pean economy) partially offset some of the general USD weakness. After solid early October US data, the dollar regained traction, with EUR/USD breaking the 1.1002 neckline. Targets of this pattern are near 1.08.

The BoE delivered a hawkish cut in August. Policy restrictiveness was indicated to be further unwound gradually. The economic picture between the UK and Europe also (temporarily?) diverged to the benefit of sterling, pulling EUR/GBP below 0.84 support. Dovish comments by BoE Bailey ended by default GBP-strength. Uncertainty on the UK budget to be released end this month is becoming an additional headwind for the UK currency.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up