Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tentative signs of a truce in the trade tensions between the US and China have given hope that the period of excitement and volatility in global trade is over and a more normal period will begin.

Tentative signs of a truce in the trade tensions between the US and China have given hope that the period of excitement and volatility in global trade is over and a more normal period will begin. It would be too good to be true. In fact, what looks like some relief at first glance will only be respite. Tensions in global trade will remain and could rather re-escalate. Clearly, trade is increasingly becoming a geopolitical instrument.

The recently announced trade agreement between the US and China will bring some relief, as it signals at least a willingness on the part of the two largest global players to compromise. However, the facts of the agreement are less impressive than the label "12 out of 10" that US President Trump gave it.

The agreement suspended rare-earth export controls and committed China to substantial soybean purchases: 12 million tons in late 2025 and 25 million tons annually through 2028. In return, the US will reduce fentanyl-related tariffs by 10 percentage points and delay new export restrictions for one year. In short: "soybeans for fentanyl tariffs". This agreement still leaves China with a US tariff rate of more than 40%, and doubts about compliance could arise quickly. This means the accord will offer respite rather than relief, and the risk of new tensions remains high.

The start of the US Supreme Court's hearing on parts of the administration's tariffs could bring back new expectations about more trade relief. Predicting how the Supreme Court will rule remains difficult, as there is only one legal precedent. Judging from betting markets, there currently is more than a 60% chance that the court will reject Trump's tariffs. However, a rejection would not mean that the era of tariffs is over. Instead, the US government will use other laws to impose new tariffs, focusing on sectoral ones, which in turn could particularly harm the pharmaceutical and automotive industries in Europe.

The Nexperia chip crisis exposed Europe's structural dependence on Chinese mid-tech components, with German carmakers warning of production halts. This is not only a German issue but a broader European one, as rare earth imports to the EU are four times higher than to the US. And while Europe is struggling to walk the walk on previous talks of strategic autonomy, the US and Australia signed an agreement on joint efforts to exploit rare earth reserves in Australia.

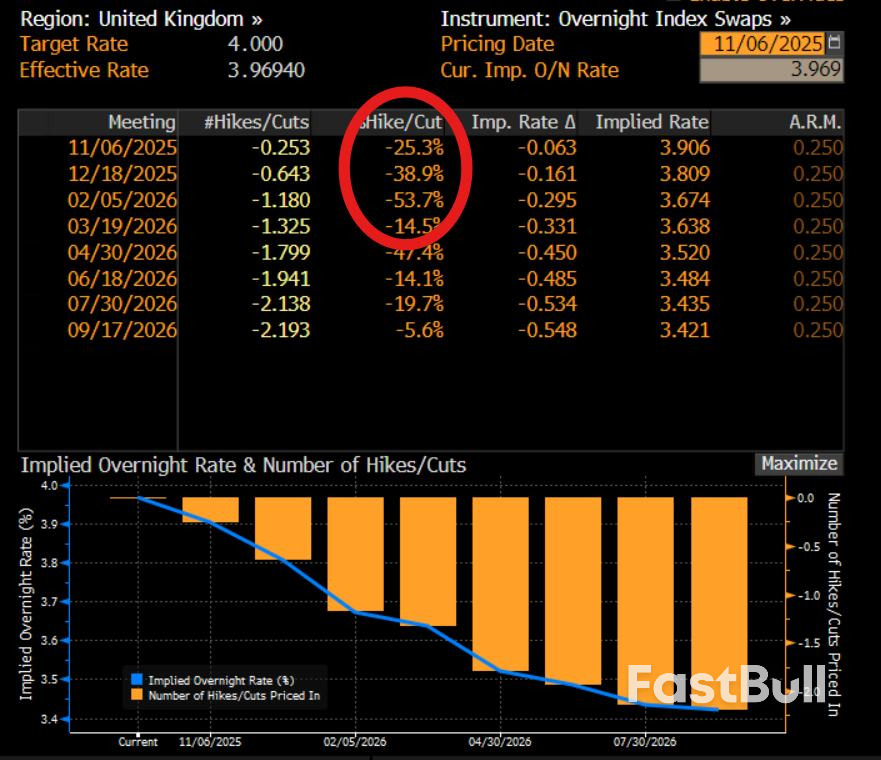

The Bank of England kept rates unchanged on Thursday in a tight decision following recent signs that inflation is slowing, which brought the pound below the highs of the day, while boosting UK government bond prices.

The poundwas last up 0.2% on the day at $1.30799, from around $1.30925 prior to the decision. It weakened a touch against the euro, which was up 0.1% at 88.1 pence, from 87.98 earlier.

British government bond yields fell, with two-year gilt yields last trading at 3.78% (GB2YT=RR), down 3 basis points on the day and down from 3.802% previously, while the blue-chip FTSE-100 indexCURRENCYCOM:UK100was down 0.2%, having pared some of the day's losses.

KIRSTINE KUNDBY-NIELSEN, ANALYST, DANSKE BANK, COPENHAGEN:

"The bar for a December cut is definitely low, with only one vote needed to tip the scale. With significant tightening in the budget in a couple of weeks' time, this should further underpin this view of the next cut being delivered in December.

"For sterling, I still think we are in for more weakness with a dovish sentiment still present in the MPC. The cut is just postponed to the next meeting."

KENNETH BROUX, HEAD OF CORPORATE RESEARCH FX AND RATES, SOCIETE GENERALE, LONDON:

"There's certainly a dovish tone, for example they are talking about the upside risk to inflation decreasing, and that along with the voting split gives it a dovish feel. December is certainly in play, but not a done deal."

"It's going to be tough for the pound, but good for rates, especially at the front end."

NEIL WILSON, UK INVESTOR STRATEGIST, SAXO MARKETS, LONDON:

"No surprise cut, no fireworks - the market called this one, just. Andrew Bailey cast the deciding vote to hold rates unchanged at 4.0% in a 5/4 split with four members preferring to cut. The calculation is that it's best to wait until after the Budget before moving - no big risk in waiting six weeks is the assumption. But equally, I would argue: why wait?"

MICHAEL BROWN, SENIOR RESEARCH STRATEGIST, PEPPERSTONE, LONDON:

"On the whole, it's a more dovish decision than expected, it's the narrowest possible margin in terms of the 5-4 vote."

"(There is) also a bit more of an explicit easing bias to the statement, having got rid of this reference to gradual and careful, and instead explicitly saying if there is further progress on disinflation then we are going to continue cutting rates."

"This is a Bank of England that is fairly confident that inflation has peaked, and it's a Bank of England that clearly wants to continue lowering rates."

NEIL MEHTA, INVESTMENT GRADE PORTFOLIO MANAGER, RBC BLUEBAY ASSET MANAGEMENT, LONDON:

"The market was pricing in a 25% chance of a cut today, but it was always going to be a difficult one ahead of the Budget.

The fact that it was 5-4 means that Bailey really does have the swing vote here and the reason for a quite muted market reaction is that focus has shifted to December.

Bailey's comments do read more tilted towards the dovish side. If we have another month where wage and inflation remain in line I think December is very much a goal and Bailey will be tilted towards swinging that 5-4 towards a cut."

ZARA NOKES, GLOBAL MARKET ANALYST, JPMORGAN ASSET MANAGEMENT, LONDON:

"While there has been some positive news on the inflation front in recent weeks, the bottom line is that headline inflation is running at 3.8% - almost twice the BoE's target."

"On the growth side, the labour market is cooling, but other economic data such as retail sales and consumer confidence paint a more resilient picture of the UK economy.

The balance of risks could shift next year if large near-term tax hikes are announced at the Autumn budget. But until there is more meaningful progress on bringing inflation down, the Bank must exercise a high degree of caution in lowering rates."

GEORGE BROWN, SENIOR ECONOMIST, SCHRODERS, LONDON:

"Holding rates today was the right decision, with inflation still nearly double the 2% target. The Bank will be in a stronger position after the dust settles from the budget, armed with additional jobs and inflation data, to judge whether further easing is warranted in December."

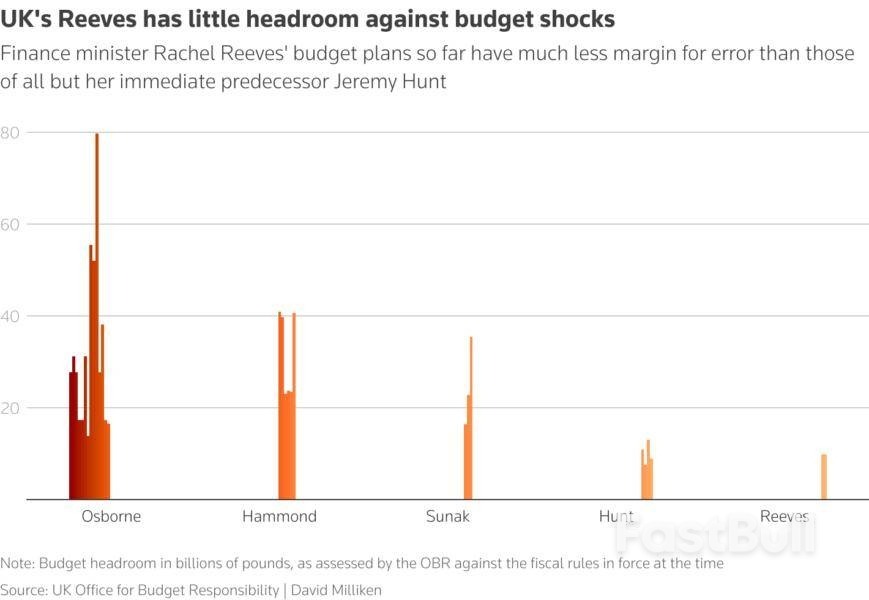

"A cautious approach remains appropriate given the risk that high inflation becomes entrenched, due to sticky wage growth and subdued productivity. However, this may change if reports the Chancellor intends to double her fiscal headroom to 20 billion pounds($26.84 billion), through fiscal tightening in the region of 40 billion pounds, are true. Alongside mooted tax cuts on household energy bills, if these measures materialise, they could create scope for the Bank to cut multiple times next year."

MATHIEU SAVARY, CHIEF STRATEGIST, BCA RESEARCH, MONTREAL:

"The BoE opted for a dovish hold. The MPC is not rushed and is waiting for the Treasury's Autumn Statement, but the labour market is clearly softening and wage inflation is slowing faster than the Committee expected this summer. With fiscal tightening ahead, a December cut remains our base case. We stay overweight gilts."

Nvidia CEO Jensen Huang has issued a stark warning that China will surpass the United States in the artificial intelligence race, citing China's lower energy costs and less restrictive regulatory environment.

"China is going to win the AI race," Huang stated Wednesday at the Financial Times' Future of AI Summit. His comments follow the Trump administration's decision to maintain restrictions on Nvidia selling its most advanced chips to Beijing, despite recent talks between President Donald Trump and Chinese leader Xi Jinping.

Huang criticized what he described as "cynicism" in Western nations including the US and UK, calling for "more optimism" instead. He specifically pointed to the potential burden of "50 new regulations" from various US states implementing their own AI rules.

The Nvidia chief highlighted China's energy subsidies as a key advantage for local tech companies running Chinese alternatives to Nvidia's AI chips. "Power is free," Huang remarked, referring to the cost benefits Chinese competitors enjoy.

Recent reports indicate China has increased energy subsidies for major data centers operated by tech giants including ByteDance, Alibaba and Tencent. These subsidies were reportedly implemented after Chinese tech companies complained about higher costs associated with using domestic semiconductors from firms like Huawei and Cambricon, which are generally less energy-efficient than Nvidia products.

Huang has previously cautioned that the latest American AI models hold only a narrow lead over their Chinese counterparts, and has urged the US government to allow more open market access for its chips to maintain global technological dependence.

Signs that U.S. economic activity remains brisk helped steady the stocks ship, but this also cast more doubt on why the Federal Reserve needs to ease again next month and that has pushed Treasury yields higher.

The week's latest tech wobble calmed on Wednesday as service sector surveys impressed, although valuation concerns smoldered. Chip designer Qualcomm's stock fell back 4% overnight despite headline earnings beats as it warned on loss of business from client Samsung.

But a rare trickle of macro data during what's now a record long government shutdown was the focus on Wednesday. Private sector jobs rose above forecast last month, service firms reported rising activity and prices and quarterly Fed lending data showed relatively stable household credit conditions.

With futures showing little more than a 60% chance of another Fed cut next month, Treasuries balked and the long-dated yields hit their highest in almost a month. A string of the Fed's heavy hitters are speaking again later on Thursday.

However, doves will point to rising layoffs as a reason to keep cutting rates and a report on Thursday from Challenger, Gray & Christmas said U.S.-based employers cut more than 150,000 jobs in October, marking the biggest reduction for the month in more than 20 years.

The overall picture left Wall Street stock index futures flat ahead of today's bell despite Wednesday's modest bounce. The dollar fell back across the major currency pairs, while gold nudged higher and Bitcoin retreated again.

Britain's pound perked up after a rough week ahead of a likely knife-edge policy decision from the Bank of England later. Markets see 40% chance of a UK rate cut as soon as Thursday as this month's critical government budget plan is expected to tighten fiscal policy.

Elsewhere, Asia stocks firmed and China's markets outperformed again. European stocks slipped.

Wednesday's Supreme Court hearings raised doubts over the legality of President Donald Trump's sweeping tariffs, with betting markets seeing just a one-on-four chance that they will give the use of emergency powers clearance. That potentially creates a hiatus in the plan as Trump would then need to seek other routes to impose the tariffs.

While the Supreme Court typically takes months to issue rulings after hearing arguments, the administration asked it to act swiftly. The timing of a decision remains unclear.

Pressure to end the record 36-day government shutdown was building meantime, with Transportation Secretary Sean Duffy saying he would order a 10% cut in flights at 40 major U.S. airports, citing air traffic control safety concerns.

In today's column, I take a look at tech sector bubble jitters and how long-term success of the AI transformation may be independent of whether current frothy valuations are justified.

U.S. Transportation Secretary Sean Duffy said on Wednesday that he would order a 10% cut in flights at 40 major U.S. airports, citing air traffic control safety concerns as a government shutdown hit a record 36th day.

The U.S. Supreme Court's tough questioning of PresidentDonald Trump's global tariffs fueled increased speculation that they will be struck down, but raised the specter of additional chaos as he is widely expected to shift to other trade tactics in the wake of an adverse ruling.

Tesla's(TSLA.O)board of directors has pushed in all its chips onElon Musk. Now investors must decide whether to back the biggest bet in company history. Shareholders will vote Thursday on whether to pay Musk up to $878 billion in company stock or take the risk he will leave.

Gold's recent retreat from a record high has raised questions about whether the precious metal has run out of steam. But ROI Asia commodities columnist Clyde Russell notes that this might not be the case, as the current rally is only the third-strongest in terms of percentage gain in the past 50 years.

Fund money has surged into the London Metal Exchange (LME) aluminium contract over the past couple of months as investors bet that the market's days of chronic oversupply are coming to an end, writes ROI metals columnist Andy Home.

Thursday's Bank of England rate decision remains a close call with markets split on whether the BoE will pull the trigger today or wait until after the government's annual budget plan on November 26. Finance Minister Rachel Reeves flagged likely tax rises this week as she struggles to keep the budget within her own fiscal rules, where room for maneuver is more limited than many of her predecessors.

* Bank of England policy decision, minutes, monetary policy report and press conference with BoE Governor Andrew Bailey

* Federal Reserve Board Governors Christopher Waller and Michael Barr both speak; New York Fed President John Williams, Philadelphia Fed President Anna Paulson, Cleveland Fed boss Beth Hammack and St. Louis Fed chief Alberto Musalem all speak; Bank of Canada Governor Tiff Macklem speaks in parliament

* U.S. corporate earnings: Microchip Technology, News Corp, Warner Bros Discovery, Moderna, Dupont De Nemours, Kenvue, Expedia, Airbnb, Wynn Resorts, ConocoPhillips, Consolidated Edison, Ralph Lauren, Monster Beverage, Parker-Hannifin, Mettler-Toledo, Trade Desk, Vistra, Insulet, Tapestry, Alliant Energy, NRG, Evergy, Akamai, Gen Digital, Rockwell Automation, Block, Viatris, EOG Resources, Camden Property, Take-Two Interactive, Epam, Solventum

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up