Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Hong Kong stocks fell 1.2% after data showed China’s economy slowed in July, with weak factory activity and retail sales.

Hong Kong stocks fell 1.2% after data showed China’s economy slowed in July, with weak factory activity and retail sales. This suggests Donald Trump’s trade war is affecting the world’s second-largest economy. Meanwhile, Japanese stocks rose 1% as the country’s economy grew faster than expected last quarter.MSCI’s broad Asia-Pacific index (outside Japan) dropped 0.2%. Japan’s Nikkei 225 bounced back 1.6%, nearing a record high after a big drop on Thursday, which ended its six-day winning streak. Australian stocks rose 0.7%, while Hong Kong stocks fell 1.1%.

China’s CSI 300 index went up 0.8% after weaker-than-expected July economic data, like retail sales and industrial production, raised hopes for new government stimulus. Markets in India and South Korea are closed for holidays.Earlier, hopes for US monetary easing had boosted market confidence, with traders expecting a quarter-point rate cut. However, US wholesale inflation rose in July at its fastest pace in three years, causing traders to lower the chances of a September rate cut to 90%, down from being fully certain before.

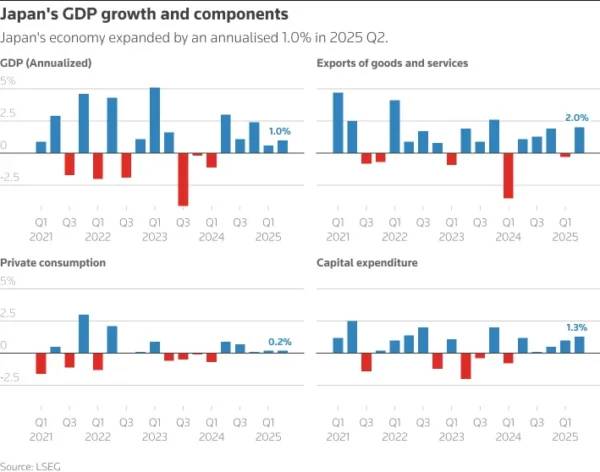

Japan’s economy grew faster than expected in the second quarter, with GDP rising 1.0% annually, marking five straight quarters of growth. This was supported by strong exports and capital spending, despite US tariffs. The growth beat market expectations of 0.4% and followed a revised 0.6% rise in the previous quarter.

However, analysts warn that US tariffs and global uncertainties could hurt Japan’s economy in the coming months, especially for automakers trying to keep prices low for US customers.

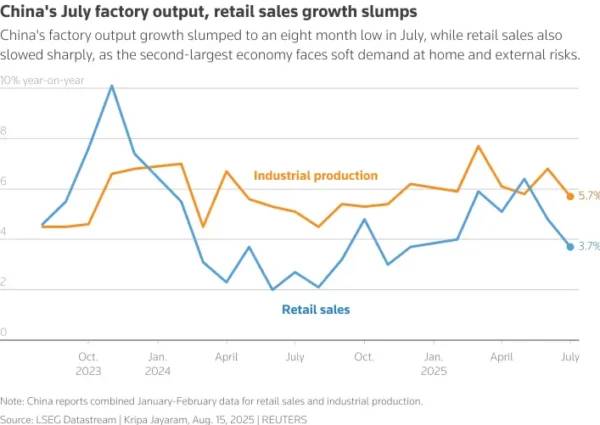

China’s factory output growth hit an eight-month low in July, and retail sales slowed sharply, increasing pressure on policymakers to boost the $19 trillion economy with more stimulus.Challenges include US trade policies, extreme weather, tough domestic competition, and a weak property sector. Industrial output grew 5.7% in July, down from 6.8% in June and below the 5.9% forecast. Retail sales rose 3.7%, the slowest since December 2024, missing the expected 4.6% increase.

Heading into the European Open, Pan-region futures rose 0.5%, German DAX futures increased 0.5%, and FTSE futures also gained 0.5%.Investors are keeping a close eye on US President Donald Trump’s meeting with Russia’s Vladimir Putin on Friday, aimed at ending the war in Ukraine.There’s concern about how long any agreement might last, and European leaders worry the US and Russia could make big decisions that leave them out or pressure Ukraine into a bad deal.

If the Trump-Putin Alaska summit gets positive feedback, European stocks are likely to see a boost. The details matter, and Europe is unlikely to fully welcome Russia, even if peace is restored. This means defense stocks might slow down their steady rise but won’t face major setbacks.On the FX front, The euro and British pound stayed mostly unchanged after dropping 0.5% and 0.3% in the previous session, ahead of US retail sales data.

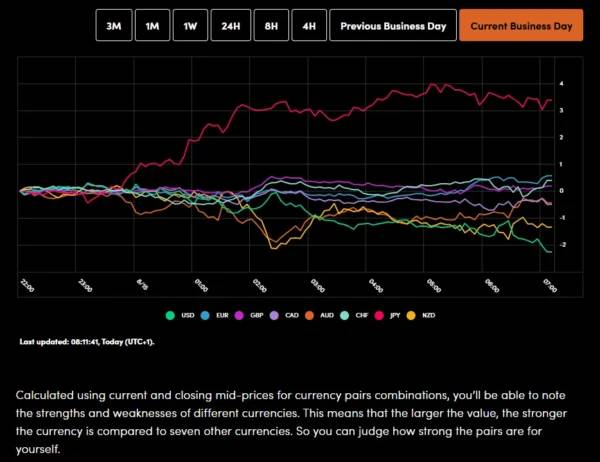

The Japanese yen strengthened thanks to surprisingly strong economic growth, with exports holding up well against new US tariffs.The Australian dollar remained steady, while the Chinese yuan fell from a two-week high due to weaker-than-expected economic data.

Currency Power Balance

Geopolitics will be in the news as the Trump-Putin meeting gets underway while we also have the Jackson Hole Symposium where all eyes will be on Fed Chair Jerome Powell.From a data perspective, the US session brings retail sales numbers will give a glimpse to consumer demand but the bigger one could be the Michigan Consumer Sentiment data.It will be interesting to see where survey respondents see inflation expectations over the 12 months in particular.

Chart of the Day – DAX Index

From a technical standpoint, the DAX index has continued to advance following yesterdays breakout.

DAX Index Two-Hour Chart, August 15. 2025

South Korea intends to restore an agreement to suspend some military activity along the border with North Korea, President Lee Jae Myung said on Friday, as his government seeks to improve relations between neighbours still technically at war.

The 2018 military accord was designed to curb the risk of inadvertent clashes, but broke down after a spike in tensions.

The so-called Comprehensive Military Agreement (CMA) signed between the two Koreas was the most substantive deal to result from months of historic meetings between leader Kim Jong Un and then-South Korean President Moon Jae-in.

On September 19, 2018, South Korea's defence minister and his North Korean counterpart signed the CMA in the North's capital, Pyongyang, accompanied by polite applause from the onlooking leaders.

Under the CMA, both countries agreed to "completely cease all hostile acts against each other" and implement military confidence-building measures in air, land and sea domains.

The measures included the two sides ending military drills near the border, banning live-fire exercises in certain areas, the imposition of no-fly zones, the removal of some guard posts along the Demilitarized Zone, and maintaining hotlines.

On the ground, both sides agreed to completely cease artillery drills and field training within 5 km (3 miles) of the Military Demarcation Line (MDL) between the countries.

At sea, they installed covers on the barrels of naval guns and coastal artillery and closed gun ports in a buffer zone along the sea border.

With inter-Korean and denuclearisation talks long stalled, the military accord started to fracture in recent years amid drills and shows of force along the fortified border between the Koreas as they accused the other of breaches.

North Korea's launch of a spy satellite in 2023 further ratcheted up tensions on the Korean peninsula, and the countries walked away from the confidence-building pact.

South Korea's National Security Council that year moved to "suspend the effect of Article 1, Clause 3" establishing no-fly zones close to the border in the 2018 military agreement, enabling Seoul to restore reconnaissance and surveillance activities along the border.

South Korea's military then restarted aerial surveillance in border areas, the defence ministry said.

North Korea in return said its army would "never be bound" by the pact, ripping up the agreement and vowing to restore all military measures it had halted under the deal.

In June 2024, former South Korean President Yoon Suk Yeol declared a complete suspension of the military pact in response to North Korea's move to send hundreds of rubbish-stuffed balloons across the border.

Later that year, as hostilities increased state-run news agency KCNA said North Korea amended its constitution to designate the South as a "hostile state".

President Lee, who won a snap election in June, has sought to re-engage Pyongyang after a period of cross-border tension and shown a willingness to return to dialogue.

He touted on Friday his government's efforts to ease tensions, including halting the launch of balloons floated by activists with anti-North Korea leaflets and dismantling loudspeaker propaganda broadcasts across the border.

How Pyongyang might respond remains unclear. Top North Korean officials have in recent weeks dismissed moves taken by Lee's new liberal government to ease tensions.

Some analysts are also sceptical about the short-term prospects of a favourable response from North Korea to such overtures.

US Treasury Secretary Scott Bessent said he isn’t calling for a series of interest-rate cuts from the Federal Reserve (Fed), just pointing out that models suggest a “neutral” rate would be about 1.5 percentage points lower.

“I didn’t tell the Fed what to do,” Bessent said on Thursday in an interview on Fox Business, referring to his comments a day before about how the central bank “could go into a series of rate cuts here”.

Bessent said Thursday that “what I said was that to get to a neutral rate on interest, that that would be approximately a 150-basis-point cut”.

The so-called neutral rate is the level at which policy neither stimulates nor restricts the economy. Fed chair Jerome Powell said July 30 that there are “a range of views of what the neutral rate is at this moment for our economy” and that his own estimate was that the current setting was “modestly restrictive”.

“I believe that there is room, if one believes in the neutral rate,” for a series of rate cuts, Bessent said. “I am not calling for one. I didn’t call for one. I just said that a model of a neutral rate is approximately 150 basis points lower.”

The Fed last month kept its target range for the benchmark rate at 4.25% to 4.5%. The median estimate of the neutral rate among Fed officials over the long run is 3%. Powell and many of his colleagues have for months argued that more time was needed to assess any impact on inflation and inflation expectations from President Donald Trump’s tariff hikes.

Trump has regularly criticised Powell for holding rates. Bessent, after taking the Treasury’s helm, said he would only address past Fed actions, not future ones, but later weighed in on what he thought markets were expecting monetary policymakers to do. This week, he has taken to referring to economic models, and has repeatedly suggested a 50-basis-point rate cut is possible at the Fed’s September meeting.

“It’s not really the role of the Treasury secretary to opine” on the neutral rate, said Julia Coronado, the founder of the research firm MacroPolicy Perspectives and a former Fed economist. “The fact that the most senior economic official in the administration is saying these things publicly is direct, public pressure on what he wants the Fed to do.”

Former Treasury secretary Lawrence Summers, who served under Democratic president Bill Clinton, said he was “surprised” to see Bessent’s remarks on Wednesday.

“Usually that kind of judgement is not made by administration officials, and I am not sure it’s helpful for the administration to be publicly prescribing on monetary policy,” Summers said on Bloomberg Television’s Wall Street Week with David Westin.

Summers, a paid contributor to Bloomberg TV, also suggested that a measure of the neutral rate should incorporate the effects of large budget deficits and elevated demand for funds to pay for data centres — along with higher asset prices that reduce the flow of funds into savings. Against that backdrop, “you wouldn’t be prescribing a 175 basis point cut in rates unless we see a recession”.

Interest-rate futures as of Thursday morning reflect bets that the Fed will cut rates by less than a cumulative 150 basis points by the end of next year. They also show slightly less confidence in a 25-basis-point reduction at the September meeting. The retreat came after a release on US wholesale inflation showed those prices climbed by the most in three years.

Speaking to Bloomberg Television on Wednesday, Bessent said “if you look at any model” it suggests that “we should probably be 150, 175 basis points lower” on the Fed’s benchmark. He also said that officials might have cut rates if they had been aware of the revised data on the labour market that came out a couple of days after the latest meeting. “I suspect we could have had rate cuts in June and July,” Bessent said.

“I don’t know what model he’s talking about,” said Jim Bianco, the president of Bianco Research and a long-time Fed and Treasury watcher. “There is no model I am aware of that says it should be that low,” he said of the Fed’s benchmark.

Other gauges of where the Fed should be, such as the Taylor rule, also aren’t arguing that the main rate should be 150 to 175 basis points lower than it is, Bianco said. He added that there have been many instances over the decades of “cajoling Fed chairs,” and they are “welcome to offer their opinion,” but it shouldn’t change the central bank leader’s opinion.

Bessent repeated on Thursday that, given the context of the weaker jobs figures and not having cut rates the past couple of months, “perhaps a 50-basis-point cut in September was warranted”.

Two Fed district bank presidents said they are not backing such a move at this point. San Francisco Fed president Mary Daly said in a Wall Street Journal interview on Wednesday, “I just don’t see that. I don’t see the need to catch up.” St Louis president Alberto Musalem said on CNBC on Thursday, that a 50-basis-point cut would be “unsupported by the current state of the economy and the outlook for the economy”.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up