Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

We've seen a notable pick-up in Dutch manufacturing production since August this year. In October, production was significantly higher for the third consecutive month than it was for 11 months prior.

We've seen a notable pick-up in Dutch manufacturing production since August this year. In October, production was significantly higher for the third consecutive month than it was for 11 months prior.

The technology industry has played an important part in the recent growth. In both machinery production and in that of electrical appliances and means of transport, we're seeing a clear recovery emerging after a period of stagnation. Like their counterparts in the eurozone, Dutch manufacturers have become somewhat more optimistic about the near future since the summer.

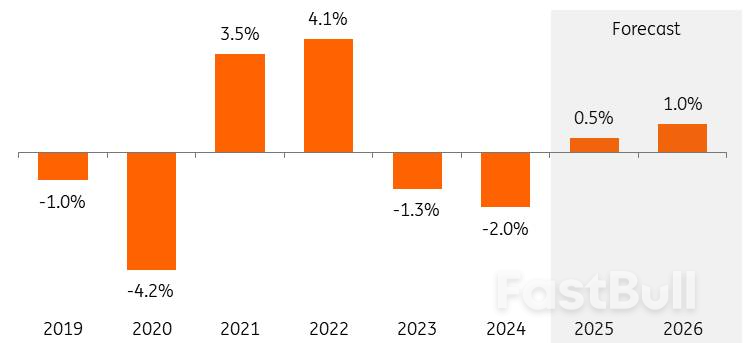

Now that the unrest around trade tariffs is also easing, production could increase further from +0.5% in 2025 to +1.0% in 2026. Still, many factors continue to slow down growth, such as export restrictions and import tariffs, stiff competition from China and structural factors like grid congestion, nitrogen emission limitations and relatively high energy costs.

Volume growth of output of Dutch manufacturing

Increasing consumer spending and additional government investment, in particular, will lead to more manufacturing orders in 2026. Although production expectations have improved and manufacturers have been receiving more new orders for some time, producers have become only slightly more positive about their order books in recent months. Getting the pipeline of customer orders well-filled again is a process that takes time.

It also takes a while for investments in defence, for example, to translate substantially into more orders and production. Expanding production takes time due to staff shortages and the required construction or conversion of factories. In turn, it isn't surprising that progress in producer confidence and the purchasing managers' index is currently stalling around the long-term average. Like the slight improvement in the orders-to-stocks ratio, sentiment indices do not yet point to substantial growth.

Industrial producers' assessment of order books and stocks of finished products*

*balance of positive-negative judgments; 2-month moving average, inventory judgment inverted (r.h.axis) Source: Statistics Netherlands, ING Research

*balance of positive-negative judgments; 2-month moving average, inventory judgment inverted (r.h.axis) Source: Statistics Netherlands, ING ResearchThe gradually increasing global demand for chip machines is yet another growth driver for Dutch manufacturing. The growth of chipmakers and equipment manufacturers remained under pressure in 2025 due to a slower-than-expected normalisation of customer inventories. While semiconductor company ASML continues to keep a close eye on this, ASM and Besi are seeing order growth recover and are optimistic about 2026.

Investors are also anticipating increasing chip machine demand in 2026. The artificial intelligence boom requires additional chips for data centres, for example, which is creating a growing need for production capacity among semiconductor producers. Demand for chips for applications other than AI, such as consumer electronics, automotive and industrial applications, is also improving.

The uncertainty surrounding the size and impact of US President Donald Trump's import tariffs has caused consumers and businesses to spend only reluctantly. As uncertainties are eased by recent trade deals, the outlook for consumption and investment is improving. Nevertheless, the uniform tariff on EU exports to the US – previously an important growth market for Dutch industry – still remains at 15%. Together with the cooling of the US economy, this will dampen export growth in 2026. The 50% rate on European products and parts made of steel and aluminium is still in place. In fact, the US is bringing more and more products with steel and aluminium parts below the high 50% tariff.

Headwinds and uncertainty also remain due to trade restrictions stemming from increasing technological rivalry with and resource dependence on China. Government policy has an increasingly large and unpredictable influence on market conditions.

Think of the intervention in Nexperia's business operations and the subsequent export restrictions of essential automotive chips by China. The restrictions on the export of advanced chip machines to China also directly affect Dutch makers and suppliers. At the same time, the persistently expensive euro against the dollar and rising competition from China, which has intensified since Trump's tariffs, are directly – and, through lower exports, indirectly – at the expense of the demand for Dutch products.

Low demand, high energy costs and cheap imports continue to hurt chemicals and base metals

Companies in the chemical and base metal sectors, in particular, will continue to face three persistent bottlenecks in 2026:

The relatively large number of eight large chemical plants (or parts thereof) that have been closed in the Netherlands this year will also have a negative impact on growth in the coming years, as part of the production (capacity) has been taken out of the market.

In that light, the current downward trend in energy prices is encouraging, but not immediately sufficient for renewed growth. This is also expected to continue in 2026, mainly due to increasing global LNG production capacity (especially in the United States and Qatar), and the gas market will structurally expand. This reduces the chance of extreme price peaks and supply problems. The high transport and processing costs of LNG do ensure that energy in Europe remains relatively expensive. LNG imports will continue to be needed for years to meet energy needs.

In addition to the increasing demand for chip machines, higher government spending on defence is also gradually increasing product demand. For example, for radars from Thales, frigates from Damen Naval and submarine parts from IHC. The €800 billion from the European Commission's ReArm-Europe programme and the new NATO standard of 3.5% of GDP will consolidate long-term investments.

An increasing amount of unused capacity is now being used for defence purposes, such as VDL's old Nedcar factory. Drone manufacturing is a fast-growing branch in which the Netherlands excels, previously for civilian purposes. More and more "dual-use companies" are responding to the new growth market by developing new military resources based on existing civilian applications.

Production growth in the food industry is set to pause in 2026 after a strong increase in 2025. Based on figures from Statistics Netherlands up to and including September, we assume production growth of at least 3% for 2025. This is partly pent-up demand after several lean years; foreign turnover is also currently growing considerably faster than domestic turnover.

In terms of production levels, the sector will come close to 2018's peak. The fact that the expected growth will fall in 2026 is mainly due to supply constraints and limited room for expansion investments. The impact of the shrinking livestock herd on the dairy and meat processing industry plays a major role in this. Still, consumer demand is developing positively, and that provides a counterbalance.

The USDCAD pair continues to decline amid positive macroeconomic data from Canada. The current quote stands at 1.3763. Details — in our analysis for 15 December 2025.

The USDCAD pair is correcting but remains under selling pressure. Investors' attention is still focused on the geopolitical environment, which continues to generate heightened volatility in commodity and currency markets.

Macroeconomic data from Canada present a mixed picture. In October 2025, wholesale trade volumes rose by 0.1% month-over-month to CAD 86.0 billion, while the market had expected a decline of 0.1%. Additional support for domestic demand came from the construction sector. In October 2025, the value of building permits issued surged by 14.9% compared to the previous month, reaching CAD 13.8 billion — the fastest pace of growth since June 2024.

Positive signals from individual sectors of the Canadian economy are increasing pressure on USDCAD, strengthening the Canadian dollar and keeping the short-term outlook for USDCAD bearish.

The USDCAD pair is consolidating below the EMA-65, confirming persistent bearish pressure. The price structure points to the formation of a Triangle pattern with a projected target near 1.3680. The USDCAD outlook for today suggests a continuation of the decline, with the nearest target at 1.3690.

An additional signal in favor of the bearish scenario is provided by the Stochastic Oscillator: the signal lines are bouncing off the descending trend line, indicating that bearish momentum remains intact.

A firm consolidation below the 1.3745 level will confirm the downside scenario and signal a breakout below the lower boundary of the Triangle pattern.

Short-term USDCAD dynamics remain under pressure. Technical analysis of USDCAD points to a continuation of the bearish move with a target at 1.3680, provided that the price holds below the 1.3745 level.

Euro zone industrial output growth accelerated in October, bolstering views that the bloc is picking up momentum as trade uncertainty is dissipating, the labour market remains tight and consumption is inching up.

Industry expanded by 0.8% on the month after a 0.2% increase in September, in line with expectations, data from the EU's statistics agency Eurostat showed on Monday.

Compared to a year earlier, output growth accelerated to 2.0% in October from 1.2% in September, beating expectations for 1.9% in a Reuters poll of economists.

German industry, expanding by 1.4% on the month, was among the top performers, offsetting a 1.0% drop in Italy and lukewarm growth in France.

The euro zone economy has proven surprisingly resilient this year, and European Central Bank President Christine Lagarde has already said that another upgrade in the growth outlook is coming this week.

Still, expansion is far from spectacular. The bloc is only growing at a rate just above 1%, near its so-called potential, as exports, the main driver of the economy in recent decades, remain weak and the domestic sector is producing nearly all growth.

Industrial exports have struggled for years as surging energy costs have put the bloc at a cost disadvantage just as China was expanding its high-tech industrial base, grabbing market share.

While industry might be bottoming out this year, there is no boom in sight and it is still somewhat unclear how the new U.S. tariff regime will alter global trading patterns.

Nevertheless the bloc appears to be adjusting well, and even if there is no boom underway, the downside risk also appears limited.

"Incoming high-frequency indicators continue to point to positive momentum in activity heading into year-end," Barclays said in a note.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up