Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

When dealing with financial instruments, understanding key valuation metrics is crucial. Two important terms often used in trading are notional value and market value.

When dealing with financial instruments, understanding key valuation metrics is crucial. Two important terms often used in trading are notional value and market value. While both relate to the worth of an asset or a contract, they serve different purposes and can significantly impact risk assessment, position sizing, and leverage calculations. In this article, we will break down the differences between notional value vs market value, explain their significance, and highlight how traders can use them to manage risk and optimise their strategies.

Notional value meaning refers to the total value of a trade based on the underlying asset. It is also known as face value or par value in stocks and bonds. It is a critical concept in leveraged instruments because it reflects the full exposure a trader has, even if only a fraction of that amount is required upfront.

It’s particularly relevant in forex, futures, and other derivatives, where traders control large positions with relatively small capital outlays. Let’s say a trader buys a standard lot of 100,000 units of the EUR/USD pair, investing only $10,000 as a margin. Although they invested only $10,000, their exposure will be $100,000. If the current exchange rate is 1.10, the notional value of this trade would be 110,000 USD (100,000×1.10). This is why traders in leveraged assets often focus on this metric when assessing risk.

Market value is the real-time worth of a position based on the current price of the asset. It fluctuates with price changes, making it essential for tracking portfolio performance and assessing potential unrealised returns.

For example, if a trader buys 500 shares of a stock at £20 each, the market value is £10,000. If the stock price rises to £25, the position’s real-time worth increases to £12,500. Conversely, if the price drops to £18, it falls to £9,000. These changes directly impact a trader’s portfolio and, in leveraged trading, can affect margin requirements.

In practical terms, it’s what someone would receive if they closed a trade at that moment. It’s also a key metric for portfolio management, as traders rely on it to track gains, losses, and overall exposure.

Both concepts are often confused, but they serve different purposes in trading. Understanding the distinction is crucial for assessing exposure, managing risk, and tracking portfolio performance. Here’s how they differ:

Notional and market value plays a crucial role in how leverage and margin work in trading. Since leverage allows traders to control larger positions with a smaller capital outlay, brokers assess both figures to determine margin requirements and potential risks.

Leverage magnifies exposure relative to the capital invested, making notional value a key factor in risk assessment. Brokers typically calculate leverage ratios based on position size rather than the funds deposited. For example, if someone has £10,000 in their account and takes a trade with a notional size of £100,000, they are using 10:1 leverage. Even if they only risk a fraction of that amount, their exposure is still based on the full figure.

While the margin is initially based on total exposure, market value fluctuations affect ongoing margin obligations. In leveraged positions, brokers require traders to maintain a minimum margin level, known as the maintenance margin. If it drops and equity falls below this threshold, a margin call may be issued, requiring additional funds to keep the trade open.For example, someone holding a £200,000 futures contract with a £20,000 margin may see the trade’s worth drop to £190,000. If this reduction lowers account equity below the maintenance margin level, the broker may demand more funds or liquidate the position.

Together, these concepts may help traders make more informed decisions about sizing, leverage, and capital allocation.

Notional value helps traders understand the true scale of their exposure. A position’s notional size determines its impact on overall portfolio risk, influencing how capital is allocated. Large total exposure relative to account size can increase overall risk, even if the margin required to open the trade is small.Market valuations, meanwhile, help in adjusting positions. It’s typical to monitor it to determine when to scale in or out of a trade. As prices move, real-time valuations help traders decide whether to maintain, reduce, or increase their holdings.

Notional and portfolio values play a key role in assessing portfolio health. Market worth fluctuates, influencing notional value and portfolio performance. These fluctuations are tracked to evaluate overall gains and losses and rebalance portfolios accordingly.

The way total position size and real-time pricing apply varies across asset classes. While some markets focus on the overall contract or lot size, others rely more on live pricing to assess worth. Here’s how different instruments incorporate these calculations:

FAQ

What Is Notional Value in Trading?

The notional value meaning refers to the total size of a position based on the underlying asset, regardless of how much capital is actually invested. It reflects the full exposure a trader has in a trade. For example, if a trader has a $10,000 margin requirement in a $100,000 standard lot of a forex pair, their exposure is still $100,000.

What Is the Notional Value in Crypto*?

Notional value in cryptocurrencies* refers to the total exposure of a position. If a trader opens a 10x leveraged position with $1,000, the notional valuation is $10,000, as the trade controls more than the initial capital invested.

Does Notional Value Include Leverage?

Yes, it accounts for the full position size, not just the margin required to open it.

What Is Net Position vs Market Value

Net position refers to the overall exposure after accounting for both long and short positions. Market value, on the other hand, reflects the current worth of individual holdings. Someone with 1,000 shares long and 500 shares short has a net position of 500 shares, but each trade still has its own current valuation based on the latest price.

Germany will halt deliveries to Israel of military equipment that could be used in operations in the Gaza Strip, taking the step over concern for humanitary suffering in the territory.

The ban on deliveries of spare parts for tanks and other defense-related goods will be in place until further notice, Chancellor Friedrich Merz said Friday in a statement. The move was prompted by Israeli Prime Minister Benjamin Netanyahu’s move to secure approval for a military takeover of Gaza City.

“The German government remains deeply concerned about the ongoing suffering of the civilian population in the Gaza Strip,” Merz said. “With the planned offensive, the Israeli government bears even greater responsibility than before for providing for them.”

The decision is a significant step by Germany, which has been one of Israel’s strongest supporters because of its historical responsibilities stemming from the Holocaust.

Merz reaffirmed that Israel has a right to defend itself, but questioned whether further attacks on Gaza can help it achieve its goals of defeating Hamas.

This indecision is starting to hint at a shift in market momentum.

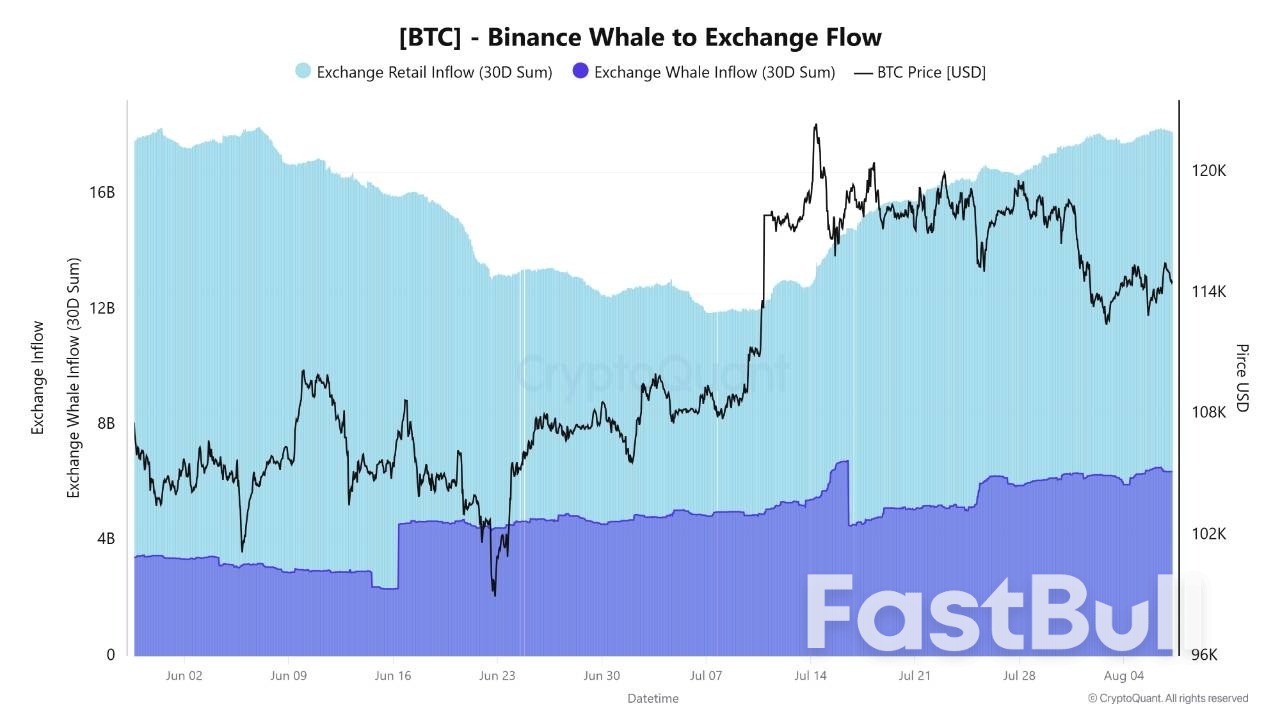

On-chain data reviewed by CryptoQuant contributor Arab Chain suggests the rally may be entering its final stretch.

The clearest signal comes from a steady wave of large BTC transfers to Binance – between $4 billion and $5 billion worth of coins moved by whales since late July. Historically, such inflows point to distribution phases, where major holders position to sell.

Adding to the caution, retail investor participation has been climbing despite subdued price action.

While small traders can push prices higher in the short term, the analyst warns that heavy retail accumulation in late-stage rallies often leaves newcomers exposed if a deeper pullback hits.

With whales unloading and retail traders buying aggressively, the setup resembles past topping patterns. Unless buying momentum returns in force, Bitcoin could be heading for a sharper correction in the weeks ahead.

President Trump's announcement on Thursday that CEA Chair Steve Miran will be nominated to the Fed Board to fill the remainder of Governor Kugler's term is yet another nail in the coffin of monetary policy independence in the US. In many ways, the appointment helps to reinforce what most market participants were already thinking – namely, that we are now dealing with a much more politically-influenced Fed, and a much less independent Fed, than we have seen in many, many decades.

While the issue of policy independence has, for some bizarre reason, apparently become rather controversial of late, I will happily admit to being an unabashed supporter of giving central banks operational independence to meet their mandates, be that an inflation aim, or a dual mandate with a focus on the labour market too. A brief glance at the UK economy over the last few decades evidences this, with inflation (ex-covid) having become considerably more stable, and predictable, since Gordon Brown granted the BoE independence in the late 90s.

Hence, given the increased risks of an Erdogan-esque policymaking approach becoming more prevalent in DC, and the subsequent higher chances of inflation expectations becoming un-anchored, the greenback is likely to continue to face stiff, structural headwinds for the foreseeable. Especially considering that President Trump is unlikely to change his tune on this front any time soon. Naturally, the biggest beneficiaries here will be the EUR (likely much to the chagrin of Mme Lagarde!), as well as gold, where demand from reserve allocators in EM remains incredibly healthy.

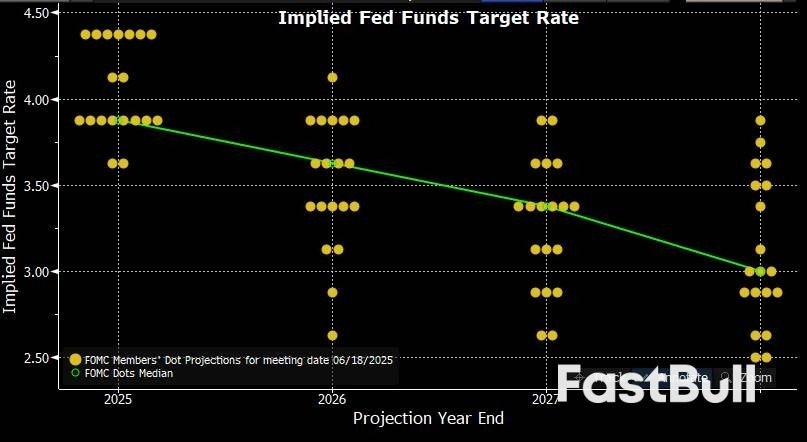

From a policy perspective, in the short-term at least, Miran's appointment probably won't change especially much. In the eyes of most market-participants, Miran will have little-to-no credibility; this is not a slight against his economic ability or knowledge, but simply a logical consequence of such a politically-motivated choice on the President's part.

I'd imagine that, at least implicitly, Miran will have espoused as many dovish credentials as possible when interviewed for the role; despite, incidentally, being an uber-hawk who was dead against the Fed's ‘jumbo' 50bp rate cut around this time last year! In light of that, though, we can be pretty safe in the knowledge that not only will Miran be the most dovish ‘dot' in the September SEP (if confirmed by then), but that he will probably also be voting in favour of the largest cut that he can plausibly make a case for at that meeting, and the ones after it, as well.

If there is an upside to all of this, it's that Miran will only be in place for three meetings, or maybe a handful more if there are delays in confirming a permanent replacement for Gov. Kugler. At least this should limit any ‘damage' that can be done.

Having said that, the appointment sets a clear tone for how Trump is going to be looking at other Fed vacancies – namely, who will replace Powell as Chair – going forwards. Clearly, loyalty to the President, both personally, and in terms of the Admin's economic policies, is the number 1 selection criteria, as Trump seeks as much influence over rates as possible.

I do wonder, however, whether all of this might just make it a little more likely that Powell himself decides to see out his term as Governor once his term in the Chair's seat ends next May. Powell has, rightly, been deliberately coy on the matter, despite continuing to face unjust, and unbecoming personal attacks from numerous Admin officials. Given how Powell views Fed independence as being of paramount importance, he may well decide that the best way to preserve that crown jewel of the US economy is to simply stay put. Doing so would, right now, look like a very wise idea indeed.

In the fast-paced world of global finance, where every central bank pronouncement can send ripples across markets, a recent development has captured significant attention: Deutsche Bank’s decision to revise its GBP Outlook upwards. This move comes on the heels of a particularly hawkish Bank of England meeting, signaling a potentially robust period for the British Pound. For investors, including those in the cryptocurrency space who often monitor macroeconomic shifts, understanding these traditional finance movements is key to navigating broader market dynamics.

Deutsche Bank, a prominent global financial institution, has delivered a vote of confidence in the British Pound. Their revised GBP Outlook suggests that the currency is poised for stronger performance than previously anticipated. This upgrade reflects a deeper analysis of the underlying economic conditions in the UK and, crucially, the Bank of England’s commitment to its inflation-fighting mandate. An upward revision from a major bank like Deutsche Bank often serves as a significant signal to the market, potentially attracting more capital flows into GBP-denominated assets. It indicates that the bank believes the factors supporting the Pound are strengthening, making it a more attractive currency for investment and trade.

The core catalyst behind Deutsche Bank’s optimism is the recent hawkish posture adopted by the Bank of England. But what exactly does ‘hawkish’ mean in central banking terms? Essentially, it describes a monetary policy stance that prioritizes controlling inflation, often by raising interest rates or maintaining them at elevated levels. The BoE’s recent communications and actions have underscored its resolve to bring inflation back to its target, even if it means tightening financial conditions more aggressively or for a longer duration than previously expected. Key indicators of this hawkish shift include:

This firm stance from the Bank of England suggests a period of higher borrowing costs, which typically supports a currency by making it more attractive for foreign investors seeking better returns on their fixed-income investments.

A Hawkish Monetary Policy, when implemented by a central bank like the Bank of England, directly influences a nation’s currency value. Here’s how:

This interplay between central bank policy and currency performance is a fundamental principle in forex markets, and the Hawkish Monetary Policy of the BoE is now a primary driver for the Pound’s trajectory.

The revised Deutsche Bank Forecast for the British Pound is not merely a knee-jerk reaction; it’s built upon a comprehensive analysis of various economic indicators and policy signals. While specific numbers are not always publicly detailed, their reasoning typically hinges on several key assumptions:

| Assumption Category | Deutsche Bank’s Likely View |

|---|---|

| Inflation Trajectory | Inflation remains elevated, requiring sustained BoE action. |

| Labor Market Strength | Resilient employment and wage growth support continued rate hikes. |

| BoE Credibility | The central bank is committed to its mandate, bolstering confidence. |

| Global Economic Context | Relatively stable global conditions allow for domestic policy focus. |

This detailed assessment allows Deutsche Bank to form a confident Deutsche Bank Forecast, projecting a more favorable path for the British Pound in the coming months. Their analysis likely factors in not just the immediate rate hike potential but also the longer-term implications of sustained tighter monetary policy.

The revised GBP Outlook and the Bank of England’s firm stance are set to create significant ripples across the entire Forex Market Impact. Here’s what market participants might expect:

Understanding this broader Forex Market Impact is crucial for anyone involved in currency trading or international investments, as it can influence hedging strategies, investment decisions, and overall portfolio performance.

While the outlook appears positive, no financial forecast is without its risks. The British Pound could face headwinds from several factors:

Investors should remain vigilant and monitor these potential challenges, as they could impact the longevity and strength of the predicted GBP rally.

Given Deutsche Bank’s upgraded GBP Outlook and the Bank of England’s hawkish stance, what actionable insights can investors glean?

Staying informed and agile in response to market developments will be key to capitalizing on the opportunities presented by a potentially stronger British Pound.

Deutsche Bank’s upward revision of its GBP Outlook, spurred by the Bank of England’s unwavering Hawkish Stance, marks a significant moment for the British Pound. This development signals a period where the fight against inflation takes precedence, potentially bolstering the currency’s value in the Forex Market Impact. While opportunities for investors may arise from this shift, a careful watch on economic data and central bank communications remains essential. The Deutsche Bank Forecast offers a compelling perspective, but the dynamic nature of global finance requires continuous vigilance to navigate potential challenges and leverage the evolving landscape. The journey of the British Pound, influenced by the robust actions of the Bank of England, is set to be a focal point for global financial markets in the coming period.

Key Takeaways:

Ethereum spot ETFs attracted $222 million in net inflows on August 7, marking three consecutive days of gains. BlackRock's ETHA led with a $104 million contribution, highlighting increased institutional interest in Ethereum investments.

Ethereum spot ETFs experienced a $222 million net inflow on August 7, 2025, marking a third straight day of positive flows. BlackRock's and Grayscale's funds played a pivotal role, enhancing institutional participation.

BlackRock's ETF ETHA led with a single-day net inflow of $104 million, contributing to a total of $9.59 billion. Grayscale's Ethereum Mini Trust recorded a $34.61 million add, underscoring improved institutional engagement.

The elevated inflow reflects a growing institutional confidence in Ethereum's market potential, indicating sustained interest from traditional asset managers. The impact on Ethereum's liquidity pool appears notable.

The financial impact of these inflows strengthens Ethereum's market position. Institutional investments could tighten the Ethereum supply, affecting Layer 2 protocols, DeFi TVL, and staking pools.

Regulatory impacts are minimal currently, but ongoing institutional interest could prompt future decisions. The inflow underscores a broader trend of Ethereum's growing acceptance within financial markets.

The trajectory aligns with historical precedents, such as Bitcoin ETF launches. The Ethereum ETF inflow could result in long-term market appreciation, drawing attention to related ecosystems like DeFi and Layer 2 solutions.

The sustained ETF interest promises enhanced market liquidity and validation of Ethereum's role in financial markets. The positive trend may influence subsequent funding movements among crypto portfolios.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up