Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Industrial Inventory MoM (Oct)

Japan Industrial Inventory MoM (Oct)A:--

F: --

P: --

Japan New Housing Starts YoY (Oct)

Japan New Housing Starts YoY (Oct)A:--

F: --

P: --

Japan Construction Orders YoY (Oct)

Japan Construction Orders YoY (Oct)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Oct)

Germany Actual Retail Sales MoM (Oct)A:--

F: --

France PPI MoM (Oct)

France PPI MoM (Oct)A:--

F: --

Germany Unemployment Rate (SA) (Nov)

Germany Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada GDP MoM (SA) (Sept)

Canada GDP MoM (SA) (Sept)A:--

F: --

Canada GDP YoY (Sept)

Canada GDP YoY (Sept)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Nov)

China, Mainland NBS Manufacturing PMI (Nov)A:--

F: --

P: --

China, Mainland Composite PMI (Nov)

China, Mainland Composite PMI (Nov)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Nov)

China, Mainland NBS Non-manufacturing PMI (Nov)A:--

F: --

P: --

South Korea Trade Balance Prelim (Nov)

South Korea Trade Balance Prelim (Nov)A:--

F: --

South Korea IHS Markit Manufacturing PMI (SA) (Nov)

South Korea IHS Markit Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

BOJ Gov Ueda Speaks

BOJ Gov Ueda Speaks China, Mainland Caixin Manufacturing PMI (SA) (Nov)

China, Mainland Caixin Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Nov)

India HSBC Manufacturing PMI Final (Nov)A:--

F: --

P: --

Italy Manufacturing PMI (SA) (Nov)

Italy Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.K. Mortgage Lending (Oct)

U.K. Mortgage Lending (Oct)A:--

F: --

U.K. M4 Money Supply YoY (Oct)

U.K. M4 Money Supply YoY (Oct)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Oct)

U.K. M4 Money Supply MoM (Oct)A:--

F: --

P: --

U.K. Mortgage Approvals (Oct)

U.K. Mortgage Approvals (Oct)A:--

F: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Nov)

Canada Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.S. ISM Inventories Index (Nov)

U.S. ISM Inventories Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Nov)

U.S. ISM Manufacturing New Orders Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Nov)

U.S. ISM Manufacturing Employment Index (Nov)A:--

F: --

P: --

U.S. ISM Output Index (Nov)

U.S. ISM Output Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Nov)

U.S. ISM Manufacturing PMI (Nov)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

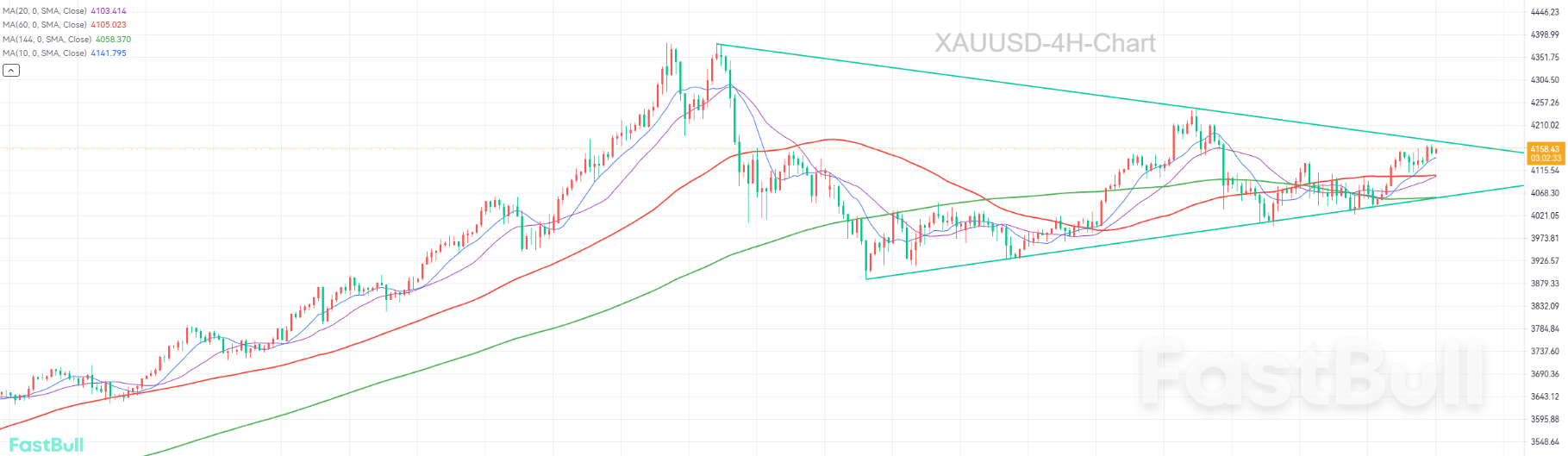

Gold (XAU/USD) edges higher amid growing market optimism for a dovish Federal Reserve, supported by weaker U.S. economic data, though cautious sentiment persists due to potential reduced safe-haven demand.

4154.95

Entry Price

4250.00

TP

4090.00

SL

145.2

Pips

Profit

4090.00

SL

4169.47

Exit Price

4154.95

Entry Price

4250.00

TP

After gold prices broke through US$4,100, bullish momentum persists as central banks' gold accumulation drives long-term foundations and bets on Federal Reserve rate cuts intensify.

4163.99

Entry Price

4346.00

TP

4085.00

SL

393.5

Pips

Profit

4085.00

SL

4203.34

Exit Price

4163.99

Entry Price

4346.00

TP

U.S. retail sales missed estimates yesterday, materially boosting market-implied odds of a December Fed rate cut and likely extending gold's upward trend.

4120.00

Entry Price

4340.00

TP

4080.00

SL

--

Pips

PENDING

4080.00

SL

Exit Price

4120.00

Entry Price

4340.00

TP

Due to widespread market expectations of a potential interest rate cut by the Federal Reserve at the December monetary policy meeting, the USD remains cautious, exerting slight bearish pressure on the CAD.

1.40777

Entry Price

1.40000

TP

1.41400

SL

45.7

Pips

Profit

1.40000

TP

1.40320

Exit Price

1.40777

Entry Price

1.41400

SL

UK Chancellor Rachel Reeves is set to unveil multi-billion-pound tax hikes. The package will test her credibility with gilt investors and welfare-expansion MPs. A fiscally disciplined stance could reinforce long-term confidence in UK assets and lend modest support to sterling.

1.32400

Entry Price

1.29000

TP

1.34000

SL

11.6

Pips

Profit

1.29000

TP

1.32284

Exit Price

1.32400

Entry Price

1.34000

SL

A renewed rejection from this zone would confirm the double top formation, triggering a bearish correction with a primary target set at 1.3981, the next major support level.

1.41400

Entry Price

1.39850

TP

1.41900

SL

--

Pips

EXPIRED

1.39850

TP

1.38268

Exit Price

1.41400

Entry Price

1.41900

SL

The Relative Strength Index (RSI) on the 4-hour chart has reached 71, clearly entering overbought territory, supporting the case for a temporary retracement toward the 100-period MA.

1.31140

Entry Price

1.32900

TP

1.30200

SL

--

Pips

EXPIRED

1.30200

SL

1.33335

Exit Price

1.31140

Entry Price

1.32900

TP

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up