Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Canada Plans To Establish Defense Bank With Multiple Countries] Canadian Finance Minister François-Philippe Champagne Said On January 30 That Canada Will Work Closely With International Partners In The Coming Months To Establish A Defense Bank To Raise Funds For Maintaining Collective Security. Champagne Posted On Social Media Platform X That Day That More Than 10 Countries, Under Canada's Auspices, Discussed The Establishment Of A "Defense, Security And Reconstruction Bank." He Did Not Specify Which Countries Were Involved In The Discussions. According To Reuters, Supporters Hope The Proposed Defense Bank Will Be A Global Nation-support Institution With A AAA Credit Rating, Raising $135 Billion For Defense Projects In Europe And NATO Member States

[A Silver Long Whale With A $29M Long Position Gets Fully Liquidated, Losing Over $4M] January 31, According To Lookintochain Monitoring, With Today'S Spot Silver Price Falling Below $75 Per Ounce, A Single-Day Plunge Of Over 35% Set The Record For The Largest Single-Day Drop In History. The Whale "0X94D3" Who Was Long On Silver Saw Their $29 Million Long Position Liquidated, Resulting In A Loss Of Over $4 Million

Iran President Pezeshkian Says Trump, Netanyahu And Europe Stirred Tensions In Recent Protests, Provoking People

NASA Announced On January 30th That It Will Postpone A Key Rehearsal For The Artemis 2 Manned Lunar Orbit Mission Due To Extreme Cold Weather. The Mission's Execution Date Has Been Adjusted To No Earlier Than February 8th. The Rocket And Spacecraft For This Mission Arrived At The Kennedy Space Center Launch Pad In Florida In Mid-January. NASA Originally Planned To Conduct A Comprehensive Propellant Loading Rehearsal At The End Of January, Simulating Key Stages From Propellant Loading To The Launch Countdown—the Complete Launch Process Excluding Ignition And Liftoff

[Starmer Responds To Trump's Remarks On UK-China Cooperation: Ignoring China Would Be "Unwise"] According To The UK's Daily Telegraph, British Prime Minister Keir Starmer Responded To US President Trump's Remarks On UK-China Cooperation In Shanghai On The 30th, Stating That Ignoring China Would Be "unwise." "It Would Be Unwise To Simply Say 'we Should Ignore It.' You Know, French President Macron Has Already Visited (China) And Had Exchanges, And German Chancellor Merz Is Also Coming To Have Exchanges," Starmer Said. "If Britain Becomes The Only Country Refusing To Engage (with China), It Would Not Be In Our National Interest."

[0Xsun'S Associated Address Deposited 2 Million U Into Hyperliquid For A 4X Long Position On Silver] January 31, According To Onchain Lens Monitoring, The 0Xsun Associated Address Deposited 2 Million Usdc Into Hyperliquid At 9:00 A.M. Beijing Time Today And Opened A Long Position For Silver With 4X Leverage On Trade.Xyz

[Fear Of Losing To Starlink? French Government Blocks Eutelsat Sale Of Antenna Assets] French Minister Of Economy, Finance, Industry, Energy And Digital Sovereignty, Roland Lescuille, Disclosed To The Media On The 30th That The French Government Recently Blocked Eutelsat's Sale Of Ground Antenna Assets To A Swedish Buyer. He Said The Decision Was Based On "national Security" Concerns, Fearing That The Transaction Would Damage Eutelsat's Competitiveness And Allow Its Rival, SpaceX's Starlink System, To Dominate The European Market

[White House Office Of Management And Budget Instructs Affected Agencies To Begin Implementation Of Shutdown Plans] On January 30, Local Time, CCTV Reporters Learned That The Director Of The White House Office Of Management And Budget Issued A Memorandum To Heads Of Various Departments, Instructing Agencies Whose Funding Was Due At Midnight To Begin Preparations For A Government Shutdown. These Agencies Include The Department Of Defense, Department Of Homeland Security, Department Of State, Department Of Treasury, Department Of Labor, Department Of Health And Human Services, Department Of Education, Department Of Transportation, And Department Of Housing And Urban Development

Mexico's Ministry Of Foreign Affairs Says Minister Spoke With USA Secretary Of State Rubio To Reiterate Bilateral Collaboration On Agendas Of Common Interest

China Southern Command Says Carried Out Naval And Air Patrols Around Scarborough Shoal On 31 Jan

Pentagon - USA State Dept Approves Potential Sale Of Patriot Advanced Capability-3 Missile Segment Enhancement Missiles To Saudi Arabia For An Estimated $9.0 Billion

Hong Kong Port Operator Violated Panama's Constitution, Failed To Serve Public Interest, Panama Court Ruled

South Korea Signs Deal With Norway To Supply Multiple Launch Rocket System Valued At 1.3 Trillion Won -South Korea Presidential Chief Of Staff

[Arctic Cold Wave Hits: Florida Citrus Industry At Risk Of Frost] The Southeastern United States Is Bracing For A Powerful Storm, Potentially Bringing Devastating Frost To Florida's Citrus Belt And Heavy Snowfall To The Carolinas. The Wind Chill In Central Florida's Orange-growing Regions Could Drop To Single Digits (Fahrenheit); Much Of Polk County Is Expected To Experience Sub-zero Temperatures, Threatening The Statewide Citrus Harvest. The Storm Is Also Expected To Bring Strong Winds And Coastal Flooding To The East Coast. Approximately 1,000 Flights Have Already Been Canceled Across The U.S. This Weekend, With Half Of Them Concentrated At Hartsfield-Jackson Atlanta International Airport

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XAU/USD is showing renewed buy interest after a significant pullback from record highs near $5,594, stabilizing around $5,170–$5,230....

5169.05

Entry Price

5350.00

TP

5050.00

SL

1190.5

Pips

Loss

5050.00

SL

5049.72

Exit Price

5169.05

Entry Price

5350.00

TP

A bullish crossover appears imminent. If the histogram transitions into positive territory and the signal lines clear the neutral level, we could see a sustained bullish correction.

0.91583

Entry Price

0.92000

TP

0.91300

SL

0.0

Pips

Flat

0.91300

SL

Exit Price

0.91583

Entry Price

0.92000

TP

This confluence of indicators suggests that the pair is gathering sufficient momentum to initiate a new bullish impulse.

0.53620

Entry Price

0.54450

TP

0.53200

SL

0.0

Pips

Flat

0.53200

SL

Exit Price

0.53620

Entry Price

0.54450

TP

EUR/USD rises near 1.1980 as US Dollar weakness persists amid Trump’s Fed uncertainty, while market eyes Eurozone consumer data and US jobless claims. Traders brace for volatility ahead of economic releases and policy signals.

1.19603

Entry Price

1.22000

TP

1.19000

SL

60.3

Pips

Loss

1.19000

SL

1.19000

Exit Price

1.19603

Entry Price

1.22000

TP

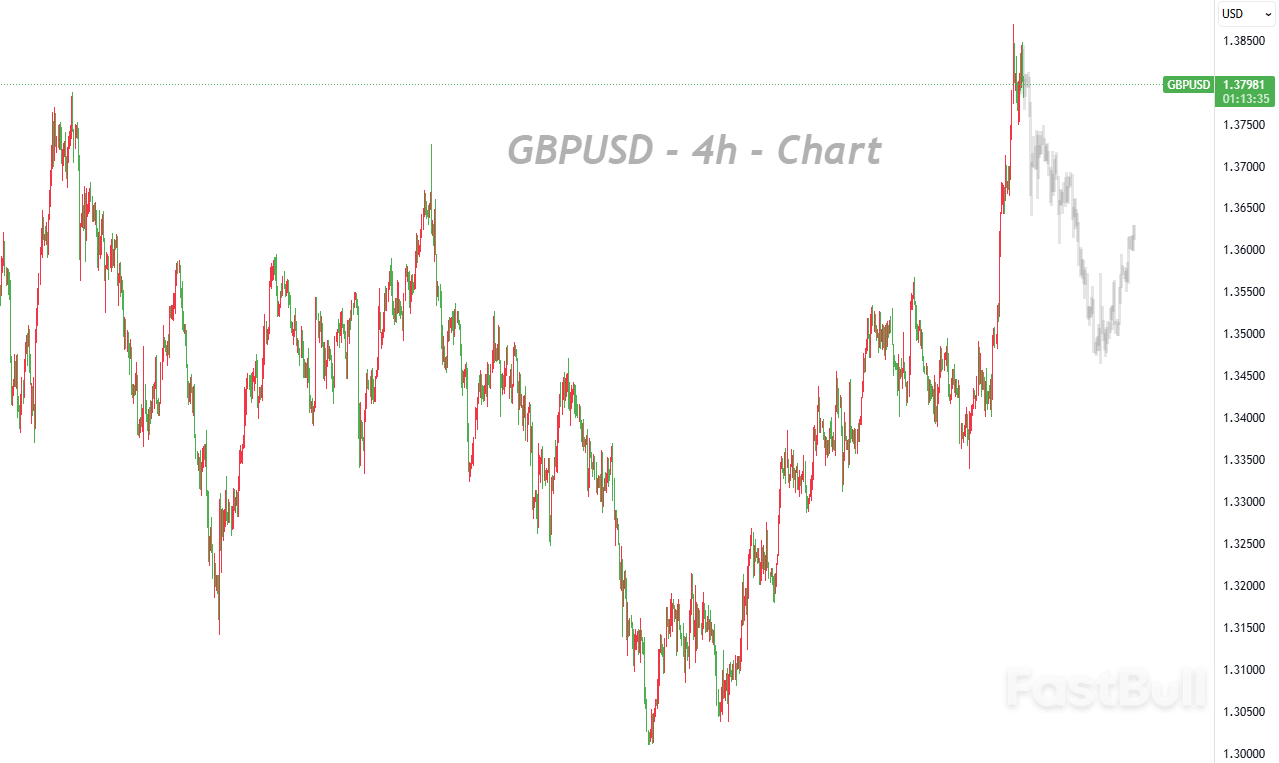

GBPUSD is consolidating near multi-year highs, while the US dollar remains under pressure amid “sell-America” trade sentiment, the Fed’s policy outlook, and elevated political uncertainty. On the technical front, a failed short-term inverse head-and-shoulders pattern signals rising pullback risk at elevated levels.

1.38081

Entry Price

1.35000

TP

1.39990

SL

0.0

Pips

Flat

1.35000

TP

Exit Price

1.38081

Entry Price

1.39990

SL

AUD/USD rises near 0.7050 after strong Australian inflation data boosts expectations of an RBA rate hike, though a steadier US Dollar limits the pair’s upside.

0.70600

Entry Price

0.72000

TP

0.70150

SL

45.0

Pips

Loss

0.70150

SL

0.70148

Exit Price

0.70600

Entry Price

0.72000

TP

Gold prices extended their record rally as geopolitical tensions, US dollar weakness, and continued expectations of Federal Reserve rate cuts drove strong safe-haven inflows, with structural demand from central banks and investors reinforcing bullion’s advance.

5540.00

Entry Price

5700.00

TP

5470.00

SL

700.0

Pips

Loss

5470.00

SL

5469.95

Exit Price

5540.00

Entry Price

5700.00

TP

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up