Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A tactical retracement toward the 0.7926 area appears highly probable before the next leg up begins.

0.79300

Entry Price

0.80700

TP

0.67890

SL

--

Pips

PENDING

0.67890

SL

Exit Price

0.79300

Entry Price

0.80700

TP

Recently, the pair attempted a breakout above the upper boundary but was met with immediate rejection, resulting in a rapid re-entry into the wedge's range.

0.67500

Entry Price

0.66000

TP

0.68200

SL

--

Pips

PENDING

0.66000

TP

Exit Price

0.67500

Entry Price

0.68200

SL

EUR/JPY trades near 182.90 as geopolitical tensions and BoJ hawkishness support the yen, while easing inflation and weak German data weigh on the euro, leaving the pair biased lower below key technical levels.

182.900

Entry Price

180.500

TP

184.000

SL

0.0

Pips

Flat

180.500

TP

Exit Price

182.900

Entry Price

184.000

SL

GBP/JPY has retreated from multi-year highs as rising China–Japan tensions and BoJ tightening signals boost the yen, though the broader trend remains bullish amid ongoing concerns over Japan’s fiscal outlook.

211.000

Entry Price

209.000

TP

212.000

SL

28.4

Pips

Profit

209.000

TP

210.716

Exit Price

211.000

Entry Price

212.000

SL

The rise in Ethereum prices has significantly impacted short positions on exchanges. Ethereum leadership has not commented directly on this matter. Institutional investors are stimulating market interest through ETFs.

3217.40

Entry Price

2785.00

TP

3596.00

SL

0.0

Pips

Flat

2785.00

TP

Exit Price

3217.40

Entry Price

3596.00

SL

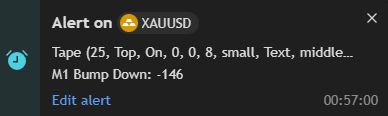

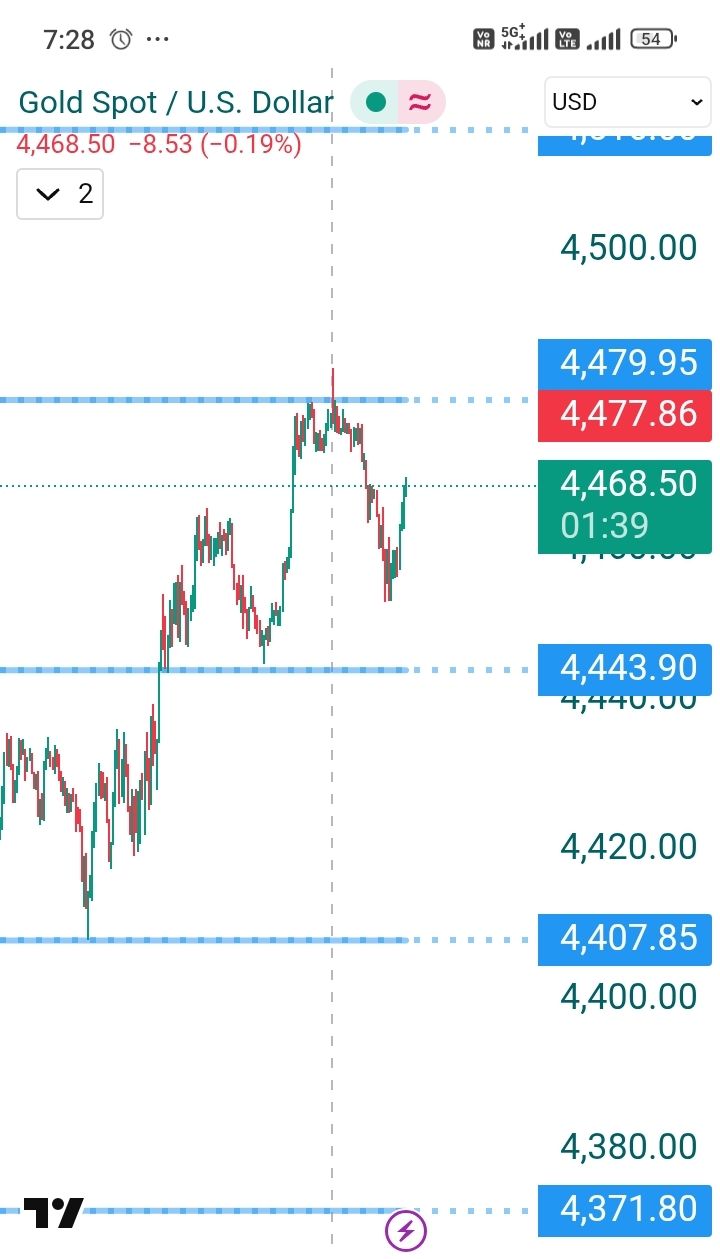

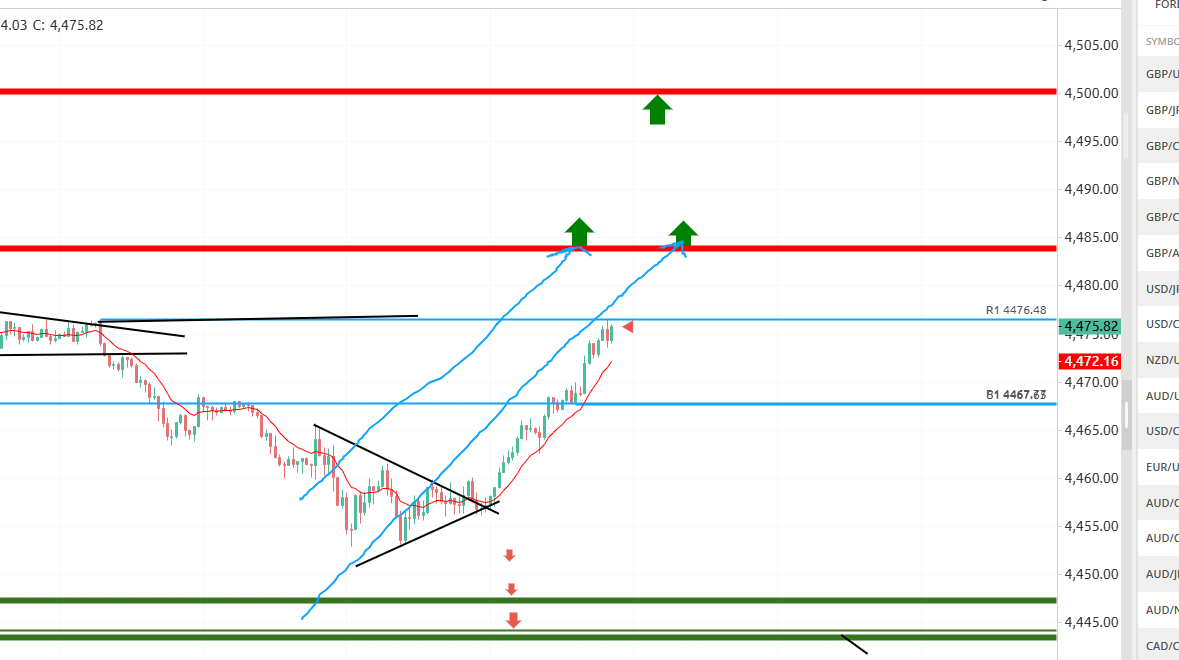

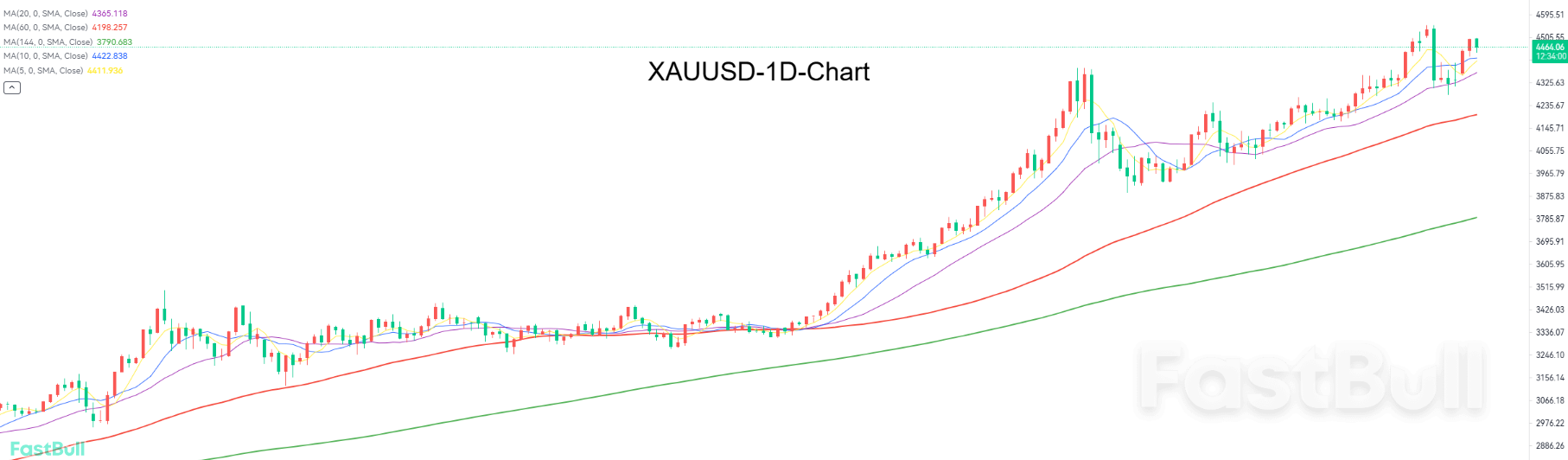

Investors are still digesting the recent U.S. strikes on Venezuela. The underlying bullish sentiment has also become a key factor triggering profit-taking in precious metals. However, escalating geopolitical tensions and market expectations of a dovish stance from the Fed appear to be limiting gold's downside potential.

4464.48

Entry Price

4100.00

TP

4600.00

SL

199.8

Pips

Profit

4100.00

TP

4444.50

Exit Price

4464.48

Entry Price

4600.00

SL

The fundamental analysis continues to support a bullish outlook for gold, but technical indicators suggest that gold is currently in a consolidation phase, likely to remain range-bound between 4,550 and 4,300 in the short term.

4465.11

Entry Price

4340.00

TP

4505.00

SL

165.1

Pips

Profit

4340.00

TP

4448.60

Exit Price

4465.11

Entry Price

4505.00

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up