Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime RateA:--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)A:--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)A:--

F: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)A:--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)A:--

F: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes Mexico Trade Balance (Nov)

Mexico Trade Balance (Nov)A:--

F: --

P: --

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)A:--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)A:--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)A:--

F: --

U.S. PCE Price Index Prelim QoQ (SA) (Q3)

U.S. PCE Price Index Prelim QoQ (SA) (Q3)A:--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)A:--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q3)

U.S. GDP Deflator Prelim QoQ (SA) (Q3)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)A:--

F: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)A:--

F: --

P: --

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)--

F: --

P: --

U.S. Industrial Output YoY (Oct)

U.S. Industrial Output YoY (Oct)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Dec)

U.S. Richmond Fed Manufacturing Shipments Index (Dec)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Dec)

U.S. Richmond Fed Services Revenue Index (Dec)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Dec)

U.S. Conference Board Consumer Expectations Index (Dec)--

F: --

P: --

U.S. Conference Board Present Situation Index (Dec)

U.S. Conference Board Present Situation Index (Dec)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Dec)

U.S. Richmond Fed Manufacturing Composite Index (Dec)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

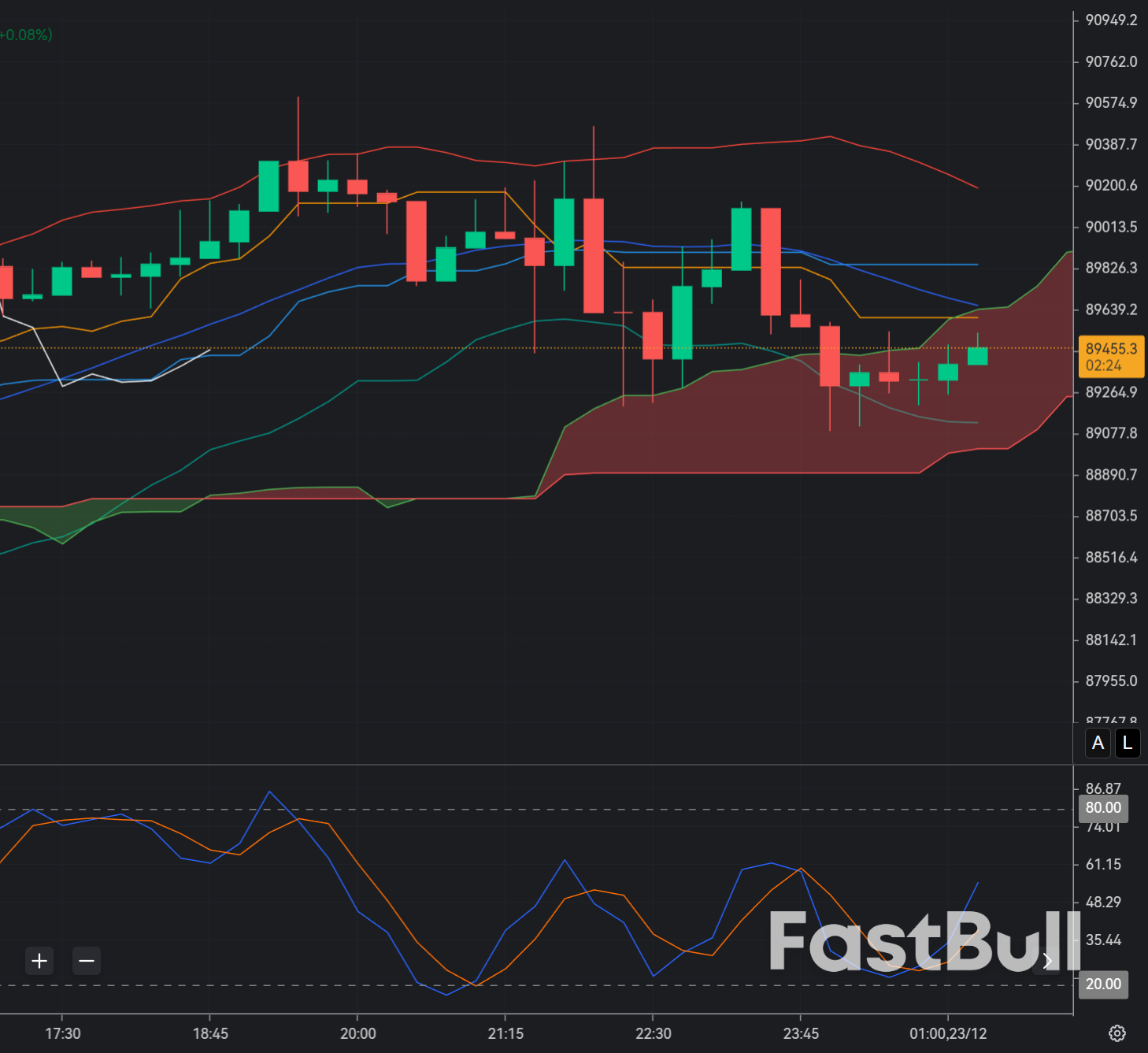

BTCUSD has rebounded and is holding around $88,800–$90,000, with buyers stepping in near support after recent consolidation....

89500.0

Entry Price

91400.0

TP

88100.0

SL

1400.0

Pips

Loss

88100.0

SL

88098.8

Exit Price

89500.0

Entry Price

91400.0

TP

GBP/JPY trades above 211 as resilient UK growth data supports Sterling, while BoJ tightening and intervention risks limit upside, keeping the broader trend bullish but increasingly stretched.

211.401

Entry Price

213.250

TP

209.800

SL

0.0

Pips

Flat

209.800

SL

Exit Price

211.401

Entry Price

213.250

TP

NZD/USD has rebounded from two-week lows on improved risk sentiment and RBNZ policy support, but upside remains limited by softer rate-hike expectations, US dollar safe-haven demand, and lingering geopolitical uncertainty.

0.57949

Entry Price

0.59000

TP

0.57350

SL

0.0

Pips

Flat

0.57350

SL

Exit Price

0.57949

Entry Price

0.59000

TP

Japanese government bond prices continued to decline following the BOJ’s rate hike. If fiscal risks are not properly addressed, yen intervention is likely to be ineffective.

156.349

Entry Price

161.230

TP

153.600

SL

0.0

Pips

Flat

153.600

SL

Exit Price

156.349

Entry Price

161.230

TP

GBP/USD climbed toward 1.3450 as steady UK growth offset BoE easing bets, with thin holiday trading and supportive technicals keeping the pound biased to the upside.

1.34500

Entry Price

1.38000

TP

1.34000

SL

--

Pips

PENDING

1.34000

SL

Exit Price

1.34500

Entry Price

1.38000

TP

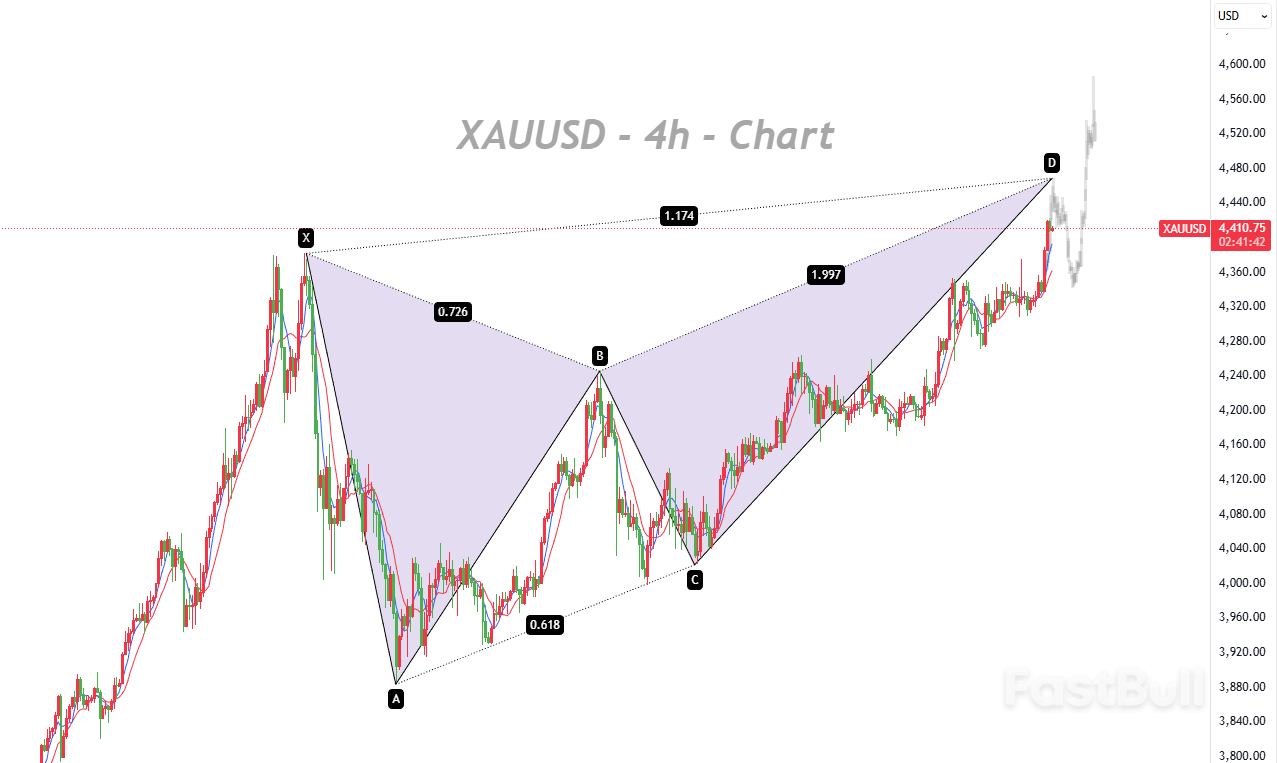

Gold soared to a new record high above $4400 on Monday, finally breaking through after weeks of sluggish performance. Thin liquidity during the Christmas holiday may amplify the current gains in gold.

4424.39

Entry Price

4685.00

TP

4362.00

SL

545.4

Pips

Profit

4362.00

SL

4478.93

Exit Price

4424.39

Entry Price

4685.00

TP

Recently, WTI crude oil experienced a rebound after a significant decline influenced by geopolitical factors, but market sentiment remains predominantly bearish regarding future oil prices, with technical analysis also indicating a continued downward trend.

56.947

Entry Price

52.800

TP

59.100

SL

0.0

Pips

Flat

52.800

TP

Exit Price

56.947

Entry Price

59.100

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up