Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

It is set to be a busy week for financial markets, with key economic data, including the eurozone’s flash inflation figures for April and the US non-farm payrolls, due for release.

Political bettors on Polymarket and other platforms are paying attention to Canada as the nation heads to the polls.

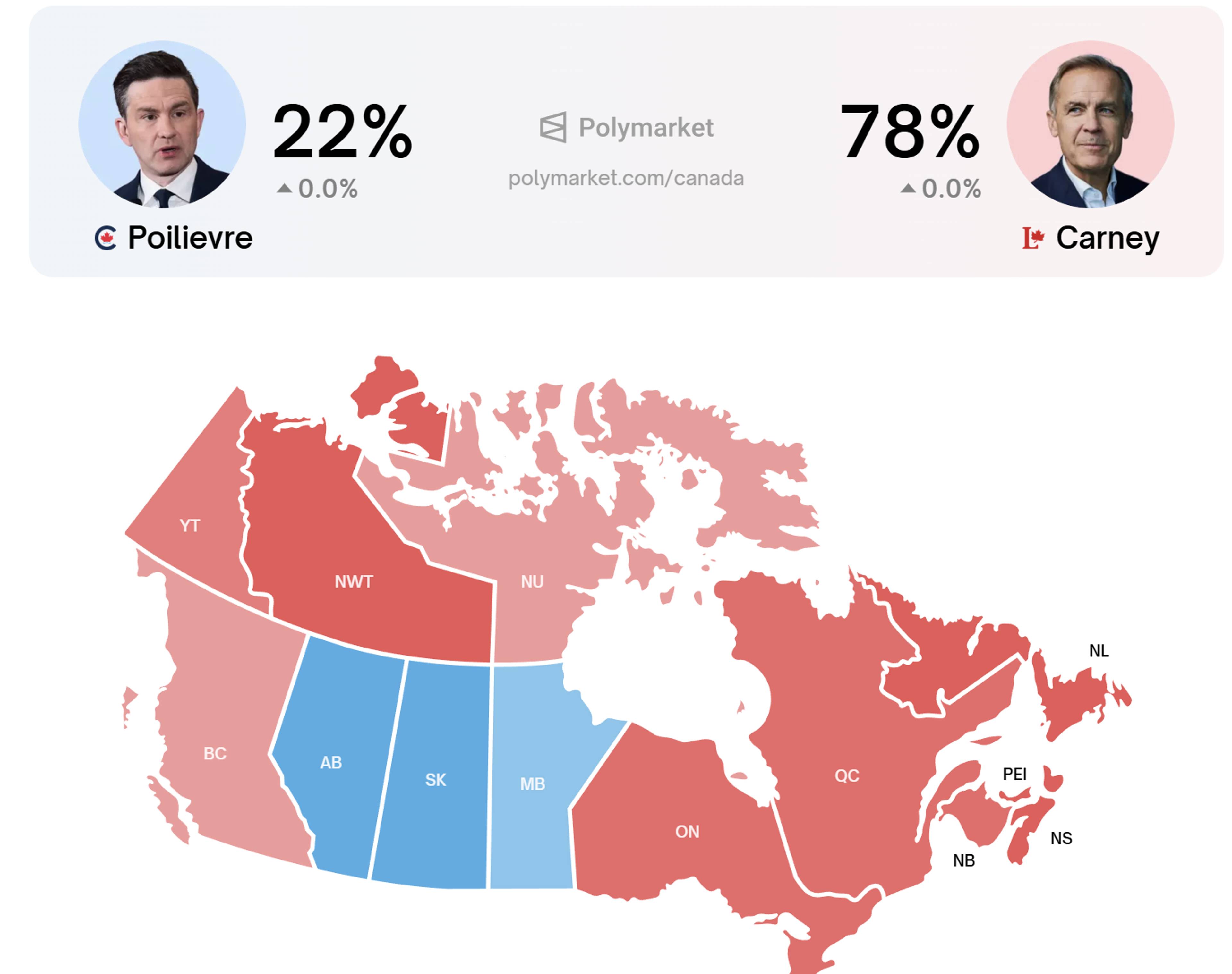

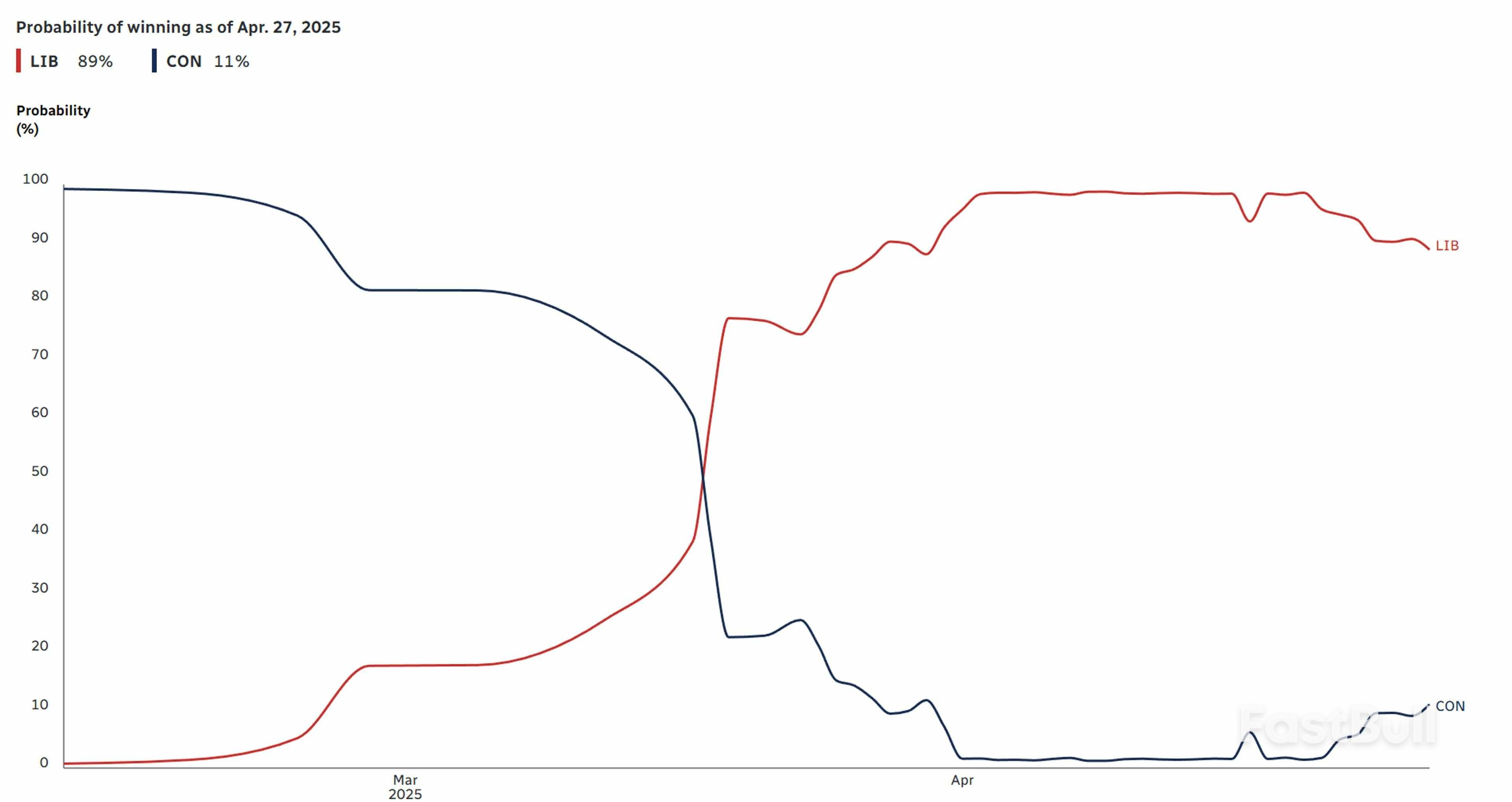

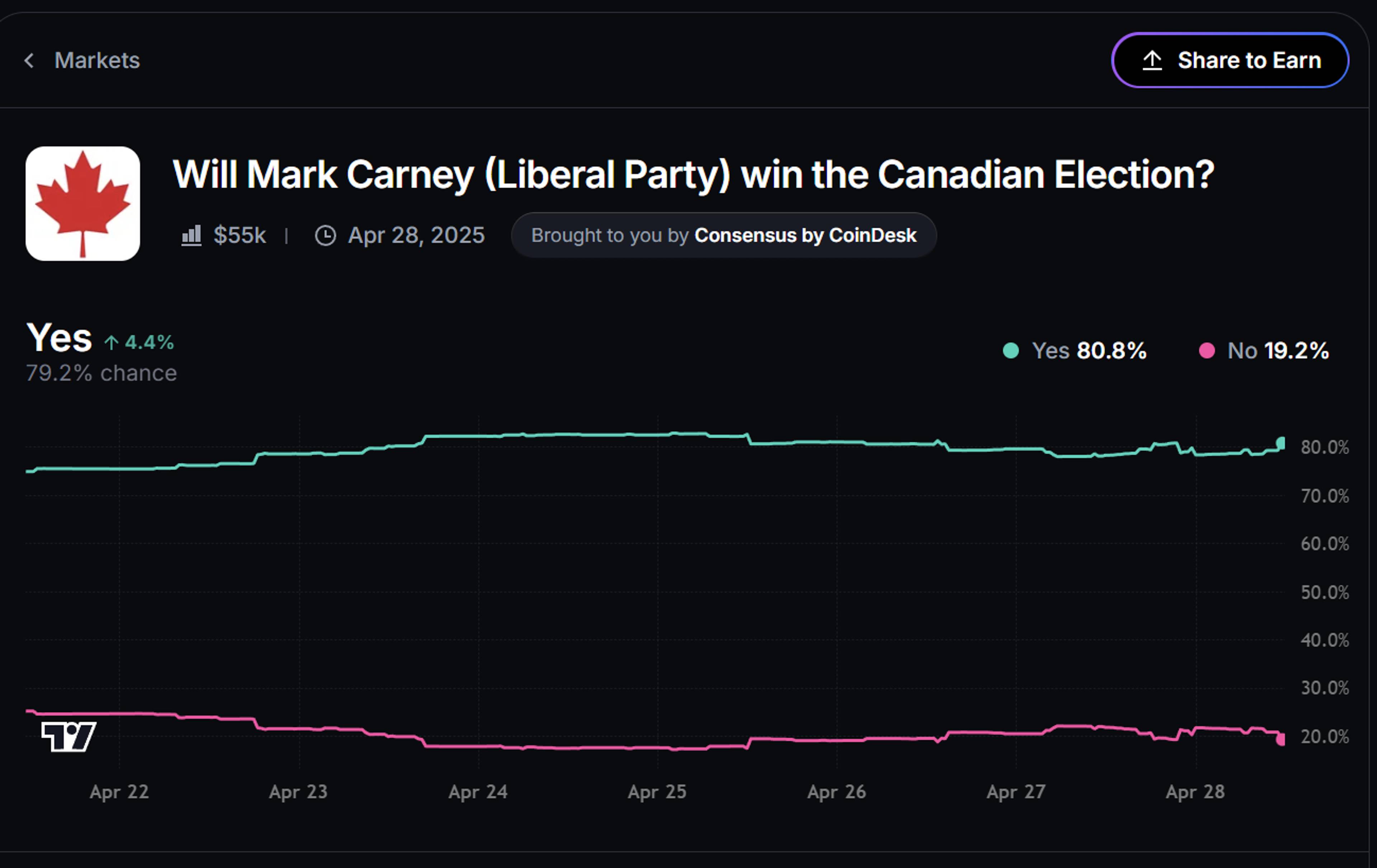

As the country's 45th election comes to a close, a contract asking bettors to predict who will be Canada's next Prime Minister gives the Liberal Party's Mark Carney a 78% chance, and the Conservatives' Pierre Poilievre a 22% shot.

Political bettors are slightly more skeptical of Carney's chances of winning than the polls, but both are pointing in the same direction. A poll aggregator from public broadcaster CBC puts Carney's chances at 89%.

Myriad Markets, another prediction market, is giving Carney similar odds to Polymarket.

FanDuel, a licensed betting platform open only to residents of Ontario, Canada, initially gave the Conservatives a sharp, contrarian lead of 70%, according to a report from the National Post. Still, odds have fallen in line with prediction markets, and it now gives the Liberals a roughly 80% chance of winning.

Unlike the U.S. election, there isn't a crypto angle up north with leaders' campaigns focused on the trade war and inflation.

A growing narrative in certain corners of the internet is that Polymarket is prone to manipulation and its numbers aren't reliable, criticisms that echo what was said in the last weeks of the U.S. election when the site gave Donald Trump a commanding lead as polls showed a tight race.

Critics say Poilievre's chances are being suppressed and do not reflect the political sentiment of the populace.

However, manipulating prediction markets would be expensive, and there's no credible evidence that this is happening even as Polymarket is banned in Canada's largest province after a settlement with its securities regulator.

Data portal Polymarket Analytics shows that the Canadian election contract leads the platform in open interest, which is the total value of active, unsettled bets and a good measure of market engagement.

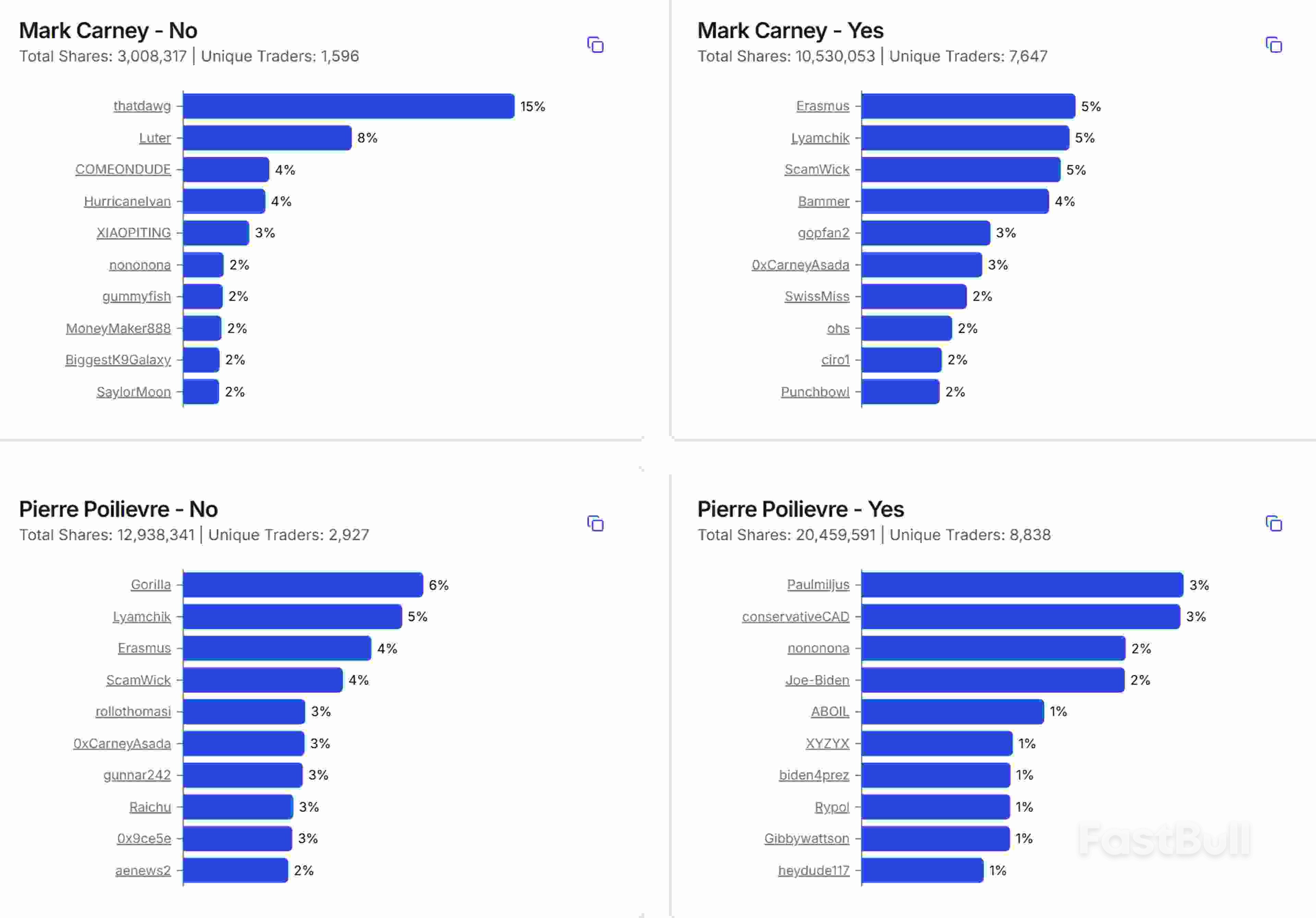

Market data also shows that position holding is quite distributed, with the largest holder of the Poilivere—No side of the contracting holding 6% of all shares and the largest holder of the Carney—Yes side holding 5%.

One bettor, who is betting big on Carney with a six-figure position, who spoke to CoinDesk, said their motives are non-partisan, and said that the quality of Canadian polling makes him confident that the Liberals will win.

"Poilievre needs a 7-point polling error to win and I think the probability of that is closer to 7% than his current market price of 23c," trader Tenadome told CoinDesk via an X DM. "The pool of Poilievre bettors seems to largely be very dumb money that believes in things like China is rigging the polls."

Currently, the trader with the largest winnings on the contract is "ball-sack" with a profit of $124,890, thanks to bets on Carney. On the other side of the trade is "biden4prez," who lost just over $98,000 – the most out of any trader – betting on Poilievre and against Carney.

Pakistan's defence minister said on Monday that a military incursion by neighbouring India was imminent in the aftermath of a deadly militant attack on tourists in Kashmir last week, as tensions rise between the two nuclear-armed nations.

The militant attack killed 26 people and triggered outrage in Hindu-majority India, along with calls for action against Muslim-majority Pakistan. India accuses Pakistan of backing militancy in Kashmir, a region both claim and have fought two wars over.

"We have reinforced our forces because it is something which is imminent now. So in that situation some strategic decisions have to be taken, so those decisions have been taken," Defence Minister Khawaja Muhammad Asif told Reuters in an interview at his office in Islamabad.

Asif said India's rhetoric was ramping up and that Pakistan's military had briefed the government on the possibility of an Indian attack. He did not go into further details on his reasons for thinking an incursion was imminent.

After the Kashmir attack, India identified two suspected militants as Pakistani. Islamabad has denied any role and called for a neutral investigation.

Asif said Pakistan was on high alert and that it would only use its arsenal of nuclear weapons if "there is a direct threat to our existence".

Treasury Secretary Scott Bessent said “all aspects” of the US government are in contact with China but that it’s up to Beijing to take the first step in de-escalating the tariff fight with the US due to the imbalance of trade between the two nations.

“We’ll see where this goes,” Bessent said in an interview with CNBC. “As I’ve repeatedly said, I believe it’s up to China to de-escalate because they sell five times more to us than we sell to them, so these 125% tariffs are unsustainable.”

The Chinese exempting some goods from tariffs indicates they are interested in reducing tensions, Bessent said, adding that he has “an escalation ladder in my back pocket and we’re very anxious not to have to use it.” Escalation could include an “embargo,” he said.

Bessent said the US has put China to the side for now as it seeks trade deals with between 15 to 17 other countries. He said he wouldn’t be surprised if a trade deal with India is the first to be announced.

Bessent also said that US officials met with their Chinese counterparts during the IMF-World Bank meetings in Washington, DC, last week to talk about “financial stability” but did not indicate that trade discussions came up during the talks.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up