Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Governor Christopher Waller is emerging as a top candidate to serve as the central bank’s chair among President Donald Trump’s advisers as they look for a replacement for Jerome Powell, according to people familiar with the matter.

Federal Reserve Governor Christopher Waller is emerging as a top candidate to serve as the central bank’s chair among President Donald Trump’s advisers as they look for a replacement for Jerome Powell, according to people familiar with the matter.

Trump advisers are impressed with Waller’s willingness to move on policy based on forecasting, rather than current data, and his deep knowledge of the Fed system as a whole, the people said. Waller has met with the president’s team about the role, but has yet to meet with Trump himself, the people said on the condition of anonymity to discuss private deliberations.

Kevin Warsh, a former Fed official, and Kevin Hassett, currently Trump’s National Economic Council director, also remain in contention for the job, the people said, which will open up when Powell’s tenure as chair expires in May 2026.

“President Trump will continue to nominate the most competent and experienced individuals,” White House Spokesman Kush Desai said in a statement. “Unless it comes from President Trump himself, however, any discussion about personnel decisions should be regarded as pure speculation.”

A representative for the Fed declined to comment.

Trump said on Wednesday that the administration has narrowed the list of candidates for Fed chair to three people. Treasury Secretary Scott Bessent, Vice President JD Vance and Commerce Secretary Howard Lutnick are on the search committee, Trump said.

Hassett has met with Trump to discuss the chair job and has also impressed both the president and the team, Bloomberg News has reported. Warsh interviewed for the job in 2017 but was ultimately passed over for Powell. In November, he was also considered to serve as Treasury secretary.

Last week, Waller was one of two Fed board members to vote against the central bank’s decision to hold its benchmark rate steady for a fifth consecutive time. He and his colleague Michelle Bowman, both Trump nominees, preferred a quarter-point reduction, citing growing signs of labor-market weakness.

A few days after the Fed announced its decision to hold interest rates, a jobs report showed that job growth cooled sharply over the previous three months, lending credence to Waller and Bowman’s dissent.

Waller’s views differed from those of Powell and other policymakers on the board, who have so far described the labor market as broadly solid and have supported a patient approach to adjusting rates so that the central bank can continue to gauge how Trump’s tariffs will impact the economy. That view has frustrated the president, who has repeatedly assailed Powell for not cutting rates sooner.

Waller, a Ph.D. economist, has attracted the attention of Trump’s economic advisers over the past year as the president talked about the economy while on the campaign trail.

Trump nominated Waller to the Fed in 2020. Before that, he had served as a research director and executive vice president at the St. Louis Fed. In 2020, senators voted 48-47 to support Waller’s nomination to the Fed board.

As a Fed governor in 2022, Waller engaged in a public debate with influential economists outside the Fed, including former Treasury Secretary Larry Summers, with his argument that the central bank could successfully lower the post-pandemic inflation without significantly raising unemployment. In the end, Waller proved right as inflation came back below 3% and unemployment never moved back above 4.2%.

Trump’s dissatisfaction with Powell has triggered questions about whether his next pick to lead the Fed would back monetary policy independence for the central bank. Waller has said that the Fed’s independence is critical for the economy, but added that the president is free to say what he wants the Fed.

Last month, Waller told Bloomberg Television that he hasn’t yet directly heard from the president about the Fed chair role.

“If the president contacted me and said, ‘I want you to serve,’ I would do it,” he said in July. “But he has not contacted me.”

While Powell’s term as chair doesn’t expire until May, Trump is getting an earlier shot at reshaping the central bank. He said on Wednesday that he planned to fill a soon-to-be vacant slot from Adriana Kugler’s early departure from the Fed board with a short-term pick, and then later name a candidate for the 14-year term opening which renews in early 2026.

US stocks rose as President Donald Trump announced some exemptions for tariffs on chips and as latest economic data reinforced expectations that the Federal Reserve will cut interest rates next month.

The S&P 500 Index gained 0.7% and Nasdaq 100 jumped 0.9% as of 9:40 a.m. New York time. The Dow Jones Industrial Average climbed 0.6%.

Recurring applications for unemployment benefits surged to the highest since November 2021, adding to recent signs that the labor market is weakening. Since last week, traders have had to contend with a weaker-than-expected jobs report and data showing a deterioration in the services sector.

“With the jobless claims beginning to rise again, this adds to concerns about the employment picture that were raised last week,” said Matt Maley, chief market strategist at Miller Tabak + Co. “When you combine this with some of the more dovish “Fed speak” we’ve heard this week, a September rate cut is becoming more probable by the day.”

Stocks also got a boost from Trump saying that companies that companies that move production back to the US, such as Apple Inc. would be eligible for exemptions from his proposed 100% levy on chip imports. Apple climbed 2.8% following the announcement. Its suppliers including Corning Inc. also gained.

Among other single stock movers, shares in Intel Corp. dropped 1.7% after Trump called for the chipmaker’s chief executive officer to resign. Eli Lilly & Co. plunged after the drugmaker reported underwhelming study results for its weight-loss pill. Shares of its main European rival, Novo Nordisk A/S, soared.

DoorDash Inc gained 3.6% after the food-delivery company reported second-quarter results that beat expectations. Crocs Inc. shares dropped 25% after the shoe company said its efforts to save money amid consumer pressure and tariffs would drive down revenue.

The S&P 500 has now spent 66 sessions at least 0.5% above its 50-day moving average, a bullish sequence that’s increasingly becoming an outlier.

The symmetric distribution definition states that data points are evenly spread around a mean, meaning price movements exhibit balance over time. In simple terms, if price movements form a symmetrical shape when plotted on a chart, it suggests that past price behaviour has been balanced, with roughly equal deviations on either side of the average. This balance is supposed to help traders analyse price trends and volatility.

One of the most well-known symmetrical distribution examples is the normal distribution, often visualised as a bell curve. In markets, this means prices are more likely to cluster around the average and become less frequent as you move further away. For example, if a stock has a mean daily return of 0.5%, most days are believed to see returns close to that figure, while extreme price moves—both positive and negative—will be much rarer.Symmetrical distribution plays a key role in statistical analysis and quantitative trading. It helps traders assess the probability of certain price movements occurring, particularly when using models that rely on historical data.

Traders use symmetrical distribution to analyse price behaviour, identify potential trading opportunities, and refine their strategies. When price movements are evenly distributed around a central point, it provides a structured way to assess market conditions. This concept is particularly useful in mean reversion strategies.

Symmetrical distribution suggests that prices tend to fluctuate around an average, making mean reversion a widely used approach. Traders applying this strategy assume that when an asset moves significantly away from its mean, it is likely to return over time. Bollinger Bands and moving averages are commonly used to measure price deviations and identify potential turning points. This is particularly relevant in markets with balanced volatility, where extreme price moves are less frequent.

Analysing whether a market follows a symmetrical distribution can help traders determine which strategies might be effective. In markets where price movements are balanced, traders may focus on range-bound approaches. In contrast, when distributions become skewed, momentum and trend-following strategies might be more suitable. Recognising these shifts allows traders to adapt their methods to changing market conditions.

Identifying a symmetrical distribution in market data involves analysing price behaviour to determine whether movements are evenly spread around a central value. While markets don’t always follow perfect symmetry, traders use statistical tools and visual techniques to assess whether a price distribution aligns with this pattern.

A histogram is one of the simplest ways to check for symmetry in price movements. By plotting historical returns or price changes on a frequency chart, traders can see whether data points cluster evenly around the mean. If the left and right sides of the distribution mirror each other, the market may be exhibiting a symmetrical pattern.

Histograms can also reveal uniform distributions, where all values occur with equal probability, forming a flat graph rather than a bell curve. A symmetric and uniform graph can help distinguish between these two patterns—while a uniform distribution shows no central clustering, a symmetric distribution forms a peak around the mean. Recognising whether a market follows a symmetric or uniform structure helps traders determine which statistical tools are most relevant for analysis.

Symmetrical distributions tend to have a mean (average) return that sits at the centre of price movements, with standard deviations determining how far prices typically move from that mean. If price fluctuations are evenly distributed around the mean, it suggests a balanced market where extreme moves are less common.

Two key statistical measures help traders confirm symmetry:

When plotted on a chart, symmetrical price behaviour often aligns with a stable moving average, where price deviations are relatively even on both sides. In contrast, a market with consistent upward or downward bias may show clear asymmetry.

However, markets don’t always move in a balanced way. While symmetrical distribution means price movements are evenly spread around a central point, real-world trading often shows skewed distributions, where prices are more likely to move in one direction than the other. Understanding the difference is key to assessing market behaviour.

A positively skewed distribution means there are more small downward price moves, but the occasional sharp rally pushes the average return higher. This often happens in growth stocks or high-volatility assets, where losses are frequent but gains can be explosive. On the other hand, a negatively skewed distribution occurs when prices drift upwards gradually but occasionally experience sudden drops. This is common in carry trades, where traders potentially earn small returns over time but risk significant losses during market shocks.

Skewed distributions challenge the assumption that markets follow normal distribution patterns. For example, many risk models assume a symmetrical spread of price moves, but in reality, market crashes and parabolic rallies occur far more often than a normal distribution would assume. This is why relying solely on symmetrical models can lead to underestimating risk in extreme conditions.Traders who recognise whether a market is symmetrical or skewed can adjust their strategies accordingly. In a symmetrical market, mean reversion strategies could be more effective, while in a skewed market, trend-following approaches could perform better.

Risk management relies heavily on statistical analysis, and symmetrical distribution plays a key role in estimating potential market movements. When price changes are symmetrically distributed, traders can use probability models to assess how far an asset is likely to move within a given timeframe.

One common application is Value at Risk (VaR), which estimates the maximum expected loss over a period based on historical price data. If potential returns follow a symmetrical distribution, traders can calculate the probability of losses exceeding a certain threshold. For example, in a normal distribution, around 95% of price movements fall within two standard deviations of the mean, allowing traders to set potential risk limits accordingly.

A symmetrical distribution also helps traders refine their risk-reward ratios. If price movements are evenly distributed, traders can estimate potential returns relative to potential losses with greater confidence. In markets where symmetry holds, a trader aiming for a 3:1 risk-reward ratio can assume that price fluctuations are balanced enough for this structure to be viable.

By understanding the distribution of price movements, traders can potentially improve position sizing. If historical data suggests symmetrical price behaviour, traders may adjust their position sizes based on expected volatility. Similarly, stop-loss levels might be set relative to the standard deviation of past price movements, ensuring that exits are placed within a statistically reasonable range.

While symmetrical distribution provides a structured way to analyse price movements, real-world markets rarely follow a perfect balance. External factors, market psychology, and liquidity shifts often distort price behaviour, making it important for traders to recognise the limitations of relying solely on symmetrical models.

Many assets, especially stocks and commodities, exhibit skewed distributions due to long-term trends, supply-demand imbalances, or macroeconomic factors. Price movements often lean in one direction rather than forming a perfect bell curve.

Unexpected events—such as central bank decisions, earnings reports, or geopolitical developments—can cause sudden price moves that disrupt symmetrical patterns. These events create fat tails, where extreme moves occur more frequently than a normal distribution would suggest.

Markets tend to experience periods of high and low volatility in clusters, rather than maintaining a steady distribution. Symmetrical models often underestimate the likelihood of extreme price swings, leading to miscalculations in risk assessment.

Large institutional orders and algorithmic trading can cause short-term price imbalances, breaking the assumption of symmetrical price behaviour. These distortions can lead to misleading statistical signals.

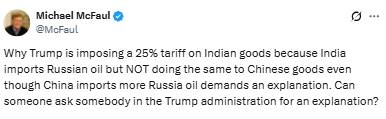

On July 30, 2025, American President Donald Trump announced a 25% tariff on a broad group of Indian products, doubling the overall import duty to 50%.

He said the action was taken in retaliation against India's continued buying of Russian oil and military equipment, and India's "unfair trade practices" and high tariffs against US products. This was the justification for doubling the Trump Tariff on India

Though this is one of the toughest sanctions leveled against a United States trading partner, many are questioning what the real motives are behind it.

Although China is buying more Russian oil than India, the president has not levied similar penalties against Beijing. This has caused confusion and criticism. The Trump Tariff move appears less about oil and more about politics and personal grievances.

There has been speculation that Trump's move might also indicate frustration with India for failing to publicly acknowledge him for aiding in holding up the previous India-Pakistan war.

The US President does not believe that China is vulnerable enough to attack directly, particularly due to China's control of rare earth elements, which are crucial to numerous U.S. industries.

Some experts feel the Trump Tariff has nothing to do with India's energy agreements. They argue that the U.S. itself is still engaged in trade with Russia, hence would be hypocritical to sanction India based on this.

The Trump Tariff is more of a symbolic move, a way for the president to show strength while avoiding confrontation with China. As one observer put it, “He tried to pick a fight with China, failed, and is now going after an easier target.”

India's insistence on safeguarding its agriculture, dairy, and fishing industries has long been a source of tension with America.

The U.S. president has targeted India for refusing to allow American businesses into these sectors, and the tariff could be an attempt to put pressure on.

Still, it is uncertain whether the action will have any effect or simply worsen the U.S.-India trade relations.

The news of the Trump Tariffs has disturbed the world markets. Investors are keenly observing if India will retaliate or if this might escalate into a greater trade war.

Experts are also worried that such a move at short notice might translate into increased prices for American consumers, particularly for goods imported from India.

The Trump Tariffs shook financial and crypto markets, with investors worried about increased trade tensions and higher import costs. Stocks related to U.S.-India trade fell, and crypto experienced volatility as global economic uncertainty increased.

The Trump Tariff on Indian products, presented as a retaliation for purchasing Russian oil, appears to be motivated by much deeper political and personal factors.

With China untouched even though it did more with Russia and U.S. business continued to engage in trade with Russia, the tariff looks more like a strategic or emotional gesture rather than a fair-minded policy.

Their long-term impact on the U.S.-India relationship, and indeed on world commerce, has yet to be seen.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up