Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street fears a hawkish Fed stance may trigger a stock selloff. Traders await Powell’s tone for rate cut signals, as uncertainty over inflation, trade wars, and growth clouds market outlook.

The Federal Reserve’s June policy meeting arrives at a critical moment for the stock market, with the benchmark S&P 500 sitting around 3% below its February record high despite a barrage of lingering uncertainty, including persistent trade war fears and fresh geopolitical headwinds between Israel and Iran.

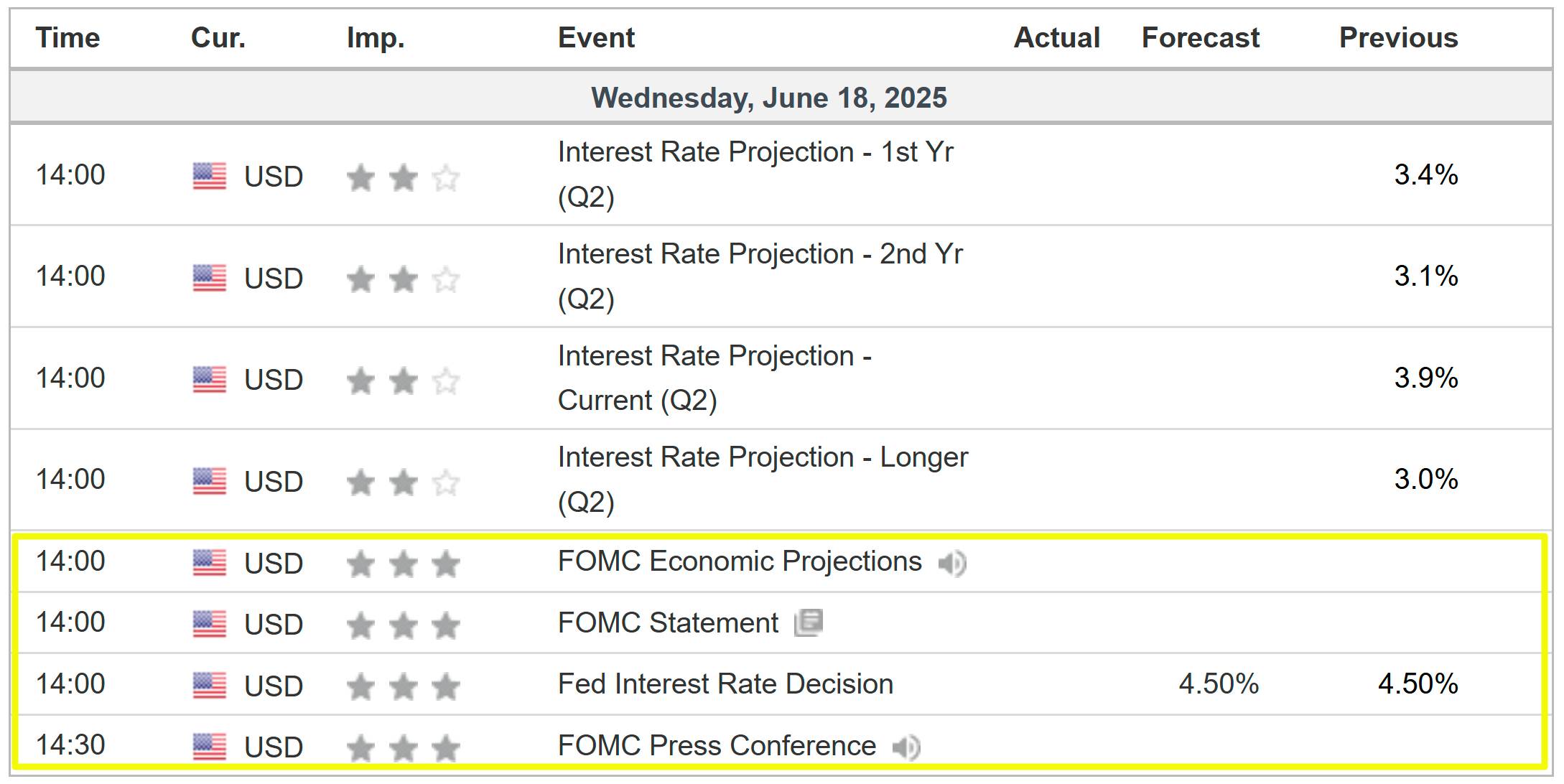

As such, a lot will be on the line when the Fed delivers its latest interest rate decision at 2:00 PM ET on Wednesday. While the US central bank is widely expected to hold rates steady at 4.25%-4.50%, investors are eager for any hints about whether it might be poised to lower borrowing costs in the coming months.

Markets currently expect two rate cuts by the end of this year, with the next one likely in September, as per the Investing.com Fed Rate Monitor Tool.

Alongside the rate decision, Federal Open Market Committee (FOMC) officials will also release their new quarterly economic projections for interest rates, inflation, and unemployment, known as the ‘dot plot’.

The last dot plot, released in March, revealed a consensus among Fed officials for two cuts in 2025.

If FOMC policymakers stick with that forecast, it could reinforce bullish sentiment—especially since recent economic data shows some softening. But if the outlook shifts to just one cut (or pushes the timeline further out), expect a market recalibration and possible pressure on stocks and risk assets.

Post-meeting comments from Fed Chair Jerome Powell at 2:30 PM ET will be closely watched and could move the market as his words often carry as much weight as the policy decision itself. Powell is likely to emphasize a data-dependent approach, citing the need for further clarity on the economic and inflationary impact of President Donald Trump’s trade tariffs before adjusting rates.

Speaking of Trump, the president’s repeated public calls for rate cuts and criticism of Powell could complicate the Fed’s messaging, though Powell is expected to reaffirm the central bank’s independence.

Financial markets may see muted initial reactions to a widely anticipated hold, but equities, bonds, gold, and the US Dollar could move based on the updated dot plot and Powell’s comments.

If the Fed signals a dovish pivot—hinting at potential rate cuts in the near future due to confidence in declining inflation—equity markets could rally, as lower borrowing costs typically support corporate earnings and valuations. Growth stocks, particularly in technology, which are sensitive to interest rates, would likely see the most benefit.

Bond yields, such as those on the 10-year Treasury, could decline in anticipation of looser monetary policy, boosting fixed-income assets.

Conversely, a hawkish stance—suggesting that rates will remain higher for longer to combat stubborn inflation—could pressure risk assets like stocks, as higher interest rates increase borrowing costs and dampen economic growth prospects.

In this scenario, the US dollar might strengthen, as elevated rates attract capital inflows, while commodities like gold could face headwinds due to a stronger currency and higher opportunity costs.

It started with her neighbor frantically knocking on her front door panicking at the sound of explosions. Then she taped her windows to prevent them from shattering and packed an emergency backpack.

By Tuesday, Neda was on a gridlocked highway, joining thousands of other Tehranis trying to flee the Iranian capital. Their aim was to find somewhere more remote where they wouldn’t be near any of the hundreds of sites that Israel might target.

“My biggest fear is the uncertainty and the ambiguity of it all,” Neda, 35, said by social media chat from a suburb on the outskirts of northern Tehran. “Will this go on for a week or for eight years? Will we have to keep on improvising life one day at a time?”

For the past five days, Israel has subjected Iran to its worst military attack since the Islamic Republic was invaded by neighboring Iraq in 1980. What’s clear in the metropolis of 10 million people, is that people don’t expect things to be the same again in a country whose leadership is hobbled and its economy shattered.

A snapshot of the mood among people contacted in Tehran suggests they expect the regime will be weakened further, but it won’t be toppled. Neda, for one, said she’s no supporter of the Iranian leadership, but right now her ire is directed at Israeli Prime Minister Benjamin Netanyahu.

Whenever the conflict ends, though, major reforms will be inevitable, said Cyrus Razzaghi, president and chief executive of Tehran-based consultancy Ara Enterprise.

That firstly would mean an overhaul of a fragmented intelligence apparatus that’s repeatedly failed to intercept clandestine Israeli operations on Iranian soil that include successive, audacious strikes killing the country’s top military and security officials.

“The Islamic Republic won’t emerge from this conflict unchanged,” Razzaghi said. “Even if regime change is unlikely in the near term, significant internal shifts are expected once the dust settles.”

US President Donald Trump’s increasingly bellicose rhetoric — on Tuesday he told Iranians to evacuate Tehran and demanded surrender — is fanning concerns that the US will join Israel’s assault. Netanyahu has said he is targeting the establishment of the Islamic Republic, not just its nuclear facilities, which he’s threatened to strike for years.

He’s appealed directly to the Iranian public, encouraging them to see his attack as an opportunity for them to oust their oppressive rulers. His military offensive has so far killed 224 Iranians, most of them civilians, according to Iran’s government.

Supreme Leader Ali Khamenei and the Islamist system of rule that he’s fortified around himself have faced unprecedented levels of unpopularity in recent years. They’ve been challenged by some of the biggest protests since the 1979 Islamic Revolution. Their demands have been ignored and the authorities have mostly doubled down on their intolerance for any dissent.

But for now, it’s Netanyahu who is the target of the anger among Iranians.

“I can’t talk for most people but I can talk about most of the people I’m in contact with and I’m certain they share this feeling I have, that with every word he says I feel this boiling rage inside of me,” Neda said of Israel’s prime minister. “My deep hatred for him is increasing.”

Khamenei’s removal could make Iran more confrontational as younger, more ideological officials rise through the ranks of various institutions and try to project the country’s strength, according to Dina Esfandiary, a Middle East analyst at Bloomberg Economics. Targeting Khamenei would also bolster the surge of nationalistic feeling that has begun to emerge since Israel’s strikes, she wrote.

The question is whether that feeling is enough to offset the deep polarization that’s afflicted Iran for years and the anger with which many view the powerful clerical-military cadre that controls the country.

At the moment, there are some sure signs of stubborn resistance. A news anchor of Iranian state television, for example, was heralded by the government for continuing to broadcast during a bombing raid as smoke and dust filled the studio.

But with an economy battered by years of trade embargoes, sanctions and endemic mismanagement, any patience left could quickly run out. Nazanine, a 55-year-old finance officer at a marketing company, is appalled by Netanyahu, though has opposed the Iranian leadership for years. “My hatred for Netanyahu and the Islamic Republic is the same,” she said. “I’m sick of them both.”

An Israeli and Western intelligence assessment seen by Bloomberg suggested that the war could lead to an economic collapse and inflation of 80%, if not higher. That, according to the report, would likely social discontent and challenge the stability of the ruling regime.

Currently Iran’s inflation rate is around 43%, one of the highest in the world, according to the International Monetary Fund. Underscoring a reliance on petrodollars, the country needs an oil price of $163 a barrel — more than double’s today’s level of around $75 — to balance its budget, according to calculations by the Fund.

There are already signs of pain. Since Friday, the rial has weakened more than 10% against the dollar on the black market, according to bonbast.com, a site that tracks the currency’s street value.

For Nazanine, the first task is to confront the shock of having to flee her city. She lives in a wealthy northern Tehran neighborhood that’s been targeted several times by Israel. Her apartment overlooks the now bombed out multistory residence of top Khamenei aide, Ali Shamkhani.

Shamkhani survived the attack and is being treated in hospital, the state-run Nour News reported on Monday without giving details of his injuries.

“I was awake when it all happened,” she said from the relative safety of the countryside on the outskirts of Tehran. “It feels like a real war.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up