Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Vietnam’s corporate bond market experienced strong growth in the first half of 2025, with total issuance reaching nearly VND 249 trillion, up 71.2% year-on-year. Credit institutions continued to dominate both issuance and buybacks, while the real estate sector showed clear signs of improved liquidity...

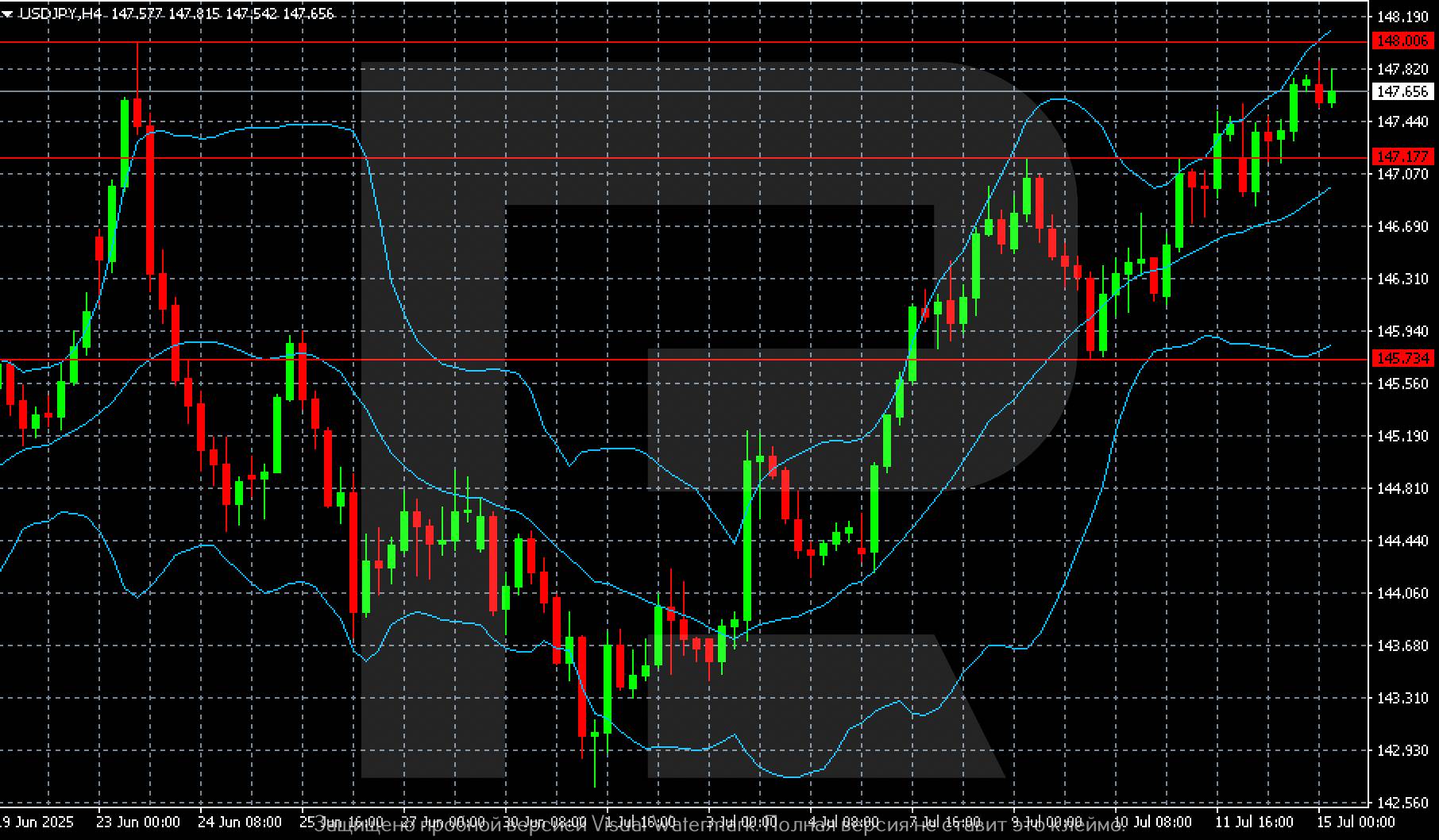

The USDJPY pair has risen significantly and retains the potential to climb further. The USDJPY forecast for today, 15 July 2025, suggests a possible test of the 148.00 level.

The USDJPY pair continues to climb as the market reacts to trade-related risks. Find more details in our analysis for 15 July 2025.

On Tuesday, the USDJPY rate rose to 147.65, marking a new two-month high, as trade risks from new US measures persist.

Washington plans to impose 25% tariffs on Japanese goods starting 1 August, while Tokyo has yet to announce any retaliatory action. Negotiations between the two parties have effectively stalled. One Japanese official warned of potential economic consequences if the tariffs are enforced.

Investors now await upcoming trade and inflation data from Japan, which will help assess the scale of pressure on the domestic economy. In addition, market focus also turns to the US inflation report, which could influence the Federal Reserve's future rate decisions.

The USDJPY forecast is positive.

On the H4 chart, the USDJPY pair is clearly in a strong uptrend since 3 July 2025. Following a period of consolidation between 144.00 and 146.00, with a local bottom formed near 144.00, the yen has lost ground rapidly. USD has strengthened to 147.65 and now approaches the key resistance level of 148.00.

The price confidently trades above the middle Bollinger Band, confirming upside momentum. The nearest support level lies at 147.18, followed by 145.73. If the price breaks above the 148.00 level, the upward wave will likely extend towards new highs.

From a technical standpoint, the outlook remains bullish. Each dip gets bought back, and the upper Bollinger Band is expanding. However, the 148.00 level may act as a short-term barrier to further gains.

Key points:

The dollar hovered near a three-week high versus major peers on Tuesday as traders awaited the release of U.S. inflation data later in the day that could provide clues on the path for monetary policy.

The U.S. currency was also buoyed by elevated Treasury yields, with investors weighing a potential exit of Jerome Powell from the Federal Reserve as President Donald Trump continued his criticism of the central bank chairman.

Currencies showed little reaction to data showing China's economy grew 5.2% last quarter, slightly topping analysts' forecasts.

Bitcoindrifted further from Monday's all-time peak of $123,153.22 following a seven-day, 14% surge as investors bet on long-sought legislative policy wins for the cryptocurrency industry this week. It was changing hands at around $117,550 as of 0520 GMT.

The dollar was little changed at 147.62 yen, after earlier rising to the highest since June 23 at 147.89 yen.

The dollar index, which tracks the currency against the yen, euro and four other major rivals, eased slightly to 98.003, not far below the overnight peak of 98.136, the highest since June 25.

The euroedged up to $1.1681, after dipping to $1.1650 on Monday for the first time since June 25.

Fed Chair Powell has said he expects inflation to increase this summer as a result of tariffs, which is seen keeping the U.S. central bank on hold until later in the year.

Economists polled by Reuters expect headline inflation to increase to 2.7% on an annual basis, up from 2.4% the prior month. Core inflation is expected to rise to 3.0%, from 2.8%.

"Should inflation fail to materialise or remain steady, questions may arise regarding the Fed's recent decision not to cut rates, potentially intensifying calls for monetary easing," James Kniveton, senior corporate FX dealer at Convera, wrote in a client note.

"Calls from the White House for leadership changes at the Fed may increase."

Trump on Monday renewed his attacks on Powell, saying interest rates should be at 1% or lower, rather than the 4.25% to 4.50% range the Fed has kept the key rate at so far this year.

Fed funds futures traders have been pricing in about 50 basis points of interest rate cuts by year-end, with the first quarter-point reduction seen as likely in September.

"If Powell leaves, we expect the (U.S. Treasury yield) curve to steepen sharply, with the short-end factoring in front-loaded rates cuts," DBS analysts wrote in a note.

"Meanwhile, the loss of confidence in price stability should translate into sharply higher 10-year and 30-year yields."

China's economic growth topped market forecasts in the second quarter - even as it slowed slightly from the prior three months - in a sign of resilience against U.S. tariffs.

At the same time, analysts warned of underlying weakness and rising risks later in the year that will ramp up pressure on Beijing to roll out more stimulus.

The Chinese yuanweakened slightly to 7.1766 per dollar in offshore trading.

The Aussiewas steady at $0.6548.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up