Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US and Ukraine on Wednesday signed a mineral deal that is expected to give Washington access to Kyiv's valuable mineral reso

The US and Ukraine on Wednesday signed a mineral deal that is expected to give Washington access to Kyiv's valuable mineral resources while providing the country with some assurance of continued American support in its war with Russia.

As part of the agreement, the two countries will set up the US-Ukraine Reconstruction Investment Fund, with plans to invest collectively for speeding up Ukraine’s economic recovery, said a statement by the US Department of the Treasury. Details of the total size of the fund were not revealed.

The deal was supposed to have been signed during Ukrainian President Volodymyr Zelenskyy's visit to the US in February. But negotiations fell through after US President Donald Trump accused Mr Zelenskyy of not being grateful enough for American assistance.

Analysts said the deal is mutually beneficial.

“For Ukraine, the deal brings much-needed US investment to support its recovery and growth while maintaining control over its resources," Joseph Dahrieh, managing principal at brokerage Tickmill told The National.

"For the US, it reduces reliance on China for critical minerals and increases its influence in eastern Europe."

The Russia-Ukraine war, now in its fourth year, has devastated Ukraine’s economy, with heavy damage to its infrastructure and housing.

Ukraine will need at least $524 billion over the next decade to repair and rebuild the country, the World Bank said in a recent report. Reconstruction of the housing sector is estimated at $84 billion, transport at $78 billion, and energy and extractives sector at $68 billion.

The country’s economy, which contracted by 28.8 per cent in 2022 following Russia’s invasion, is projected to have expanded by 3.5 per cent last year, according to the International Monetary Fund. It is forecast to grow between 2 per cent to 3 per cent this year.

The US International Development Finance Corporation (DFC), a US government entity, will also be involved in managing the fund along with the UK Treasury Department and Ukraine government, the statement said.

DFC, with a global investment portfolio worth $49 billion, partners with the private sector to mobilise capital for strategic investments around the world. It invests in sectors including infrastructure and critical minerals, energy, food security and agriculture.

“President Trump envisioned this partnership between the American people and the Ukrainian people to show both sides’ commitment to lasting peace and prosperity in Ukraine,” said US Treasury Secretary Scott Bessent.

Ukrainian First Deputy Prime Minister and Economy Minister Yulia Svyrydenko said in a post on X that the fund will help Kyiv attract international investment.

“The implementation of the agreement will allow both countries to expand their economic potential through equal co-operation and investment. The agreement does not contain any mention of any debt obligations of Ukraine to the United States,” she said.

“We expect that for the first 10 years, the fund's profits and revenues will not be distributed, but can only be invested in Ukraine − in new projects or reconstruction."

The US has heavily supported Ukraine in its war with Russia. Washington has been Kyiv's single largest military donor with aid of more than €64 billion ($72 billion) since the war began in February 2022, according to the Kiel Institute think tank in Germany.

Ukraine is rich in natural resources including critical minerals, which are used in consumer electronics, electric vehicles and military applications, among others.

The country has 22 of the 50 strategic materials identified by the US as critical, and 25 out of the 34 recognised by the EU as critically important. Particularly, Ukraine holds very competitive reserves of graphite, lithium, titanium, zirconium, beryllium and uranium, according to the Ukrainian Geological Survey website.

Global rare-earth mining is currently dominated by China, which is locked in a trade war with the US after Mr Trump's sharp tariff increases.

Ukraine also has reserves of gold, uranium, cobalt, nickel and zinc, among other minerals.

“Ukraine has the largest reserves in Europe of titanium, lithium, and uranium and holds about 5 per cent of global rare-earth reserves, making the country an important partner for energy, defence, and clean technology supply chains,” Mr Dahrieh said.

The deal could offer the US a stable source of critical materials needed for defence, clean energy, and high-tech industries, he added.

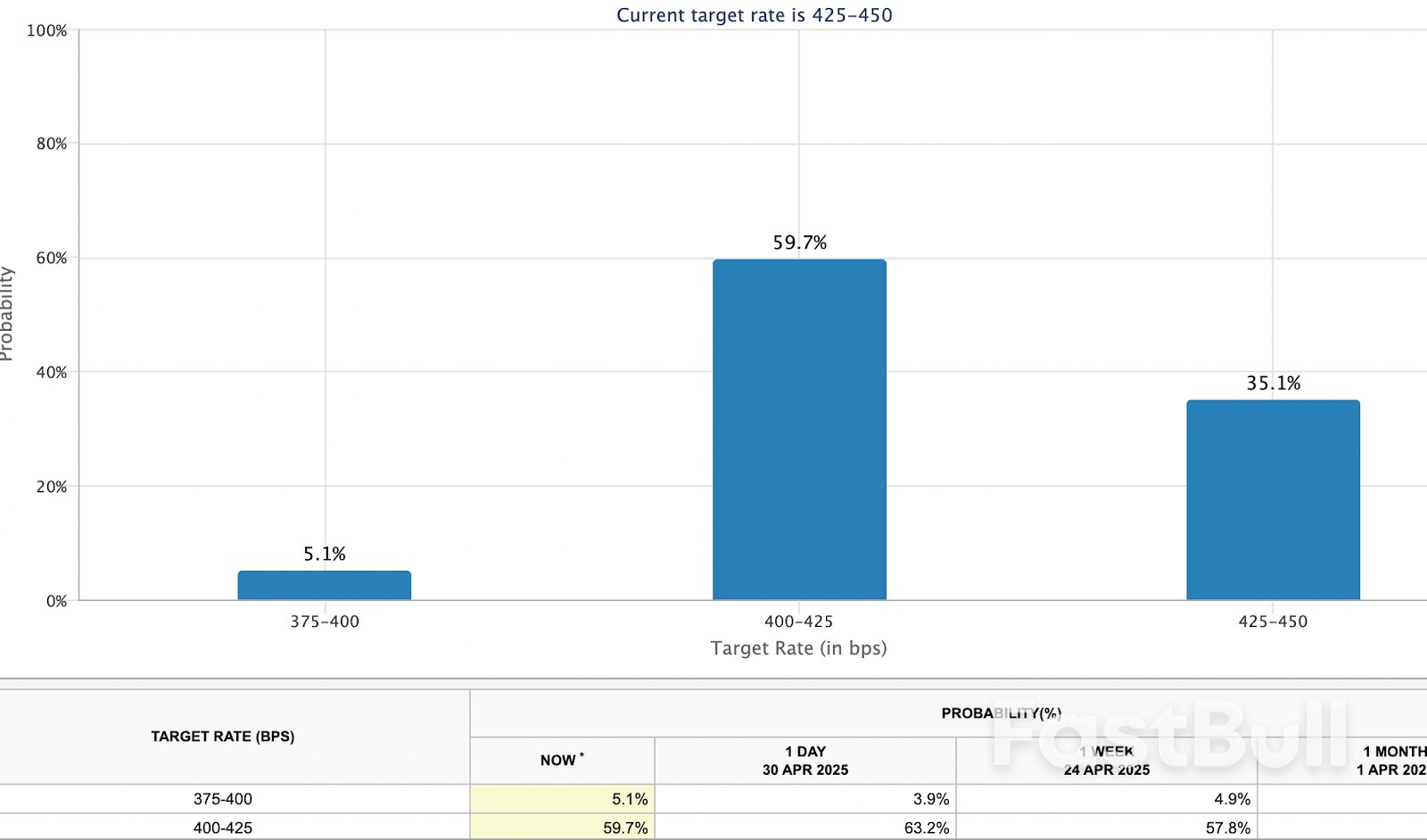

Fed target rate probabilities for the June 18 Fed meeting. Source: CME FedWatch

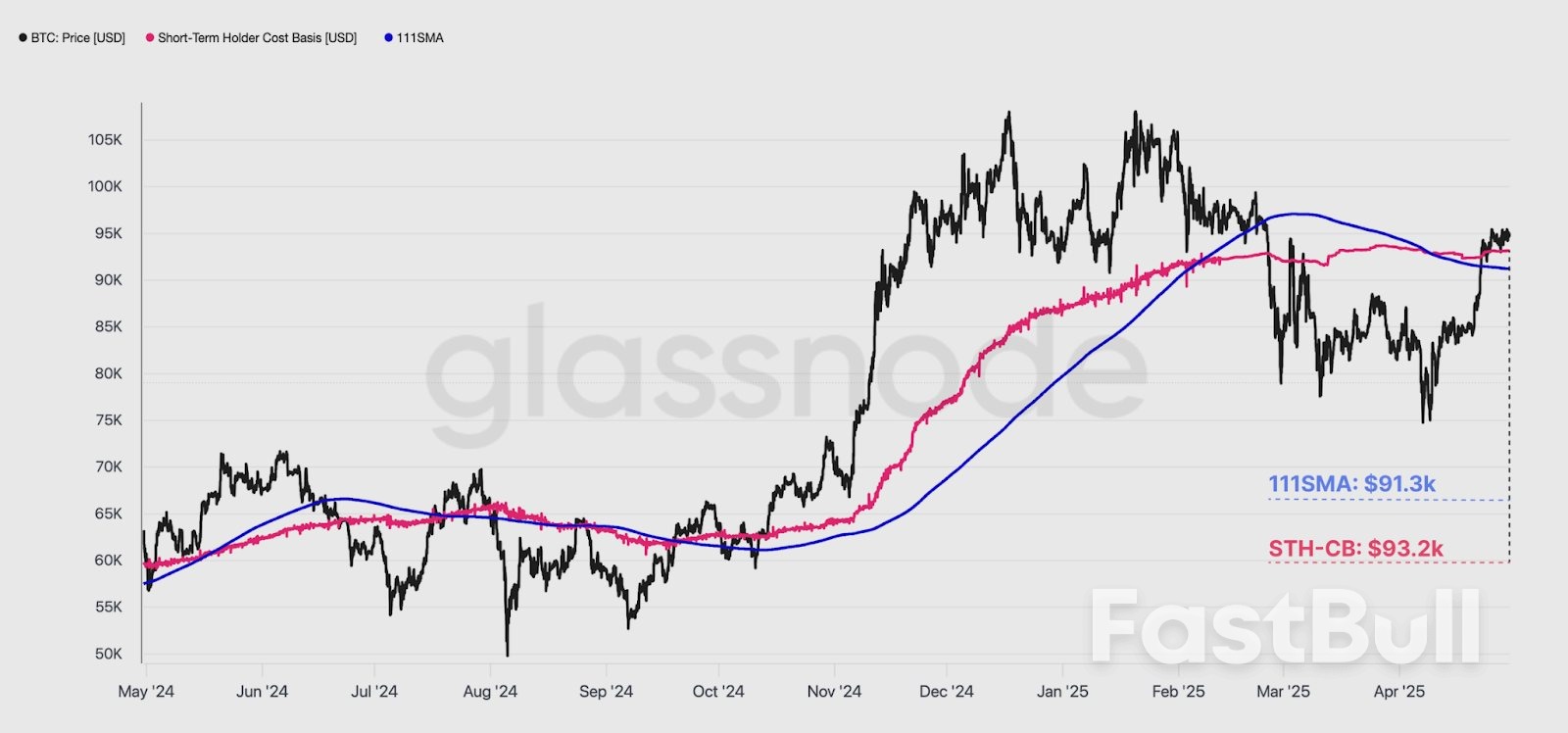

Fed target rate probabilities for the June 18 Fed meeting. Source: CME FedWatch BTC/USD chart showing STH cost basis and 111-day SMA. Source: Glassnode

BTC/USD chart showing STH cost basis and 111-day SMA. Source: Glassnode BTC/USD four-hour chart. Source: AlphaBTC

BTC/USD four-hour chart. Source: AlphaBTC BTC/USD hourly chart. Source: Daan Crypto Trades

BTC/USD hourly chart. Source: Daan Crypto TradesThe Institute of Supply Management (ISM) has released its Manufacturing Purchasing Managers Index (PMI) Report, showing a slight uptick in manufacturing activity. The actual figure revealed was 48.7, a marginal increase from the previous month.

However, this figure still fell short of the forecasted 48.0, indicating a slower pace of expansion than economists had anticipated. It’s a signal that the manufacturing sector, a significant component of the U.S. economy, continues to grapple with challenges despite the slight improvement.

When compared to the previous month’s figure of 49.0, the actual ISM Manufacturing PMI for this month shows a decline. This sequential drop in the index suggests that manufacturing activity has slowed down, even though it did not contract as much as predicted.

The ISM Manufacturing PMI is a crucial economic indicator, based on data compiled from monthly surveys of purchasing and supply executives in over 400 industrial companies. The index measures various aspects of manufacturing activity, including new orders, production, employment, supplier deliveries, and inventories. A higher than expected reading is generally considered positive or bullish for the USD, while a lower than expected reading is seen as negative or bearish.

This month’s PMI reading, while higher than the previous month, continues to underscore the challenges facing the manufacturing sector. Despite the slight rebound, the fact that it remains below the forecasted figure indicates that the sector’s recovery may be slower than initially anticipated.

The ISM Manufacturing PMI is closely watched by investors and policymakers as it provides a timely snapshot of the health of the U.S. manufacturing sector. The slight uptick this month, despite falling short of forecasts, could be a sign that the sector is slowly beginning to recover. However, the continued weakness in the index also suggests that the road to full recovery may still be long and fraught with challenges.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up